India: Imported aluminium scrap prices fall on sluggish LME and low buying interest

...

- Domestic-import price gap widens, hurting trade

- Domestic casting scrap prices drop on improved availability

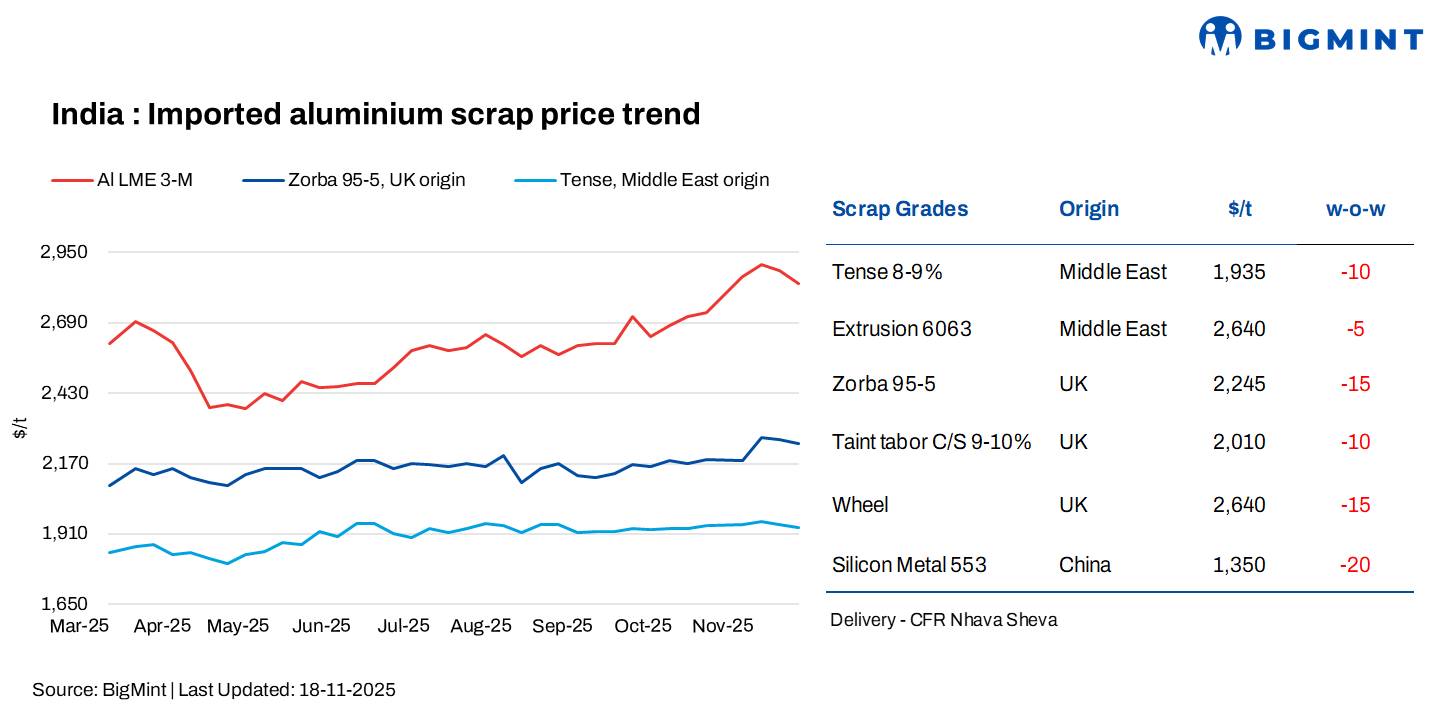

India's imported aluminium scrap prices edged down by $15-20/t w-o-w, following negative movements on the London Metal Exchange (LME). BigMint assessed UAE-origin Tense scrap at $1,935/tonne (t), down by $10/t w-o-w, while UK-origin Taint Tabor C/S (9-10%) stood at $2,010/t, down by $10/t w-o-w.

UK-origin Zorba 95/5 stood at $2,245/t w-o-w, down by $15/t, while UAE Extrusion 6063 decreased by $5/t to 2,640/t w-o-w. Meanwhile, UK-origin Wheel decreased by $15/t to $2,640/t w-o-w.

LME prices decrease w-o-w; inventories rose

At closing on 17 November, LME aluminium prices stood at $2,834/t, down by $49/t from $2,883/t last week.

Meanwhile, aluminium inventories at registered warehouses increased notably by 2,975 t to 550,200 t from 547,225 t in the previous week, indicating tightening supply conditions.

Market scenario

India's imported aluminium scrap market continues to see muted buying as firm global prices and slow LME movement keep landed costs elevated. Domestic aluminium scrap prices have also edged lower, widening the gap between local and imported material.

Trader sources say the market is facing a clear mismatch, with domestic prices not keeping pace with international levels. As a result, most buyers are avoiding fresh bookings, leading to weaker demand across key ports. The overall sentiment remains subdued, with both sluggish LME trends and softer local prices limiting trade activity in the imported aluminium segment.

According to trader sources, several containers of aluminium TT from the US are reportedly stuck at JNPT port. While the exact reason remains unclear, market participants believe weak demand for the material may be a key factor. There have also been claims-related issues tied to the cargo, adding to the uncertainty.

Overall, demand for imported aluminium scrap has been muted, largely because firm prices are keeping buyers away. Many buyers are holding back on purchases as bid-offer gaps continue to widen.

One trader noted that although scrap prices have corrected slightly this week, they remain relatively high. Strong LME aluminium prices are still keeping imported scrap values elevated.

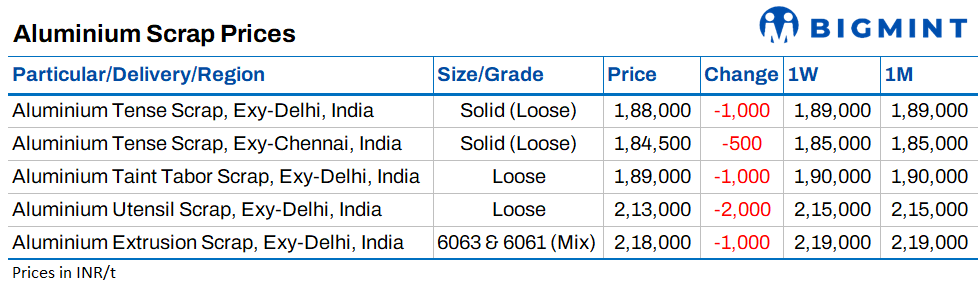

Meanwhile, domestic aluminium scrap prices have fallen this week. Casting scrap, in particular, has seen a notable decline in the Delhi and Chennai markets due to improved availability.

An alloy maker in South India said, "Demand for ADC12 alloy ingots is steady at the moment, and the better availability of casting scrap has pushed tense scrap prices down in Chennai. There are also ongoing payment issues in the southern market."

Silicon price trends

According to BigMint's assessment, China's 553-grade silicon prices edged down by $20/t w-o-w which stood at $1,350/t CFR Mundra, due to softening demand, along with improved availability from Chinese producers.

Outlook

Imported aluminium scrap prices are likely to remain under pressure in the near term as weak buying sentiment, slow LME cues, and a widening domestic-import price gap curb fresh booking. With LME aluminium trending lower and inventories rising, suppliers may face added downward pressure on offers. Demand is expected to stay subdued until price levels correct further or domestic markets stabilise.