India's stainless steel market remains cautious amid global pressures

...

- Year-end slowdown keeps overall market activity muted

- Tsingshan raises 304 HRC offers on nickel concerns

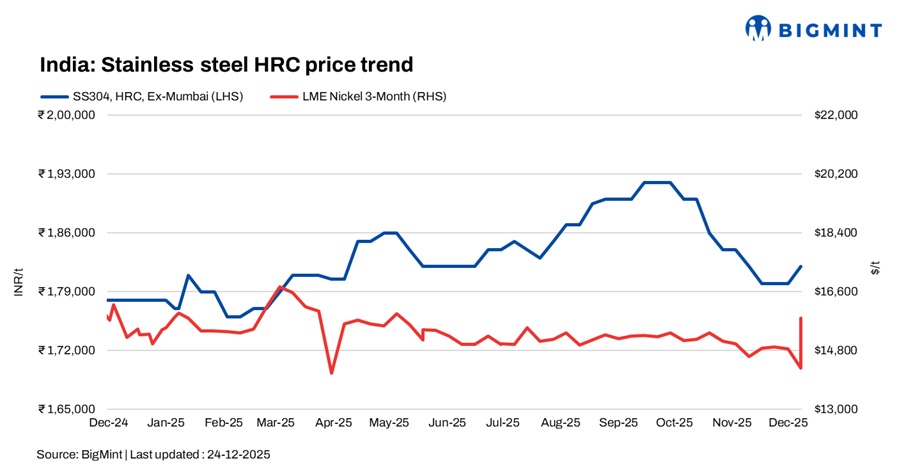

India's stainless steel market remained largely cautious during the week ended 24 December, with global cost-side pressures offering selective support to flat products, while weak domestic consumption continued to weigh on longs market. Market activity stayed muted amid year-end slowdown, as participants remained watchful of firming nickel prices, emerging supply-side risks from Indonesia, and ongoing shifts in global trade flows.

Finished flats find marginal support

India's stainless steel market sentiment remained moderate during the period, with only a marginal improvement in demand. Domestic trading activity stayed subdued, as major mills largely remained on the sidelines amid muted downstream consumption.

On the global front, stainless steel prices continued to find support following China's announcement of a new export licensing system covering all stainless steel products, effective from 1 January 2026. The policy has strengthened price expectations across Asian markets by potentially restricting low-priced export flows.

Adding to the supportive tone, Indonesia-based Tsingshan Steel raised its export offer prices for 304-grade hot-rolled stainless steel coils by $30/t in two times over the past week. The cumulative increase since early December has now reached $90/t, driven by concerns over a sharp reduction in Indonesias nickel mining quota and rising raw material costs.

BigMint's benchmark assessment for 304 HRC stood at INR 182,000/t ex-Mumbai, steady w-o-w, while 316 HRC stood at INR 330,000/t, down INR 5,000/t w-o-w.

Stainless steel longs remain under pressure

India's stainless steel finished longs market remained subdued during the week, as weak domestic demand continued to weigh on buying activity. Mills were largely focused on liquidating existing inventories rather than ramping up fresh production, keeping market sentiment muted.

BigMint's benchmark assessments for stainless steel 304L (25 to 100 mm) black round bars was INR 152,000/t ex-Mumbai, down INR 1,000/t w-o-w. Meanwhile, SS 316L black round bars were at INR 268,000/t ex-Mumbai, steady over the week.

In the export market, indicative FOB offers for Indian stainless steel longs were heard at $2,050-2,100/t for 304-grade bright bars and $3,550-3,570/t for 316-grade bright bars. European offers remained significantly higher, at $3,000-3,400/t for 304 and $4,000-4,050/t for 316. However, trading activity in Europe remained thin due to the year-end holiday period.

LME nickel rallies on Indonesia supply concerns

At the time of reporting, three-month nickel prices on the London Metal Exchange (LME) stood at $15,785/t, significantly increased by 9% compared to last week's $14,450/t. Nickel stocks at LME-registered warehouses stood at 254,604 t, largely range-bound compared to 252,528 t t in the previous week. With the effects of Indonesias planned nickel ore production cuts for next year beginning to materialize, and market expectations rising that the Federal Reserve may cut interest rates twice next year, the US dollar has weakened, pushing nickel prices sharply higher.

Chinese stainless steel & NPI prices

In China, prices of domestic stainless steel 304-grade CRCs stood at RMB 13,300/t ($1,883/t) exw, while FOB tags of 304-grade CRCs were firm at $1,880/t.

Indonesian FOB prices of nickel pig iron (NPI) (8-12%) were at $112/t and NPI (10-14%) stood at $113/t.

Raw material market overview

Ferro molybdenum: Indian ferro molybdenum prices remained largely stable, edging up by INR 18,000/t ($201/t) w-o-w to INR 2,662,000/t ($29,685/t) exw as of 24 December, according to BigMint's assessment. Firm offers from sellers and a mild pickup in stainless steel demand lent support to prices. However, buying activity remained cautious, with procurement largely on a need-based basis. Around 19 tonnes were traded last week within the price range of INR 2,660,000-2,770,000/t ($29,640-30,867/t) exw.

Ferro chrome: Indian high-carbon ferro chrome (HC60%) prices remained steady at INR 107,400/t ($1,181/t) exw-Jajpur.

Ferro silicon: Indian ferro silicon (70%) prices inched down by INR 900/t ($10/t) on 22 December compared with the assessment on 15 December. According to BigMint, prices stood at INR 96,700/t ($1,078/t) exw-Guwahati on 22 December. In Bhutan, prices declined by INR 1,700/t ($19/t) w-o-w to INR 96,800/t ($1,079/t) exw.

Ferrous scrap: India's imported scrap market remained subdued, with mills showing minimal interest in fresh bookings amid weak steel demand, tight margins, and year-end holidays. Buying activity was sporadic, while quality concerns weighed on UK-origin HMS. Offers were largely stable, heard at $345-350/t CFR for EU-origin shredded, $316-320/t for HMS 80:20, Australian shredded at $336-342/t, HMS 80:20 at $315-320/t, and PNS at $330340/t, reflecting cautious sentiment and thin trade activity.

Outlook

Indias stainless steel prices are expected to firm gradually after the New Year, supported by rising global cost pressures and stronger upstream cues. However, the longs segment is likely to remain under pressure in the near term, as weak domestic demand and low exports due to holidays in key importing nations will likely to cap any major upside.