Copper prices slip 3% w-o-w to $10,370/t on LME after touching 16-month peak

...

- Mine disruptions tighten supply, supporting prices

- Falling TC/RCs highlight global concentrate shortage

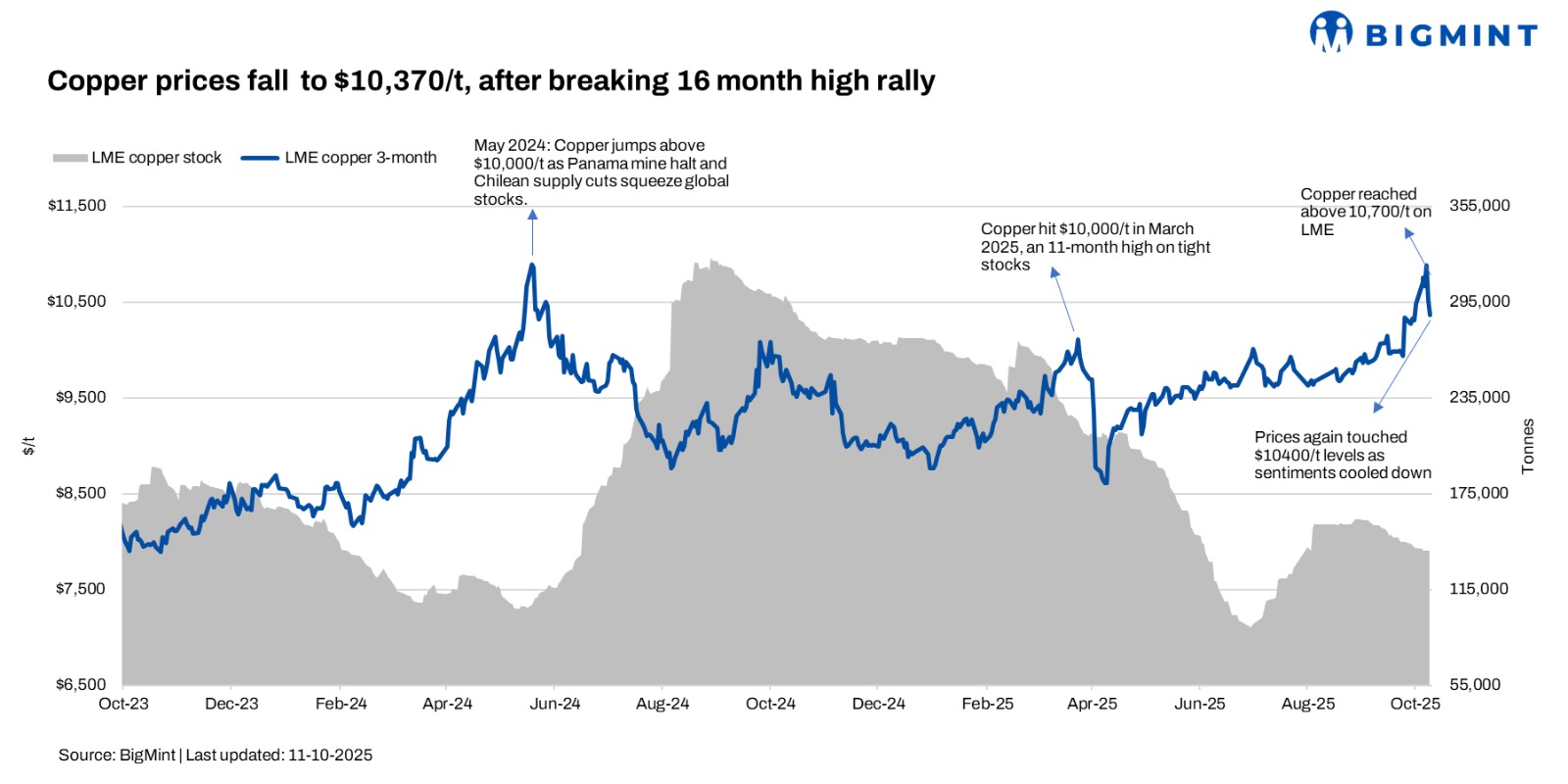

The benchmark three-month copper contract on the London Metal Exchange (LME) closed at $10,370/t on 10 October 2025, registering a sharp 3% decline from 3 October, when the red metal had briefly scaled a 16-month high above $10,700/t. This correction reflects a recalibration in speculative positioning rather than a fundamental shift in the underlying supply-demand balance.

Coppers early October rally was driven primarily by supply disruptions and tight availability signals. Market sentiment was buoyed by continued output interruptions at Freeport-McMoRans Grasberg mine in Indonesia, which faced mudflow and logistics constraints through late September, as well as weather-related issues impacting Chiles northern mining belt, including Escondida and Collahuasi operations. These developments reinforced expectations of lower refined copper output through Q4-2025 and potential drawdowns in LME inventories, which had already declined below 125,000 tonnes by early October the lowest since May 2023.

However, the momentum reversed swiftly once speculative long positions began to unwind following a series of macro-economic triggers. The US dollar index strengthened on expectations that the Federal Reserve might delay rate cuts amid still-resilient labour data, making dollar-denominated commodities relatively costlier for non-US buyers.

The International Copper Study Group (ICSG) has revised its global copper balance outlook, projecting the market to swing into a refined copper deficit of around 150,000 tonnes in 2026, compared with a modest surplus anticipated for 2025. This shift is primarily driven by lower-than-expected mine production growth, as several major assets across Latin America and Southeast Asia face ongoing operational and permitting challenges.

On the cost side, treatment and refining charges (TC/RCs) have fallen sharply, highlighting the tightness in copper concentrate supply. As of Q3 2025, spot TC/RCs averaged around $45/t, slipping into negative territory for the first time in years as smelters competed aggressively for available concentrates. The 2025 annual benchmark, settled between Antofagasta and Jiangxi Copper, was fixed at $21.25/t, marking a steep decline of nearly 73 % from the 2024 benchmark of $80/t. This reflects the widening mismatch between mine supply and smelting demand.

Analysts expect that 2026 benchmark terms could drop even further, potentially testing lows near $1015/t, unless mine output normalizes in Chile and Indonesia. Such compressed TC/RC levels have already begun squeezing smelter margins globally, particularly in China and India, where many processors depend on imported concentrates. The sustained weakness in TC/RCs underscores the persistent global shortage of copper concentrate, reinforcing the medium-term bullish narrative for refined copper prices.

Outlook

Copper prices are likely to stay rangebound between $10,20010,600/t in the near term, as supply tightness offsets uneven demand recovery. Ongoing mine disruptions and low LME inventories keep fundamentals firm, while Chinas post-holiday restocking and steady demand from India and Southeast Asia lend support. A brief consolidation phase is expected, with prices remaining well above $10,000/t amid tight supply and resilient consumption.