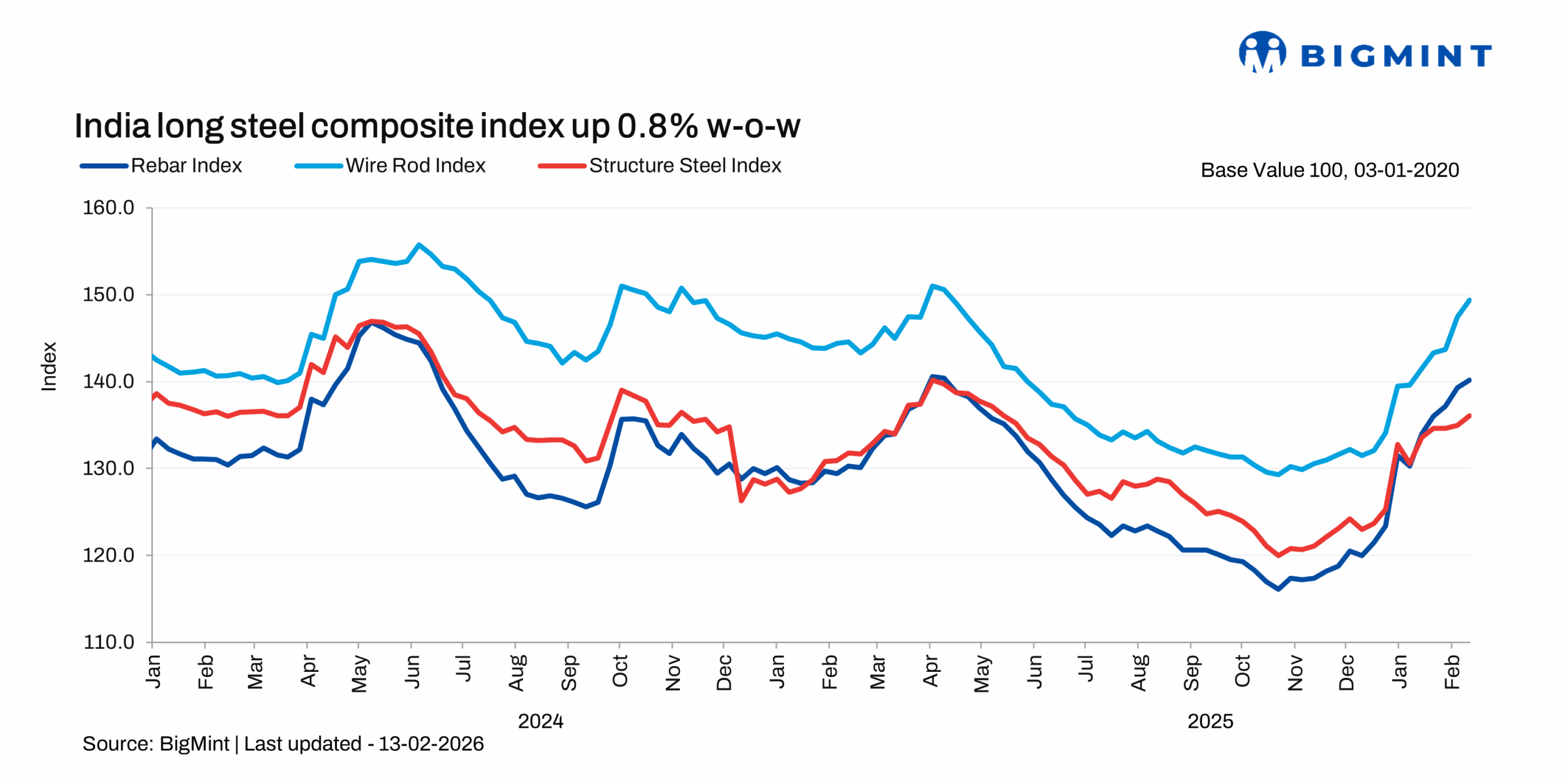

BigMint's India steel index rises w-o-w but growth pace slows markedly

...

- HRC trade prices rise marginally, CRC prices drop

- Tier-1 mills raise BF-rebar prices by INR 1,000/t ($11)

- Mills may raise HRC prices further but trade sentiments weaken

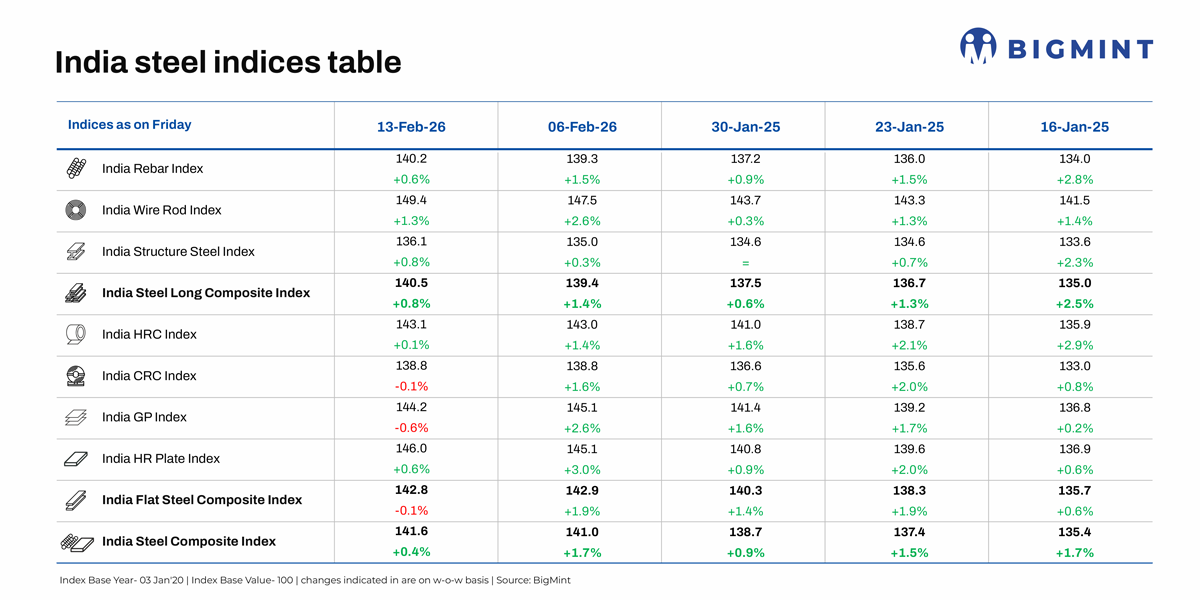

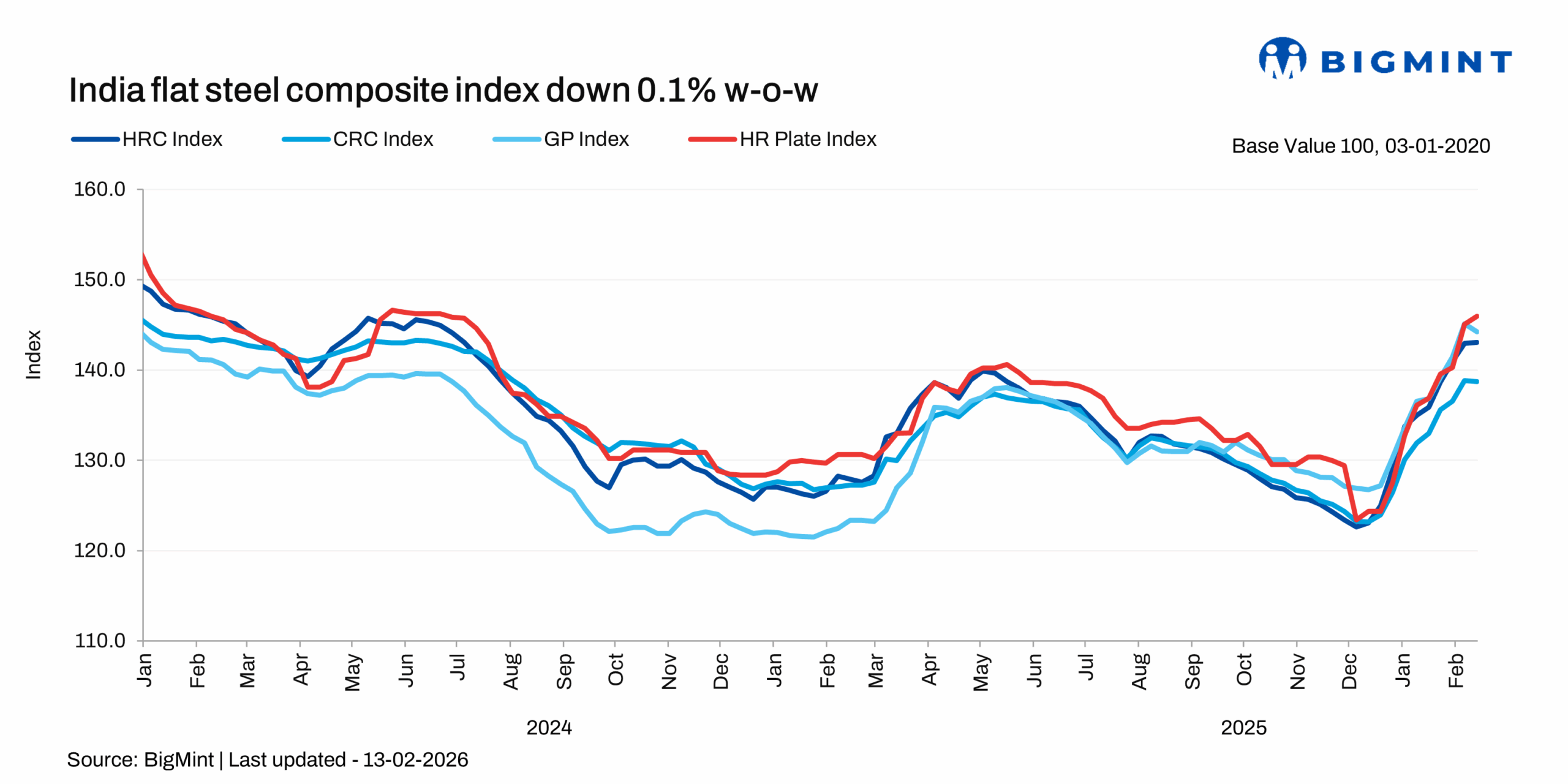

Morning Brief: Domestic steel prices trended higher, as assessed on the week ending 13 February 2026, with BigMint's composite steel index edging up 0.4% - at a rate far slower compared with the previous week as the market kept absorbing the sharp price hikes since early January, and trading sentiment turned cautious at higher price levels. However, the strength in the raw materials segment provided support to finished steel prices, BigMint notes.

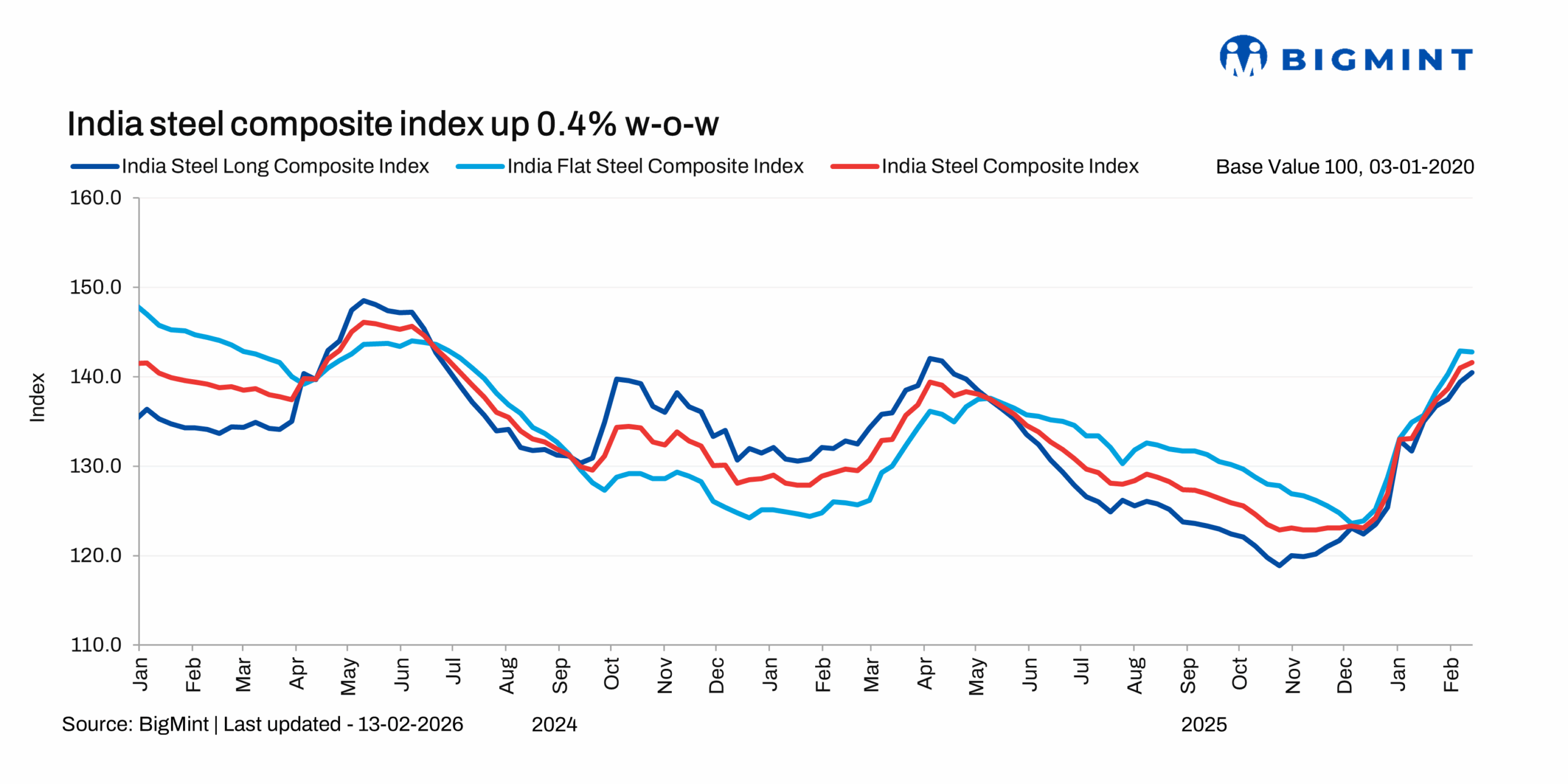

While the longs composite index maintained the growth trend w-o-w, albeit at a slower pace, the flat steel index saw a sharp correction: from 1.9% growth in the previous to a 0.1% drop last week, with CRC prices correcting towards the end of the week.

Price highlights

HRC prices rise marginally, CRC drops: Trade-level prices of hot-rolled coils (HRC) in India showed mixed trends w-o-w on slow trading activity. BigMint's benchmark assessment (bi-weekly) for HRC (IS2062, Gr E250, 2.5-8 mm/CTL) remained stable w-o-w at INR 53,800/t ($594/t) on 10 February. However, CRC (IS513, Gr O, 0.9 mm/CTL) prices fell by INR 400/t w-o-w to INR 59,400/t on 13 February against INR 59,800/t on 10 February.

These prices are ex-Mumbai for the distributor-to-dealer segment and exclude 18% GST.

The HRC market showed mixed trends, aligning with reports of regional variations and supply constraints. A slight price uptick in the northern region was observed amid shortages, while in other regions prices remained stable.

Short supply of different grade sizes supported the mild uptrend, particularly in the north. Demand remains moderate overall, with sales feasible at lower prices amid slow trading activity. Mill price hikes are anticipated in the upcoming week as soon as momentum builds.

Primary mills raise rebar prices: Indian primary steelmakers increased rebar prices by up to INR 1,000/tonne (t) ($11/t) this week, sources informed BigMint. Post-revision, list prices stood at INR 58,000-59,500/t ($640-656/t) on landed basis. Trade-level BF-rebar prices (distributor to dealer) rose by INR 400/t ($4/t) w-o-w to INR 58,600/t ($646/t) exy-Mumbai. Market participants said that buyers were reluctant to place fresh orders at elevated levels following the recent sharp price increase, leading to cautious procurement behaviour. Demand from the projects segment remained steady with dispatches of previously booked orders.

Strong material lifting last month led to significant liquidation of inventories at mill yards, resulting in tighter availability across select rebar sizes. Additionally, the shutdown of a major steelmaker's blast furnace for capacity upgradation since September 2025 has constrained availability.

Trade participants indicated that "major mills are operating with restricted inventories and are largely booked for nearly a month due to ongoing project commitments, thereby limiting spot supplies and creating shortages in certain sizes".

Notably, inventory levels at primary mills fell by around 40% m-o-m in early-February.

Cautious buying amid higher prices: IF-route rebar prices saw mixed trends w-o-w. Buying activity was limited at higher price levels, and fresh order bookings were lacking as buyers adopted a wait-and-watch approach. Manufacturers preferred either to lower their offers or to increase trade discounts, depending on their booking orders. Mill inventories are currently assessed at around 8-12 days across regions.

The BF-IF rebar price spread in Mumbai widened to around INR 8,500-9,000/t ($94-99/t) due to a sharper hike in BF-rebar prices recently. IF rebars continue to dominate the Indian market with a 65-70% share.

Outlook

HRC prices may rise, as expected, with mills having enough room for another increase amid stable imports and rising prices in major Asian countries. Restocking demand after the CNY holidays will be another factor to watch out for. However, domestic long steel prices face stiff buyer resistance after successive hikes through January and into February. We believe prices may remain rangebound on strong seasonal demand sentiments.