20-November-2025

- Domestic HMS prices drop INR 2,000-2,500/t since Aug25

- Rapid growth in sponge iron output reshapes raw material dynamics

- Vehicle recycling poised to bolster long-term scrap availability

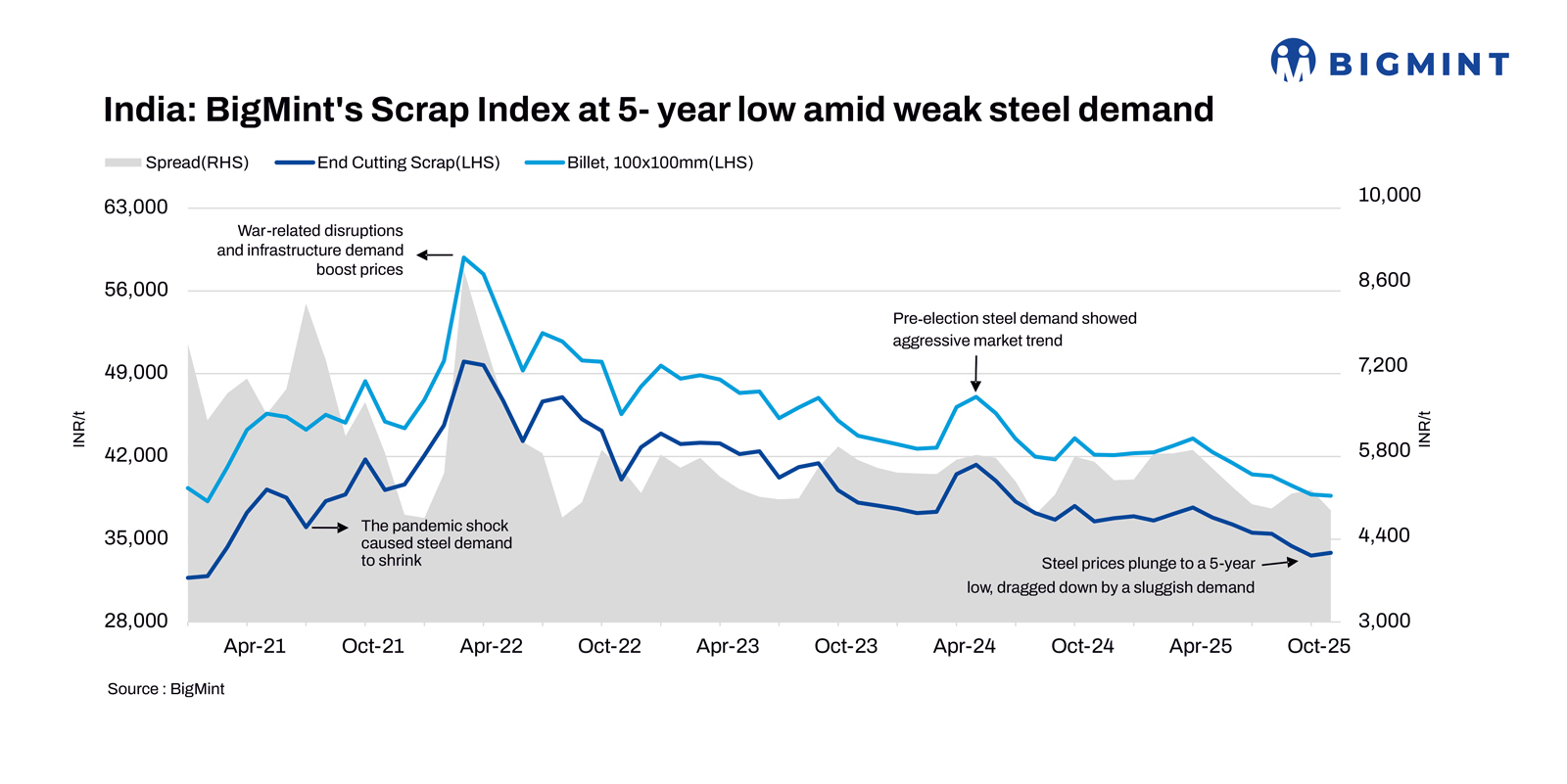

Morning Brief: Indias domestic ferrous scrap market has plunged to its lowest level in nearly five years as sluggish steel demand and tight liquidity continue to erode buying appetite. Prices for HMS 80:20 have fallen by INR 2,000-2,500/t since August 2025, now assessed between INR 27,000 and INR 31,000/t delivered at plant (DAP) across key hubs including Mandi Gobindgarh, Chennai and Jalna.

Mandi Gobindgarhs steel mills in Punjab are losing their historic charm and competitiveness due to a range of structural, economic, and regulatory pressures.

The decline of the Mandi Gobindgarh steel cluster reflects a combination of high operational costs, policy and taxation bottlenecks, competition from neighbouring states, regulatory hurdles, and lack of strategic upgrades. Without targeted interventions in taxation, raw material sourcing, environmental policy, and technological adoption, retaining the clusters prominence will remain highly challenging.

Scrapyards and processors, facing prolonged cash-flow constraints, are offloading inventories at discounted rates to generate liquidity. The downward trend has been reinforced by festive holidays, lower trading activity, and weak construction demand during monsoon, which have collectively dampened steel mill procurement and pushed the market into oversupply.

How has weak steel demand intensified market pressure?

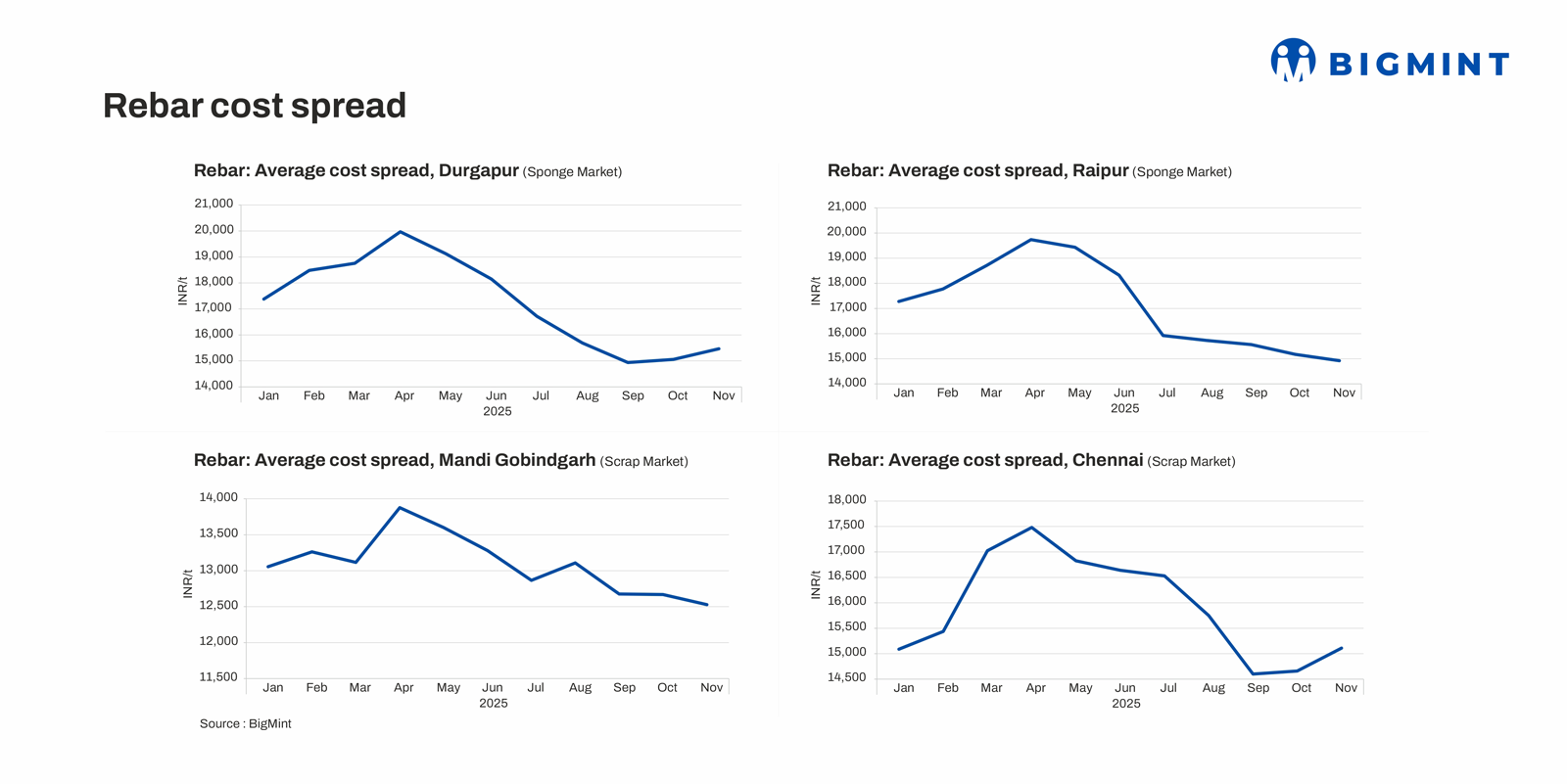

Secondary and re-rolling mills are operating at reduced capacity utilisation levels amid weak demand for long steel products such as rebar and structural sections. An extended monsoon and subdued infrastructure spending have further curtailed end-user demand, tightening margins across the value chain.

Rebar prices have dropped by INR 2,000-3,000/t since August, currently quoted between INR 38,000 and INR 43,500/t across regions. Billet prices have slipped to INR 34,300-38,800/t. The correction in finished steel prices has prompted mills to cut back on raw material procurement, reinforcing bearish sentiment across the ferrous scrap market.

Is sponge iron reshaping Indias raw material balance?

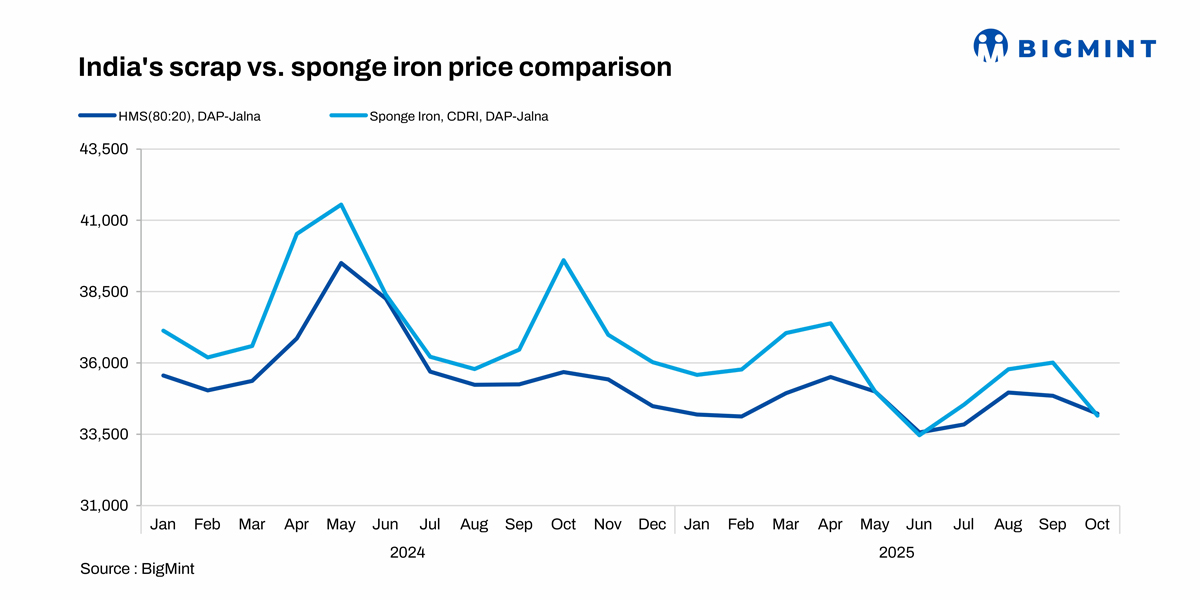

Sponge iron production in India has surged 44% between 2021 and 2024, rising from 37.06 million tonnes (mnt) to 54.28 mnt underpinned by new capacity additions and improved plant utilisation. Output for 2025 is projected around 55 mnt and could approach 65 mnt by 2030, reflecting the growing preference of sponge iron in secondary steelmaking.

Indias sponge iron consumption has grown by 41% between 2021 and 2024, from 37 mnt to 53.4 mnt, with consumption expected to reach 54.5 mnt in 2025, indicating steady demand from the secondary steel sector.

This expansion is steadily altering Indias ferrous feedstock composition. Sponge irons predictable supply, stable pricing, and consistent metallic yield have made it a preferred substitute for scrap, particularly in regions where delivered sponge iron remains more cost-effective. As a result, mills are optimising charge mixes toward sponge iron to mitigate exposure to volatile scrap.

How are consumption trends influencing scrap dynamics?

Indias ferrous scrap consumption has increased by nearly 29% during the review period from 26.46 mnt in 2021 to 35 mnt in 2024, and is projected to reach 36-37 mnt in 2025. However, the comparatively faster growth in sponge iron consumption has shifted raw material preference, contributing to current price weakness in the scrap segment.

At the import level, subdued global steel demand and adequate domestic scrap supply have further weighed on sentiment. Imported HMS 80:20 (Europe origin) at Nhava Sheva fell from $397/t in January 2024 to $325/t in October 2025, while US-origin shredded scrap declined from $413 to $354/t during the same period. Between January and September 2025, India consumed about 29.07 mnt of scrap, with imports contributing 6.53 mnt, underscoring the industrys growing reliance on domestic sources.

Can vehicle recycling support long-term scrap availability?

Vehicle recycling is emerging as a structural pillar of Indias scrap generation framework, supporting national circular economy and decarbonisation targets. As of November 2025, 183 vehicle scrapping facilities have received government authorisation, with 121 already operational. The expansion of such centres is expected to lift automotive scrap availability, offering more consistent feedstock flows for secondary steelmakers.

As vehicle lifespans shorten and recycling technology advances, higher recovery rates and improved scrap quality are expected to enhance the domestic scrap pool. This evolution could help balance the countrys feedstock mix over the long term, reducing dependence on imports and moderating volatility in the secondary steel value chain.

Outlook

The near-term outlook for Indias ferrous scrap market remains weak, with prices likely to stay under pressure through the final months of 2025 as steel demand shows little sign of recovery. Mills are expected to maintain cautious procurement amid compressed margins, subdued construction activity, and ongoing liquidity constraints.

The steady rise in sponge iron output and its competitive pricing will continue to cap scrap demand, limiting any immediate upside in domestic quotations. A gradual recovery may emerge in early 2026 as infrastructure projects resume post-winter and government spending accelerates ahead of the new fiscal year, potentially lending modest support to both steel and scrap prices.

Get ready to dive deep into the future of steel.

Join us at the 7th India International DRI and Steel Summit 2026

Date: 16 January 2026 | Venue: Hotel Le Meridien, New Delhi

Do not miss the opportunity to gain exclusive insights, attend expert sessions, and network with industry leaders.

Register now to secure your spot.