South Asia: Imported ferrous scrap offers drop amid weak sentiments, India goes against the grain

...

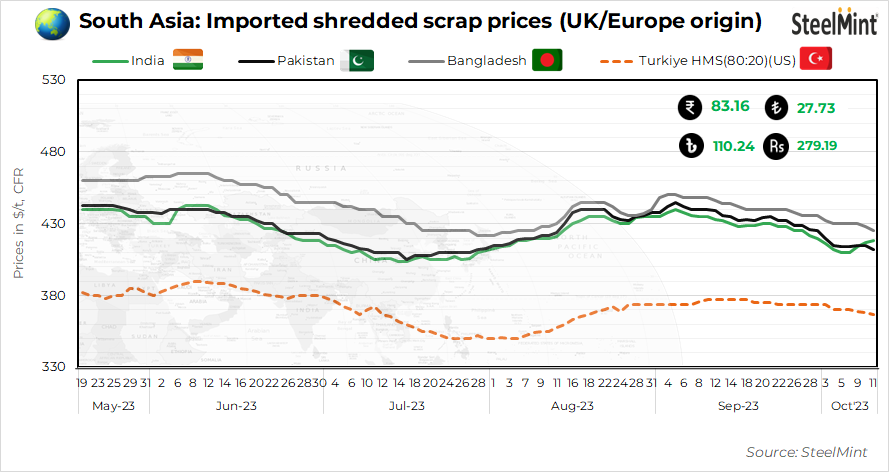

The South Asian ferrous scrap market saw a downward trend today, with the exception of India where a few deals were reported. However, market participants are hesitant to commit to large volumes at the current price levels, as buyers are seeking lower than what is being offered. Consequently, negotiations are in progress.

In Pakistan, Bangladesh, and Turkiye, a lack of buying interest led to a slight decline in offers of around $1-3/t.

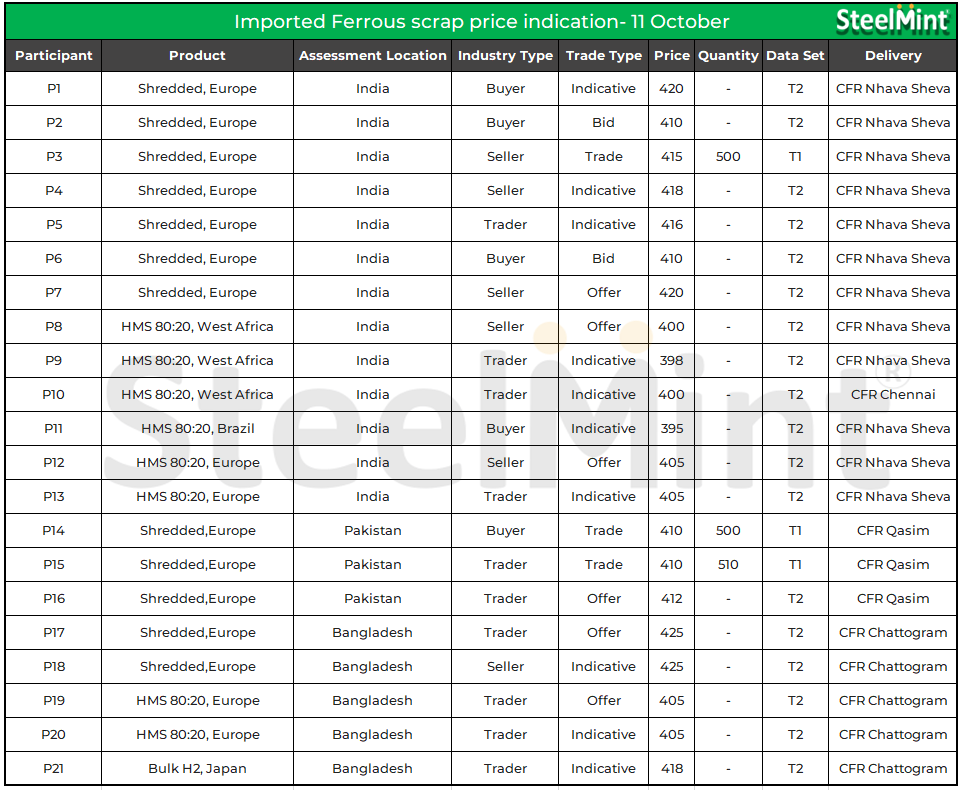

Market overview

India: In the Indian scrap market, demand for imported shredded scrap WAS rather sluggish recently. The main contributing factor to this subdued demand WAS the notable price disparity between what sellers offered and what buyers were willing to pay.

Offers for shredded scraps arriving from Europe were being quoted in the range of $415-$420/tonne (t) CFR Nhava Sheva. However, potential buyers set their sights on a lower price point, aiming for $410/t CFR levels.

HMS (80:20) from West Africa was priced at $400/t CFR Nhava Sheva, while the same grade of scrap from Brazil was available at a slightly lower cost of $395-398/t CFR.

A trader informed, "The workable offers for shredded scrap currently stand at about $415/t. However, buyers seem to be adopting a more cautious approach, resulting in a slower pace of purchasing activity at this time." The market appears to be in an adjustment phase as both buyers and sellers carefully evaluate and negotiate their positions, he further added.

Pakistan: The imported ferrous scrap market in Pakistan was observed to be slow as buyers were expecting prices to correct further on the strengthening of the PKR against the US dollar. Offers for shredded scrap were assessed at $410-415/t CFR Qasim.

Bangladesh: The demand for imported scrap in Bangladesh has been negatively impacted by difficulties related to opening letters of credit (LCs) and the limited availability of foreign reserves at banks. Offers for shredded scrap from Europe were assessed at $425/t CFR Chattogram.

HMS (80:20) from Australia were available at $420-425/t CFR, while PNS scraps from Europe were heard at $440-445/t CFR.

Turkiye: In the Turkiye steel industry, market participants are closely monitoring the unfolding situation following the escalation of conflict in the Gaza Strip. They are considering whether potential port closures and precautionary interventions by the Turkish Ministry of Trade could impact the market in the near future.

Mills are expecting scrap prices to soften further. Production costs have recently risen, domestic demand for finished steel remained weak, and the primary export destination is in the midst of a conflict.

Indicative tradable values for US/Baltic-origin or premium HMS (80:20) were mostly discussed in the range of $365/t CFR, creeping up on the higher side of $360/t CFR. US recyclers were reportedly aiming for prices close to $370/t CFR.

Market participants are adopting a cautious approach as it is too early to predict how the ongoing conflict will affect Turkiye. Additionally, a few deals had been concluded from Europe in the range of $359-361/t CFR, marking a slight drop in prices.

Recent deals

- Around 500 t of Europe-origin shredded scraps were booked at $415/t, CFR Mundra

- Approximately 250 t of cast iron rotter drum scrap from the US were traded at $455/t CIF Mundra.

- A parcel of 500-t shredded scraps from Europe was booked at $415/t CFR Mundra.

- About 1,010 t of shredded scrap from Europe were acquired at $410/t CFR Qasim.

Price assessments

India: UK-origin shredded scrap offers were at $418/t CFR Nhava Sheva, up by $1/t d-o-d.

Pakistan: UK-origin shredded scrap offers were down by $3/t to $412/t CFR Qasim today.

Bangladesh: Offers for UK-origin shredded scrap were at $425/t CFR Chattogram, down by $3/t d-o-d

Turkiye: US-origin HMS 1&2 (80:20) prices were down by $1/t to $367/t CFR Turkiye

Outlook

The imported ferrous scrap market in South Asia is anticipated to continue facing challenges due to resistance from buyers at current price levels, particularly in Pakistan. Meanwhile, in Bangladesh, the demand is expected to remain under pressure until the central bank intervenes to enhance the availability of foreign currencies. India is expected to lead the market in terms of market activities and prices.