India: Major ERW pipe producer hikes prices for early Apr'24 sales

...

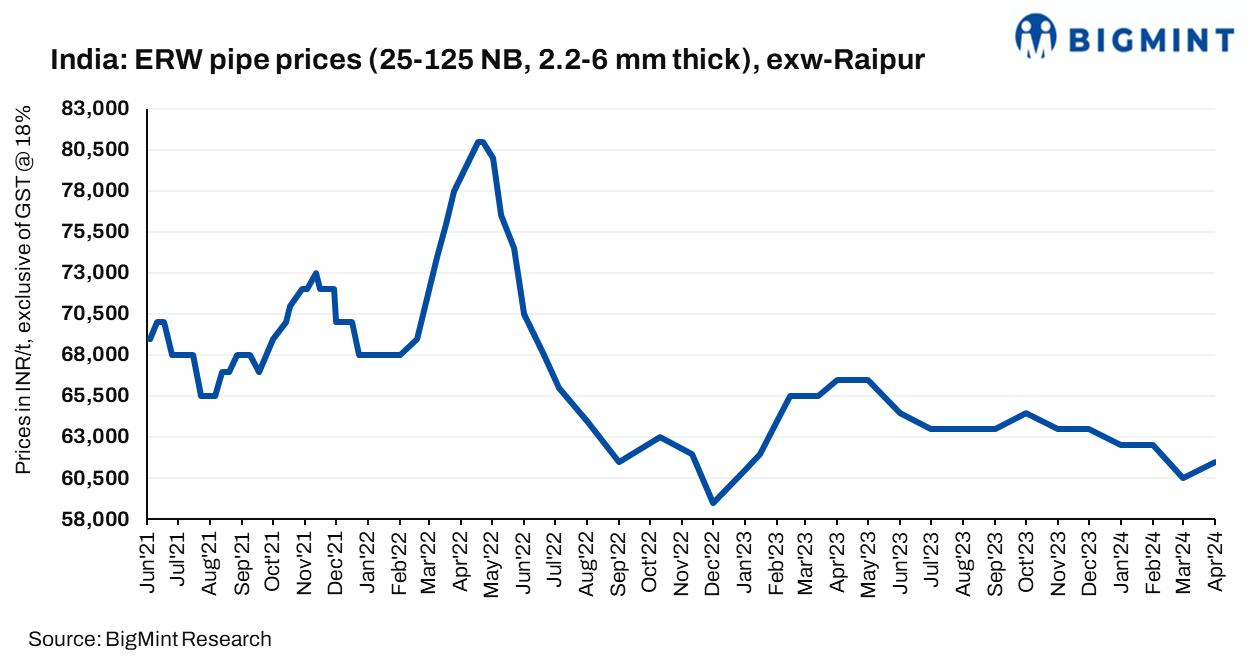

A major ERW pipe manufacturer specialising in HRC-based products, has implemented an upward price revision for its base-grade pipe (25-125 NB, 2.2-6 mm) for early-April 2024 sales, sources informed BigMint.

Following this adjustment, prices now stand at INR 61,500/t ($737/t) exw-Raipur, excluding 18% GST. This marked an increase of approximately INR 1,000/t ($12/t) m-o-m in Raipur. It is worth noting that the company had trimmed prices by INR 2,000/t ($24/t) m-o-m for March sales.

However, the manufacturer has kept prices stable m-o-m for other regions like Pune, Mumbai, Bangalore, Hyderabad and Delhi. Current prices now stand at INR 64,500/t ($773/t) for Pune and Mumbai, INR 62,500/t ($749/t) for Bangalore, INR 62,500/t ($749/t) for Hyderabad and INR 64,500/t ($773/t) for Delhi. Listed prices are ex-works (exw), excluding 18% GST.

In Raipur, distributor level prices for ERW pipe saw a decline w-o-w amid lack of trade activities and weak demand. Prices dropped by INR 500/t ($6/t) w-o-w to INR 59,000/t ($707/t) in the first week of April compared to INR 59,500/t ($713/t) in the end of March.

Decline in trade-level HRC monthly average prices:

Monthly average prices for trade-level HRC, which is a key raw material for ERW pipe, have fell m-o-m to INR 52,800/t ($633/t) ex-Mumbai against INR 53,900/t ($645/t) in February.

Imports of bulk HRCs and plates dropped off to around 3,82,000 t in March against 465,000 t in February. However, Export volumes for bulk HRCs and plates increased to around 6,90,000 t in March against 6,42,000 t in February.

Primary steel mills held onto their prices for HRC in March, keeping them at the same level as the end of February. However, export offers for HRC from India fell due to global festivities. Steel mills might once again maintain their price lists for sales in April, at the same level they were at the end of March.

Outlook:

There are mixed signals for the ERW pipe market in early-April. While the manufacturer has raised prices in Raipur, distributor prices there have dipped due to weak demand. Trade-level HRC pries, have also dropped w-o-w. Overall, the market seems to be headed for a wait-and-see approach, awaiting primary mills to announce their HRC prices in April.