Weekly wrap: Coal market sentiment remains cautious amid firm import prices, weak demand

...

- Imported coal prices firm, buyers cautious

- Domestic auctions ensure higher supplies, limit price rise scope

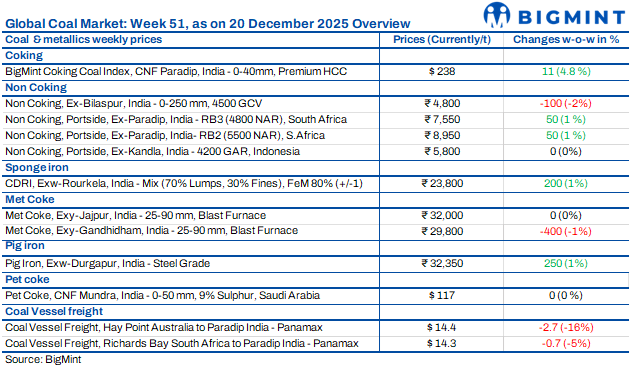

Indian coal market sentiment stayed cautious this week as firm imported offer levels contrasted with weak downstream consumption. Imported coal prices remained supported on supply-side constraints and logistics issues, but buying interest stayed limited due to subdued sponge iron and steel demand. Domestic coal availability was comfortable following recent auctions, keeping price pressure intact. Market participants largely adopted a wait-and-watch approach, with trading activity thinning further ahead of the holiday period.

Indonesian coal prices stable

Indian portside Indonesian thermal coal prices stayed unchanged in the week ended 19 December despite a rise in Indonesia's HBA benchmark, as ample inventories and weak spot demand capped gains. BigMint assessed 5,000 GAR at INR 7,200/t in Kandla and INR 7,100/t in Vizag, while 4,200 GAR held at INR 5,800/t and INR 5,700/t, respectively. The 3,400 GAR grade remained stable at INR 4,500/t in Navlakhi. Buying interest stayed muted, with bids lagging offers amid comfortable stocks and limited Chinese demand. FOB East Kalimantan prices softened, with 3,400 GAR bids easing to $30-31/t and 4,200 GAR bids at $44-45/t. Indonesian miners resumed sales, adding supply pressure, while uncertainty over a potential export tax kept sentiment cautious.

South African offers firm, demand lags

In the week ended 19 December South African thermal coal offers strengthened further, while buying interest stayed weak. BigMint assessed RB2 (5,500 NAR) ex-Paradip, Vizag and Gangavaram at INR 8,900-8,950/t, while RB3 (4,800 NAR) rose to around INR 7,550/t, up INR 50-150/t w-o-w. Offers at higher levels of INR 9,200-9,250/t exw failed to attract active trades. Portside offers firmed due to low stocks at Kandla and Mangalore and ongoing cargo tightness linked to RBCT constraints. However, sponge iron and steel demand remained fragile, limiting acceptance despite a few spot deals. Portside stocks stayed broadly stable at 13.07 mnt, keeping sentiment cautious.

Domestic coal prices soften

Domestic coal prices in India declined further in the week under review. Prices of 5,000 GCV fell to INR 5,750/t, while 4,500 GCV eased to INR 4,800/t, down INR 50-100/t w-o-w. Demand remained weak, while coal availability was comfortable across key consuming regions. Supply was eased further by SECL's auction held on 12 December which recorded strong participation. Around 2.80 mnt of coal was allocated out of the 3.22 mnt offered in the auction, confirming adequate near-term availability in the domestic market. The combination of lower prices and sufficient supply kept market sentiment subdued during the week, with prices continuing to trend lower on a w-o-w basis.

Coking coal index rises sharply

BigMint's premium hard coking coal (PHCC) index was assessed at $238/t CNF Paradip on 19 December, up $11/t w-o-w, marking the highest level in over a year. The increase followed firmer global prices and limited availability of Australian mid-vol material. An eastern India-based mill booked 30,000 t of Australian PHCC at $238/t CNF India for January loading, while another deal was heard at $239/t. Import costs also rose as the currency depreciation against the US dollar. Australian PHCC prices climbed to $217/t FOB, the strongest since August 2024. Meanwhile, expectations of further met coke price cuts in China persisted even as Indian steelmakers raised HRC and CRC list prices by INR 750-1,000/t in mid-December.

Met coke prices diverge

India's metallurgical coke market showed mixed trends in the week ended 19 December as cost pressures rose while buying stayed selective. In eastern India, BF-grade met coke was steady at INR 32,000/t ex-Jajpur w-o-w. In contrast, western India saw corrections, with BF-grade met coke at INR 29,800/t ex-Gandhidham, down INR 400/t, and foundry-grade at INR 35,800/t ex-Rajkot, lower by INR 200/t. Producers continued to face margin pressure as Australian coking coal FOB offers rose by around $10-11/t w-o-w to $217/t, while INR weakened below 91 against the dollar. Weak offtake and comfortable inventories in western India led to distressed sales. Pig iron prices eased, with ex-Durgapur assessed at INR 32,100/t, down INR 150/t. Overall sentiment remained cautious.

Imported pet coke market stalls

India's imported pet coke market remained stalled for the third consecutive week, with no confirmed spot trades reported. BigMint's assessment showed offers steady at $120-121/t CFR India, while buyer bids stayed limited to $114-115/t, leaving a persistent $5-7/t gap. Market participants continued to favour thermal coal, citing US Northern Appalachian, South African and Mozambican coal as cheaper by $5-10/t on a delivered basis. Buyers remained inactive as inventories stayed comfortable following purchases made earlier in Q3 and early Q4. Despite a marginal easing in US Gulf-India freight rates, landed pet coke costs remained uncompetitive. As a result, buying interest stayed muted, and the market continued in a wait-and-watch mode heading into early January.

IOCL applies selective pet coke hikes

Indian Oil Corporation Limited (IOCL) announced its second pet coke price revision for December, effective 9 December, with selective increases across eastern refineries. At Paradip, road-supply prices were raised to INR 11,710/t and rake prices to INR 11,510/t, both up INR 200/t from the first December revision. Haldia also saw a similar INR 200/t increase, with road prices at INR 11,880/t and rake prices at INR 11,680/t. In contrast, prices at Koyali and Panipat were left unchanged in this round, indicating a region-specific pricing adjustment rather than a uniform hike across refineries.

Coal freights to India slip

Dry bulk coal freight rates to India declined sharply during the week as cargo demand softened and vessel availability increased across key routes. Australia-India Panamax freights fell to a six-month low at $14.4/dmt, down $2.7/dmt w-o-w, while South Africa-India rates eased to $14.3/dmt, a four-month low. Indonesia-India Supramax freights slipped $0.24/dmt to $13.76/dmt. Weak steel demand in India, muted fixing activity and longer open vessel lists pressured earnings. Lower bunker prices offered limited relief. The Baltic Panamax index dropped 335 points to 1,389, while the Supramax index fell 129 points to 1,258. Freight sentiment remained soft.