18-July-2025

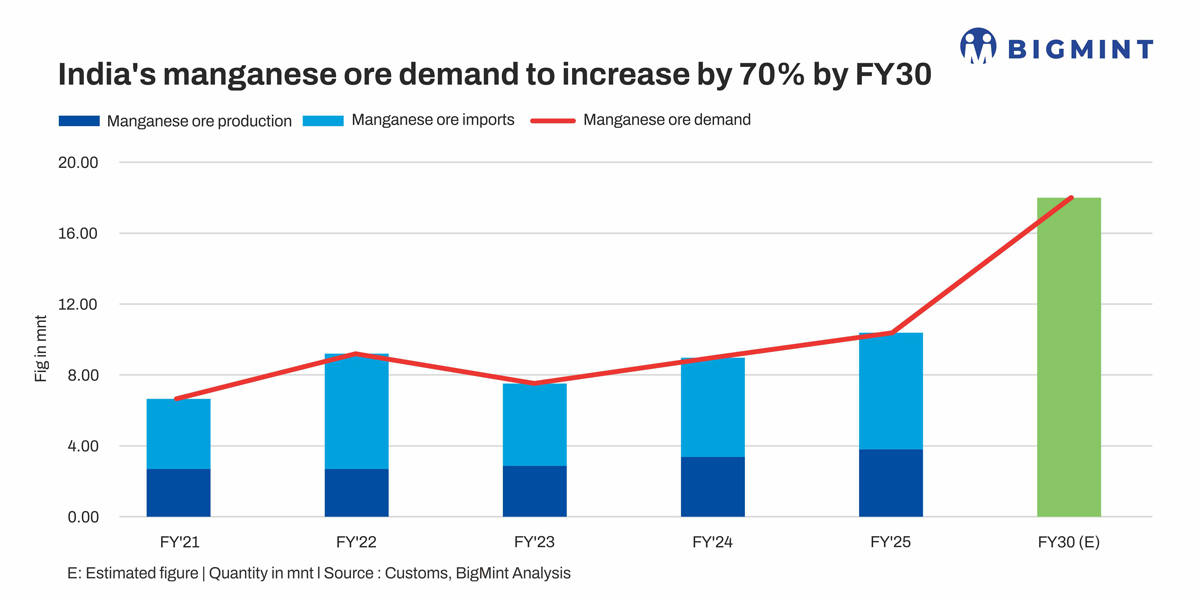

- Manganese ore demand jumps 55% in FY'21-25

- Domestic output up 41%, imports rise 66.5%

- Crude steel output climbs up 6% y-o-y in FY'25

Morning Brief:India's demand for manganese ore, a critical raw material for steel production, is set to see a sharp 65-70% surge by FY'30, powered by accelerated industrial momentum.

Over FY'21-FY'25, the country's manganese ore demand jumped by over 55% to 10.38 million tonnes (mnt) from 6.66 mnt. With steel capacity expansion, infrastructure push, and manganese alloy production ramping up, India's ore demand is expected to grow to 18 mnt by FY'30 from FY'25 levels.

It is to be noted that these numbers are inclusive of domestic manganese alloys consumption and exports of the same.

What's fuelling this surge? BigMint goes behind the scenes to understand the key reasons driving the growth.

1. Crude steel production logs steady growth: India's crude steel production increased by 6% y-o-y to 152 mnt in FY'25 from 144 mnt in the preceding fiscal. In FY'24, crude steel production increased more sharply, by over 14% y-o-y.

Additionally, India's crude steel production capacity increased by over 10% y-o-y in FY'25 to 205 mnt, aligned with the National Steel Policy's target of reaching 300 mnt by 2030. Capacity has almost doubled from 109 mnt in FY'15.

This steady growth, in both output and installed capacity, is expected to continue, on the back of robust infrastructure and manufacturing activity. This will drive up the production and consumption of manganese alloys and ore in the future.

2. Manganese alloys production to rise at healthy pace: Another factor contributing to the uptick in demand is rising manganese alloys production, which grew 15% y-o-y to 5.18 mnt in FY'25.

Furthermore, both ferro manganese and silico manganese output have climbed up by around 50% over FY'21-FY'25 to 2.31 mnt and 2.88 mnt, respectively.

With India's crude steel output consistently rising y-o-y, the consumption of manganese alloys will certainly jump. BigMint's projections suggest that domestic consumption will increase to around 4-5 mnt and exports will stand at around 2-2.5 mnt.

Higher manganese alloys output will clearly require increased manganese ore availability.

How is rising demand being met?

1. Manganese ore production on the rise: India has steadily increased its manganese ore output in recent years. From 2.70 mnt in FY'21, production expanded by 41% to 3.80 mnt in FY'25.

Key contributors to this growth include public sector giant MOIL, which alone produced around 1.8 mnt in FY'25. On the other hand, another private player, Sandur Manganese, contributed approximately 0.51 mnt in the same year. These two accounted for over 70% of the total domestic output.

This growth reflects a strategic push towards domestic resource utilisation and self-reliance in raw materials, particularly for steel and manganese alloy manufacturing. However, even with this growth, production still lags behind total demand.

2. Manganese ore imports climb up: To bridge the demand-supply gap, imports have surged significantly. Manganese ore imports shot up by 66.5% to 6.58 mnt in FY'25 from 3.95 mnt in FY'21, recording a larger uptick than in domestic production.

Despite India's efforts to boost mining output, the scale of consumption still requires strong import dependency, largely because of limited domestic resources and the unavailability of required grades. Nonetheless, this rising import trend also highlights the growing appetite of the manganese alloys and steel industries.

Outlook

BigMint estimates that India's crude steel production will grow rapidly from 152 mnt in FY'25 to 220-230 mnt in FY'30. As steel output rises, so does the requirement for manganese alloys. This will ultimately drive up the demand for manganese ore even further, making it one of the key minerals in India's industrial roadmap towards FY'30 and beyond.

In terms of the current fiscal, MOIL is targeting a 40% y-o-y growth in manganese ore production to close to 2.5 mnt in FY'26 against 1.8 mnt in FY'25. This will help fulfil rising demand from the manganese alloys sector, where, too, production is soaring, backed by steady crude steel output growth.

Additionally, the export market for manganese alloys may remain firm, though the EU's safeguards, if imposed, could pose a hurdle to India's ambitions, given that the region is a key importer. However, in case curbs are placed, exporters are likely to explore new markets and diversify from traditional destinations.

Listen to industry experts and gain insights on "Balancing Manganese Alloys Demand vs Resources" at the 5th International Ferro Alloys Conference 2025 - Navigating Trade Uncertainties: Sustainable Growth in Ferro Alloys, to be held during 2-4 September 2025 at JW Mariott, New Delhi.