Turkiye: Imported ferrous scrap market witnesses volatility with moderate activities; price down by $4/t w-o-w

...

The Turkish imported ferrous scrap market experienced volatility in terms of prices throughout this week. Steelmakers refrained from new import scrap purchases at the beginning of 2024; the market remained in pause mode mid-week as participants assessed their next moves, citing ample offers but needing time to establish market direction.

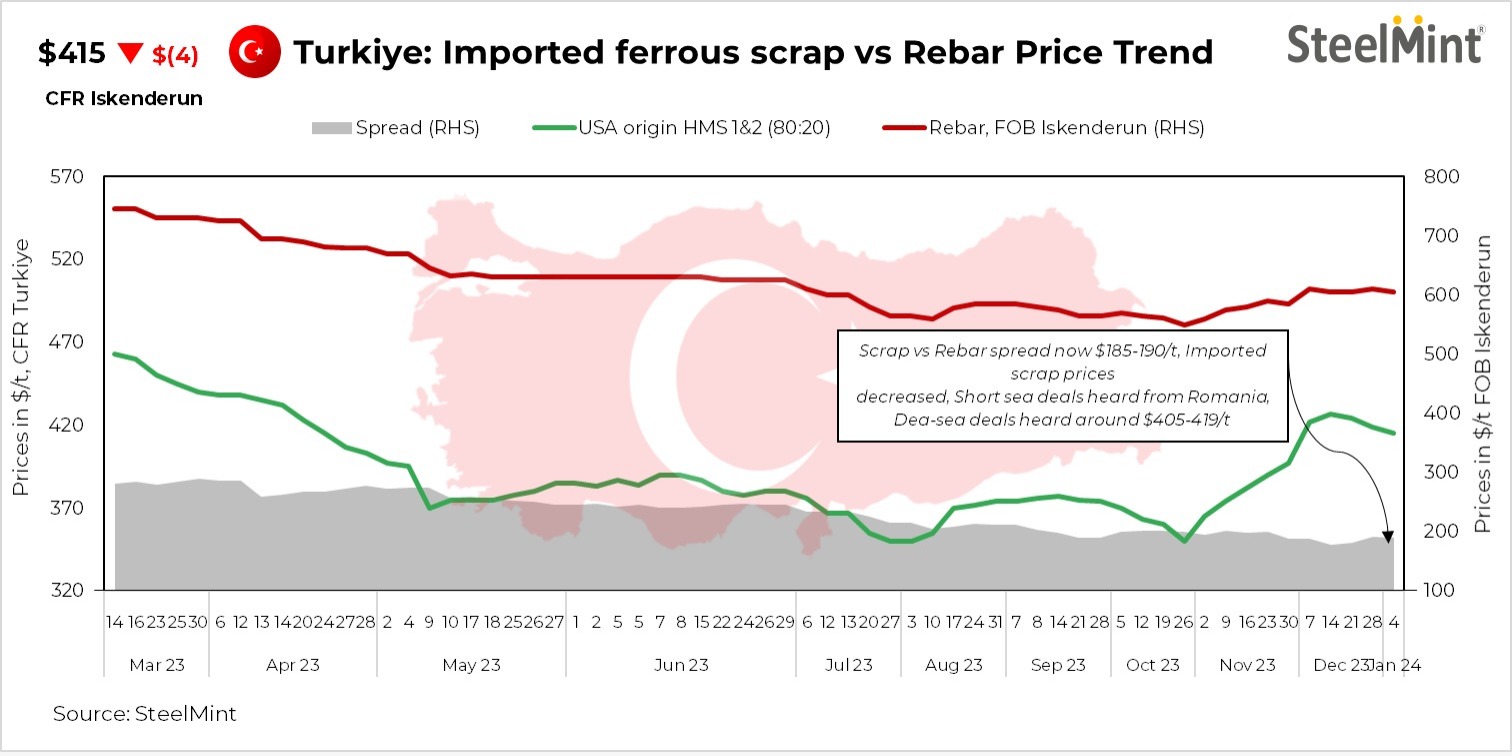

SteelMint's assessment for the US-origin bulk HMS (80:20) declined by $4/t w-o-w, reaching $415/t CFR Turkiye.

The scrap-to-rebar spread was assessed at $185-190/t as export offers for rebar hovered around $600-605/t on a FOB basis.

Recent deals:

An East-Marmara-based steel mill secured a shipment of HMS (80:20) scraps at around $410/t CFR and bonus scrap at $430/t CFR originating from Europe. An Iskenderun region mill booked a UK-origin HMS (80:20) at $405/t CFR.

A West black sea region-based steel mill secured a US-origin shipment of HMS (95:5) scraps at around $415/t CFR and PNS scrap at $430/t CFR for early February shipments.

Another US-origin cargo was booked by a Mediterranean region-based mill comprising HMS(80:20) at $419/t on a CFR Turkiye basis.

A UK-based supplier sold a cargo with HMS(80:20) and Bonus at $414/t and $439/t on a CFR Turkiye basis.

Domestic steel market: To counter the influx of foreign steel, Turkish authorities imposed a temporary safeguard measure on imported alloyed and non-alloyed wire rods, applying a provisional duty and safeguard measure on select steel imports for 200 days. The safeguard measure aims to protect local steel producers.

Turkish authorities postponed the implementation of the rebar monitoring system (IDIS) initially set for 1 January 2024, to 30 April 2024. The system was conceived for round bars under HS Code 7214.20 to enhance building security following earthquakes in the country. The decision provides participants with additional time to sell rebar inventories without the required safety labels.

In November 2023, Turkish steel producers increased imported scrap volumes for the second consecutive month, reaching 1.56 mnt. Europe remained the primary source, accounting for 59%, while North America saw a 2.4-fold growth in scrap supplies, reaching 30% of the total volume.

Steel output: Turkish steel output surged by 25.4% y-o-y in November, contributing to a gradual recovery in the steel industry's overall performance. The country's crude steel output for the first eleven months of 2023 totalled 30.5 mnt, down 6.1% y-o-y.

Kocaer Steel, an Izmir-based producer, plans to temporarily pause operations at one of its Aliaga-based factories for two months for planned revisions and the installation of new equipment and machinery. The facility can produce 300,000 t/year.

Ekinciler, a Turkish long steel producer, is closer to starting construction on its solar energy project, a 31.2 MWm (27.5 MWe) solar power asset worth TRY 401.4 million (about $13.8 million). Construction is expected to begin in April-May 2024.

Turkiye announced plans to build two new ports in the Iskenderun region, namely the Mersin Logistics Port and the Adana Main Container Port Project. These projects aim to strengthen Turkiye's logistics potential and enhance global trade connections.

Outlook: Sellers adopted a cautious approach, preferring to wait until mid-January, anticipating a potential price recovery. Whereas as per few market insiders, the price trend will remain volatile this month due to high freight rate and slow collection rate across supplier side.