India: BigMint's billet index remains stable despite weak buying sentiment

...

- Demand softens as sellers try to raise offers

- Finished steel prices fall by INR 100/t d-o-d

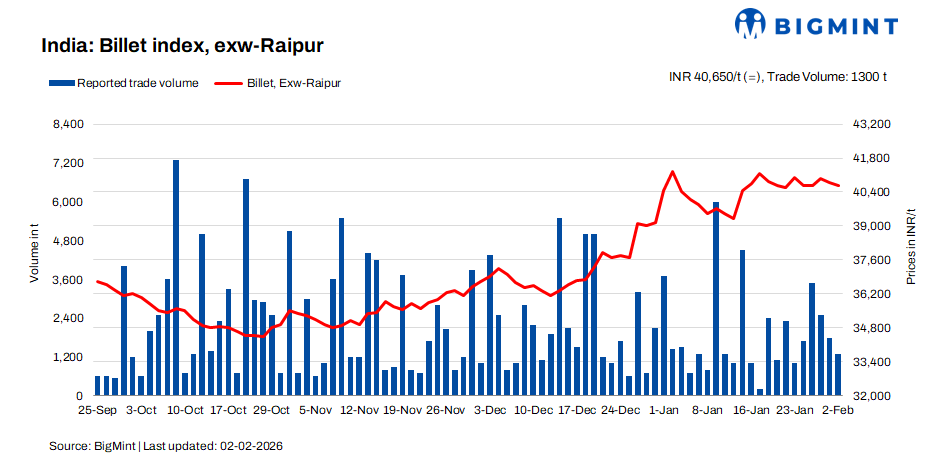

BigMint's billet index was steady d-o-d at INR 40,650/t exw-Raipur on 2 February 2026, even as weak demand and cautious buyer sentiment limited market participation. Trading activity stayed thin throughout the day, reflecting restrained procurement across key consuming regions.

Demand softened as sellers attempted to raise billet offers following a price rise in the previous session. The lack of support from the finished steel segment prevented any meaningful upside. Buyers largely stayed on the sidelines, citing weak downstream offtake and uncertain near-term price direction. Enquiries across both semi-finished and finished steel segments remained limited, keeping transactions largely need-based.

Finished steel prices soften

In the Raipur market, finished steel prices edged lower, reinforcing cautious sentiment. Rebar and wire rod prices declined by INR 100/t d-o-d, weighed down by limited enquiries and muted demand. Traders noted that buyers continued to defer fresh bookings due to weak end-user demand.

Sponge iron prices fall as sellers attempt to stimulate buying

Sponge iron prices in Raipur declined by INR 200/t d-o-d, as sellers reduced offers to attract buyers. The correction helped improve booking activity, although volumes remained modest. Despite the price adjustment, overall sentiment stayed cautious, with mills closely monitoring billet realisations before committing to larger purchases.

The conversion spread from pellet-based sponge iron (PDRI) to billets for standalone induction furnaces in Raipur was assessed at around INR 15,150/t, indicating compressed margins amid weak steel demand.

Rationale

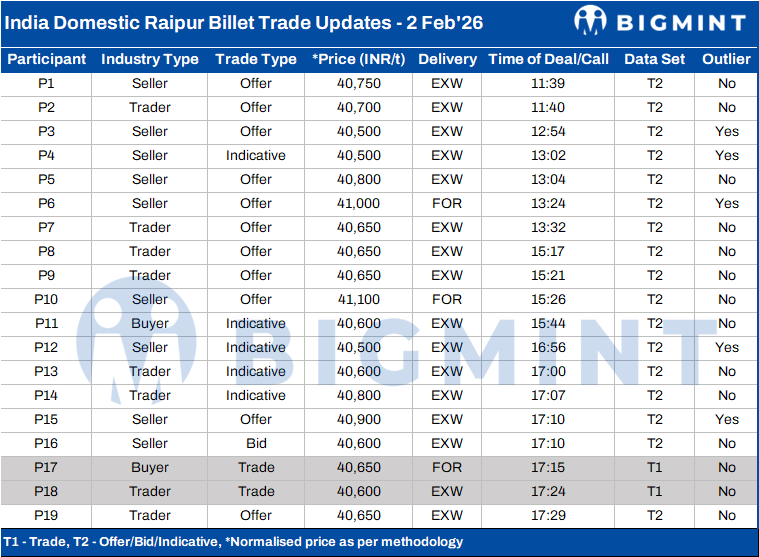

This index is derived based on transactions, offers, bids, and indicative price data sets. Transactions are considered T1 and given a weightage of 50%, whereas other data sets are considered as T2 and given a weightage of the balance 50%.

Transactions (T1) - Two trades at INR 40,600-40,650/t were recorded during the 10:30 am to 5:30 pm BigMint trading window and considered for final price calculation as T1 inputs. The average of these transactions was INR 40,623/t, which was given a 50% weightage in the final price calculation.

Other price indicators - bids/offers/indicatives (T2) - Seventeen offers were reported in the trading window and considered as T2 inputs. The average price of these seventeen was INR 40,712/t and given a 50% weightage in the final price calculation.

The final price of billets was INR 40,667/t exw-Raipur, rounded off to INR 40,650/t exw.

Click here for detailed methodology