India: Aluminium ADC12 prices rise w-o-w on less raw material availability

...

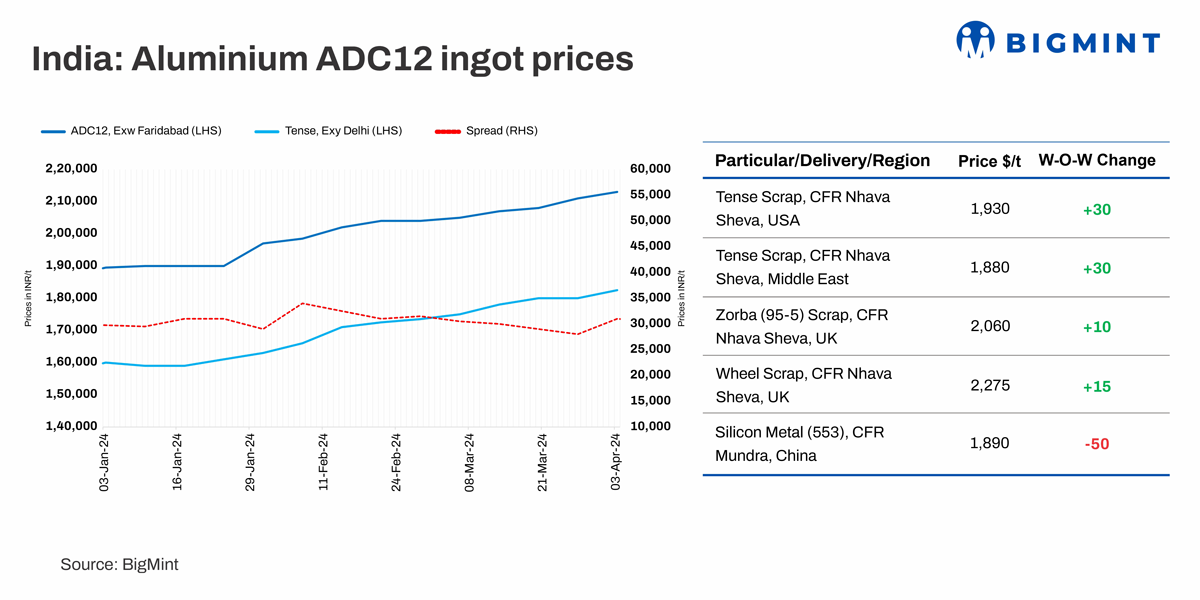

Aluminium ADC12 alloy ingot (automobile equivalent) spot prices increased marginally by INR 2,000/t to INR 213,000/t w-o-w exw Delhi, excluding GST.

Presently, tense offers in Delhi and Chennai stand at INR 182,000-183,000/t. However, tradable levels in Chennai are around INR 181,000/t. Additionally, the spot price for ADC12 in Chennai stands at INR 215,000- 216,000/t exw with immediate terms, excluding GST, marking an increase of up to INR 3,000/t compared to the previous week.

Market insights from participants

An alloy producer stated: "At present, we're exclusively fulfilling ADC12 orders through bulk contracts at fixed prices and have adjusted production up to certain level. A few specific buyers are being offered aluminum clean tense material at premium of INR 184-185/kg, ex-Delhi."

Presently, OEM prices for ADC12 are below spot prices owing to long-term contracts.

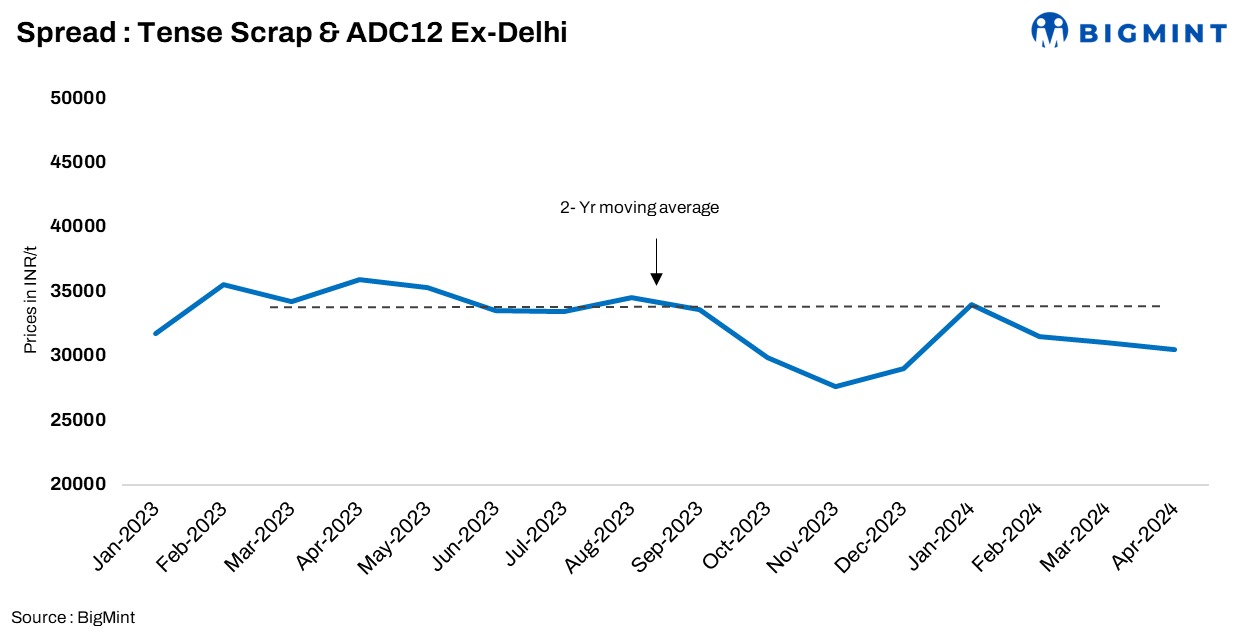

A manufacturer said : "Currently, the demand for ADC12 is subdued due to high raw material costs. To maintain profit margins, materials are being redirected to southern markets at automobile company rates. However, the northern market is experiencing a slowdown and may rely less on company rates due to inappropriate spreads."

One of the sources told BigMint: "Bulk quantities of aluminium casting scrap, including tense, troma are being exported to Korea due to more favourable returns. UK aluminium troma is priced at approximately $2,330-2,350/t for exports to Korea. Currently, Korea is outbidding India for the purchase of aluminium and copper motor scrap, offering up to $100/t higher price."

A northern alloy producer said: "ADC12 production is currently running at 60-70% capacity due to our decision not to accept new orders because of price discrepancies. However, we are honoring our existing contracts by providing material at automobile companies' rates."

Presently, silicon 553 from China is priced at $1,850-1,860/t to Chennai, reflecting a significant decrease due to market demand. Offers for Silicon 441 are at $2,010-2,030/t to Chennai.

The price for silicon 853 is at INR 180,000/t and for 553 grade is INR 185,000/t ex Delhi with 30-40 credit payment terms.

Pricing trend

Imported tense scrap prices from the Middle East, particularly from the UAE, rose by $30/t to $1,880/t yesterday. Tense (6-7%) from the US was heard at $1,930/t, up by $30/t. The price for zorba 95-5 from the UK stood at $2,060/t CFR Nhava Sheva.

However, three-month futures for aluminium were currently at $2,289/t, reflecting a $90/t rise w-o-w.

Recent deals and offers

- ADC12 offers from the UAE to CFR Chennai stood at $2,470/t.

- ADC12 offers from the UAE to CFR Mundra stood at $2,450/t.

- Sold 10 t of ADC12 at INR 216,500/t, ex Chennai.

- Sold 20t of ADC12 at INR 215,000/t, ex Coimbatore.

- Bought 10t of tense scrap at INR 180,000/t, ex Chennai.

- China silicon 441 bought at $2020/t, CFR UAE in 6 containers.

- 20 t clean tense scrap bought at $1750/t, exy Dubai.

- Sold ADC12 on credit basis at 219/kg recently at 100 ex Delhi.

- Sold ADC12 at INR 212,500/t for 50 t ex Delhi.

- Aluminium taint tabor HRB 2-3%, South America-origin was sold to Dadri India at $1,900/t recently for 50 t.

- USA Zorba 95-5 recently traded at $2,030/t CIF Nhava Sheva for 45 t.

Outlook

It is expected that price by major automobile company may see a rise for May, 2024 contracts which may further support prices in near term.