Taiwan's Feng Hsin hikes rebar, scrap prices

...

Feng Hsin Steel, Taiwan's largest rebar producer headquartered in Taichung in central Taiwan, has decided to raise its rebar list prices and procurement prices for local scrap for transactions over April 1-3, a company official confirmed on Tuesday.

It is a short working week in Taiwan because of the public holiday for the Qingming Festival and Children's Day over April 4-7, Mysteel Global noted.

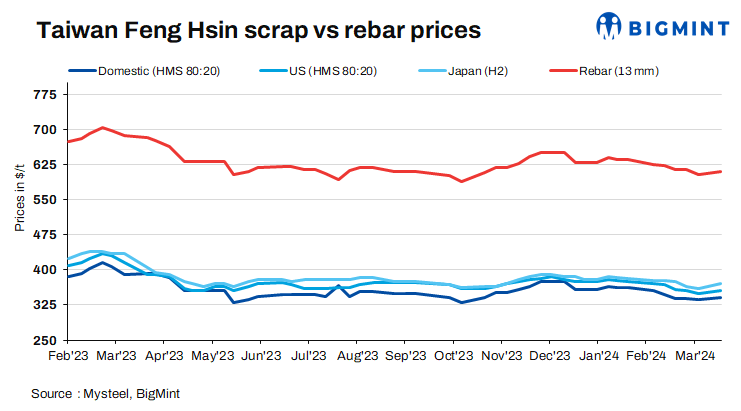

For business discussions till this Wednesday, the mini-mill is offering its 13mm dia rebar at TWD 19,500/tonne ($608/t) EXW, gaining TWD 300/t on week, and its buying price for local HMS 1&2 80:20 scrap reaches TWD 10,900/t after the on-week rise of TWD 200/t, the company official told Mysteel Global.

Global scrap prices delivered to Taiwan kept firm over the past week, lending some support to the local steel market. As of April 1, the price of US-sourced HMS 1&2 80:20 scrap was reported at $355/t CFR Taiwan, the same level from one week before, while the price of Japan-origin H2 scrap increased continuously by another $5/t on week to reach $370/t CFR Taiwan, according to a local market source.

Feng Hsin Steel's price hike was partly to reflect its higher production costs with the increased scrap prices and the higher electricity prices, Mysteel Global learned.

Taiwan Power (Taipower), the state-run electricity supplier, has announced higher electricity prices for residential and industrial users to take effect from April to offset mounting financial losses, as Mysteel Global reported.

Last week, rebar prices in mainland China lost ground on negative sentiment and lackluster demand from end-users. As of April 1, China's national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, was assessed by Mysteel at Yuan 3,591/tonne ($496/t) including the 13% VAT, lower by a notable Yuan 127/t from one week earlier.

Note: This article has been written in accordance with an article exchange agreement between Mysteel and BigMint.