Weekly round-up: India's domestic semi finished steel prices inch down, flats range-bound w-o-w

...

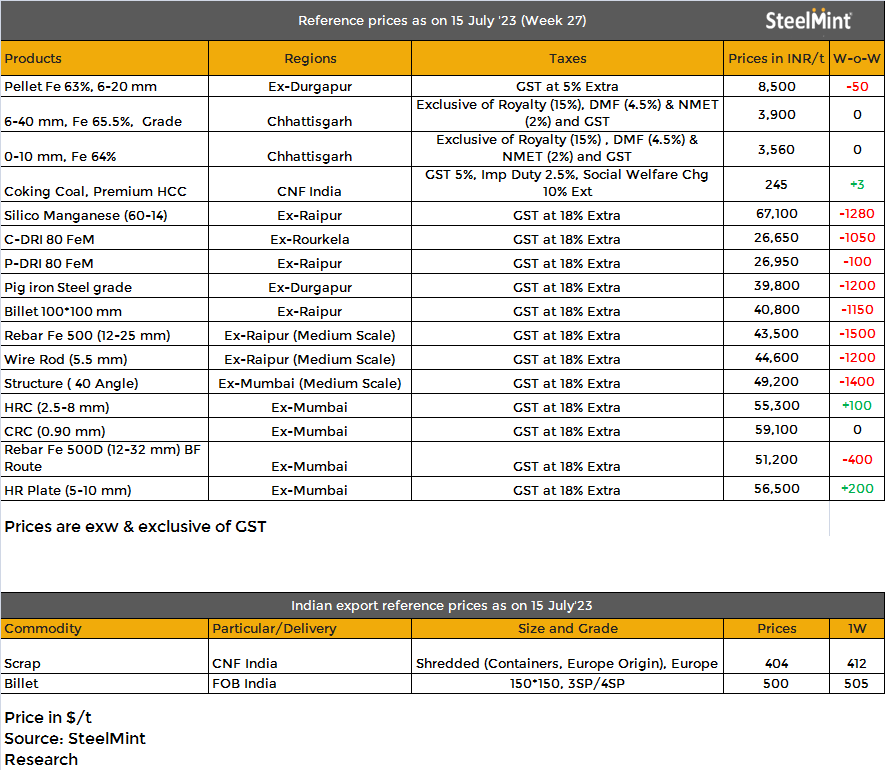

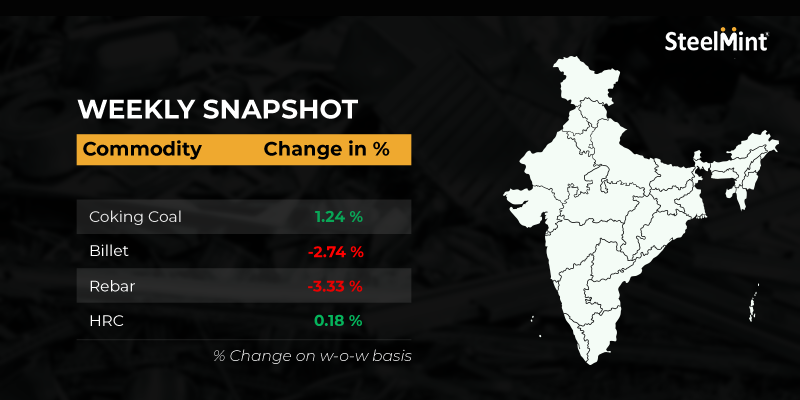

India's domestic steel market saw negative price trends during week 27 ( 10 July- 15 July, 2023). While, semi-finished steel prices went down by INR 350-1,450/tonne (t), induction furnace finished long steel offers were on the downtrend with prices plunging by INR 500-2,000/t. Flat steel prices, on the other hand, remained range bound w-o-w.

Iron ore and pellets

- SteelMint's bi-weekly domestic pellet (Fe 63%) index, PELLEX, remained stable w-o-w at INR 9,000/t DAP Raipur. Deals of 35,000 t were recorded at INR 8,800-9,000/t (Fe 63/63.5%) DAP Raipur throughout the week.

- Orissa Minerals Development Company (OMDC) had conducted an auction for 27,584 t of iron ore fines (Fe 58.27-59.26%) from its Bhadrasahi mines on 13 Jul'23. As per sources, the entire material was booked at INR 2,190-2,640/t. Notably, bid prices were higher by around INR 180-600/t against the set base price of INR 2,010-2,040/t (excluding royalty, DMF & NMET).

- At Vedanta's auction, the entire quantity of 16,000 t of iron ore lumps (10-40mm,Fe56.5%) got booked at the base price of INR 3,578/t. All prices are exclusive of royalty, DMF and NMET.

- At NMDC-Donimalai mines' iron ore auction, 92,000 t of lumps (10-40mm,Fe61%) and 148,000 t of fines (Fe59%) were booked at the base price of INR 2,878/t and INR 2,469/t, respectively. All prices are exclusive of royalty, DMF and NMET.

- SteelMint's India pellet (Fe 63%, 3% Al) export index FOB east coast inched down by $1/t w-o-w to $107/t on 12 July, 2023. Pellet prices remained steady due to lack of market clarity on price direction in the face of slow demand. It was expected that pellet export trade may remain volatile in monsoon. A deal of 55,000 t of pellets was recorded at $117-118/t CFR China so far this week.

Coal

- Australian premium hard coking coal prices remained largely stable w-o-w at $232/t FOB and $245/t CNF India amid muted trading activity.

- Portside prices of South African RB3 (4800 NAR) thermal coal at Vizag Port were recorded at INR 7300/t, rising by 4% w-o-w amid Transnet's issues causing delay in deliveries.

- RB1 (6000 NAR) grade prices fell by around 12% w-o-w to $92.85/t FOB while RB3 prices remained largely stable to $72/t FOB Richards Bay, South Africa.

Ferrous scrap

- In India, scrap buyers witnessed tardy negotiations, as demand remained weak. However, imported scrap offers edged down on slow demand. Suppliers and buyers were not in a hurry to conclude transactions. However, an imported scrap deal was concluded at $405-410/t CFR.

- In regards to the domestic market, due to the flood-like situation in north Indian states and congestion on highways, it became very difficult to deliver goods. Traffic jams were rampant on highways and transporters were not being allowed to continue working in risky conditions. On the other hand, steel producers are expecting prices of semis to remain under pressure on account of a slight rise in inventories of both semis and finished long steel.

Ferro alloys

- Domestic silico manganese (60-14) prices dropped marginally by up to 2% w-o-w to INR 65,600-69,750/t exw -Durgapur, Raipur and Vizag. Demand was low as a result of falling steel prices and sluggish global market trends, and buyers were looking for lower offers.

- Domestic ferro manganese (HC70%) prices dropped 1% w-o-w amid low export inquiries and poor demand for special steel. Offers hovered at around INR 68,250-69,100/t exw- Durgapur and Raipur.

- Domestic ferro chrome (HC60%) prices were at around INR 100,800/t exw-Jajpur, falling by INR 1,200/t due to sluggish demand and the gloomy outlook of the Chinese market. Additionally, market participants are also eagerly awaiting the upcoming OMC auction, which will take place on 19 July.

- Domestic ferro silicon prices were at INR 108,700/t ex-Guwahati, down by INR 700/t w-o-w. Prices fell as sellers sold material apprehending further price cuts even as demand remained weak. Offers from Bhutan fell by INR 200/t over the course of the week but offers stayed essentially same at INR 109,600/t.

Semi finished

- Prices decreased as finished steel products enquiries in the key markets remained limited. Domestic billet prices fell by INR 500-1,450/t. Similar concerns caused sponge producers to begin lowering their offers by INR 350-1,050/t w-o-w. However, sponge prices in the southern region witnessed a marginal uptick of INR 50-150/t.

- SAIL's Rourkela Steel Plant (RSP) held an auction for 5,100 t of steel grade pig iron on 10 July 2023. The entire quantity was booked at an average price of INR 38,960/t exw.

Finished long

- India's induction furnace-route finished long steel prices edged lower w-o-w owing to weak market sentiments. Heavy rainfalls in the key northern and central regions slowed down buying activities. Manufacturers lowered offers and along with that, were offering heavy discounts in order to liquidate material, but buyers still opted for a wait-and-watch mode as they are expecting further price correction in the coming days.

- Rebar prices declined by INR 500-2,000/t across the regions while wire rod prices went down by INR 1,000-1,200/t in the Raipur and Durgapur markets.

- The trade reference price of Fe 500 grade rebar manufactured via the IF route for 10-25 mm size was assessed at INR 43,300-43,700 /t exw-Raipur and INR 47,500-48,000 /t exw-Jalna.

- Trade reference price of heavy structural steel for base size 150mm channel stood at INR 46,000-46,300/t exw-Raipur.

- Trade reference prices of wire rod hovered at INR 44,500-45,000/t exw-Raipur.

- Trade level prices of rebars made through blast furnace (BF)-route slid amid slow buying interest. This marks the 23rd consecutive week of decline in prices.

- Offers in the project segment hovered around INR 49,000-50,000/t FOR Mumbai. Buying interest remains subdued, as buyers were procuring hand-to-mouth and heavy rains in the northern provinces also impacted trade activities. Also, inventory pressure from mills weighed on prices.

- SteelMint's weekly price assessment for rebars (12-32 mm, BF-route, IS 1786, Fe500D) for the trade segment fell by INR 400/t w-o-w to INR 51,200/t, exy-Mumbai, excluding GST at 18%.

Finished flat

- Prices of finished flat steel products were range-bound at the trade level markets. Although end-buyer demand was slow, the mill maintenance shutdown and its impact on supplies kept traders' market prices firm.

- "The number of inquiries has increased slightly over the past couple of weeks; however, buyers are still trying to bargain on the current price levels," a few sources informed. Distributors, however, are reluctant to reduce their offers because the supply chain is constrained, and stock levels have depleted.

- Market sentiments stood mixed as a few participants opine buyers to start procuring in the near term, while a few others were still concerned about the slow sales months of monsoons, said a north based distributor.

- On the exports front, Indian mills were heard to have turned inconsistent in quoting to the Middle East (ME) this week. Last heard offers for HRC (SAE1006) stood around $605-610/t CFR UAE. However, last week, a private Indian mill was heard quoting $580/t CFR Vietnam for HRC (SAE1006) after a gap of around 2-3 months. Later, in the middle of the current week, the market was abuzz with the news of Indian HRC being booked for Vietnam at $585-587/t CFR.

- SteelMint's India HRC (SAE1006) export index - which is based on the ME and Vietnamese markets - stood unchanged at $570/t FOB east coast this week.

- Furthermore, HRC export (S275, 3mm) offers to Europe inched up by $5-10/t w-o-w to $670-675/t CFR Antwerp against $660-670/t CFR Antwerp a week ago. European buyers were buying in small parcels to avoid future shortages and logistical issues in September.

- Flat steel producing mills are planning an increase list prices in the upcoming week. Constrained supplies led by the maintenance shutdowns along with the increasing need of restocking pushed the mills to hike prices.