Indian steel majors report mixed production, sales trends in Q3FY'26

...

- JSW's output falls 11% on planned BF-3 shutdown at Vijayanagar

- Tata Steel lifts quarterly output above 6 mnt for first time ever

- JSW Steel, SAIL, AM/NS's sales volumes surpass production

Morning Brief: Indian Tier-1 mills' production volumes showed mixed trends y-o-y in Q3FY'26 (October-December 2025). Meanwhile, sales figures pointed to growth across all companies, except for JSW Steel, whose deliveries declined slightly, though not as steeply as the fall in its production. Additionally, mills EBITDA per tonne declined as steel prices hit a five-year low while raw material costs increased.

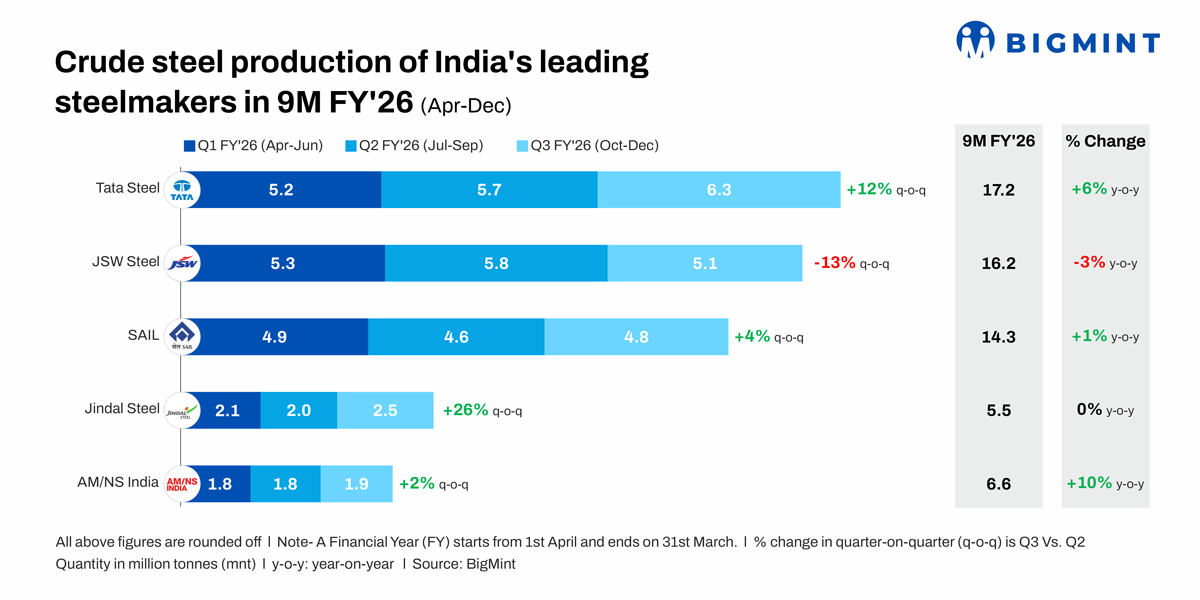

Production shows mixed trends y-o-y

Production trends across India's major steelmakers were mixed y-o-y.

JSW Steel's (standalone) crude steel production fell 11% y-o-y to 5.08 million tonnes (mnt) in Q3FY26, attributed to the planned shutdown of Blast Furnace-3 at Vijayanagar. The furnace, taken offline in end-September 2025, is to be expanded to 4.5 mnt/year, with commissioning targeted in Q4FY26.

Tata Steel's (standalone and NINL) production increased by 11% y-o-y to its highest-ever 6.34 mnt, the first time it has crossed the 6-mnt mark. The proposed 4.8 mnt/year expansion at NINL (execution in around 40 months) and the 0.75 mnt/year electric arc furnace (EAF) at Ludhiana (start-up possibly in mid-March) are also expected to boost production growth in the future.

SAIL's crude steel production increased slightly by 4% y-o-y to 4.8 mnt, as the company continued to modernise and expand operations. Most notably, the capacity at IISCO will be increased to 7.1 mnt/year from 2.5 mnt/year, with the blast furnace contract already awarded. Completion is targeted within 41 months.

AM/NS Indias output declined by 4% y-o-y to 1.88 mnt. Work is underway at Hazira for increasing production capacity to 15 mnt/year by the first half of 2027 from 9 mnt/year currently. The possibility of further expansion at Hazira is also under investigation, while land acquisition has been completed for a greenfield project in Andhra Pradesh with a capacity of 7.3 mnt/year.

Jindal Steel's production increased 26% y-o-y to 2.51 mnt, its highest ever. In September, the company commissioned a new 3 mnt/year basic oxygen furnace (BOF) at Angul as part of its plans to increase crude steel production capacity to 12 mnt/year by FY26.

Q-o-q, JSW Steels production was 13% lower. For the rest, production increased across the board: Tata Steel by 12%, SAIL by 4%, AM/NS by 2%, and Jindal Steel by 26%.

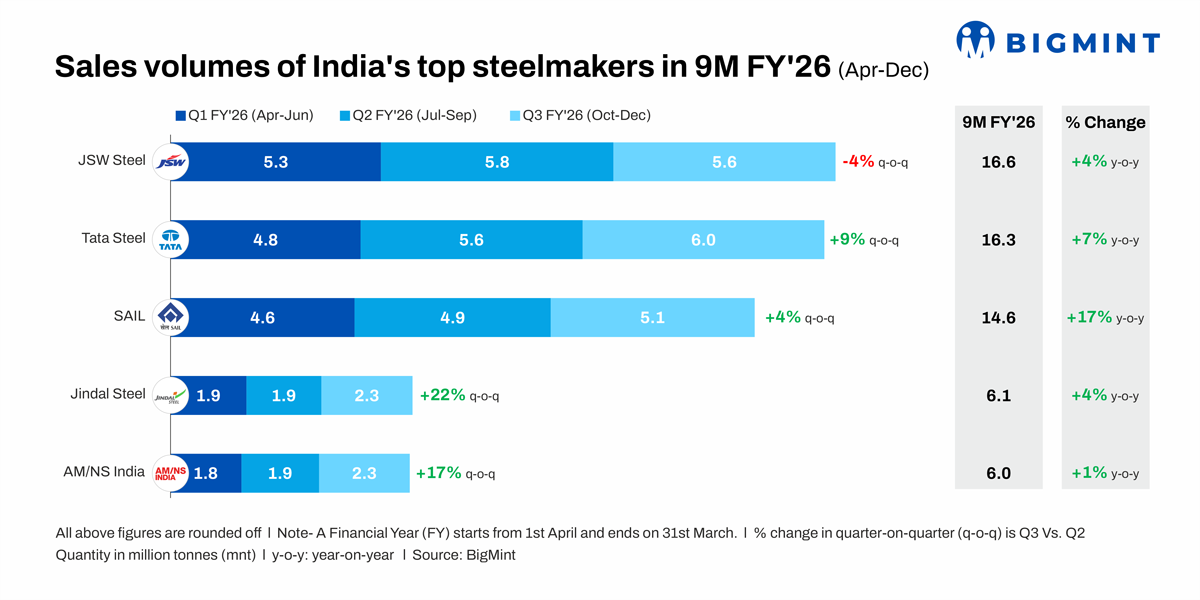

All mills except JSW raise sales y-o-y

Apart from JSW Steel, which recorded a minor 0.7% drop y-o-y to 5.55 mnt, all other Tier-1 steelmakers increased their sales from the year-ago period: Tata Steel by 14% to 6.04 mnt (highest ever), SAIL by 16% to 5.1 mnt, AM/NS by 6% to 2.27 mnt, and Jindal Steel by 20% to 2.28 mnt (highest recorded).

The same trends were reflected on a q-o-q basis as well. Except for JSW Steel (-4%), all steelmakers were able to lift sales: Tata Steel by 9%, SAIL by 4%, AM/NS by 17%, and Jindal Steel by 22%.

Notably, JSW Steel, SAIL, and AM/NS India recorded higher sales volumes than production in Q3FY'26, suggesting that mills had to draw down on previous inventories to fulfil orders.

The increase in sales aligns with the strong growth in steel consumption. In Q3FY'26, finished steel production in India stood at 39.5 mnt, while domestic consumption was higher at 40.7 mnt, as per JPC data. This indicates demand outpaced production.

Steel inventories fell sharply from 13.66 mnt at the end of Q2 to 11.9 mnt by end-December, pointing to significant inventory drawdowns during the quarter.

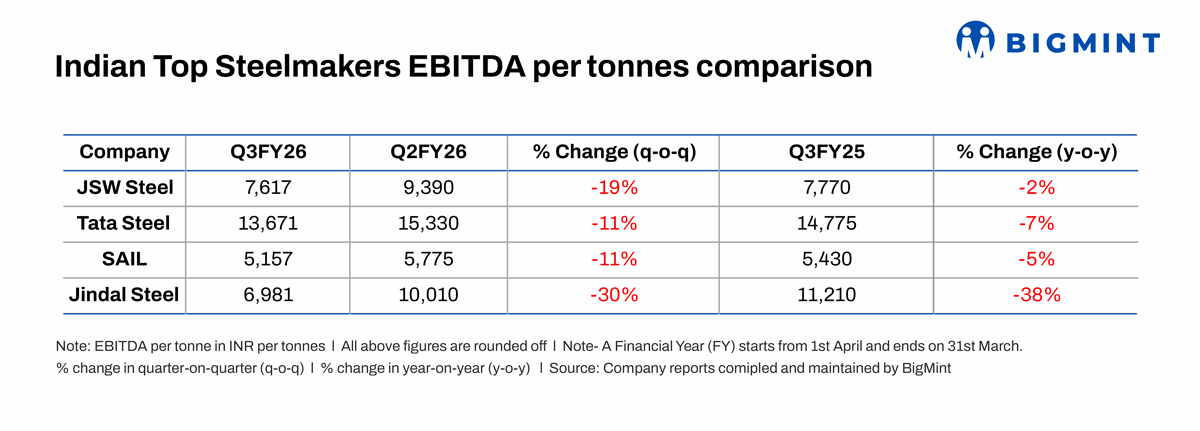

EBITDA per tonne declines y-o-y, q-o-q

In terms of EBITDA per tonne of steel produced, all mills posted declines on both y-o-y and q-o-q bases, as per BigMint's calculations. The q-o-q decline was higher for JSW Steel, Tata Steel, and SAIL compared to the y-o-y one; only Jindal Steel recorded a softer drop q-o-q.

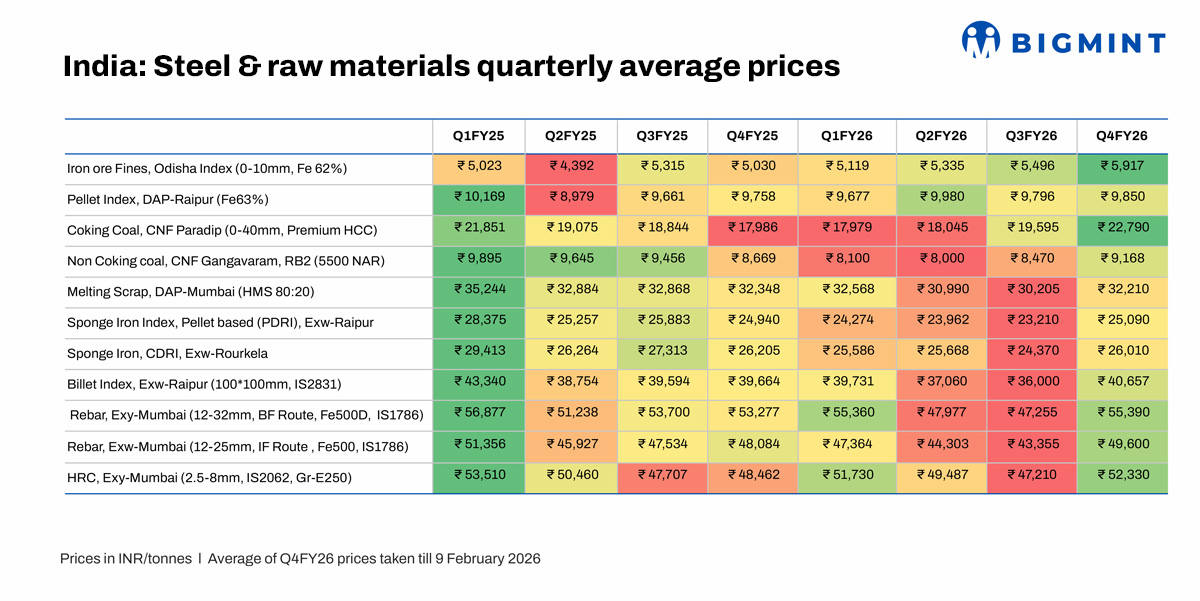

Overall, EBITDA per tonne declined as raw material costs increased while steel prices moved lower, hitting a five-year low in November. The higher decline q-o-q could be attributed to an 9% increase in coking coal prices. Y-o-y, coking coal prices were higher by a modest 4%. Meanwhile, iron ore was higher by 3% sequentially as well as annually.

The magnitude of decline in steel prices varied on q-o-q and y-o-y bases. Q-o-q, trade-level hot-rolled coil (HRC) prices decreased more sharply by 5% against a 1% drop y-o-y. In contrast, blast furnace (BF) route rebar prices were down by 2% q-o-q, with the y-o-y fall being a higher 12%.

Outlook

With Q4FY'26 being the peak steel consumption period in India, Tier-1 mills are likely to record higher production and sales volumes q-o-q. Additionally, Indian steel consumption has been growing consistently, and steel majors are accelerating production expansions. This is likely to lift both output and deliveries in the next few years at least, though certain quarters may see short-lived dips due to various operational factors.

Meanwhile, mills financial performances are set to improve in the final quarter as steel prices surge. Mills have announced successive list price hikes since end-December, and the market has absorbed these increases. However, elevated coking coal costs remain a concern, which could squeeze margins.