Ship recycling volumes in South Asia surge 25% y-o-y in CY'25 as India records sharp growth

...

- Alang leads with strong HKC compliance and rising arrivals

- NOC delays, weak fundamentals hit Bangladesh's recycling sector

- Compliance gaps, liquidity crunch, cheap imports affect Pakistan market

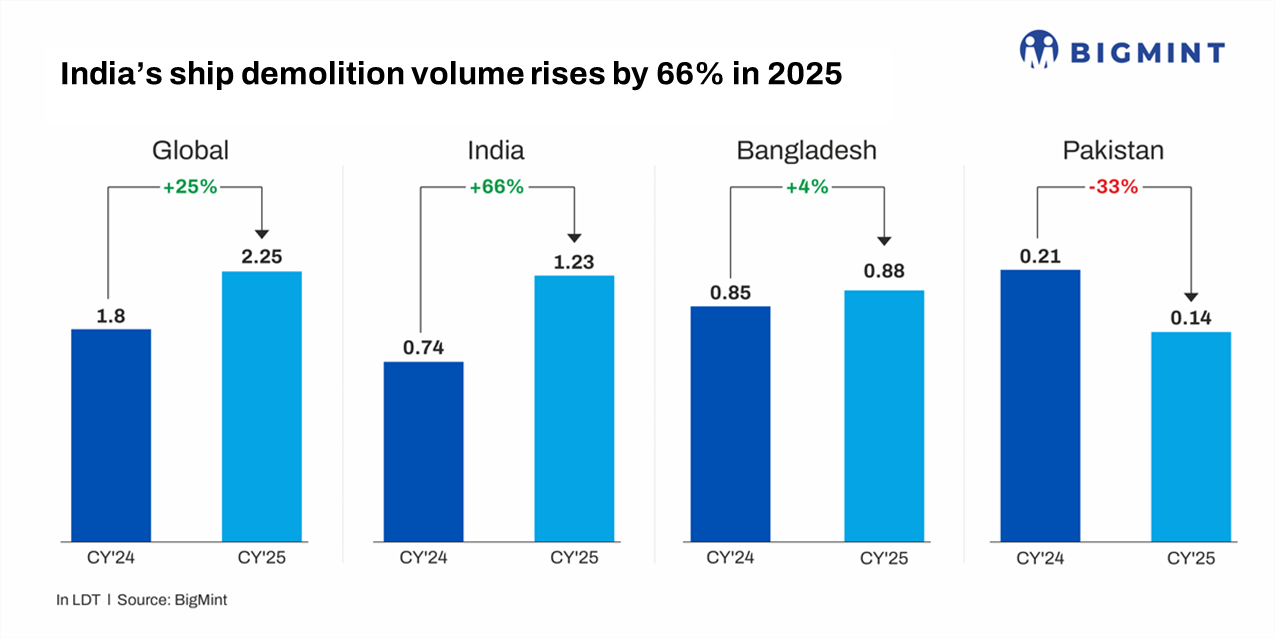

Morning Brief: South Asia's ship-breaking market expanded in 2025, with total demolition activity rising 25% y-o-y to 2.25 million light displacement tonnage (mn LDT) from 1.8 million LDT in 2024, according to BigMint data.

Notably, Pakistan's ship-recycling tonnage dropped to a multi-year low of just 0.14-0.15 mnt in 2025. Bangladesh also witnessed total tonnage of below 1 mnt for the second straight year. This is of course a major decline from over 2.5 mnt in 2021.

Growth was uneven across the region, driven primarily by India, while Bangladesh and Pakistan lost momentum as compliance gaps, financing constraints, and operational bottlenecks continued to erode competitiveness.

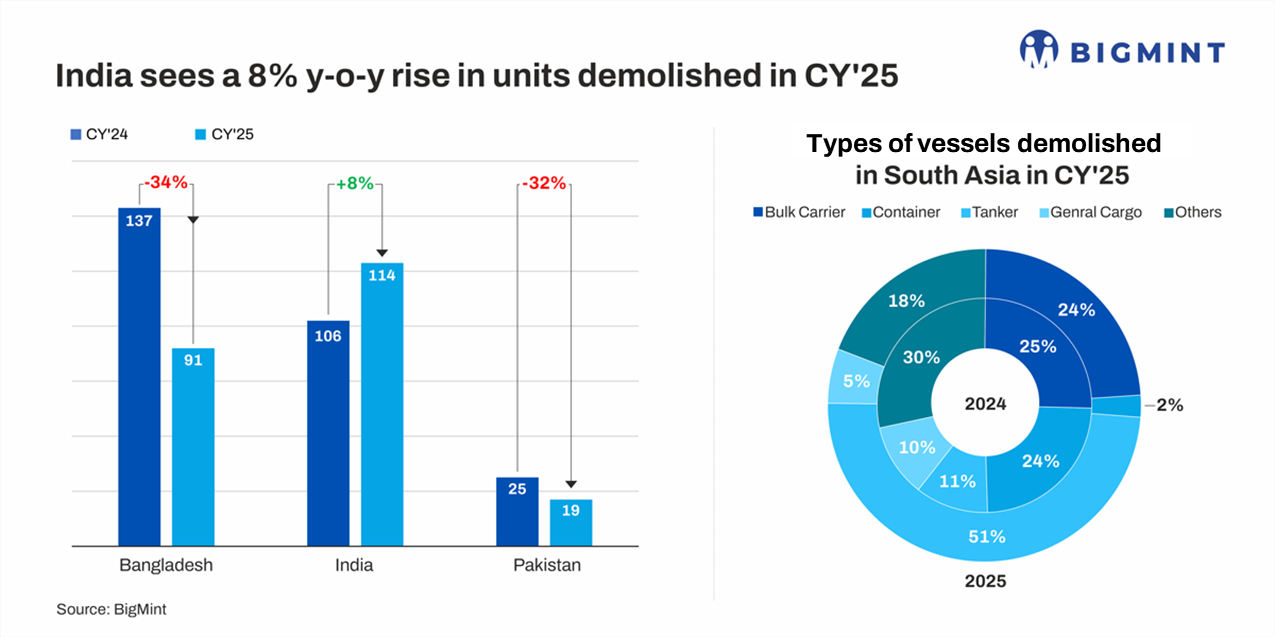

Total vessel arrivals across South Asia slipped to 224 units in 2025 from 268 units in 2024, reflecting more cautious ship owner sentiment amid volatile freight markets and uneven regional compliance readiness. India captured a larger share of available tonnage as Bangladesh and Pakistan saw thinning arrivals, especially in the second half of the year, when financing and compliance pressures intensified.

India strengthens leadership in ship recycling

India's ship recycling industry recorded strong growth in 2025, reinforcing its position as the region's most reliable demolition destination. Total vessel arrivals at the Alang yard increased to 1.23 mn LDT, a 66 % jump from 0.74 mn LDT in 2024.

The number of vessels dismantled rose to 114 units from 106 a year earlier. India's high Hong Kong Convention (HKC) compliance--115 of 131 operational yards certified--ensured uninterrupted access to compliant tonnage, even as global volumes remained selective.

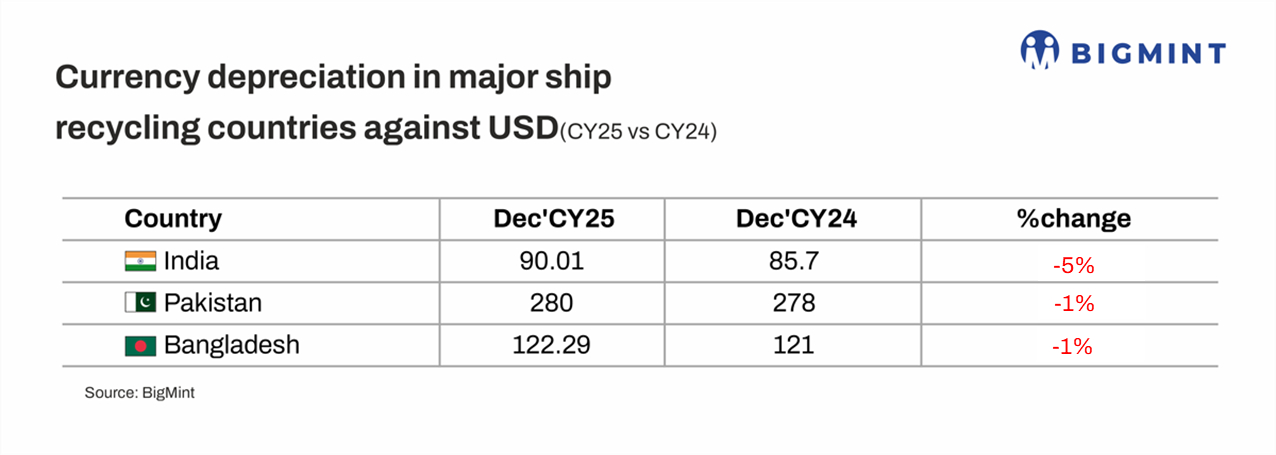

A flexible regulatory environment, willingness to handle sanctioned and Office of Foreign Assets Control (OFAC)-linked vessels, and greater payment stability created a two-tier market that benefited India. Despite weak domestic steel prices and currency pressure, Alang's operational depth, financing stability and clear regulatory pathways supported higher arrivals.

Alang emerges as global green maritime hub

The Alang-Sosiya Ship Recycling Yard continues to be positioned as Gujarat's global green maritime hub. Handling around 55% of South Asia's total demolition volumes, Alang benefits from upgraded infrastructure and an INR 1,224-crore master plan aimed at doubling capacity. Gujarat's strategic vision includes recycling 15,000 ships over the next decade and expanding capacity to 9 mn LDT by 2035, transforming Alang into an integrated maritime-industrial ecosystem.

Bangladesh faces financial,regulatory constraints

Bangladesh's ship-breaking sector experienced another difficult year, with total demolition volumes rising by 4% y-o-y to 0.88 mn LDT in 2025, up slightly from 0.85 mn LDT in 2024. The number of vessels dismantled saw a sharper decline, dropping to 91 units from 137 a year earlier, marking one of the steepest y-o-y reductions.

Bangladesh's competitiveness suffered due to tightening domestic fundamentals. Falling steel plate prices and persistent currency volatility eroded margins. Political uncertainty ahead of national elections pressured sentiment and slowed decision-making in the financial ecosystem. Despite gradual progress on HKC upgrades, over 20 out of the country's 130 yards are certified.

Non-availability of NOCs, compliance-related paperwork delays, and inconsistent yard readiness continue to restrict operational capacity. Many recyclers turned cautious after absorbing heavy tonnage in earlier quarters, with limited resale options and higher freight costs making vessel procurement riskier.

Pakistan witnesses steep volume losses

Pakistan's ship recycling activity remained subdued, with volumes declining 33% y-o-y to 0.14 mn LDT in 2025 from 0.21 mn LDT in 2024. Vessel arrivals fell to 19 units from 25 the year before, marking the lowest momentum among its South Asian competitors.

Multiple headwinds weighed on Pakistan's market. Despite securing its first HKC-certified yard, overall certified capacity remains minimal, limiting access to compliant vessels. The delayed implementation of the Document of Authorisation for Ship Recycling (DASR) framework, gaps in compliance infrastructure, and slow regulatory coordination reduced ship owner confidence.

Market fundamentals were also weak: steel prices stayed soft, Iranian re-rollable imports undercut local plate markets, and persistent currency depreciation widened working-capital pressures. Liquidity shortages, LC restrictions, and anchorage delays further constrained vessel inflows.

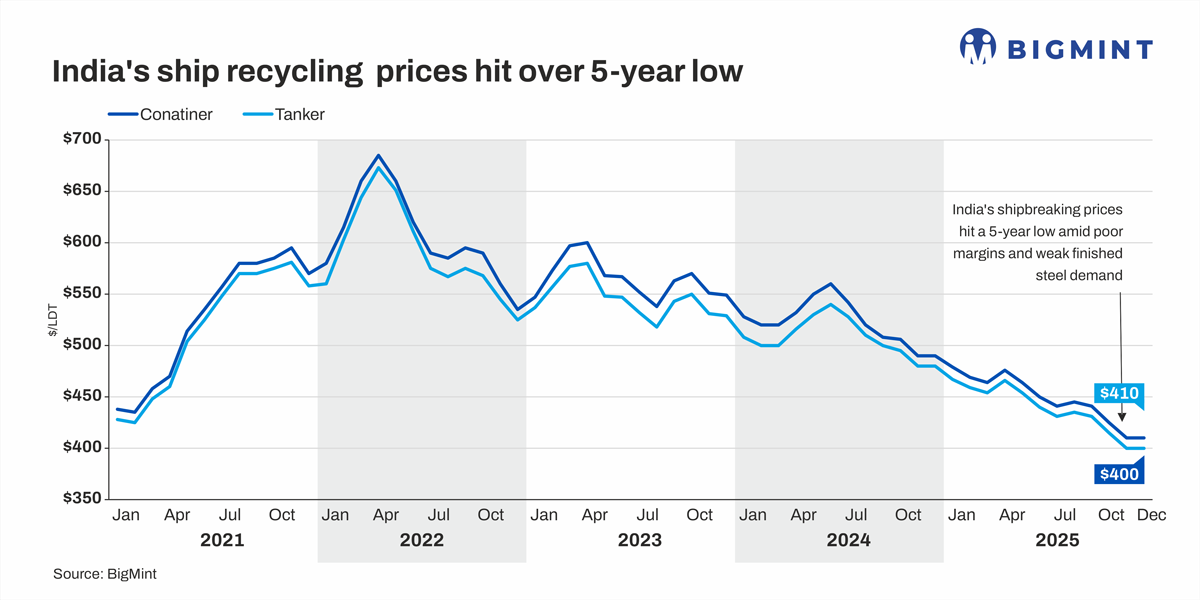

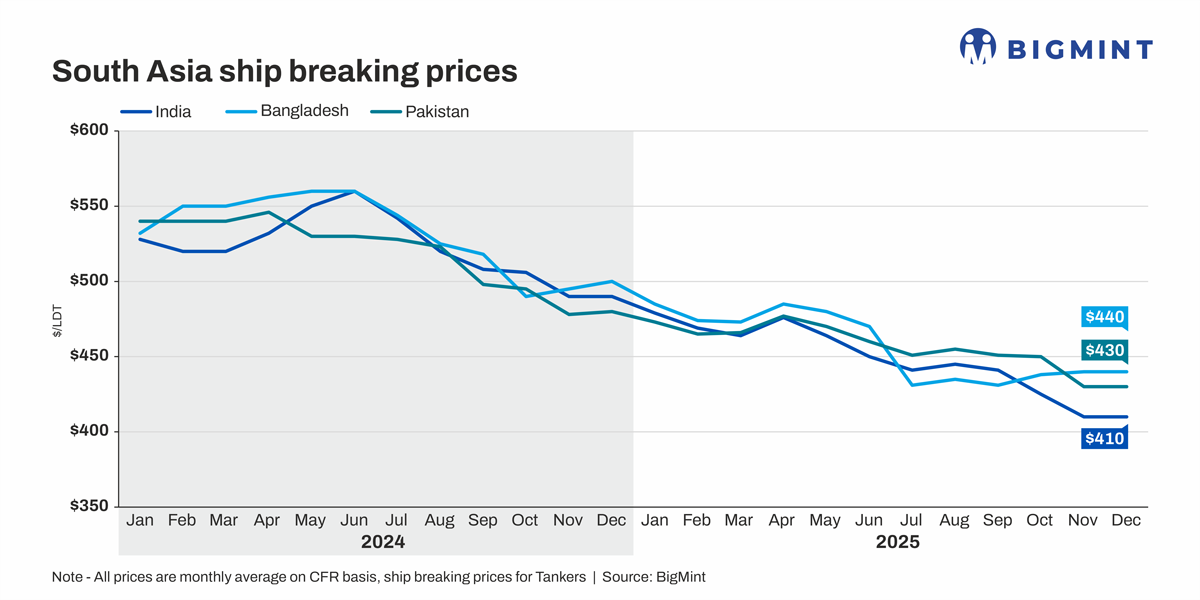

Price soften across South Asia

Demolition prices weakened across South Asia. Container vessel prices in India averaged $448/LDT in 2025, down from $522/LDT a year earlier. Bangladesh and Pakistan averaged $457/LDT, compared with $532/LDT and $519/LDT, respectively.

Demolition prices weakened across South Asia. Container vessel prices in India averaged $448/LDT in 2025, down from $522/LDT a year earlier. Bangladesh and Pakistan averaged $457/LDT, compared with $532/LDT and $519/LDT, respectively.

Tanker prices showed similar declines, with India averaging $438/LDT, while Bangladesh and Pakistan settled at $447/LDT against $516/LDT and $506/LDT a year earlier. Weaker domestic steel demand and fluctuating freight markets reduced recyclers' ability to bid aggressively.

Outlook for 2026

India is expected to maintain its leadership in the South Asian ship recycling market through 2026, supported by HKC compliance, regulatory predictability, and strong yard-level capacity. Bangladesh and Pakistan may struggle to regain competitiveness unless compliance gaps narrow, financing constraints ease and domestic steel fundamentals improve.

India's newly introduced mechanism offering ship owners a 40 % credit of scrap value--redeemable against new vessel construction at Indian shipyards--could further strengthen inflows. Additionally, the Coastal Cargo Promotion Scheme, aimed at increasing coastal shipping's modal share from 6 % to 12%, is expected to generate recurring demand for vessel maintenance and repair, deepening India's maritime ecosystem.