22-August-2025

- Ferro chrome production down 26% y-o-y in Jan-Jun'25

- Domestic chrome ore production drops 28% y-o-y

- China's monthly tender prices to keep exerting control over market

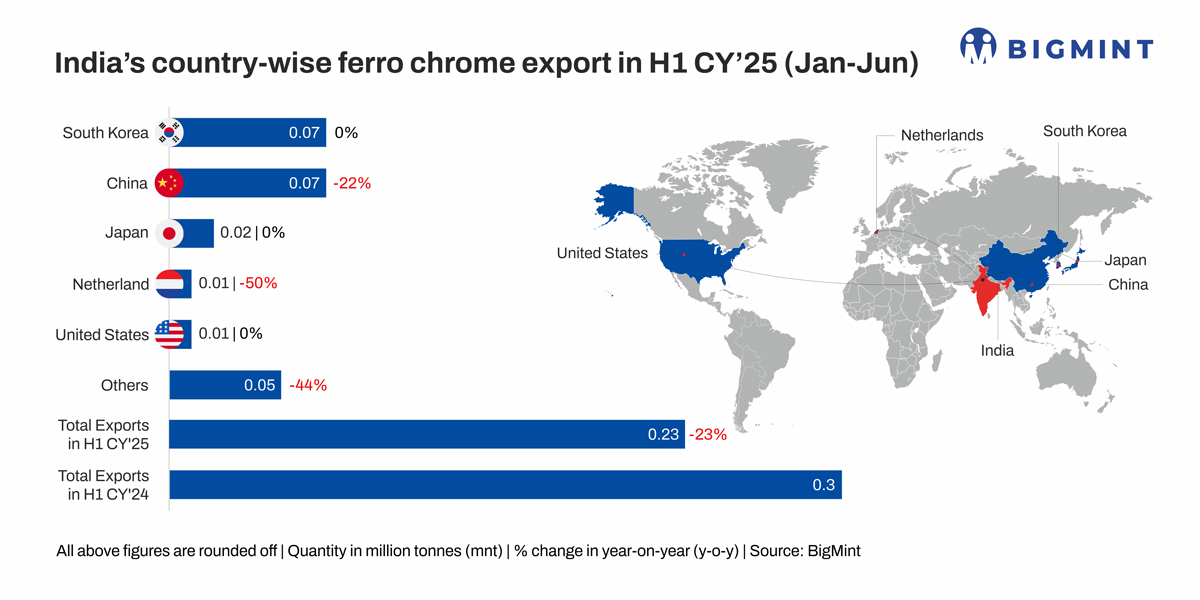

Morning Brief: India's ferro chrome exports fell by 23% y-o-y in H1CY25 (January-June 2025), slipping to 0.23 mnt from 0.30 mnt in H1CY'24. With exports making up nearly half of India's production, the drop highlights growing structural challenges for the industry at a time when international competition and shifting trade dynamics are reshaping the market.

China and South Korea remained the largest buyers in H1CY'25, absorbing 30% each of India's total shipments, followed Japan at 9% (0.02 mnt). But India's dependence on these markets is increasingly being tested as domestic and external headwinds weigh on trade flows.

Why did ferro chrome exports dip?

Production cutbacks tighten supply

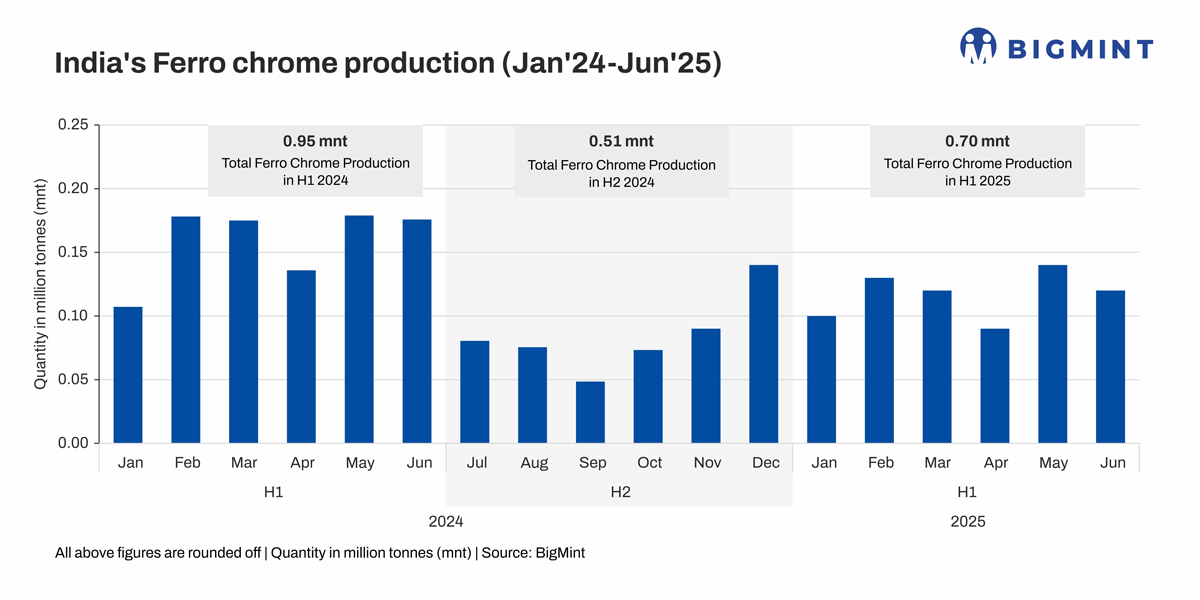

India's ferro chrome production fell 26% y-o-y, slipping from 0.95 mnt in H1CY'24 to 0.70 mnt in H1CY'25. Subdued stainless steel demand and softer domestic prices forced several producers to curtail output. Notably, four key suppliers, with combined annual capacity of 0.7 mnt, reported sharp output reductions of 32-70% y-o-y in Q1CY'25 as they shifted to production of other alloys like manganese alloys and other variants of ferro chrome like low-silicon and low-carbon ferro chrome.

BigMint's benchmark high-carbon (HC 60%, Si:4%) ferro chrome prices fell by 11% y-o-y in H1CY'25 to INR 100,137/t exw-Jajpur from INR 112,558/t in H1CY'24, cutting into margins and forcing selective participation in export markets.

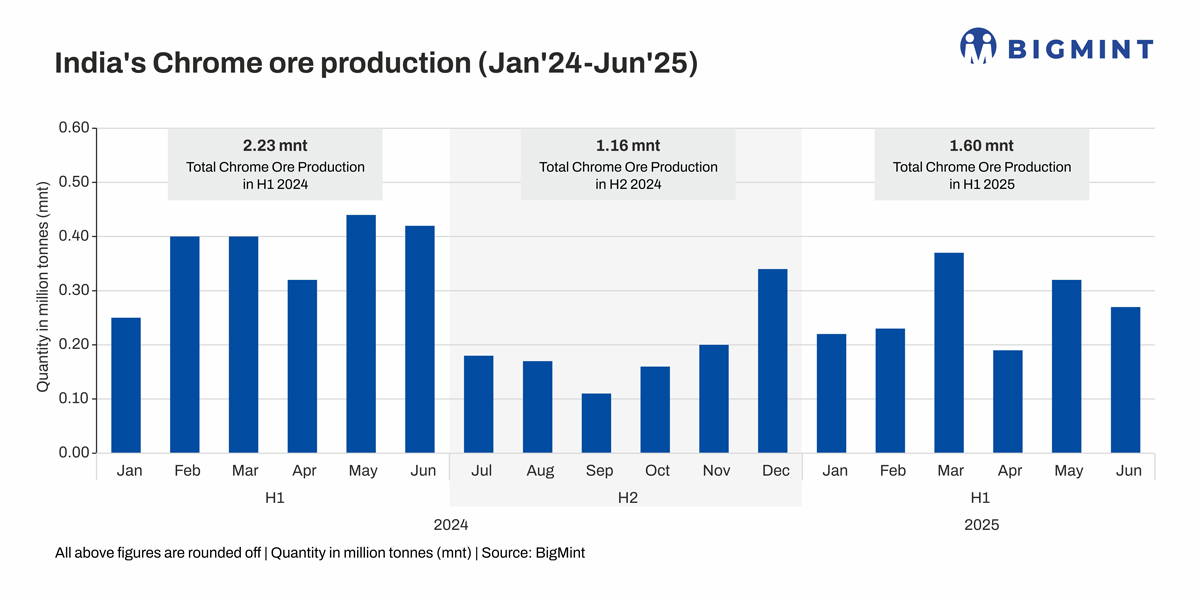

Raw material shortage deepens pressure

A 28% y-o-y fall in chrome ore output further restricted availability. It was 1.6 mnt in H1CY'25 in comparison with 2.23 mnt in H1CY'24.OMC's production dropped to 0.6 mnt from 1.3 mnt, while Tata Steel reported a 45% y-o-y decline to 0.33 mnt primarily due to lower output from the Sukinda mines. The ore shortage not only reduced smelter throughput but also amplified cost pressure.

Weaker export realisations

Export prices in Indias top three overseas markets declined sharply in H1CY'25

China: -13% y-o-y to 84.36 cents/lb CNF Tianjin

Japan: -15% y-o-y to 91.45 cents/lb CNF Tokyo

South Korea: -14% y-o-y to 87.71 cents/lb CNF Busan

Lower realisations continued to make exports from India challenging, particularly as China, the largest destination, maintained pressure on prices. Stainless steel mills in China (Tsingshan and TISCO), which set monthly tender prices for ferro chrome procurement, reduced their average bids by RMB 1,283/t y-o-y, reflecting weak stainless steel demand and high inventory levels.

At the same time, China increasingly relied on local ferro chrome supplies rather than imports. Several smelters in North China restarted operations after maintenance, while producers in South China benefitted from lower electricity costs due to strong hydroelectric output. Stable demand also boosted market confidence, prompting aggressive domestic production.

Near-term outlook

Indian ferro chrome exports are expected to remain under pressure amid lower domestic production and weak realisations. However, the recent surge in demand may lend some support to prices. Chinas monthly tender prices will continue to play a key role in shaping trade flows and sentiment, keeping the market cautious in the near term.

5th IFAC 2025

Join industry leaders at the 5th International Ferro Alloys Conference 2025, taking place from 2-4 September at JW Marriott, New Delhi. With a dedicated Stainless Steel & Ferro Chrome Deep Dive session, the event will offer insights into emerging trends and the future outlook across global ferro alloy markets.