India: MOIL raises offers for all manganese ore grades from Apr'25

...

- Imported ore tags inch up m-o-m in Mar'25

- Global miners increase offers for April shipments

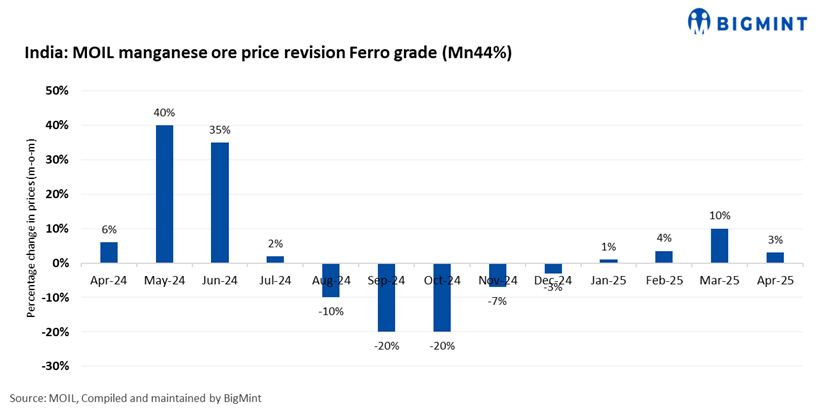

MOIL, the Indian state-owned mining company, has implemented a price adjustment for manganese ore, effective 1 April 2025. Prices for grades higher than Mn44% have been modestly increased by 3%, while those for grades below Mn44% have experienced slight rise by 0.5%. Meanwhile, all SMGR grades (Mn 30%, Mn 25%, Mn 20%) also edged up by 0.5% m-o-m.

Factors supporting prices

Imported high-grade manganese ore prices up m-o-m in March: South African-origin manganese ore (37%) prices stood firm at a monthly average of $4.54/dry metric tonne unit (dmtu) in March compared to $4.55/dmtu in February. However, for manganese ore of Australian (46%) origin, prices rose by 7% to $5.48/dmtu in March as against $5.1/dmtu in February. Gabon-origin ore (Mn44%) too moved up by 7% to $5.12/dmtu in March as against $4.77/dmtu in February.

Global miners lift manganese ore offers for April: Eramet Comilog, a major manganese ore exporter from Gabon, has set its April shipment prices for Mn 44.5% lumps at $5.1/dmtu , an increase of $0.35/dmtu m-o-m. Tight supplies has kept global manganese ore prices supported.

Additionally, South32, a leading global miner, has announced prices of 37% grade South African semi-carbonated manganese ore lumps. Prices remained firm m-o-m for April shipments at $4.65/dmtu CIF China.

Moreover, Jupiter Mines Limited, operator of the Tshipi Borwa Manganese Mine in the Kalahari manganese field in South Africa, has set the offer price for April shipments of its high-grade Mn36.5% semi-carbonate lumps at $4.45/dmtu CIF China. These prices are up $0.35/dmtu m-o-m.

Domestic silico manganese prices stable m-o-m: India's prices of 60-14 grade silico manganese were steady m-o-m to around INR 72,920/t ($852/t) exw Raipur in March compared to INR 73,170/t ($855/t) in February, as per BigMint's assessment. Price stability resulted from buyer resistance to elevated quotes, restricting price fluctuations and fostering a cautious market environment. This restraint reflected a careful, measured approach amid rising costs.

India's export offers down m-o-m: Silico manganese (60-14) export prices fell by 1% to $855/t FOB India in March compared to $867/t in February. Meanwhile, the 65-16 grade also fell by 2% to $950/t FOB India in March as against $966/t in February. Prices edged down m-o-m, driven by weak demand. Most buyers had fulfilled their material requirements in February, anticipating price hikes for March deliveries. Procurement remained limited as buyers adopted a wait-and-watch approach.

Indian billet prices increase m-o-m: Domestic billet prices rose m-o-m, with tags at INR 40,600/t ($475/t) exw-Raipur in March compared to INR 39,300/t ($459/t) in February, up by 3%. This uptick was driven by the hike in steel prices on tightening supply, and increased raw material costs, which fuelled the upward pressure on prices despite global market fluctuations.

Outlook

Manganese ore prices may experience slight fluctuations in the coming month, influenced by subdued global demand. Market stability will largely depend on supply dynamics and cautious buyer sentiment in key regions.