South Asia: Dull imported scrap trade continues as bid-offer gaps persist

...

- Post-holiday market pause keeps demand muted in India

- Falling domestic scrap prices lure Bangladeshi buyers away

Imported scrap markets across South Asia and Turkiye remained largely subdued for the day, with limited buying interest and muted activity. Market participants adopted a cautious stance amid a post-holiday market pause (in India, particularly), weak domestic steel demand, and high freight and collection costs, resulting in narrow price movements and continued bid-offer disparities across regions.

India: Indian imported scrap prices remained stable, with limited buying interest. Suppliers waited for the market to return to normal after the Diwali holidays. Demand was lacklustre towards the weekend.

Indicatives for European shredded hovered between $354-356/t CFR Nhava Sheva, whereas bids were heard at $345-348/t CFR, with tradable levels of around $350-352/t CFR.

Market insiders noted that spot activity was muted, as most participants remained on the sidelines. "There is still no real buying; everyone is expected to be back properly in the coming week."

Pakistan: Mills kept purchases limited, focusing on current steel orders, with most bids for UK-origin shredded scrap around $355/t against offers of $360-364/t. Meanwhile, Middle East shredded scrap was offered at $375-380/t, with buyer interest seen at $370-372/t.

Bangladesh: Market sentiment was flat, as mills delayed fresh bookings amid weak domestic rebar sales and falling local scrap prices. Australian scrap held firm due to higher freight and collection costs, while some interest emerged for Japanese bulk scrap. Mid-sized bulk cargoes from Hong Kong and Singapore also drew inquiries from Chattogram-based mills.

Turkiye: Market activity remained quiet, with participants in a wait-and-watch mode amid mixed near-term price expectations. Limited material availability during winter and high Atlantic freight kept US-origin HMS (80:20) offers around $352-355/t CFR, clustering near $353-354/t. European sellers stayed hesitant due to high freight and collection costs, with realistic offers reportedly above $348-350/t CFR.

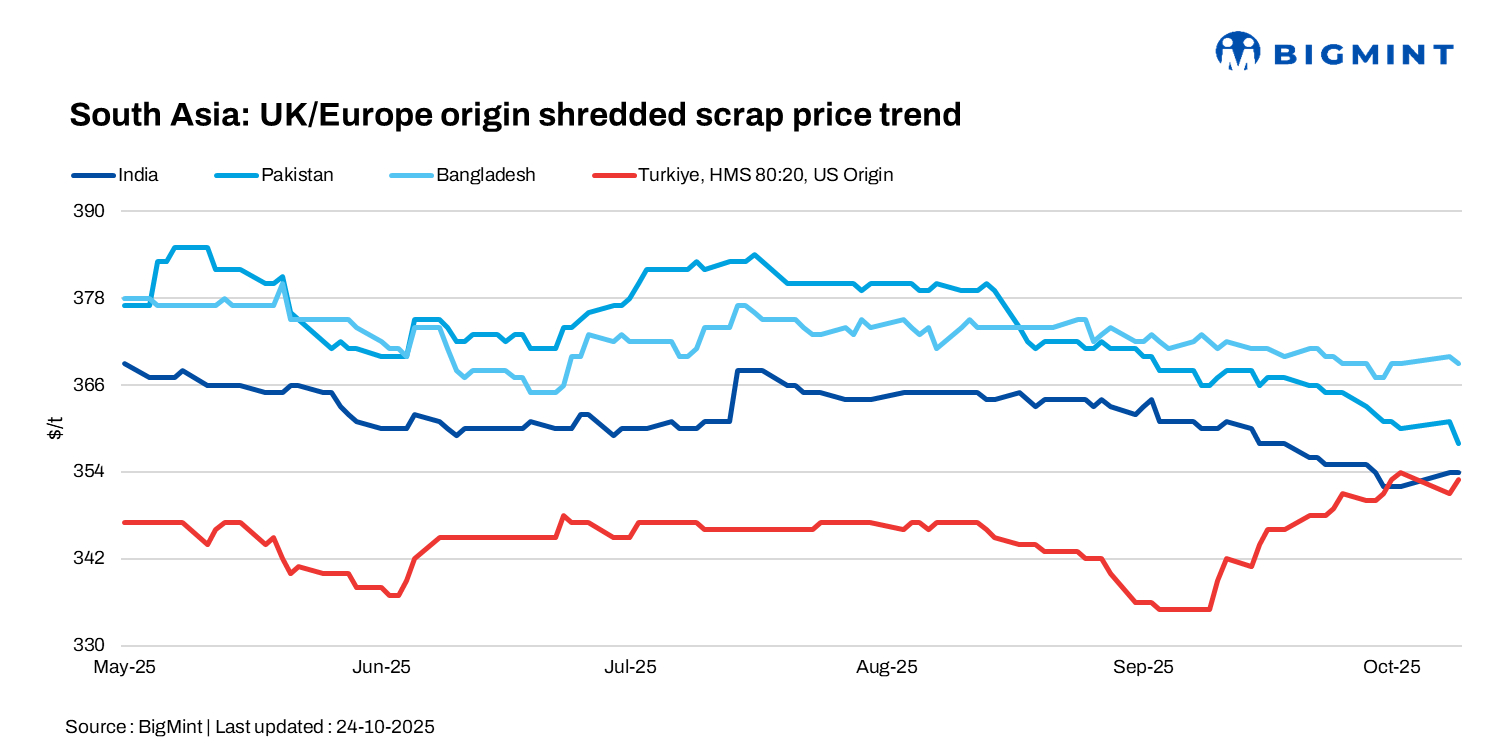

Price assessments (d-o-d)

India: UK-origin shredded prices were at $354/t CFR Nhava Sheva, stable.

Pakistan: UK-origin shredded prices inched down by $3/t to $358/t CFR Qasim.

Bangladesh: UK-origin shredded prices stood at $369/t CFR, down by $1/t.

Turkiye: US-origin HMS 80:20 bulk prices were at $353/t CFR Turkiye, up by $2/t.