10-November-2025

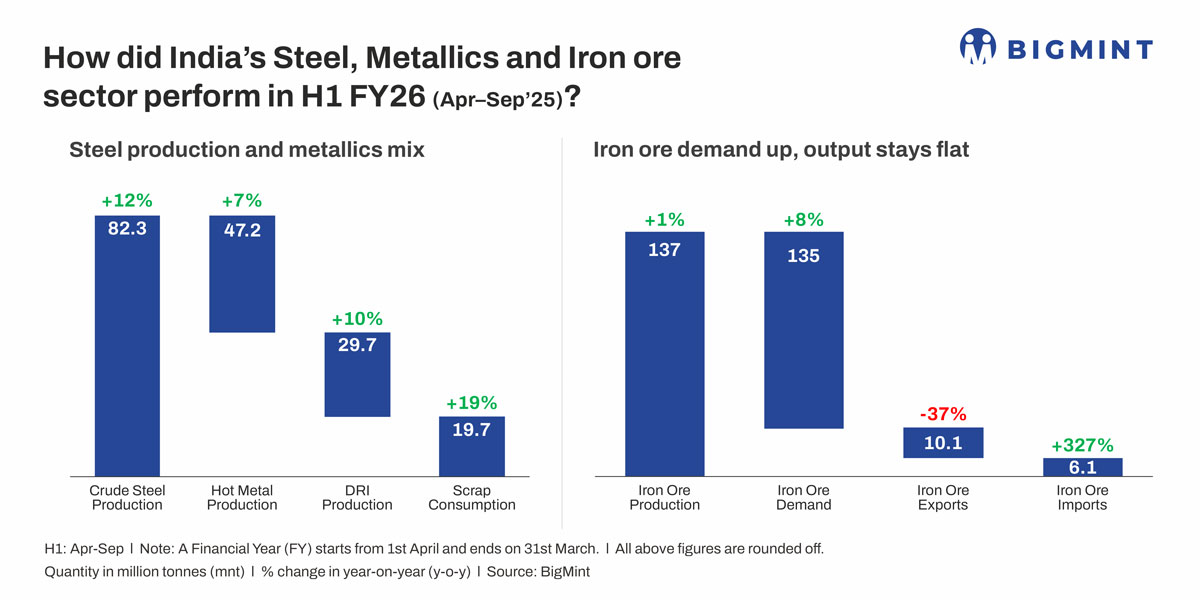

- Combined hot metal and DRI production increases by 8.5% y-o-y

- Scrap consumption shows robust 19% growth, iron ore output flat

India's crude steel production witnessed a strong growth of 12.4% y-o-y in the first six months of FY'26, reaching 82.3 million tonnes (mnt) compared to 73.2 mnt in the same period last year. This surge underscores the continued momentum in domestic steelmaking, supported by robust infrastructure demand and strong manufacturing activity.

Rising metallics production, scrap usage

Hot metal production increased by 7.3%, while sponge iron output rose by 10% y-o-y. Overall, metallics production (HM+DRI)climbed up by 8.5% from 71 mnt in FY'25to 77 mnt in FY'26. This growth is closely tied to higher crude steel production and the rising need for metallic inputs across both primary and secondary steel routes.

Scrap consumption also showed a remarkable 19% y-o-y rise to 19.7 mnt - underscoring the growing adoption of scrap-based steelmaking routes in India. Of this, 4.2 mnt were imported, while the remaining volume came from domestic generation.

This trend reflects the industry's increasing focus on sustainability, circular economy practices, and cost optimisation, particularly among electric arc furnace (EAF) and induction furnace (IF) producers.

Iron ore demand-supply dynamics

India's iron ore demand increased by 8.2% y-o-y to 135 mnt from 124 mnt, primarily driven by expanding steel and pellet capacities. However, iron ore production remained largely stable at around 137 mnt, indicating a supply constraint at the mining level.

While several major mines witnessed a decline in output during the period, NMDC and Lloyds Metals stood out with incremental growth, partially offsetting the overall production stagnation.

Iron ore exports down, imports up

Iron ore exports fell sharply by 37% to 10.1 mntfrom 16.1 mnt, reflecting a clear shift toward prioritising domestic consumption over overseas shipments. On the other hand, imports surgedto 6.1 mntfrom just 1.43 mntlast year, mainly due to specific grade requirements and regional supply imbalances.

Iron ore availability tightens

Despite stable iron oreproduction and lower exports, overall availabilityduring the first six months stood at 133 mnt, compared with domestic consumption of 135 mnt -- resulting in a deficit of around 2-3 mnt. This indicates that the industry is currently drawing down existing inventory stocksto meet the strong consumption demand.

Outlook

According to BigMint's estimation, India's crude steel production is expected to reach 167-168 mnt in FY'26, maintaining a healthy growth trajectory. Consequently, metallics output, scrap consumption, and iron ore demand are all likely to rise further in the second half of the fiscal year.

With steady demand and limited production growth in H1, iron ore output is expected to improve in H2 as mining operations ramp up to meet domestic requirements. Continued attention on improving logistics efficiency, expediting mine expansions, and optimising resource utilisation will be crucial for maintaining balance in India's iron ore market.

Get ready to dive deep into the future of steel.

Join us at the 7th India International DRI and Steel Summit 2026

Date: 16 January 2026 | Venue: Hotel Le Meridien, New Delhi

Do not miss the opportunity to gain exclusive insights, attend expert sessions, and network with industry leaders.

Register now to secure your spot.