South Asia: Imported ferrous scrap prices see mixed trend d-o-d, limited buying in India and Pakistan

...

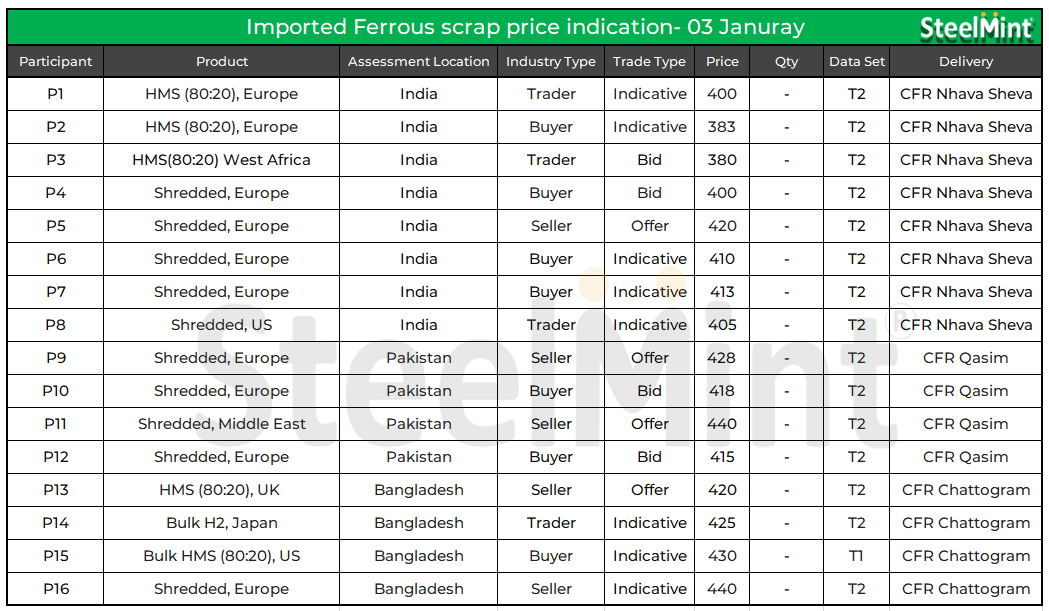

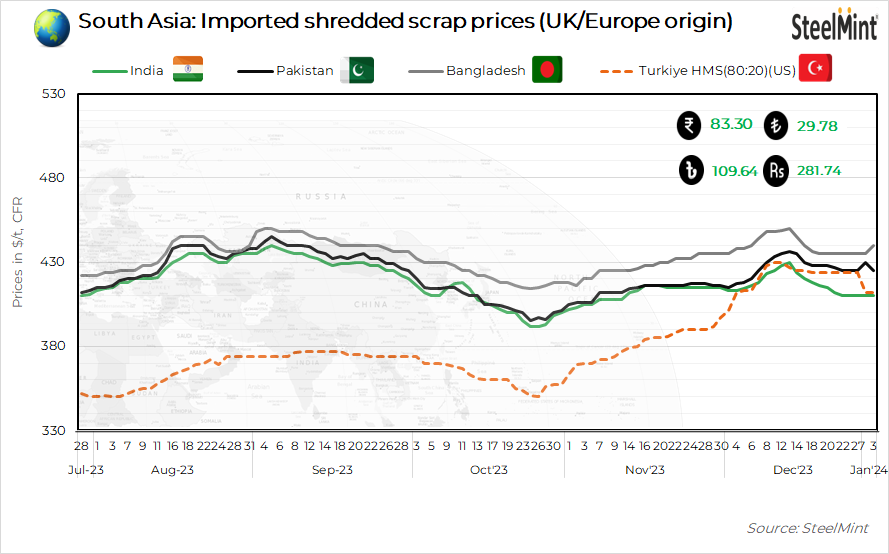

The South Asian ferrous scrap prices displayed a mixed trend d-o-d. In India and Pakistan, offers remained unchanged due to a lack of buying interest. Conversely, in Bangladesh, there was an uptick of $5/t d-o-d attributed to re-stocking activities ahead of the elections scheduled for next week.

Market overview

India: Today, the demand for imported scrap in India remained subdued as buyers hesitated amid global market uncertainty. Additionally, no firm offers were reported from the US and Europe post-Red Sea crisis, and freight rates are anticipated to increase.

Indicative offers for shredded scraps from Europe were at around $410-415/t CFR Nhava Sheva, while HMS (80:20) was quoted at $380-390/t CFR.

A trader highlighted, "The current uncertainty in the imported scrap market, noting iron ore prices surpassing $152-155/t. Limited demand in the Indian market, linked to upcoming central elections and reduced cash flow. If current conditions endure, finished product prices may rise, or mills could operate at reduced capacity. Recent declines in domestic scrap prices made imported scrap less appealing for many mills in terms of cost-effectiveness."

Pakistan: In Pakistan, the demand for imported scrap stayed low due to unclear offers. Indicative prices for shredded scrap from Europe were noted at $430-435/t CFR Qasim, and $435-440/t from the Middle East.

A representative from a trading company stated, "Import prices are currently unavailable as sellers are away from the market due to ongoing holidays."

In the local market, scrap prices fluctuated between PKR 160,000-170,000/t ex-works.

Bangladesh: Bangladeshi mills engaged in re-stocking activities ahead of the elections, with reports indicating bookings of around 7,000 t of HMS (80:20) from the Middle East at approximately $425-430/t CFR in the past few days. In the domestic market, ship-breaking scrap prices were reported at BDT 61,000-62,500/t, busheling scraps at BDT 63,000/t, PNS scraps at BDT 60,000/t, HMS (90:10) at BDT 59,000/t, and HMS (80:20) at BDT 57,000/t.

Turkiye: Turkish imported scrap prices faced pressure from mills, but recyclers resisted. Turkish mills were expected to return in January for February shipments, and the last December trade, a Venezuelan deal at $410/t CFR Marmara, set a confusion towards current offers. However, starting of this week witnessed somewhat bearish sentiment emerged from Turkish scrap importers. While mills aimed for prices below $410/t CFR, no downward adjustments were confirmed as recyclers resisted the pressure. Offers for premium HMS (80:20) stood at $415-$420/t CFR Turkiye, with European asking prices at a minimum of $410/t CFR. Recent rebar sales in the Turkish domestic market supported scrap prices.

Price assessments

India: The UK-origin shredded scrap indicatives remained stable at $410/t CFR Nhava Sheva today.

Pakistan: The UK-origin shredded scrap indicatives were down by $5/t to $425/t CFR Qasim today.

Bangladesh: The UK-origin shredded scrap prices were assessed at $440/t CFR Chattogram, up by $5/t d-o-d.

Turkiye: The US-origin HMS (80:20) bulk prices were assessed stable at $412/t CFR Turkiye.

Outlook

In the short term, imported scrap prices may experience volatility due to uncertainty among buyers regarding offers, as the US and Europe are still partially observing holidays. Additionally, the recent crisis in the Red Sea suggests a rise in freight costs, contributing to an anticipation of increased offers for imported scrap in the market.