20-November-2025

- Odisha emerges as leading producer, with highest share

- Capacity expansions of 13 mnt announced in Apr-Oct

India's sponge iron production remained robust during April-September 2025 (H1FY'26), with the country maintaining its position as the world's largest producer of direct reduced iron (DRI) via the coal-based route.

However, domestic demand lagged behind production growth, creating a supply-demand imbalance across key markets, especially in central India, and leading to steady price corrections.

Production rises 9% y-o-y on stable operations

India's sponge iron production increased by 9% to around 29 million tonnes (mnt) in April-September 2025 compared to 27 mnt in the year-ago period, according to provisional data compiled by BigMint. The increase was due to stable operations at large coal-based DRI units. Steady raw material availability also facilitated strong production momentum. At a larger level, growth was enabled by a notable 12% y-o-y uptick in crude steel production to 82 mnt in H1FY'26 and a moderate 5% increase in pellet output to 56 mnt. The government's focus on infrastructure projects and rapid industrialisation encouraged sponge iron producers to boost output. However, squeezed margins prompted production cuts in some regions in Q2FY26. Indias sponge iron production fell to a seven-month low of 4.71 mnt in September.

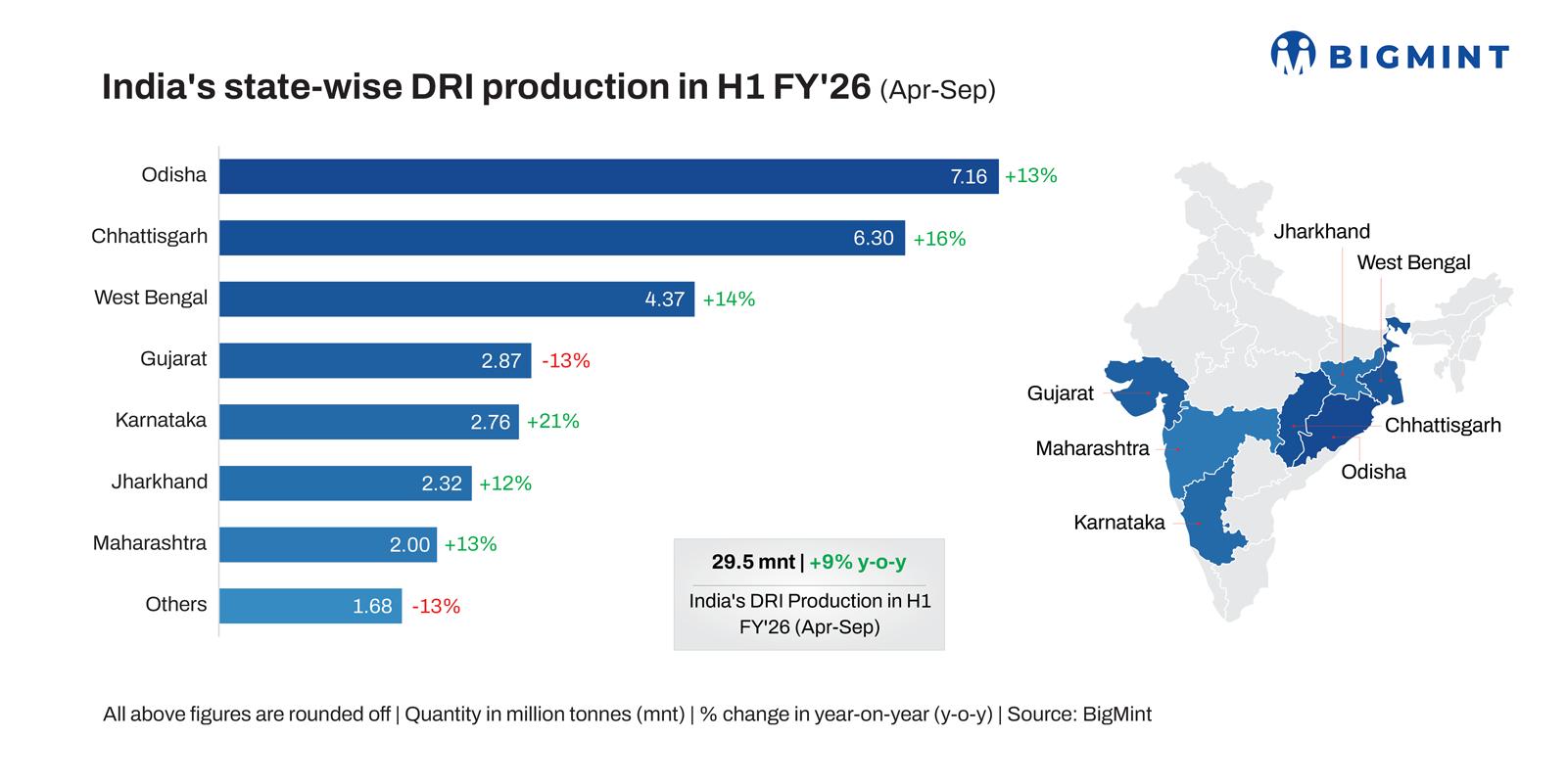

State-wise production scenario

As per BigMint's estimates, Odisha produced the highest volume in H1FY'26, at 7.1 mnt (13% share). Chhattisgarh followed, with 6.3 mnt (16%), while West Bengal's output totalled 4.37 mnt (14%). Gujarat's production stood at 2.9 mnt, Karnataka 2.7 mnt, and Jharkhand 2.3 mnt.

DRI Capacity Expansions in FY'26

Despite prevailing price weakness and reports of compressed margins, several sponge iron producers in India have announced new capacity additions during January-October 2025, aggregating to around 13 million tonnes (mnt), according to provisional data compiled by BigMint. Among states, Odisha stands with nearly 5 mnt of planned capacity concentrated in the Jharsuguda region, followed by Chhattisgarh, where producers have announced expansions totaling approximately 5.5 mnt. Meanwhile, West Bengal has reported fresh capacity announcements of around 2.4 mnt.

Prices hover at pandemic levels. Considering Raipur as the benchmark, sponge iron prices stood at a four-month low of INR 22,900/tonne (t). Before 2025, similar levels were last seen five years ago, in October 2020, during the pandemic. Factors contributing to this decline included excess supply, weakening coal prices, and muted market sentiment. Consumption declined notably, with BigMint recording transactions for only 371,000 t of sponge iron (PDRI and CDRI) as part of its daily exw-Raipur price assessments in April-October 2025. This marks a sharp 23% decline from the 481,000 t recorded in the year-ago period. However, it is to be noted that these deals represent only a share of overall deal volumes.

In Raipur and nearby clusters, trade activity has stayed subdued through most of the year. Consumption from rolling mills and re-rollers weakened as finished steel demand from construction and infrastructure slowed, compounded by seasonal monsoon disruptions and limited liquidity among secondary mills. Export opportunities were limited due to low overseas inquiries and freight challenges, leaving producers largely dependent on the domestic market. By mid-year, rising inventories and soft bookings pushed sponge iron prices down sharply, with only marginal recovery seen in August-September on the back of slight production discipline and marginal raw material cost increases. Facing squeezed margins, many mid-sized producers implemented production cuts of around 30% by late Q2FY'26 to balance market oversupply.

Overall, while India's sponge iron production remained strong through October 2025, domestic offtake failed to keep pace, reflecting a broader slowdown in downstream steel consumption and subdued market sentiment.

Outlook

Looking ahead, the outlook is cautiously optimistic. On the positive side, ongoing infrastructure and construction spending, steel capacity expansions, and further pellet/ore availability could revive demand for DRI. Several reports foresee the Indian sponge-iron market growing at a healthy clip over the coming five years. Additionally, with the government considering reforms to boost iron ore production (stable y-o-y in H1FY'26) and pellet capacity expanding, input constraints may ease. As such, BigMint projects that India's sponge iron capacity may surpass 70 mnt by FY'30.

On the other hand, prices are expected to rebound and stabilise in the final quarter of 2025 as the supply-demand balance improves. However, risks loom: weak global steel markets, overcapacity in sponge iron plants, margin pressures, and potential regulatory or environmental constraints (especially for coal-based DRI) could temper price growth. Moreover, despite the tight availability of scrap and relatively higher prices, many producers prefer scrap to reduce carbon emissions and stay competitive in the market. Therefore, in the long term, sponge iron prices are likely to continue facing pressure.

Get ready to dive deep into the future of steel.

Join us at the 7th India International DRI and Steel Summit 2026

Date: 16 January 2026 | Venue: Hotel Le Meridien, New Delhi

Do not miss the opportunity to gain exclusive insights, attend expert sessions, and network with industry leaders.

Register now to secure your spot.