South Asia: Imported ship-breaking prices drop w-o-w amid sluggish trade

South Asia’s ship-breaking market last week experienced a sluggish week in terms of transactional activities, with prices remaining flat. However, sub-continent...

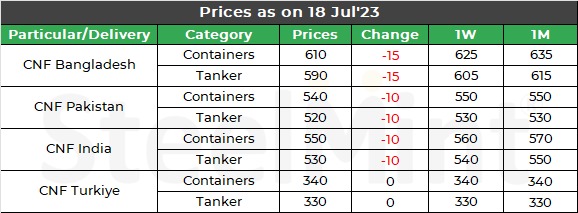

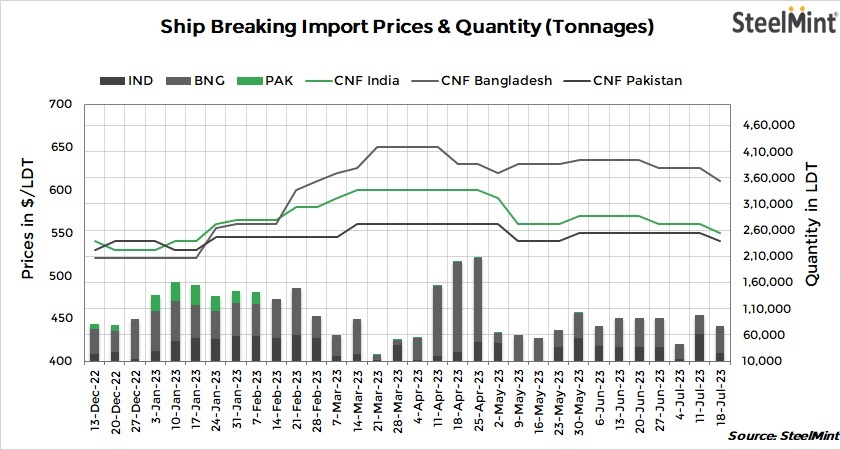

South Asia's ship-breaking market last week experienced a sluggish week in terms of transactional activities, with prices remaining flat. However, sub-continent yards are operating with minimal labour capacity due to constant rains. Demand for new vessels in Bangladesh remains muted, while financing issues burden the market. Similarly, the Indian market continued to remain less active. Pakistan's recent International Monetary Fund (IMF) loan is anticipated to provide some economic relief and may lead to a re-entry into the ship recycling industry once letter of credit (LC) issuance resumes.

On the other hand, amidst the ongoing scarcity of tonnage, the Turkish ship-breaking market experienced further downward pressure on fundamentals last week.

India

Ship owners and cash buyers are not enticed by Alang buyers' offers below $500/light displacement tonnage (LDT), leading to limited sales in the Indian ship-breaking market. Available tonnage is expected to move to competing markets such as Bangladesh and recently funded Pakistan. Transactional activities remain sluggish in the Indian market due to the monsoon season and labour availability.

The total tonnage at Alang port as of last week was 24,579 LDT.

Bangladesh

According to the GMS report, the Bangladeshi market saw the sale of a bulk carrier vessel called XIANG HE (9,016 LDT) at a price of $520/LT LDT on an 'as is' Singapore delivery basis. However, the deal was finalised at lower price levels. Currently, the market is grappling with limited demand, causing mills to operate at lower capacities compared to their previous levels. Consequently, there is a shortage in the procurement of scrap materials. Furthermore, persistent issues with obtaining permissions from the Central Bank are hindering the financing process for new LCs.

The total tonnage at Chattogram port as of last week was 51,645LDT.

Pakistan

Recently, Pakistan had received a significant portion of the $3 billion IMF bailout loan, with $1 billion already disbursed. This development brings hope to the ship recycling industry in Pakistan, which has faced a shortage of tonnage due to ongoing political and economic challenges. Once commercial banks resume issuing fresh LCs, the industry may witness an increase in deals. However, to capitalise on this opportunity, Gadani recyclers must focus on facility upgrades and stay abreast of industry changes, particularly with the Hong Kong Convention (HKC) coming into force in Bangladesh.

The total tonnage at Chattogram port as of last week was nil.