India: Iron ore concentrate prices remain steady, auction outcome to shape next move

...

- Ongoing dispatches limit fresh market offers

- Base price revision sparks upward expectations

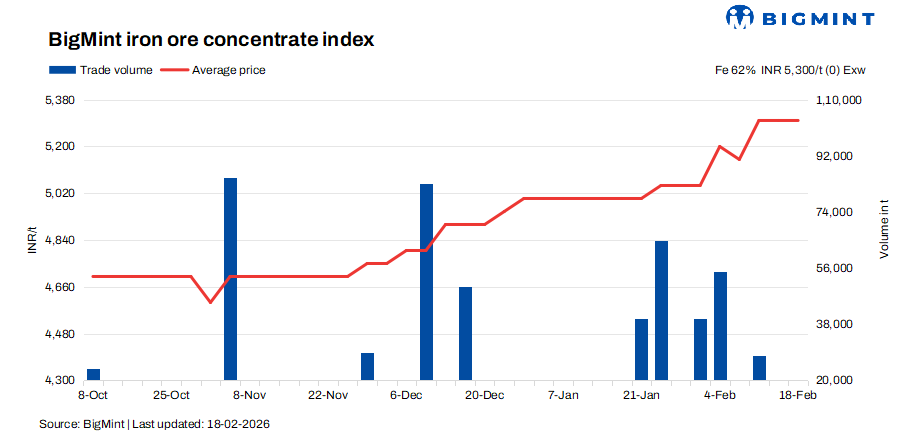

BigMint's latest bi-weekly assessment shows that iron ore concentrate (Fe 62%) prices in Jabalpur remained firm at INR 5,300/t ($58/t) ex-works as of 18 February, unchanged from 14 February, with prices also steady on a w-o-w basis. Despite relatively subdued spot transactions this week, underlying fundamentals continue to lend strong support to the market, particularly for high-grade material.

The firmness in prices is largely underpinned by a combination of rising pellet prices and sustained stability in the Odisha iron ore market. Additionally, several concentrate producers in the region are already booked for the next month, with dispatches against earlier orders still ongoing. This tight forward positioning has effectively restricted spot availability, reinforcing price resilience in Jabalpur.

Market participants are closely monitoring the upcoming auction by Odisha Mining Corporation (OMC), which is scheduled to auction 3.833 million tonnes (mnt) of iron ore on 19 February 2026, comprising 1.58 mnt of lumps and 2.25 mnt of fines. Notably, OMC has increased base prices m-o-m lumps by INR 100-300/t and fines by INR 150-350/t. The upward revision reflects expectations of robust Q4 demand, the impending expiry of merchant miners' FY26 environmental clearances (ECs), and a broadly optimistic steel market outlook.

A Jabalpur-based seller informed BigMint that, "in light of the recent hike in OMC's base prices, they are reassessing prevailing market dynamics and plan to revise their offers within the next couple of days. The participant indicated that producers are cautiously aligning their strategies with broader auction trends before committing to fresh quotations."

Another regional seller expressed confidence that "the current upward trajectory is likely to sustain, citing February-March as a peak demand period."

Importantly, supply constraints are becoming increasingly visible across the region. Many miners have already exhausted their allocated volumes, resulting in a pronounced demand-supply imbalance. This structural tightness, coupled with firm downstream steel sentiment, is expected to translate into a strong response to the upcoming OMC auction.

Rationale

- One (1) trade was recorded in this publishing window and was taken into consideration, receiving a 50% weightage.

- Eight (8) offers and indicative prices were heard, and five (5) were taken into consideration as T2 trades, receiving 50% weightage.

Factors supporting prices

- Pellet prices remain steady in Raipur: PELLEX, BigMint's bi-weekly domestic pellet (Fe 63%) index for Raipur, was assessed stable at INR 10,550/t ($117/t) DAP on 17 February, unchanged from the previous assessment on 13 February. Market activity remained moderate during the period, with limited fresh deals reported. Most buyers have already built adequate raw material inventories and are currently maintaining a cautious stance toward additional procurement, resulting in balanced demand-supply dynamics and steady price levels in the Raipur market.

- Odisha iron ore prices unchanged wo-w: BigMint's Odisha iron ore fines (Fe 62%) index held steady w-o-w at INR 6,000/t ($65/t) ex-mines on 14 February 2026, as market participants remained cautious ahead of the 19 February auction by Odisha Mining Corporation (OMC). With limited spot activity and no major fresh triggers, buyers and sellers preferred to wait for clearer price signals from the auction outcome.

Outlook

Iron ore concentrate prices are expected to remain largely stable in the near term, as most sellers continue to dispatch earlier booked orders and are unlikely to release fresh offers until these commitments are cleared. Spot availability is therefore limited, keeping price movement steady for now. However, the outcome of the upcoming auction by Odisha Mining Corporation (OMC) will be a key determinant for the next pricing direction, as sellers are expected to recalibrate their offers in line with auction premiums and prevailing demand trends.