BigMint's India steel index maintains upward trajectory, rises 0.9% w-o-w

...

- BigMint's benchmark HRC prices rise INR 600/t ($6) w-o-w

- Tier-1 mills raise BF-route rebar prices by up to INR 1,000/t

- Coking coal prices surge on supply disruptions, iron ore firm

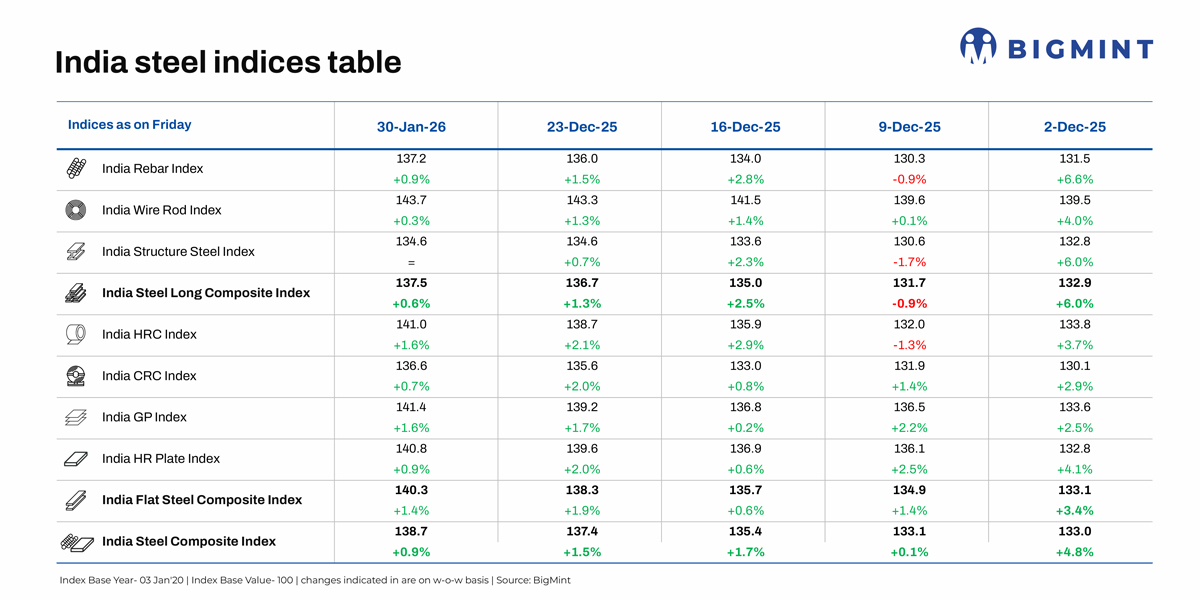

Morning Brief: BigMint's flagship India steel composite index inched up by 0.9% w-o-w, as assessed on 30 January, in a continuation of the uptrend that started in late-December. With prices bottoming out in late-2025, the leading mills had ample opportunity to increase prices through successive hikes throughout January amid surging raw material prices and the safeguard duty acting as a buffer against steel dumping.

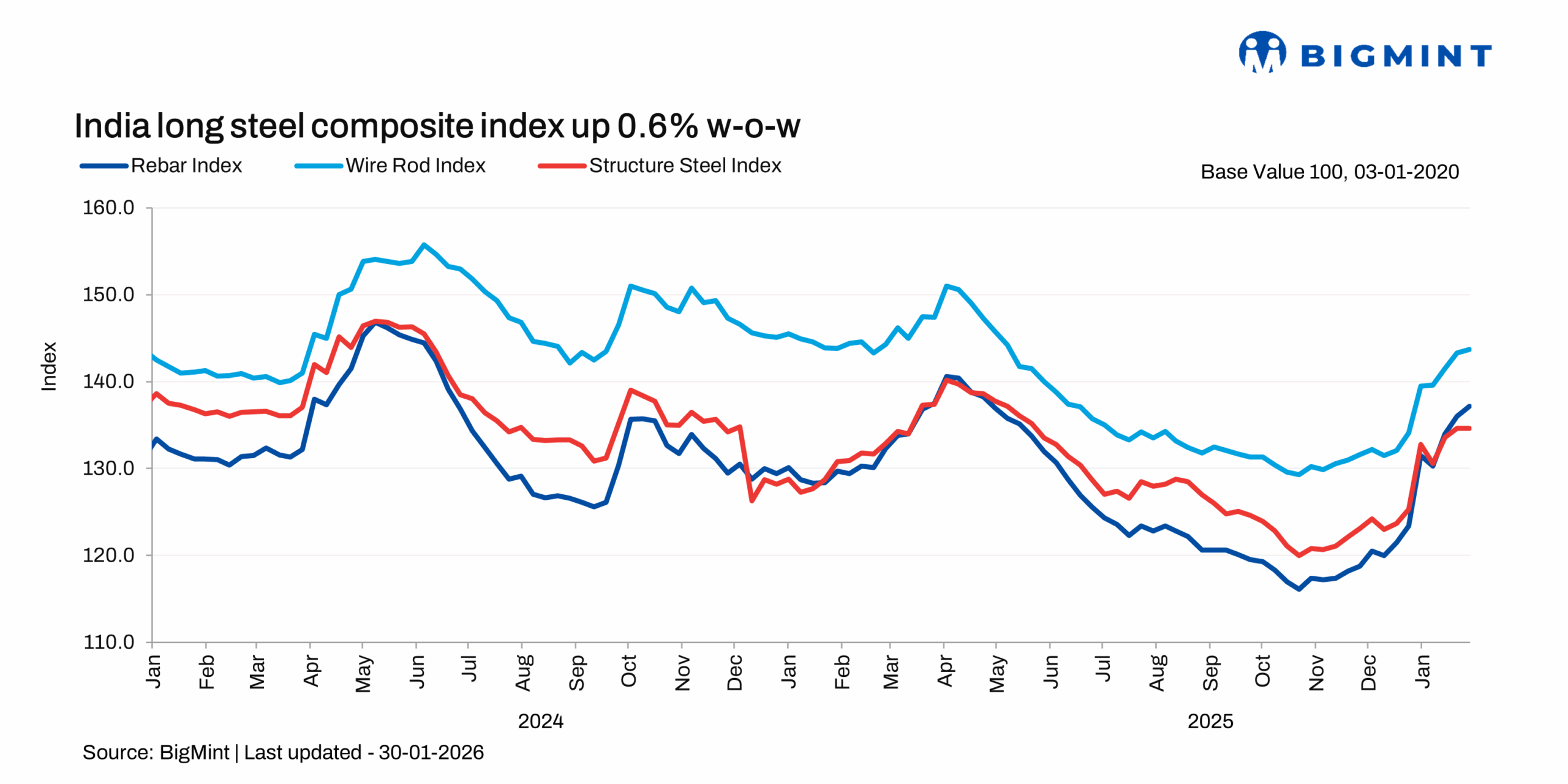

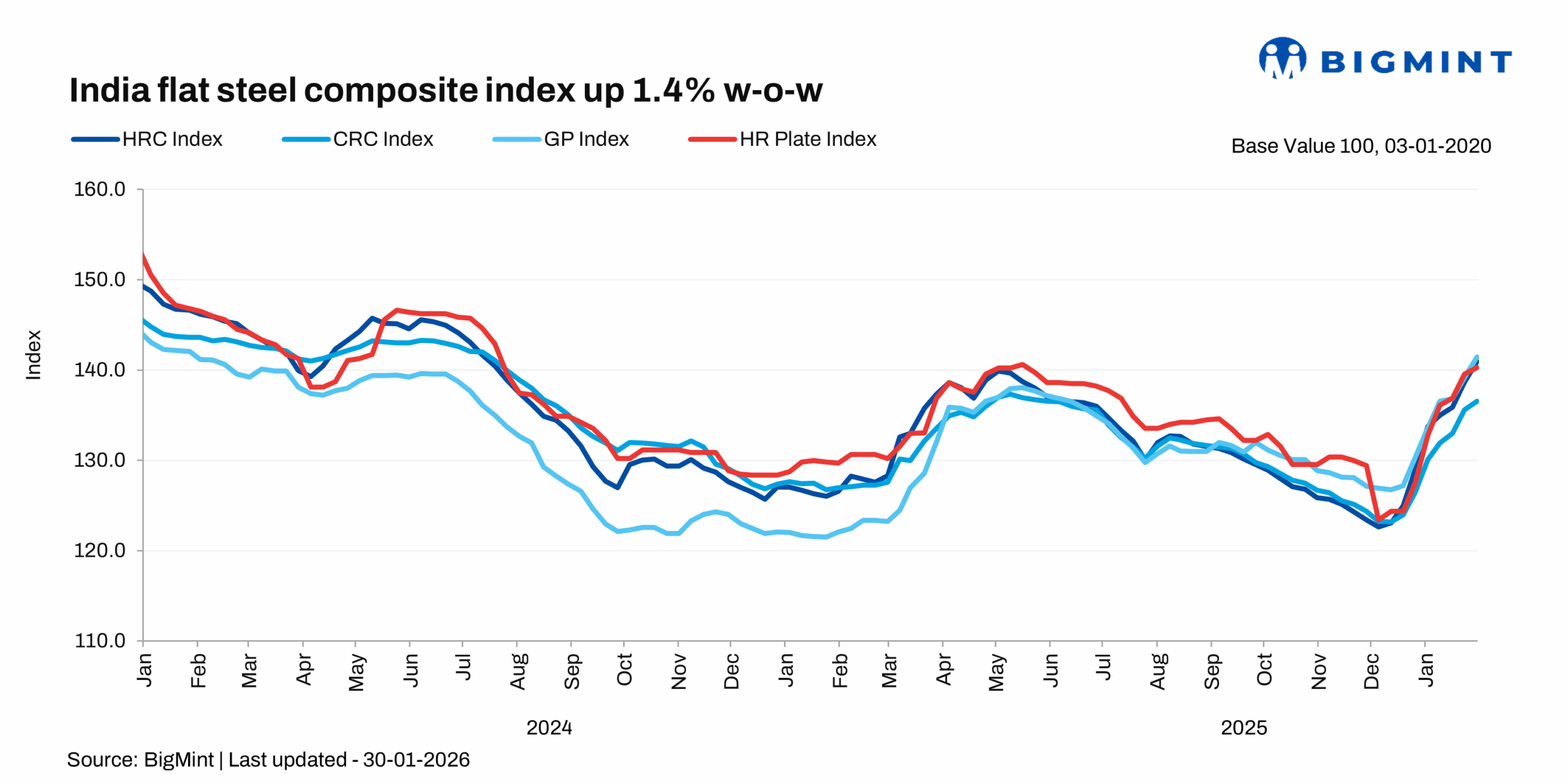

W-o-w, the flat steel index edged up by 1.4% compared to 1.9% last week, while the longs index recorded slower growth of 0.6%.

Highlights of price movements

HRC market strengthens: BigMint's benchmark assessment (bi-weekly) for HRC (IS2062, Gr E250, 2.5-8 mm/CTL) increased by INR 600/t ($6/t) w-o-w to INR 53,000/t ($578/t) on 27 January against INR 52,400/t ($572/t) on 20 January. CRC (IS513, Gr O, 0.9 mm/CTL) prices rose by INR 900/t ($10/t) w-o-w to INR 58,800/t ($642/t). Trade-level prices, too, showed an uptick w-o-w on 27 January amid positive market sentiments.

Additionally, tight supply conditions supported the upward trend following mill-announced price hikes, although demand remained moderate. A market participant informed BigMint that prices are likely to increase by INR 1,200-1,500/t in February.

Import dynamics are expected to remain broadly supportive of domestic prices in February. The three-year definitive safeguard dutyset at 12% in year onehas created an effective landed-cost disadvantage for imports compared to domestic HRC.

Tier-1 mills hike BF rebar prices: Indian tier-I mills increased rebar prices by up to INR 1,000/t ($11/t) this week, sources informed BigMint. Post-revision, list prices stood at INR 55,500-57,000/t ($604-620/t) on landed basis. After the hike by mills, trade-level blast furnace (BF) rebar prices (distributor to dealer) increased w-o-w across major Indian markets. Seamless material lifting and lower availability of material has kept market sentiments firm this week.

Inventories at primary mills have reduced by 15-20%, as per market sources. Most steelmakers are booked out for the coming days, and some are not offering to the projects segment owing to low stocks.

IF-route rebar prices showed mixed trends w-o-w. Weak enquiries and lack of fresh bookings kept trading activity subdued, prompting sellers to reduce offers or extend discounts. Buyers stayed in a wait-and-watch mode. However, demand for sponge iron and billets improved in some regions which supported prices.

Raw material prices rise: While domestic iron ore prices remained firm amid tight supply of lumps and high-grade ore, coking coal prices surged on supply disruptions. Australian premium hard coking coal (PHCC) prices rose by $14/t w-o-w at $254/t CNF Paradip. Higher input costs have led to a hike in steel prices.

Outlook

The JanuaryMarch construction window will continue to lift sales volumes, and the post-Budget pickup in economic and infrastructure activity will support steel prices. Yet production growth still exceeds demand growth. As a result, upside risks have increased, but price appreciation is expected to remain measured rather than explosive.