How has India's steel metallic mix shifted over the last 5 years? BigMint analysis

...

- Sponge iron usage surges on ample supply, competitive prices

- Scrap consumption rises on expanding domestic generation

- Hot metal output rises slower, BF share shrinks to 42% in CY'25

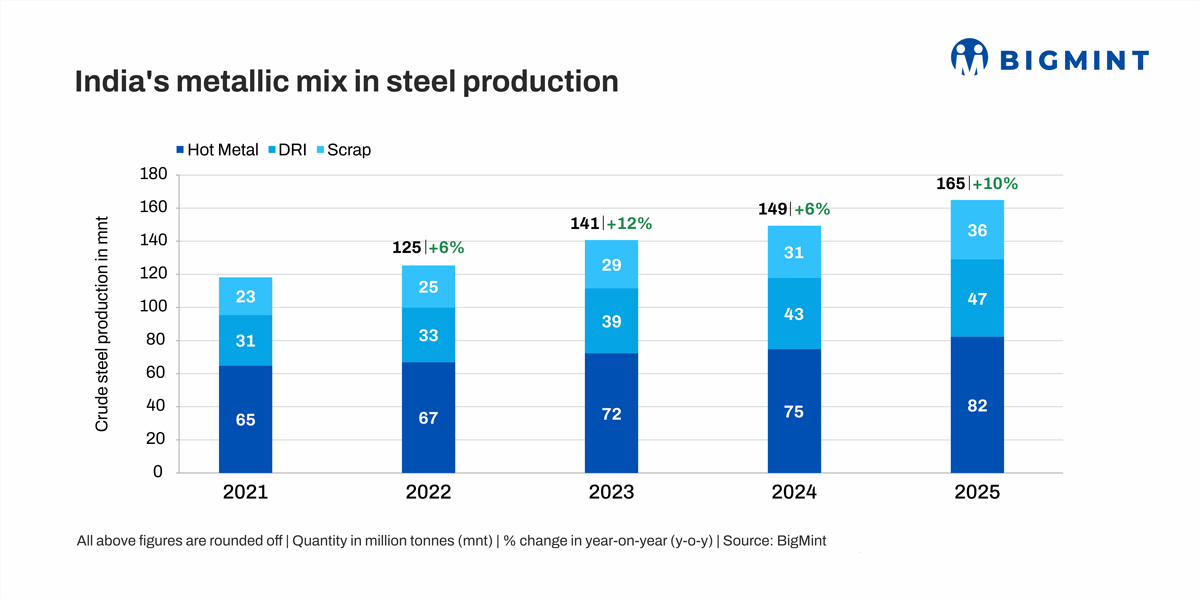

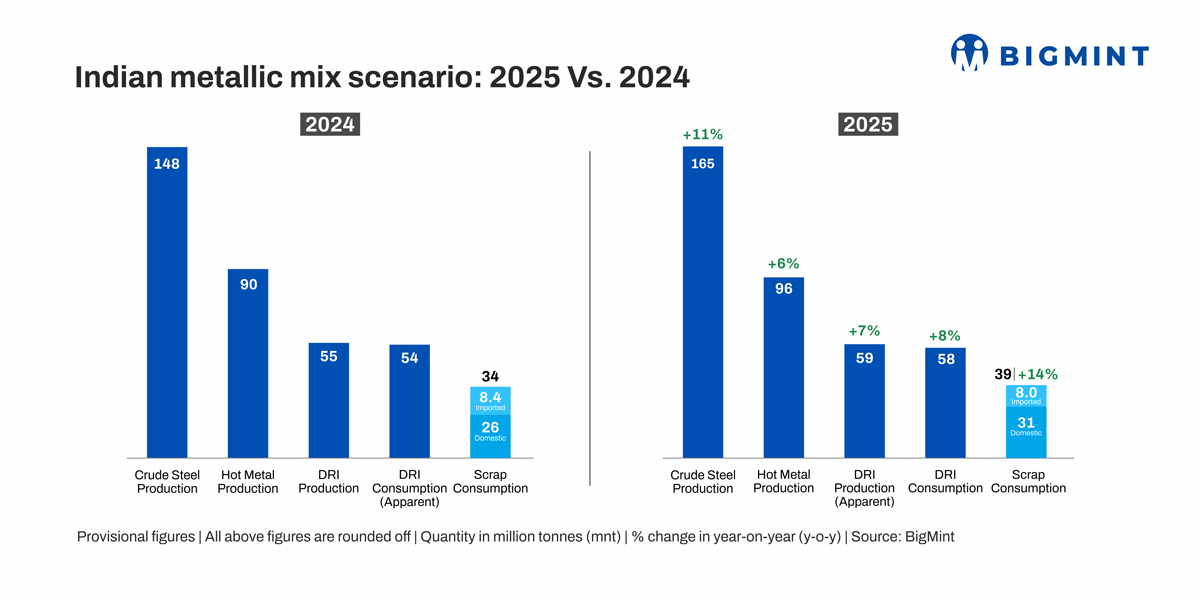

Morning Brief: India's raw material mix for steel production has shifted notably in the last five years, though hot metal output continues to dominate. While Indias crude steel production has risen at a compound annual growth rate (CAGR) of 7% between CY21 and CY25, sponge iron or direct reduced iron (DRI) and scrap consumption have increased at sharper CAGRs of 9% and 10%, respectively. This suggests an increasing share of crude steel is being produced from these two metallics rather than hot metal.

In absolute terms, scrap consumption has increased by 14 million tonnes (mnt) to 39 mnt in CY25 from CY21. Sponge iron consumption has increased by a higher 21 mnt to 58 mnt in CY25. In part, this shift has been enabled by a sharp increase in induction furnace (IF) based crude steel production over CY21-25 (15% CAGR). Meanwhile, output from electric arc furnaces (EAFs) has remained stable over the years. However, given that steel production has climbed up steadily, the share of EAF-based output has gradually shrunk to 20% from 27%. Although crude steel output from hot metal remains the dominant steelmaking route, it has increased the slowest, at 5%. Consequently, the share of blast furnace (BF) based output has declined slightly to 42% from 46%.

CY'23 marks turning point

As per BigMint data, the majority of steel growth in CY23 came from the IF route. The surge reflected strong post-pandemic construction demand, faster ramp-up capability among smaller mills, and elevated coking coal prices that squeezed margins at integrated BF-based steelmakers.

Factors influencing Indias shifting raw material mix

Ample supply, competitive prices boost DRI output: Sponge iron production has increased at a CAGR of 9% to 59 mnt in CY25 from 39 mnt in CY21. The rapid growth in sponge iron production can be attributed to the easy availability of iron ore and coal at competitive prices, cost-efficient operations achieved through the utilisation of waste heat in the coal-based DRI process, and the limited supply of ferrous scrap in the domestic market. Sponge iron prices have also declined 22% since CY22 if yearly averages are considered. Sponge iron (PDRI) averaged INR 31,000/tonne (t) exw-Raipur in CY22 and INR 24,100/t in CY25. Meanwhile, HMS 80:20 prices in Raipur fell 20% to INR 34,000/t DAP in CY25. The decline in sponge iron prices comes from rapid capacity growth, which has outpaced consumption, as well as subdued steel market dynamics. Capacity was estimated to be at around 68-70 mnt in CY25. Therefore, sponge iron remains more attractive than expensive scrap or coke-dependent hot metal.

Policy measures boost scrap generation but structural challenges remain: The Indian steel industry has also embraced greater scrap usage in pursuit of green steel targets. However, despite rising domestic scrap availability and policy push, scraps share remains lower due to structural limitations. Indias per capita steel consumption has only recently crossed 100 kilograms, meaning much of the countrys steel stock is still in use. Obsolete scrap generation typically lags consumption by up to around 30 years, limiting near-term supply. If domestic scrap collection and processing infrastructure fail to scale quickly, scrap penetration could slow, forcing mills to rely more heavily on sponge iron. Geopolitical tensions, disruptions to sea routes, and rising protectionist stances on scrap trade flows, are also likely to constrain import growth.

Outlook

With capacity expansion progressing rapidly, sponge iron production and consumption are projected to continue rising in CY26. However, a sponge iron-heavy mix has negative implications for emissions and policy, so over the longer term, DRI is expected to yield ground to scrap, aligned with the governments sustainability agenda. Consequently, scraps share in Indias metallic mix will eventually surpass that of DRI.