10-November-2025

- Production in H1FY'26 reaches nearly 56 mnt

- West Bengal records a sharp 21% surge in production

- Higher sponge iron production boosts pellet output

Morning Brief: Production of iron ore pellets in India in the April-September period of the current fiscal (H1FY'26) stood at around 55.6 million tonnes (mnt), as per provisional data with BigMint. India's pellet production rose by over 5% y-o-y from around 53 mnt in H1FY'25.

Iron pellet production reached over 105 mnt in financial year 2024-2025 (FY'25), an increase of 5% y-o-y from 100 mnt in FY'24. Production has surged at a rapid pace over the last few years on rising crude steel production and the ever-increasing requirement of ensuring material and energy efficiency in steel production.

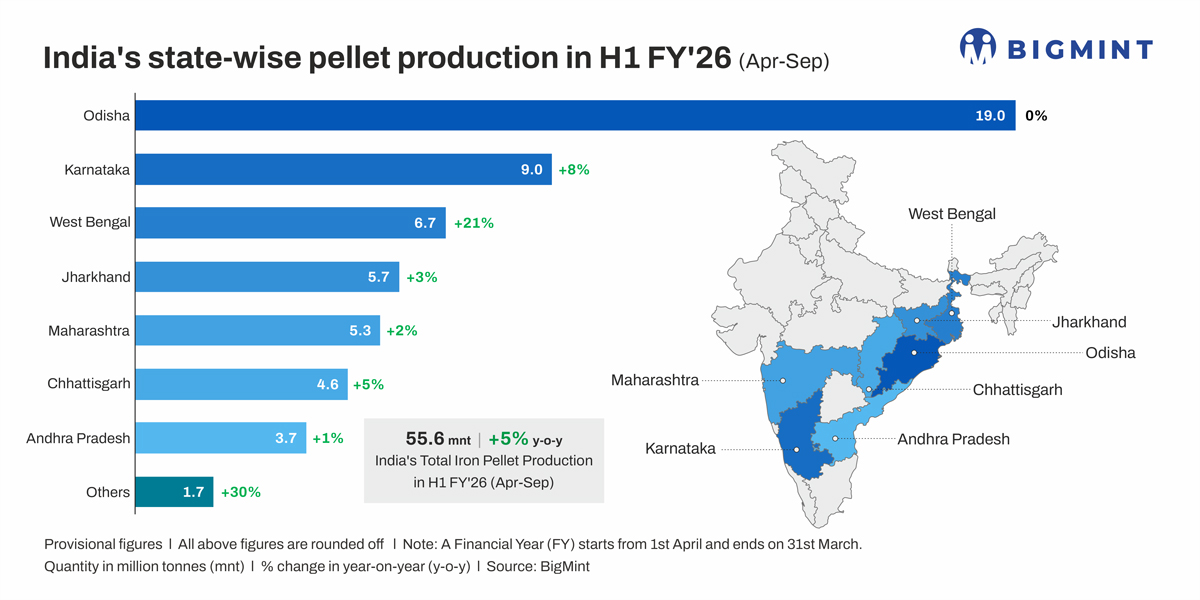

State-wise production

BigMint data show that the country's production capacity of iron ore pellets was around 165 mnt in FY'25 compared with 140 mnt in FY'24.

India's leading iron ore producing state, Odisha, retained the top spot among pellet producing states, although production remained flat y-o-y at 19 mnt in H1FY'26. However, Karnataka saw output increasing by over 7% to around 9 mnt.

West Bengal had edged past Jharkhand, Maharashtra and Chhattisgarh to emerge as the third-largest pellet producing state last fiscal, with output increasing by almost 30% y-o-y to over 11 mnt. In H1FY'26, the state recorded a 21% surge in production.

Maharashtra and Jharkhand were the other leading producers, recording output at 5.3 mnt and 5.7 mnt respectively in H1.

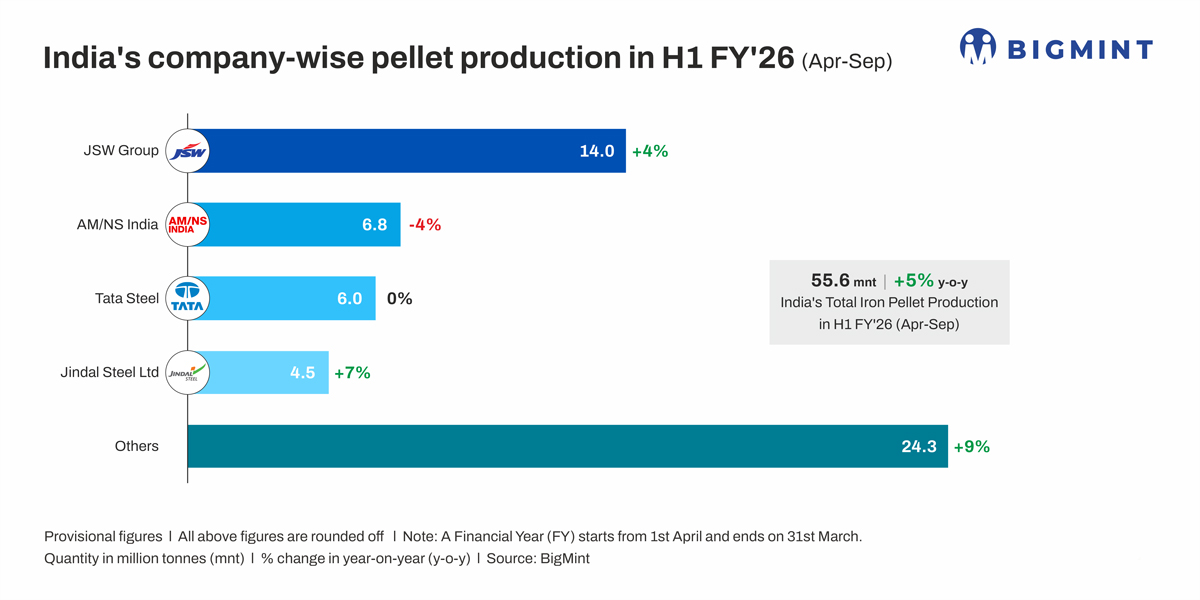

Top producers

JSW Steel was the top producer of pellets in H1FY'26, with output at 14 mnt an increase of nearly 5% y-o-y. The company's standalone pellet production capacity at the Vijaynagar and Dolvi works alone account for over 30 mnt/year. Increasing captive iron ore capacity post-acquisition of mines at auctions in Odisha and Karnataka has boosted the company's pellet production.

However, the other leading producer, AM/NS India, recorded a 5% y-o-y decline in production in H1 due to the pressure on domestic producers amid surging imports from mid-2024 and the sharp downtrend in pellet export shipments in FY'25 and also H1FY'26.

Other leading producers raised their output: for instance, Tata Steel recorded a 1% y-o-y growth in output, thanks to new capacity coming up in Kalinganagar over and above existing ones in Gamharia and Jamshedpur. Jindal Steel, too, raised production by around 8% in H1.

Factors boosting pellet production

- Higher crude steel production: Crude steel production declined 1.7% m-o-m to 13.789 mnt in September from 14.022 mnt in August. Y-o-y, production increased by 14.9% from 11.998 mnt in September 2024. Cumulative output during April-September 2025 stood at 82.307 mnt, reflecting a 12.4% increase from 73.227 mnt in the year-ago period. This was the key reason for higher pellet production.

- Higher sponge iron output: India's sponge iron output stood at 29.5 mnt in H1FY'26 from 26.5 mnt in H1FY'25. Domestic sponge iron production has witnessed rapid growth over the years nearly 45% compared to FY'22. Production reached 56 mnt in FY'25, an increase of 8% y-o-y. Iron ore production in H1, too, increased marginally by 0.7% y-o-y.

- Capacity additions in WB, Maharashtra: Lloyds produced 0.81 mnt of pellets in the first half of FY'26. Notably in June, the company commissioned a 4 mnt per annum pellet plant at Konsari, Maharashtra. In West Bengal, production has surged after gradual ramp up of capacities by Bengal Energy and the Adukia Group among others. Expansions in steelmaking capacity, announced for example by the Rashmi Group, are expected to further boost output.

Outlook

The blast furnace-based steel producers have raised their usage of pellets significantly from a level of around 25% to over 50% and they are also raising captive production capacities. This will be the key factor, apart from surging DRI production, driving domestic pellet output.

However, the capacity utilisation rate of the industry is currently around 65%, which hardly inspires optimism. If the export market continues to remain dull for long enough, the rapid rise in domestic capacity may just outstrip real demand by a considerable margin, which might affect the market and prices.

Total production in FY'26 should be around 110-115 mnt, considering a rate of 5% growth being maintained in H2FY'26.

Get ready to dive deep into the future of steel.

Join us at the 7th India International DRI and Steel Summit 2026

Date: 16 January 2026 | Venue: Hotel Le Meridien, New Delhi

Do not miss the opportunity to gain exclusive insights, attend expert sessions, and network with industry leaders.

Register now to secure your spot.