Global steel exports rise slightly in CY'25, driven by China

...

- Weak domestic demand pushes China, Russia to divert material overseas

- EU-based importers lift intake on CBAM uncertainty, competitive prices

- Trade barriers, tariffs reduce imports in US, South Korea, Vietnam, India

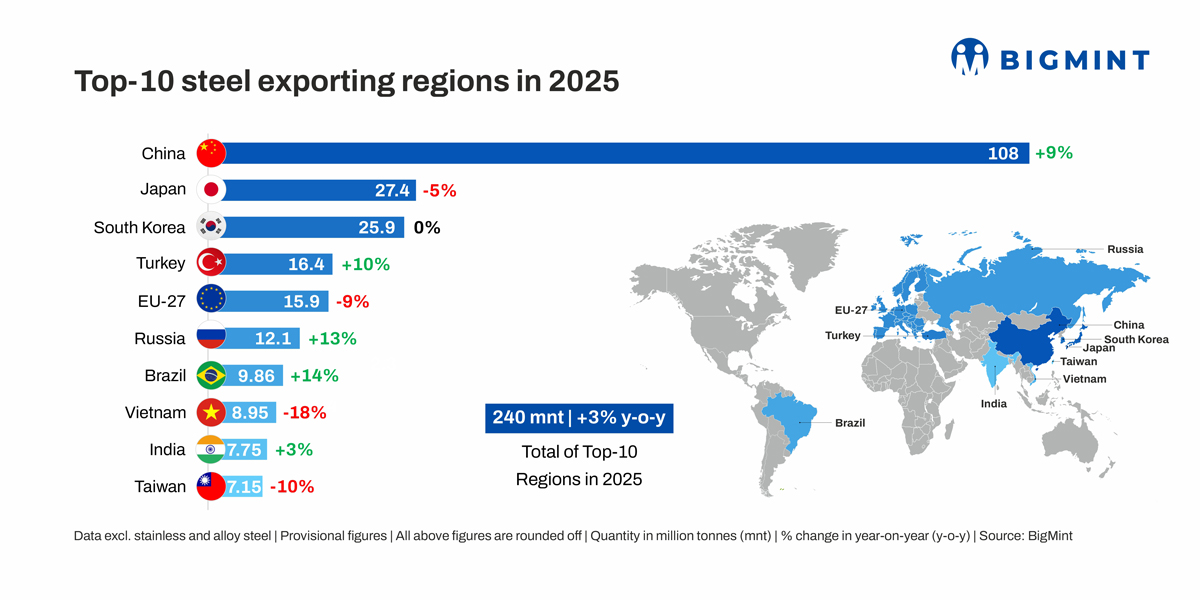

Morning Brief: The top 10 global steel exporting regions shipped 240 million tonnes (mnt) in CY'25 -- a modest 3% uptick from 232 mnt in CY'25, as per BigMint data (excluding alloy and stainless steel). China was the obvious growth driver with a 9% increase, while Turkiye, Russia, and Brazil also recorded double-digit hikes.

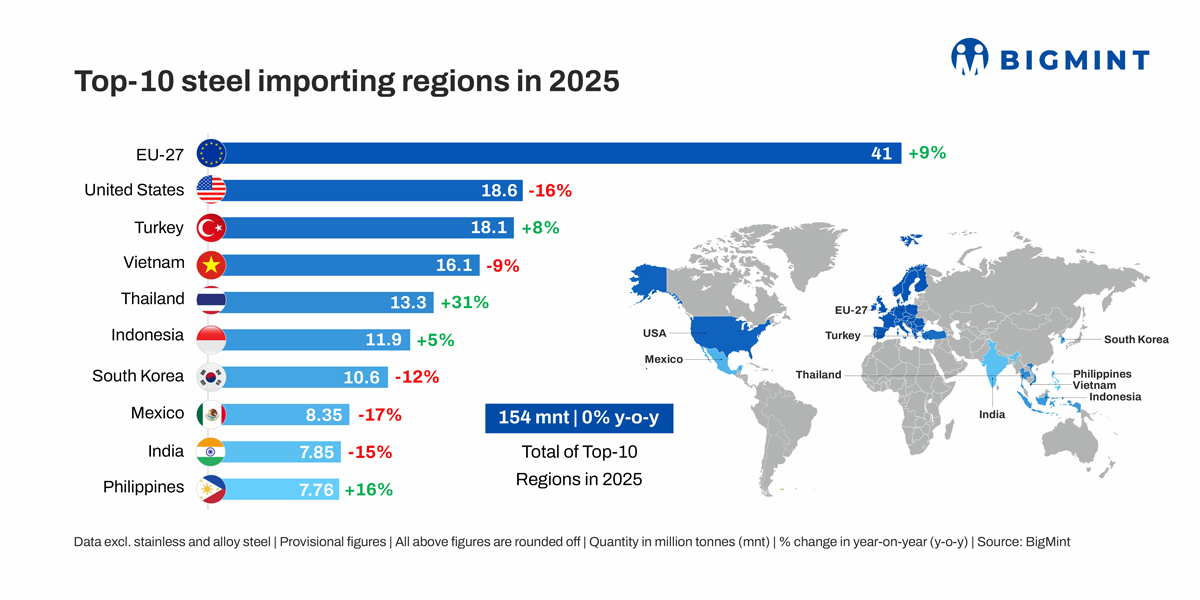

On the other hand, arrivals into the top 10 importers remained stagnant y-o-y. The EU, Turkiye, Thailand, Indonesia, and the Philippines recorded robust upticks, which were balanced by declines in the US, Vietnam, South Korea, Mexico, and India.

Last year, global steel markets remained oversupplied, driven by surplus availability in exporters such as China and Russia. Additionally, worldwide, steel demand remained stagnant in part due to subdued manufacturing activity. Global crude steel output also dipped 2%, with mills in China, Japan, Russia, South Korea, etc. tightening production in response to weak market fundamentals. This points to a widespread depression, which limited export growth.

Factors influencing global steel exports in CY'25

Weak domestic demand propels China's export surge: China's exports grew 9% y-o-y despite a 4% drop in production to 961 mnt, as Chinese steelmakers struggled with weak domestic demand (5% decline in CY'25).

Consequently, excess supply was diverted to overseas markets, with aggressive price undercutting helping Chinese exporters to move more material into emerging economies with fast-growing infrastructure and consumption demand.

However, China's increasing market share restricted growth from other Asian exporters. The easy availability of low-cost steel from China weighed on exports from Japan, South Korea, and India.

Russian exporters capitalise on export duty removal: Russian steel exports increased 13% amid a 14% fall in domestic consumption -- mirroring the trend in China. In CY'25, Russian material became more competitive following the removal of export duties. Unrestricted access to the EU market, especially through slab exports, also helped boost volumes.

India, Turkiye lift exports as CBAM pulls forward demand in EU: The EU's steel imports increased by 9%, as the full implementation of the Carbon Border Adjustment Mechanism (CBAM) from January 2026 triggered uncertainty over additional taxes and costs. This led to frontloading of shipments from exporters such as Turkiye, India, and even China.

High electricity and gas prices and persistent disruptions in raw material supply also kept production costs elevated for local mills. Domestic mills' prices ultimately remained higher than those of imports, dampening demand for their products.

Additionally, the US steel tariffs also diverted more material into the EU, where trade barriers were not as steep. For example, Brazil's steel exports rose as shipments to the EU doubled following the US import tariffs, as per an Argus report. As cheap Chinese steel flooded Brazil, local producers shifted focus to export markets and especially Europe to capitalise on higher prices there.

Trade barriers curb overall export growth: The mere 3% growth in cumulative exports could largely be attributed to rising protectionist policies in major importing regions. Amid rising global overcapacity, set to reach 721 mnt by 2027 as per the Organisation for Economic Co-operation and Development (OECD), many importing countries made stringent policy interventions to protect their domestic industries from import dumping and boost domestic capacity utilisation. For example, the US steel tariffs -- initially set at 25% and then raised to 50% -- led to a sharp 16% drop in US imports. Similarly, Vietnam and South Korea implemented anti-dumping duties on Chinese hot-rolled coils (HRCs), driving steep reductions in imports. India too implemented a safeguard duty from April in addition to other duties and import restrictions.

Outlook

BigMint expects current mixed steel export trends to continue in CY'26, again leading to moderate growth in overall volumes. The two major reasons are as follows: First, global steel demand is expected to bottom out in CY25 and rise moderately in CY'26, as per the World Steel Association's short-range outlook published in October. Secondly, Chinese exports will persist at an elevated level, as domestic supply-demand dynamics remain weak. Russian volumes may also continue increasing in the absence of a substantial domestic demand recovery. However, growing protectionism in the form of anti-dumping duties, tariffs, and shrinking EU import quotas may soften global trade growth.