South Asia: Imported ferrous scrap prices remain range-bound amid limited buying interest

...

- FY closure, bid-offer gaps keep Indian buyers wary

- Turkish scrap prices edge up despite mills' resistance

South Asia's imported scrap markets remained sluggish, as holiday-related slowdowns, financial constraints, and bid-offer mismatches weighed on trading activity. In India, the financial year's end and regional festivities kept buyers cautious, while Pakistan's market was muted due to the Eid holidays and letter of credit (LC) issues. Bangladesh also saw limited transactions, as buyers resisted high offers amid restricted LC approvals. Meanwhile, Turkiye's scrap market remained range-bound, with weak finished steel sales and oversupply pressuring sentiment.

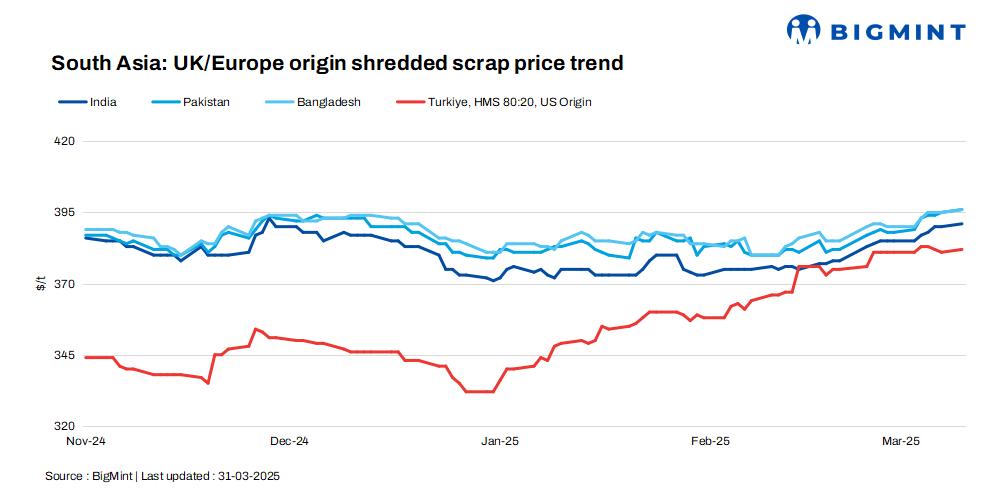

UK-origin shredded offers remained range-bound, edging up by $1/t in India, Pakistan, and Bangladesh. US-origin bulk HMS 80:20 offers to Turkiye also edged up by $1/t compared to the last close on Friday.

Overview

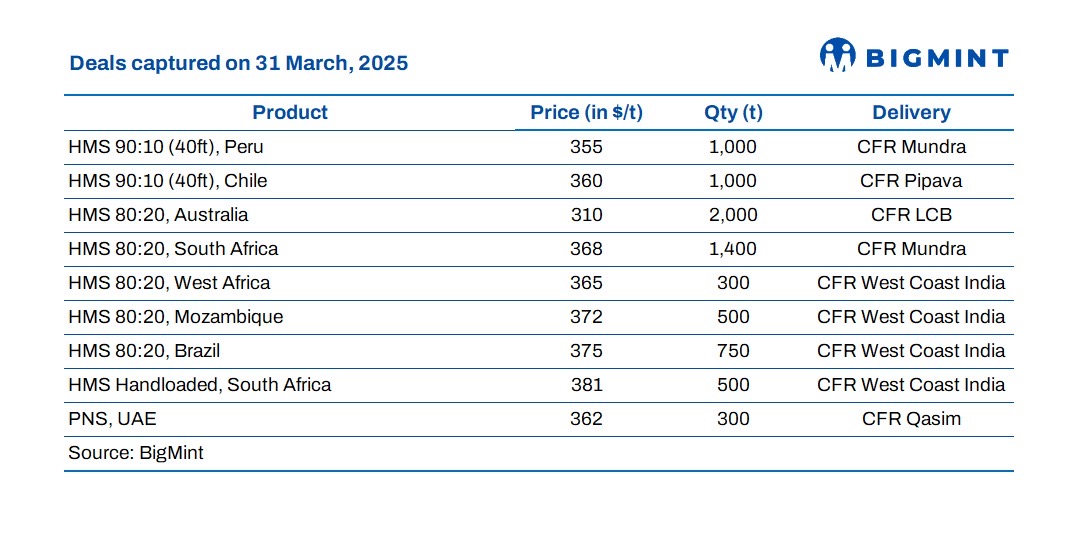

India: India's imported scrap market slowed down, as the financial year-end and regional festivities such as Eid and Navratri kept buyers cautious. While some optimism in northern and western regions led to some bookings, overall activity slowed due to persistent bid-offer mismatches. Shredded offers stood at $390-395/t CFR, but buyer resistance above $385-388/t limited transactions. HMS 80:20 from the UK/Europe and West Africa was quoted at $360-370/t CFR, though buyers aimed for $355-365/t, further constraining trade.

Pakistan: In Pakistan, market activity was subdued, as buyers were in a holiday mood amid Eid celebrations. Liquidity constraints and ongoing LC issues further dampened transactions. While activity is expected to pick up post-Eid, high global scrap prices and economic uncertainty could limit a sharp recovery. Shredded offers from the UK/Europe were heard at $395-400/t CFR Qasim, with bids ranging within $390-395/t CFR.

Bangladesh: Bangladesh's imported scrap market remained muted, as buyers resisted high offers, while limited LC approvals due to the Eid holidays further restricted trading. Market activity is expected to fully resume in the coming days. Deals included PNS from Hong Kong at $390/t CFR and Australian shredded at the same level, while buyers sought Australian HMS 80:20 at $364-365/t CFR. Demand for UK/Europe-origin scrap weakened, as buyers favoured nearshore suppliers.

Turkiye: The Turkish imported scrap market remained range-bound with bearish sentiment, as weak finished steel sales dampened demand. Despite the strong availability of April shipment cargoes, mills were hesitant to restock, with only a few cargoes needed while numerous offers flooded the market.

Prices of US-origin HMS 80:20 hovered at around $383/t CFR, with EU-origin offers slightly lower at $373-379/t CFR.

The market faced oversupply, particularly from European sellers who held out for higher prices, which did not materialise.

Amid the ongoing Eid holidays, activity is expected to remain subdued, and prices could see a slight decline once trading resumes. Buyer-seller price gaps also slowed fresh deals.

Price assessments

India: UK-origin shredded indicatives were assessed at $391/t CFR Nhava Sheva, up by $1/t compared to the last close on Friday.

Pakistan: UK-origin shredded indicatives stood at $396/t CFR Qasim, rising by $1/t compared to the last close on Friday.

Bangladesh: UK-origin shredded indicatives were assessed at $396/t CFR Chattogram, up by $1/t compared to the last close on Friday.

Turkiye: US-origin HMS (80:20) bulk scrap prices were assessed at $382/t CFR Turkiye, up by $1/t compared to the last close on Friday.