India: Pellet trade volume declines by 27% m-o-m in Jan'26 on cautious buying sentiment

...

- Pellet prices rise INR 250-900/t in domestic market

- Cost-effective iron ore lumps impacts pellet trade

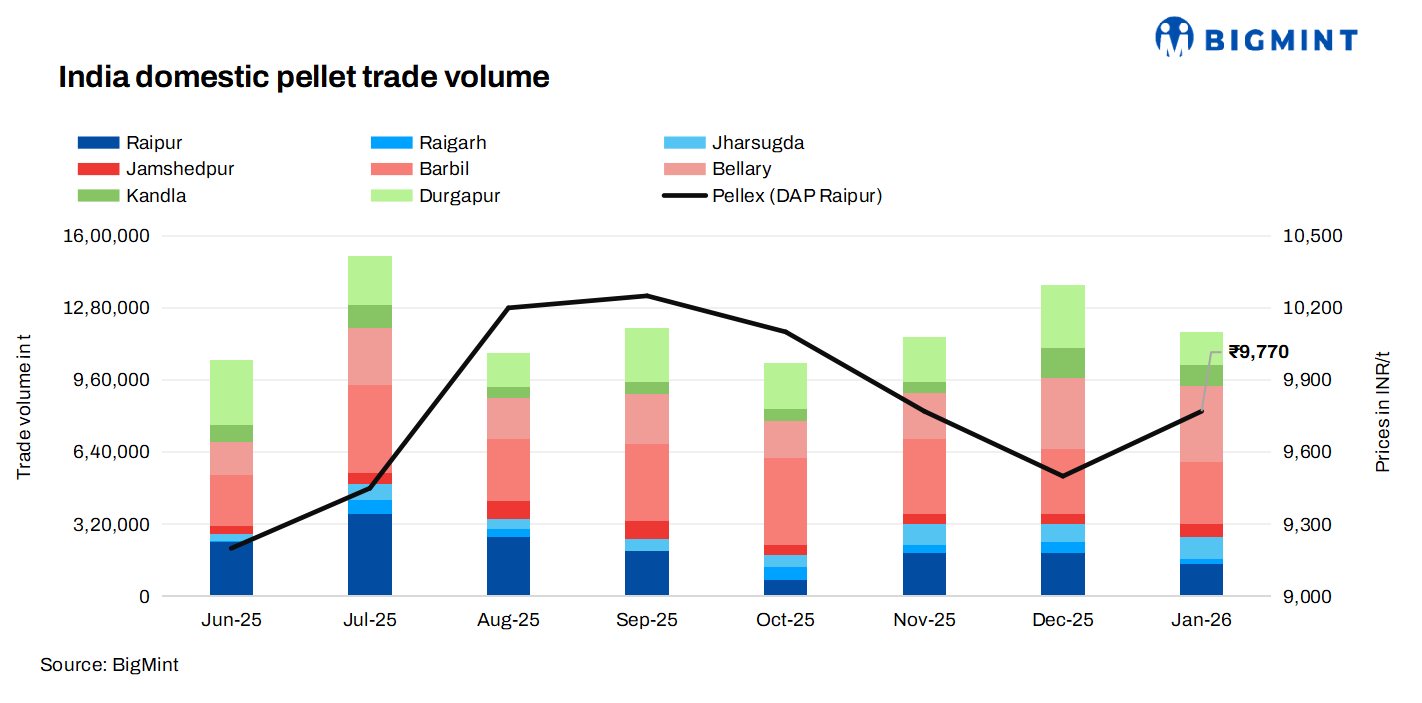

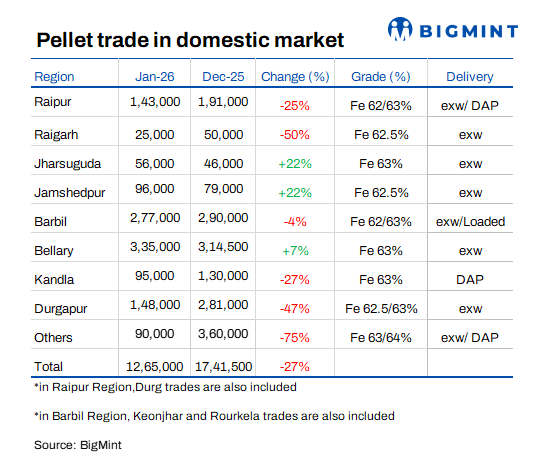

India's domestic pellet trade fell by around 27% m-o-m in January 2026 to 1.26 million tonnes (mnt) compared to 1.74 mnt in December, as cautious buying sentiment and elevated prices weighed on overall market activity.

Key trading regions witnessed a notable fall in volumes, with markets such as Barbil, Raipur, Durgapur, and Kandla reporting a drop of up to 45% compared to December levels.

Market updates

Market participants said that steelmakers largely adopted a need-based procurement strategy during the month, opting for more cost-effective raw material alternatives. A steel producer informed, "Pellet prices were relatively higher in January due to the increase in iron ore fines prices. As a result, many buyers shifted towards lumps, particularly in the central and eastern regions where lumps offered better cost economics."

However, not all regions experienced weakness. Trading activity in Bellary, Jamshedpur, and Jharsuguda remained comparatively firm, supported by local demand and steady plant operations. A trader from eastern India noted, "Inquiries were minimal during the first half of January, but trading momentum improved in the latter half as buyers returned to the market to cover short-term requirements."

Additionally, domestic trading volumes were impacted as some pellet manufacturers opted to conclude export deals through tenders rather than focusing on domestic bulk tenders. This shift diverted material away from the domestic merchant market. In central India, a few plants remained shut during January, while others increased captive consumption in the Odisha region, further tightening availability and contributing to lower trade volumes.

India's pellet exports surged to 0.36 mnt in January, up from 0.08 mnt in December. Meanwhile, pellet imports declined to 0.04 mnt in January, down from 0.22 mnt in December. Notably, pellet production stood at 10.1 mnt in January.

Factors driving pellet market in Dec'25

- Bids surge in OMC's auction: In OMC's iron ore fines auction for 2.24 mnt (Fe 51-62%) on 19 Jan'26, around 2.03 mnt (91%) were booked at INR 2,450-6,200/t. The lots received premiums of INR 550-1,150/t over base prices, with INR 750/t being the average premium. Bids (weighted average) rose by INR 425/t m-o-m. Positive steel market sentiment, amid expectations of a pick-up in demand in Q4FY26, led to the robust auction response.

- PELLEX increases m-o-m: The monthly average domestic pellet index, PELLEX, increased by around INR 300/t m-om in January to INR 9,800/t DAP Raipur. Pellet prices increased due to higher offers from local pellet producers, driven by rising iron ore fines offers and escalating downstream steel prices.

- Sponge PDRI prices rise m-o-m: In January 2026, Indian sponge iron prices climbed up m-o-m across both domestic and export segments, supported by improved buying activity. Sponge iron prices rose by INR 300-1,200/t ($3-13/t) m-o-m across India. Sponge PDRI (Lumps, FeM 80%, +/-1) prices in Raipur rose by INR 1,400/t m-o-m to INR 24,700/t exw.

- NMDC rake movements rise m-o-m: NMDC dispatched 647 rakes from its Chhattisgarh mines in January, equivalent to 2.49 million tonnes (mnt) of iron ore. This marks an uptick of 4.5% compared to 619 rakes (2.38 mnt) in December, as per BigMint data. On a y-o-y basis, dispatches in January rose by 15.7% compared with 519 rakes in January 2025.

Outlook

Pellet trading volumes are expected to remain rangebound. While procurement may continue to be based on need fulfillment, pricing sentiment is expected to stay firm amid sustained higher costs.A market participant said, "If iron ore fines prices remain elevated, pellet offers are unlikely to soften significantly. Buyers may continue balancing between pellets and lumps based on cost efficiency."