India: BigMint's HRC export index falls w-o-w on post-holiday slowdown

...

- HRC offers to EU fell w-o-w; while Middle East offers rose

- HRC offers to Nepal rise on higher Indian domestic prices

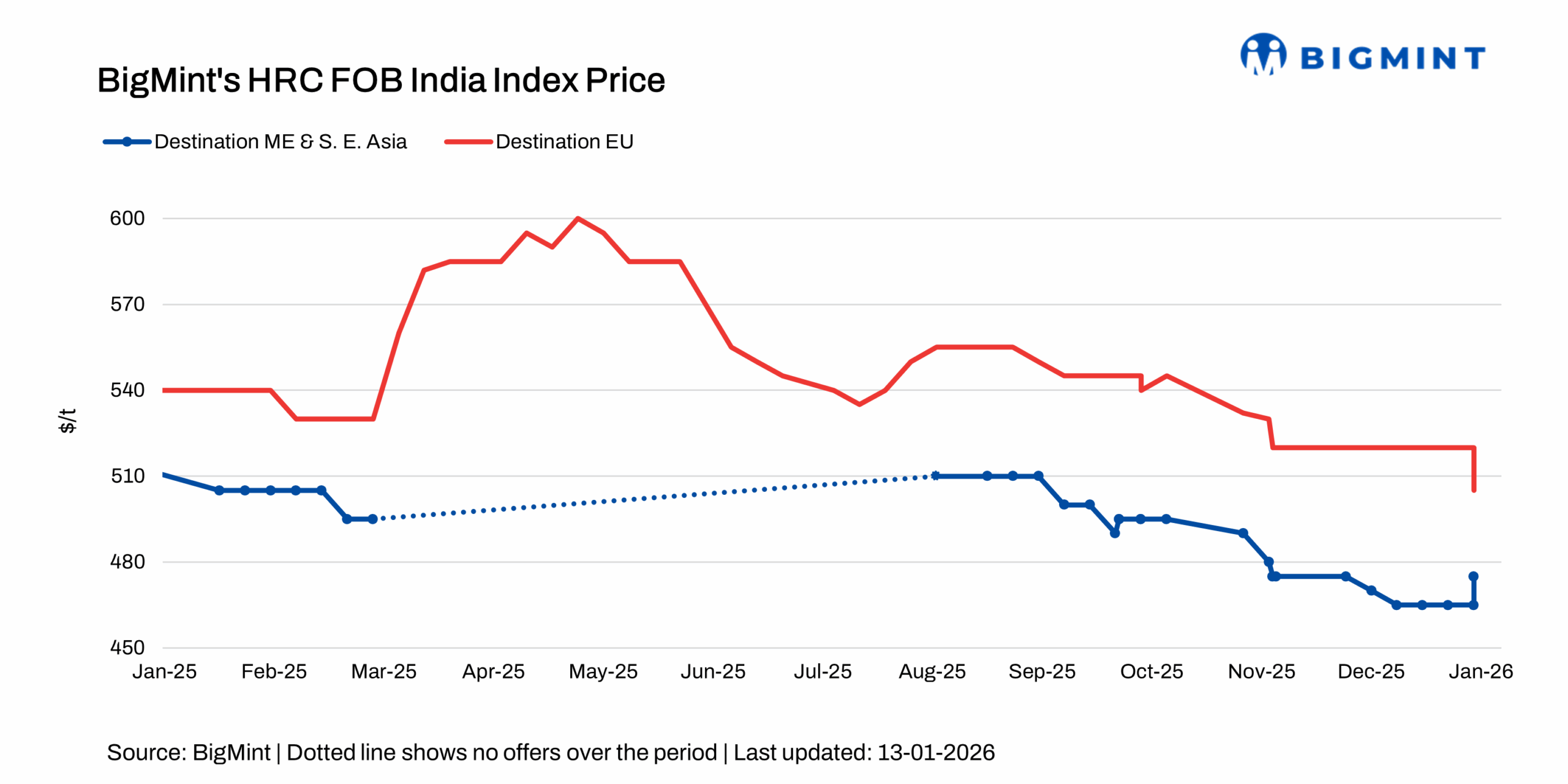

BigMint's Indian HRC (S275) export index for the European Union (EU) declined by $15/t w-o-w to $505/t FOB main port from $520/t a week earlier. "Indian mills have fully exhausted their allocated quota for Q1 CY26. With the Carbon Border Adjustment Mechanism (CBAM) now in force, buyers are increasingly relying on mills' declared emissions values, while the verification process has been initiated by most mills," a BigMint source noted.

However, Indian HRC (SAE 1006) export index for the Middle East increased by $5-10/t to $470-475/t FOB main port, up from $465/t a week earlier. A BigMint source, however, noted that "overall demand in the region remained steady, with market activity continuing at a moderate pace.

1. HRC offers to the EU: Indian HRC export offers to the EU dropped by $15/t w-o-w to $555/t CFR Antwerp from $570/t a week ago. Market sentiment remained cautious amid slow post-holiday trading and weak demand. However, mills are attempting to push prices higher, supported by the introduction of the Carbon Border Adjustment Mechanism (CBAM) in January 2026.

Market chatter indicates that "a steel major has booked around 60,000 tonnes (t) of HRC at $520-525/t CFR levels, however, the deal remains unconfirmed". In addition, another BigMint source indicated that "an unconfirmed deal of around 30,000 t has been booked at $560/t CFR Antwerp for February shipments".

2. HRC offers to the Middle East: Indian HRC export offers to the Middle East increased by $5-10/t w-o-w to around $495-500/t CFR UAE from $490/t the previous week. Notably, an unconfirmed deal of around 15,000 t has been reportedly concluded at $520/t CFR Oman for February shipments.

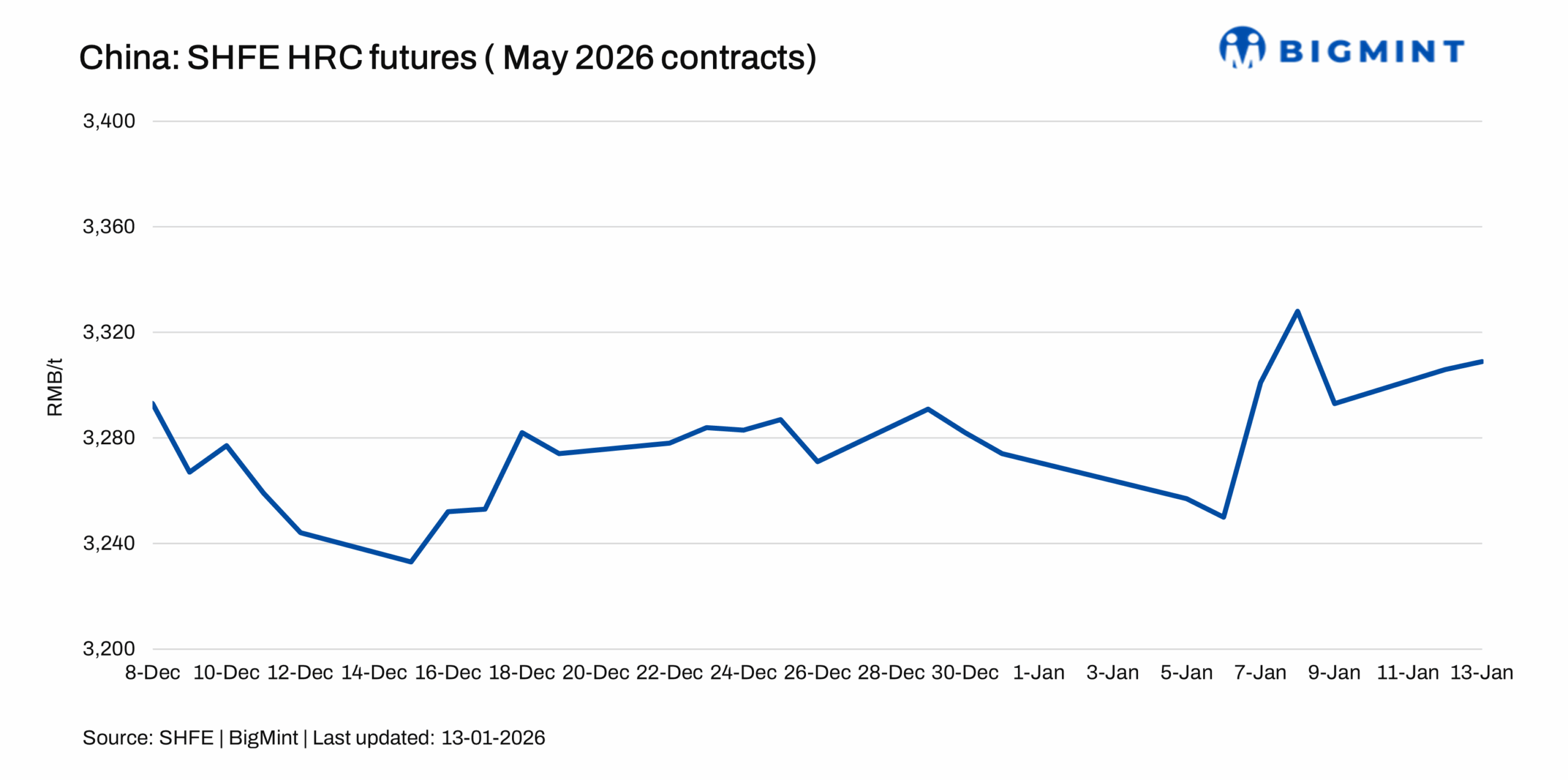

Chinese HRC export offers to the Middle East rose by around $5/t w-o-w to $490-500/t CFR UAE, up from $485/t last week. May 2026 HRC contracts on the Shanghai Futures Exchange (SHFE) also went up by RMB 59/t ($8/t) w-o-w to RMB 3,309/t ($474/t) on 13 January 2026, compared with RMB 3,250/t ($466/t) the previous week.

3. HRC offers to Nepal: Indian HRC export offers to Nepal surged by $10/t w-o-w to $515/t CFR Raxual from $505/t a week ago. A BigMint source noted that, "no fresh bookings have been made from India to Nepal, as offers from Indian mills remain high and Nepali buyers already have ample inventories".

Outlook

The Indian HRC export market is expected to record a gradual pickup in the coming weeks as trading activity resumes following the holiday slowdown. Fresh inquiries and offers are expected to emerge and overall demand trends may become more clearer as buying interest picks up.