20-November-2025

- Manufacturing PMI slides to 4-month low

- Crude steel production drops by 4% m-o-m

- GST cuts, festive demand boosts auto sales

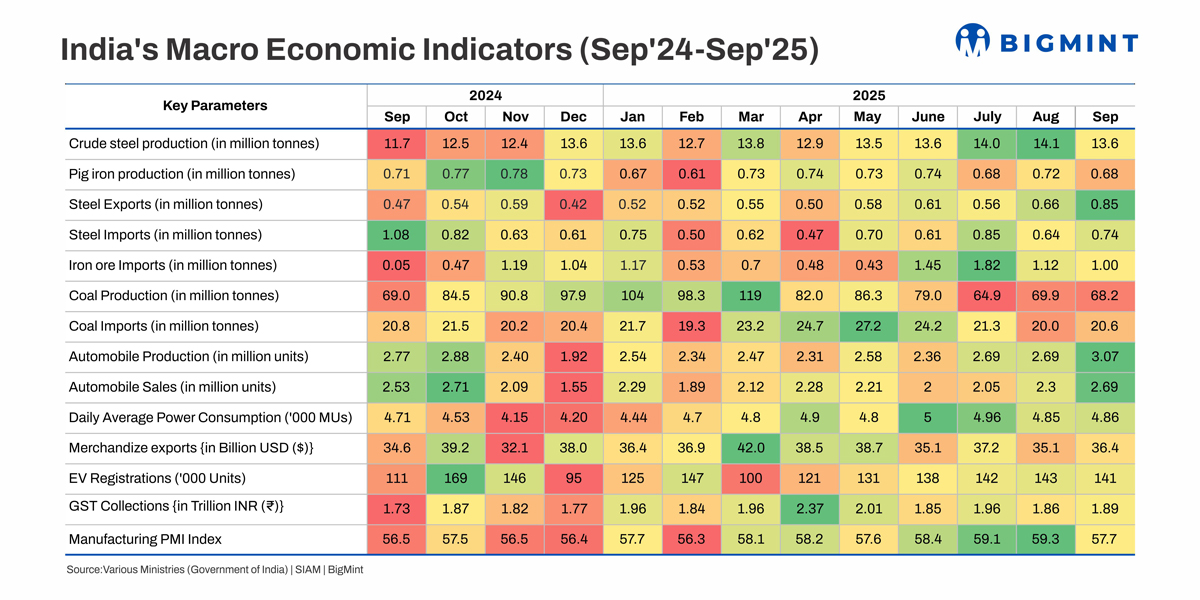

Morning Brief: India's steel industry witnessed sustained growth in September 2025, albeit at a slower pace. While crude steel production fell m-o-m as the monsoon impacted consumption trends, end-user activity moderated slightly, except in the auto sector.

The Index of Industrial Production showed a growth rate of 4%, a three-month low. The mining, primary goods, and consumer non-durables sectors witnessed notable contractions, while manufacturing and consumer durables logged strong growth.

Furthermore, the index recorded growth of just 3% in April-September, the slowest in at least five years, as per The Hindu.

Even the Index of Eight Core Industries reflected a slowdown. India's core infrastructure output grew at its most sluggish pace in the past three months, at 3% compared to 6.5% in August. This was driven by a decline across coal, crude oil, natural gas, and refinery products, while steel, cement, and electricity witnessed increases.

Highlights

Crude steel production drops m-o-m

India's crude steel production slid 4% m-o-m to 13.56 million tonnes (mnt) in September 2025, with weak demand due to the extended monsoon weighing on margins and prompting production cuts by certain steelmakers. Parallelly, pig iron production declined by 6% m-o-m to 0.68 mnt.

Steel exports, imports increase m-o-m

Steel exports jumped by 22% m-o-m to 0.85 mnt, while imports increased by 14% to 0.74 mnt. Buyers' fears and uncertainty regarding the additional tax burdens to be imposed by the Carbon Border Adjustment Mechanism (CBAM) brought forward demand from the EU, which is expected to place additional emissions-related tax burdens on imported goods.

Meanwhile, imports increased m-o-m, likely due to attractive global prices and limited availability of required material in India. Buyers may have been stocking up ahead of the peak steel demand season in India. However, imports declined by 30% y-o-y due to the impact of the safeguard duty and other trade barriers.

Iron ore imports slide m-o-m

India's iron ore and pellet imports dropped by 12% m-o-m to 1 mnt in September but remained substantially higher y-o-y. Tight availability of high-grade ore and competitive pricing has prompted buyers to increasingly source imported material.

Coal production dips, imports inch up

Coal production slipped by 2% m-o-m to 68 mnt due to rainfall-driven operational disruptions. Coal demand also remained weak, with power utilities showing lower procurement interest.

For this reason, Coal India missed its September production targets, with volumes dropping by 4% y-o-y to 48.97 mnt.

Meanwhile, imports inched up by 3% m-o-m to 20.63 mnt due to a moderate depletion of stocks at coal-based power plants.

Auto sales zoom on festive demand, GST cuts

Automobile production climbed up by 12% m-o-m to 3.07 mnt in September, the first month since January 2024 in which volumes have topped 3 mnt. This shows robust confidence in Indian consumer sentiment improving following the GST cuts.

Additionally, sales increased by 14% to 2.69 mnt, though the first 21 days witnessed muted demand as consumers waited for the GST cuts to kick in. The simultaneous onset of Navratri also led to festive demand, and steady RBI interest rates boosted purchasing power. Passenger and two-wheeler segments led growth due to affordability gains.

However, EV registrations declined by a minor 1.4% m-o-m to 141,300 units due to, ironically, the GST cuts, which made automobiles with internal combustion engines (ICEs) and hybrid set-ups more affordable. The wide price gap weighed on electric passenger vehicle sales in particular.

Power consumption stable as monsoon continues

Daily average power consumption was stable m-o-m at 4,860 million units. Due to the extended monsoon, weather conditions remained cool across regions, which reduced power demand. Industrial activity also slowed, contributing to lower power consumption.

Merchandise exports inch up

India's merchandise exports inched up by 4% y-o-y to $36.4 billion, showing resilience despite global economic turmoil and the US imposing steep tariffs. Higher shipments of oil and gems and jewellery drove up overall exports, even as the US reduced its imports from India by 12% m-o-m.

GST collections rise despite rate cuts

GST collections increased by 1.6% m-o-m to INR 1.89 trillion, indicating robust consumption and industrial activity despite concerns around postponement of big-ticket purchases. Adjusted tax rates for as many as 375 items came into effect from 22 September, boosting consumption following the first three weeks of muted activity.

Manufacturing PMI slows

India's purchasing managers' index in September reflected a ''mild loss of momentum" despite sustained growth, as per the official release. The index stood at a four-month low of 57.7 points, down by 1.6 points.

New orders, as well as output and input buying, increased at their slowest pace since May, though producers remained optimistic due to the GST cuts. However, new export orders rose in September, with demand from non-US markets compensating for the loss of business from the US due to tariff hikes.

Outlook

Despite a minor deceleration in September, the near-term outlook remains positive. The GST cuts are expected to spur higher consumption activity, and coupled with festive demand, October may see record-high growth. To illustrate, the Manufacturing PMI rose to 59.2 points in October, on the back of strong demand. This robust growth is likely to be seen in other end-user segments as well.

Get ready to dive deep into the future of steel.

Join us at the 7th India International DRI and Steel Summit 2026

Date: 16 January 2026 | Venue: Hotel Le Meridien, New Delhi

Do not miss the opportunity to gain exclusive insights, attend expert sessions, and network with industry leaders.

Register now to secure your spot.