BigMint's India steel index rises sharply as mills announce further price hikes for key products

...

- Primary mills raise BF rebar prices by INR 3,000/t

- IF rebar prices rise by $50/t m-o-m in Jan'26

- Tier-1 mills hike HRC, CRC prices by INR 1,750-2,500/t

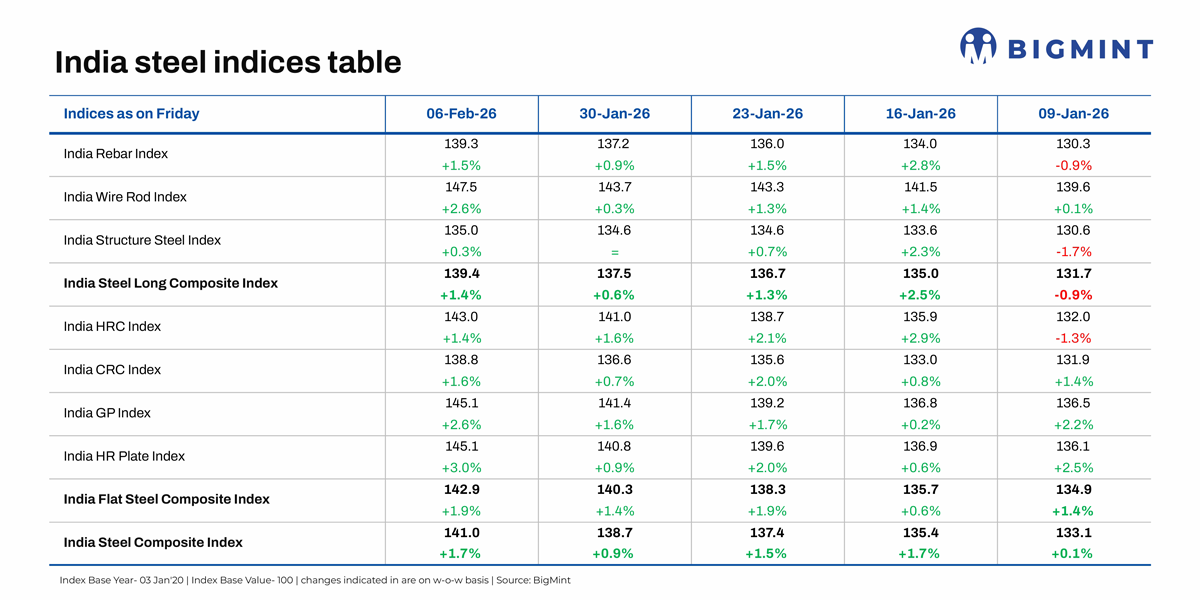

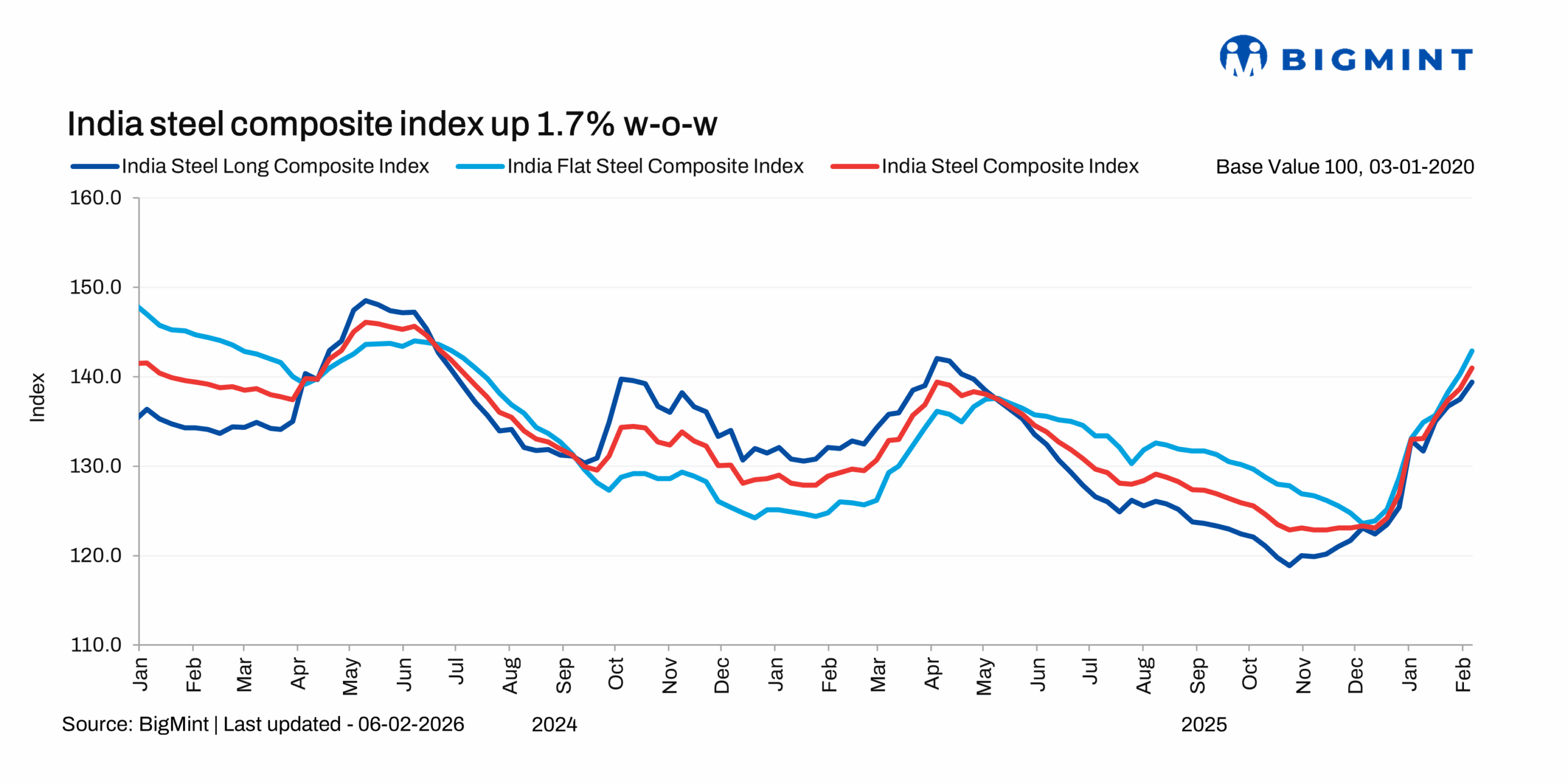

Morning Brief: The India steel composite index, BigMint's flagship offering which is a barometer of the domestic steel market, witnessed a spike in the week ending 6 February 2026, rising by 1.7% w-o-w as steel prices improved across segments on mill price hikes and positive sentiment. The uptrend in steel prices has been sustained throughout January and a strong demand outlook in Q4 is positive for the market.

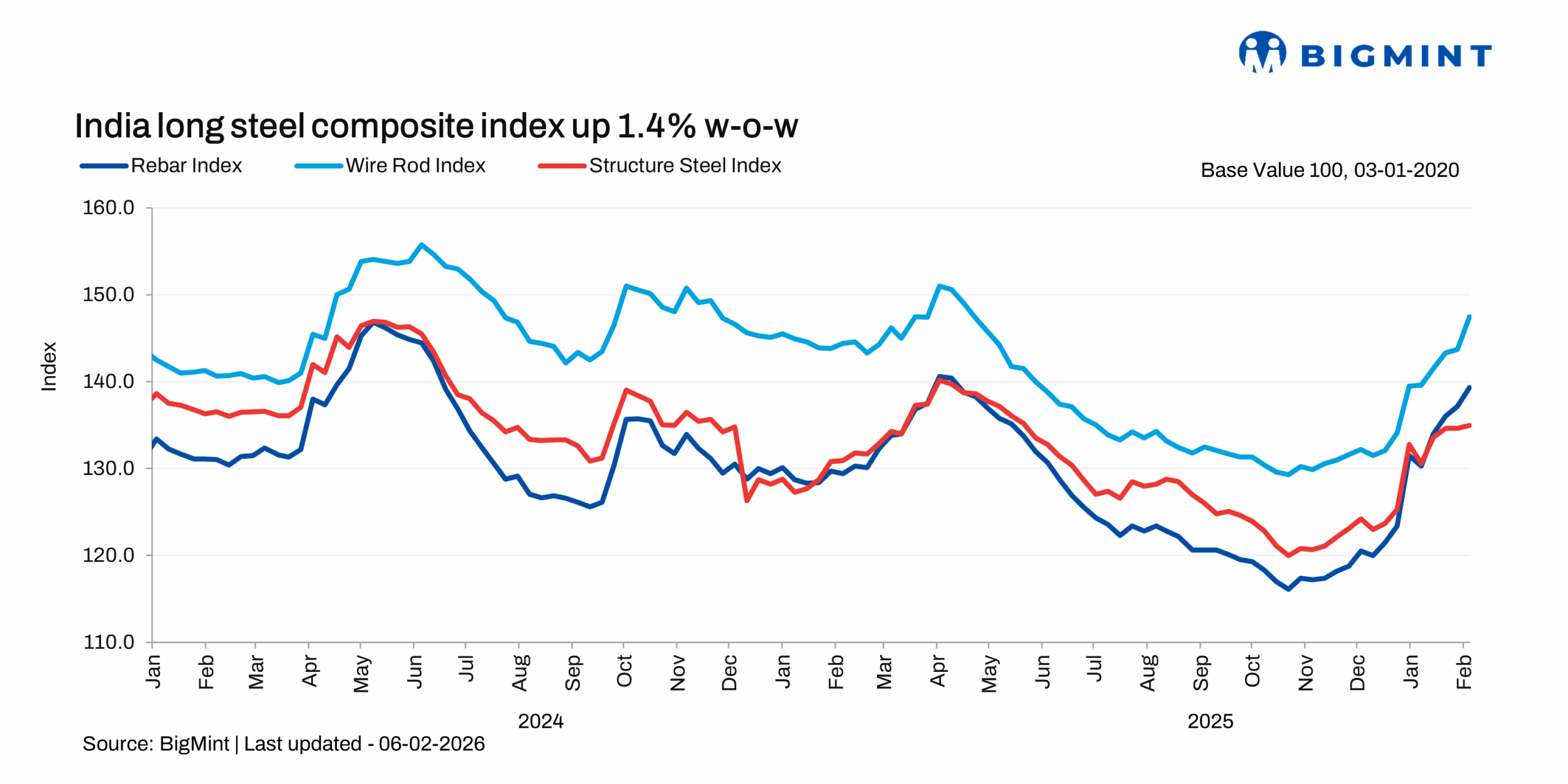

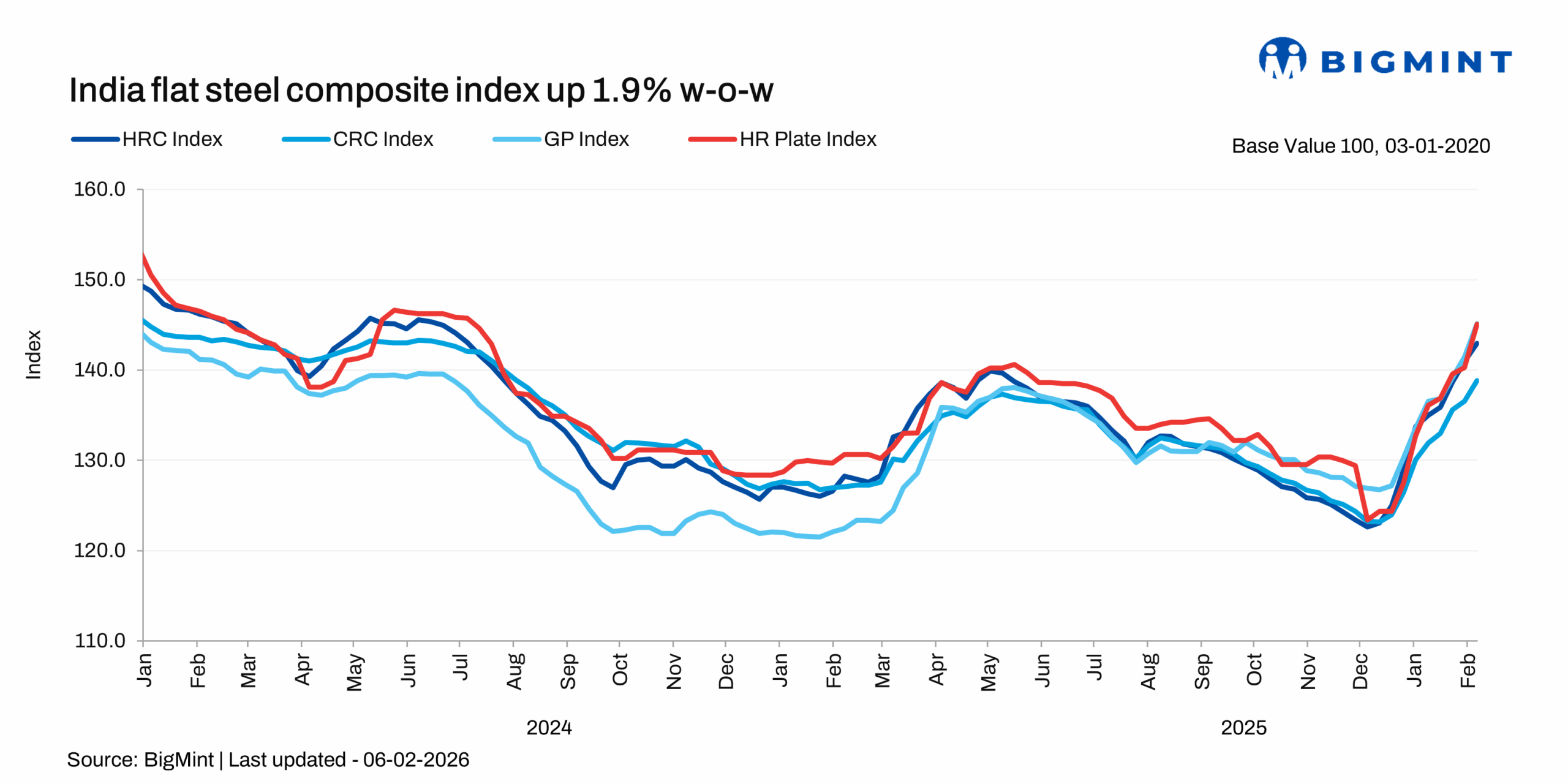

While the longs composite index recorded an increase of 1.9% the flats index rose 1.4% w-o-w as mills raised prices to meet higher costs and shore up margins.

Highlights of price movements

Mills hike BF rebar prices: Indian primary steelmakers increased rebar prices by up to INR 3,000/tonne (t) ($33/t) for early-February dispatches over end-January levels, sources informed BigMint. Post-revision, list prices stood at INR 57,000-58,000/t ($630-641/t) on landed basis. Trade-level BF-rebar prices (distributor to dealer) rose by INR 600/t ($7/t) to INR 58,000/t ($641/t) exy-Mumbai.

Healthy order bookings supported market sentiment and prompted price hikes, with several mills also facing substantial order backlogs for the coming days. Inventory levels at primary mills fell by around 40% m-o-m in early-February on the back of strong dispatches last month, which led to inventory reduction.

IF rebar prices surge m-o-m: IF rebar prices rose by INR 4,500/t ($50/t) m-o-m to a monthly average of INR 49,500/t ($547/t) exw-Mumbai in January. Prices strengthened across major markets, supported by healthy demand, strong order bookings, and firm semi-finished steel prices. The price hike was supported by an increase in prices of billet, sponge iron and pig iron. Improved dispatches reduced inventory pressure.

HRC, CRC prices rise further: The primary steelmakers increased list prices of hot-rolled coils (HRCs) and cold-rolled coils (CRCs) by INR 1,750-2,500/t ($19-28/t) for early February sales. List prices of HRCs (2.5-8 mm, IS2062, Gr E250 Br) ranged within INR 53,450-54,250/t ($593-601/t) ex-Mumbai. Moreover, CRCs (0.9 mm, IS513 CR1) were listed at INR 60,200-61,500/t ($667-682/t).

Notably, after the release of January sales prices, list prices were revised again twice or thrice in the month. As a result, in early February, the cumulative m-o-m increase in list prices was INR 2,500-3,250/t ($28-36/t).

These successive revisions also led to a sharp increase in monthly prices in the trade market. M-o-m, trade-level HRC prices rose by INR 4,900/t ($54/t) to INR 52,000/t ($576/t) in January compared with INR 47,100/t ($522/t) in December 2025.

Throughout January, India's HRC and CRC trade markets witnessed bullish sentiment. Demand remained steady, while some regions witnessed tight supply. A north India-based trader informed BigMint, Some supply constraints have emerged recently at mills, though inventories are moderate at the distributor level.

Some market participants also reported of smooth absorption of prior price hikes and potential acceptance of a price rise.

Higher raw material costs were a key factor influencing the sharp uptick in prices. In January, BigMint's coking coal index increased 9% or $20/t m-o-m to $250/t CFR India, while the Odisha iron ore fines index (Fe 62%) was up by INR 200/t or 4% m-o-m at INR 5,900/t.

Additionally, HRC imports decreased by over 20% m-o-m in January and HRC export prices to the EU are on the rise on the back of strong domestic sentiments.

Outlook

India's crude steel output was significantly higher y-o-y in Q3FY'26, with the major steel producers witnessing strong growth. Production discipline and supply side balance are likely to impact steel prices, while a supply surfeit in certain regions remains a threat amid rapid growth in production. Also because export sentiments may not improve significantly in the coming one-two months, supplies will increase in the domestic market.

Globally, steel prices are showing a recovery, with the major Asian mills increasing HRC prices. Domestically, a strong demand scenario is boosting prices and the uptrend is set to continue.