India: Domestic stainless steel scrap prices rise w-o-w despite declining nickel prices

...

- Higher import offers, rising molybdenum oxide prices lift prices

- Buyers prefer domestic scrap as stronger dollar lifts import costs

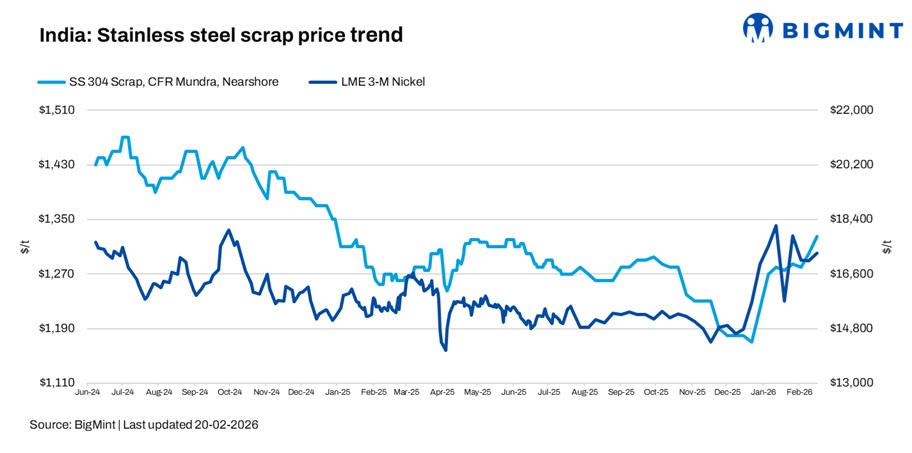

Indias stainless steel scrap prices strengthened in the week ended 20 February, even as nickel futures on the London Metal Exchange (LME) declined w-o-w. Higher import offers, currency pressure, and rising alloy costs kept sentiment firm across grades.

As per BigMint's assessment, domestic 304-grade scrap rose INR 1,000/tonne (t) w-o-w to INR 119,000/t DAP Delhi. Nearshore-origin 304 scrap increased by $20/t to $1,325/t CFR Mundra.

Imported 316-grade scrap offers were heard around $2,700/t, while workable bids stood at $2,550-2,600/t, reflecting a persistent bid-offer disparity. The firmness in 316 was largely attributed to higher molybdenum oxide prices amid tight US supply, prompting exporters to lift offers.

Domestic mills indicated that bookings remained continuous, with local scrap comparatively cheaper than imports due to a stronger dollar against the rupee.

LME nickel prices edge down w-o-w

On the cost side, benchmark three-month contract nickel prices on the London Metal Exchange (LME) closed at $17,150/t on 19 February,down 3% from $17,670/t in the previous week. LME-registered nickel stocks stood at 287,706 t from last week's 286,386t, slightly higher w-o-w.

BigMint's scrap assessments

Nearshore-origin SS 316 scrap (loose): $2,585/t, up by $10/t w-o-w.

Nearshore-origin SS 201 scrap (loose): $685/t, up $15/t w-o-w.

Nearshore-origin SS 430 scrap (loose): $620/t, up $20/t w-o-w.

SS 316 scrap, DAP Delhi: INR 222,000/t, up INR 2,000/t w-o-w.

SS utensil scrap, DAP Delhi: INR 68,000/t, up by INR 1,000/t w-o-w.

Outlook

Stainless steel scrap prices are expected to remain elevated, underpinned by dollar strength, firm molybdenum oxide prices, and steady mill bookings. However, further downside in nickel or weakening finished steel demand could moderate the upside.