India's steel industry remains in expansion mode in Dec'25 even as downstream activity slows slightly

...

- India records highest-ever monthly crude steel output

- Growth in industrial activity surges to 2-year high

- Manufacturing PMI falls but remains highest globally

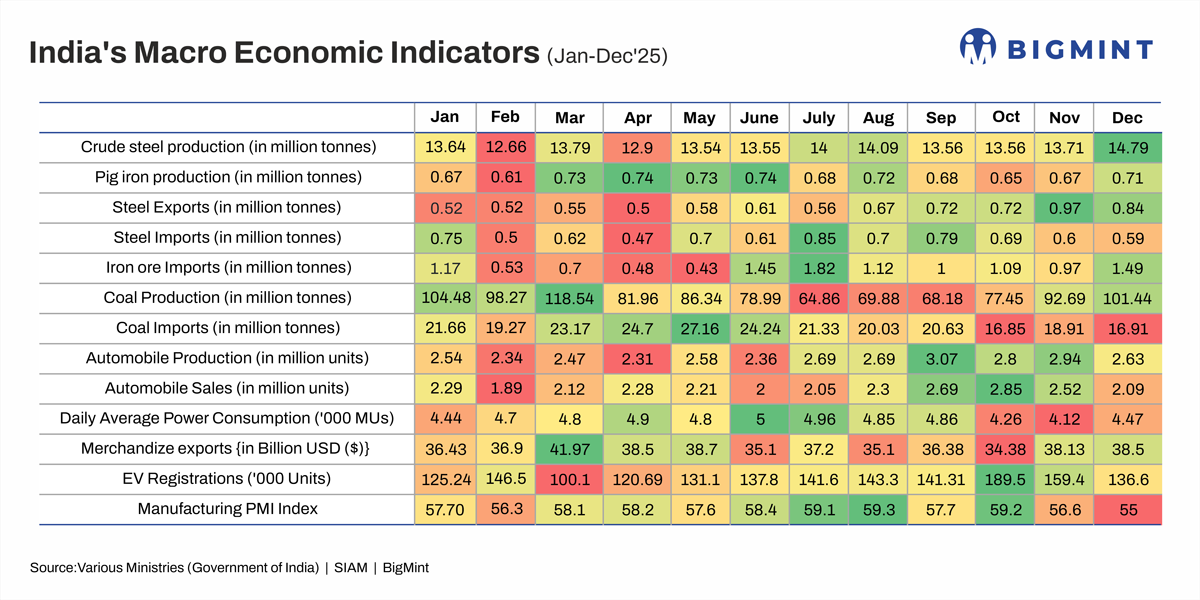

Morning Brief: India's steel industry witnessed broad-based growth in December 2025 despite a slight slowdown in the manufacturing, automobile, and infrastructure and construction sectors.

Highlights of Indias steel, iron ore, coal Industry dynamics

Crude steel production increased by 8% m-o-m and 9% y-o-y to an all-time monthly high of 14.79 million tonnes (mnt). Steelmakers may have ramped up production ahead of the fourth quarter of the fiscal year, when consumption picks up rapidly due to conducive weather and approaching project deadlines.

Steel exports moderated m-o-m but remained high due to robust demand from the EU ahead of the full implementation of the Carbon Border Adjustment Mechanism (CBAM). Meanwhile, total imports remained on the lower side, aided by the safeguard duty and other tariff barriers. India consistently remained a net exporter throughout Q3FY26.

Meanwhile, iron ore imports remained elevated, as steelmakers demand outpaced domestic supply.

Coal production rose, supported by improved mine productivity and the commissioning of additional capacity at CIL. The miners production rose 4.6% y-o-y to 75.7 mnt in December.

Coal imports declined m-o-m, as well as y-o-y, as buyers continued to source domestic supply due to ample availability and competitive pricing.

Key macroeconomic Indicators in Dec25

Industrial output hits over 2-year high

Indias Index of Industrial Production (IIP) rose to a 26-month high of 7.8% in December following Novembers strong 7.2% growth. The manufacturing sector expanded by 8.1%, emerging as the core growth driver in December, though there was a slight moderation from Novembers over-two-year high of 8.5%. Technology- and mobility-linked segments logged the highest manufacturing growth.

Mining growth accelerated to 6.8% in December from 5.8% in November as a result of strong raw material demand from the steel and infrastructure segments, while electricity returned to growth at 6.8% against a contraction of -1.5% in November as consumption picked up.

Meanwhile, in terms of use-based sub-components, the infrastructure/construction sector logged 12.1% growth compared to a sharper 13.0% in November. Expansion in capital goods was also slightly slower at 8.1% in December against 10.1% in November. Consumer durables grew 12.3% in December against 11.2% in November.

The strong rebound in the IIP could be attributed to improvements in consumer confidence, liquidity conditions, and infrastructure investment.

Auto production, sales decline m-o-m

While automobile production declined by 11% m-o-m to 2.63 million units, sales fell by 17% to 2.09 million units. A high base, stemming from robust festive demand, likely contributed to the sharp m-o-m moderation. Y-o-y, production jumped by 37% and sales by 35%, linked partially to a low base effect. Weak sentiment and tight liquidity had dragged automobile sales to a low 1.55 million units and, similarly, production to 1.92 million units.

Meanwhile, year-end inventory clearances, improved freight movement, advanced purchases ahead of price hikes in January, and GST cuts-driven positive sentiment also influenced the sharp increase y-o-y. Passenger vehicle inventory fell by around seven days to a relatively 37-39 days in December.

In CY25, automobile production and sales increased by 9% y-o-y and 7%, respectively. Growth was sluggish initially but accelerated from the second half of the year, as the repo rate cuts, GST reforms, and income tax relief boosted consumer demand and improved affordability.

Power consumption jumps on increased heating demand

Daily average power consumption increased by 8% m-o-m to 4,470 million units. Severe cold weather across north India during December led to increased heating demand and, consequently, power consumption. Meanwhile, industrial activity strengthened, in line with the traditional rebound in economic activity during winter, supporting power consumption growth.

Merchandise exports edge higher as shipments to US stabilise

Indias merchandise exports climbed up marginally on both m-o-m and y-o-y bases to $38.5 billion in December 2025. Indian exports to the US remained more or less stable at $6.89 billion in December compared to $6.92 billion in November 2025 while slipping by a minor 1.8% from $7.01 billion in December 2024. Volumes seem to have stabilised following y-o-y declines in September and October, fuelled by the USs doubling of import tariffs on Indian goods to 50%. China, the UAE, Malaysia, Hong Kong, and Spain were the top growth drivers in December, while the US was the destination with the largest growth (9.75%) during April-December.

Manufacturing PMI slides to 2-year low

The manufacturing purchasing managers index (PMI) dropped to a two-year low of 55.0 points, driven by global competitive pressures and lacklustre sales in certain segments. Growth in new export orders was the slowest in 14 months, though stronger demand from Asia, Europe, and the Middle East softened the m-o-m drop.

Similarly, the expansion in manufacturing output was the least since October 2022, while output prices grew at their slowest pace in nine months. Business confidence plunged to its lowest in three years, with market participants expecting heightening competition and trade uncertainties to remain key headwinds in 2026 despite steady output growth.

Despite the subdued momentum, India recorded the highest PMI reading globally in December. The global manufacturing PMI moderated to 50.4, as output growth eased and new order inflows remained stagnant. New export orders declined for the ninth consecutive month, pointing to weak consumer confidence amid trade uncertainties.

Outlook

Overall, despite dips here and there, Indias steel industry continues to grow resolutely. A rebound in infrastructure and construction activity during Q4CY25, as well as strong manufacturing momentum, is expected to keep steel demand strong in January and February. Additionally, while the recent US and EU trade deals do not target steel directly, downstream sectors such as manufacturing are expected to reap benefits, which will help lift steel demand. Exports of machinery, engineering equipment, and capital goods are expected to grow. Meanwhile, Indias FY26 GDP forecast has been revised upwards to 7.4%, suggesting brightening prospects.