India: BigMint's HRC export index for EU rises w-o-w, driven by domestic price gains

...

- HRC offers to Middle East rise by $10/t w-o-w

- European mills recently raise HRC prices

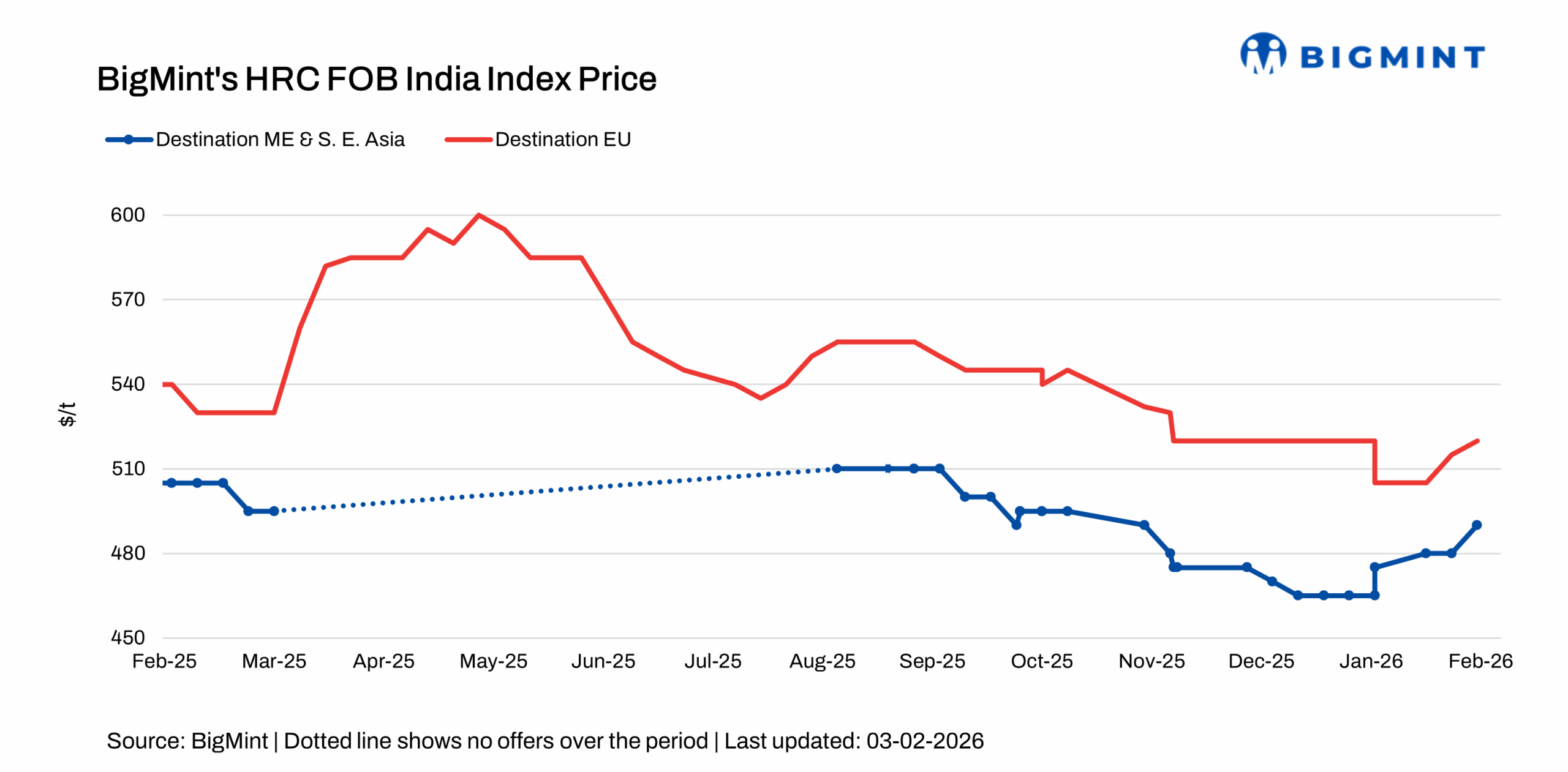

BigMint's India HRC (S275) export index for the European Union (EU) increased by $35/t w-o-w to $550/t FOB main port on 3 February from $515/t a week earlier, driven by price gains in the Indian domestic market. Meanwhile, Indian HRC (SAE 1006) export index for the Middle East and South East Asia rose by $10/t w-o-w to $490/t FOB main port from $480/t a week earlier.

1. HRC offers to the EU: Indian HRC export offers to the EU increased by $35/t w-o-w to $600/t CFR Antwerp as compared with $565-570/t CFR a week ago. Strong price gains in the Indian domestic market seem to have driven this price increase. For example, Indian trade-level HRC prices increased by INR 800/t ($9/t) w-o-w on 3 February to INR 53,800/t ($596/t) exw-Mumbai, while the monthly average for January stood at INR 52,000/t ($576/t), up by INR 4,900/t ($54/t) m-o-m. However, it is to be noted that Indian mills seem more focused on the domestic market due to better realisations on sales.

Additionally, European HRC mills recently raised their prices, also contributing to Indian mills' higher export offers. However, buyers initially resisted due to cautious demand and ample inventories. However, sentiment has gradually shifted, with buyers beginning to accept higher prices as import availability has tightened. This price increase is not driven by stronger demand fundamentals but by concerns over reduced import volumes under CBAM and safeguard measures. Overall, EU market sentiment remains cautiously optimistic despite sluggish end-user demand.

2. HRC offers to the Middle East: Indian HRC export offers to the Middle East rose by $10/t w-o-w to $515/t CFR UAE compared with $505/t in the previous week. These are indicative levels, however, as again, Indian mills remain more focused on the domestic market and are not making firm offers to the region. Additionally, current Chinese and Russian offers are too low for Indian mills to compete with.

Moreover, a deal of around 30,000 t was reportedly concluded at around $470/t CFR from Russia for March 2026 shipment.

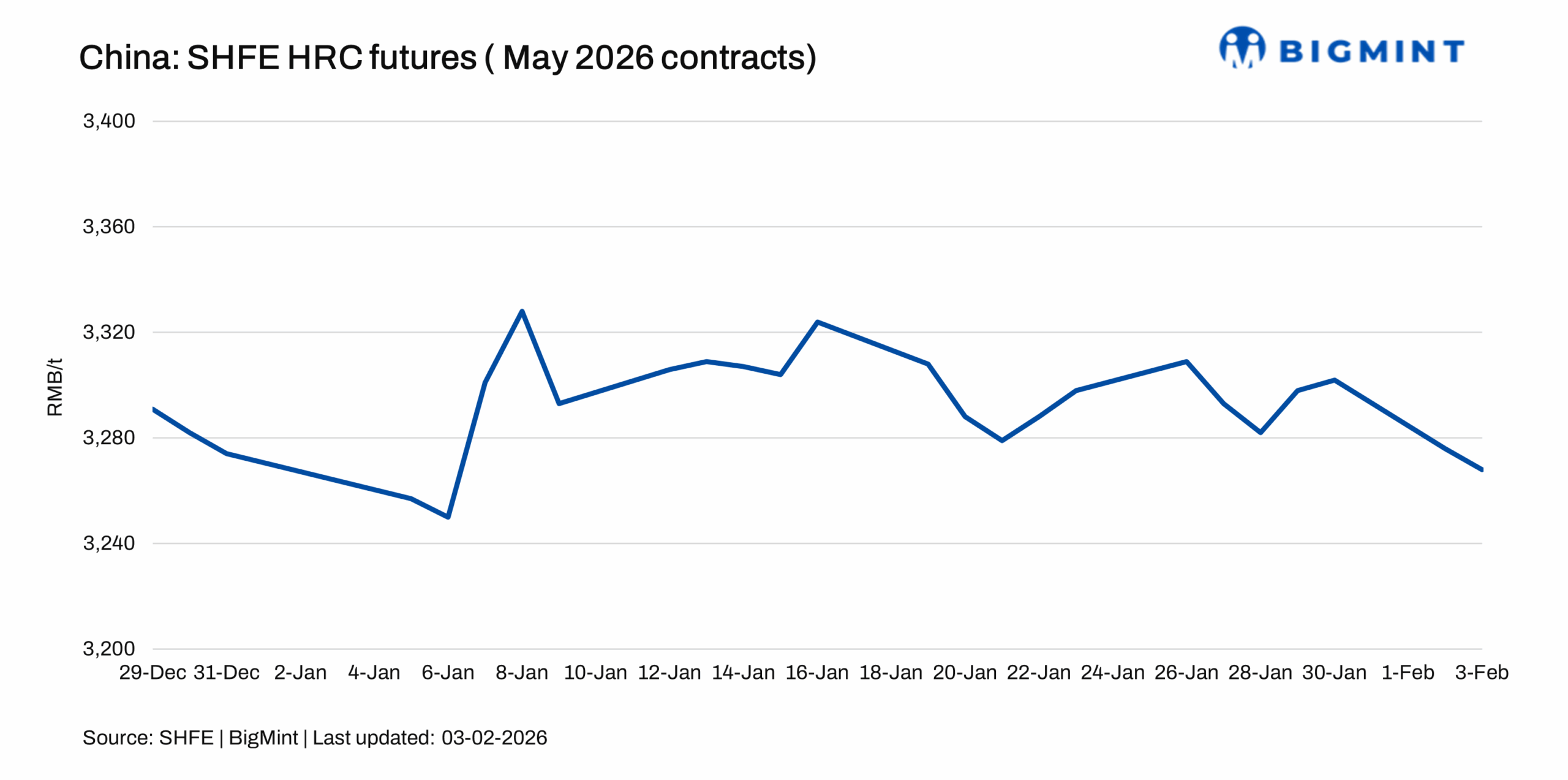

China's HRC export offers to the Middle East remained stable w-o-w at $500/t CFR UAE amid sluggish activity ahead of the Lunar New Year. Moreover, a deal of around 30,000 t was heard concluded at similar levels for March 2026 shipments. May 2026 HRC contracts on the Shanghai Futures Exchange (SHFE) declined by RMB 25/t ($4/t) w-ow to RMB 3,268/t ($471/t) on 3 February from RMB 3,293/t ($475/t) on 27 January 2026.

Outlook

The Indian HRC export market is expected to be influenced by tightening import availability and moderately supportive domestic sentiment in the EU amid CBAM and safeguard measures, despite weak underlying demand. In the Middle East, buying interest remains limited, while competitive Chinese export offers continue to exert pressure on the market. With primary Indian mills announcing February price hikes, the market's focus is likely to stay on the domestic market. Supported by higher realisations, Indian steelmakers are likely to prioritise domestic sales over exports in the near term.