25-July-2025

- Production shutdowns in NE India reduce domestic supply

- Stainless steel output rises 26% y-o-y, strengthening demand

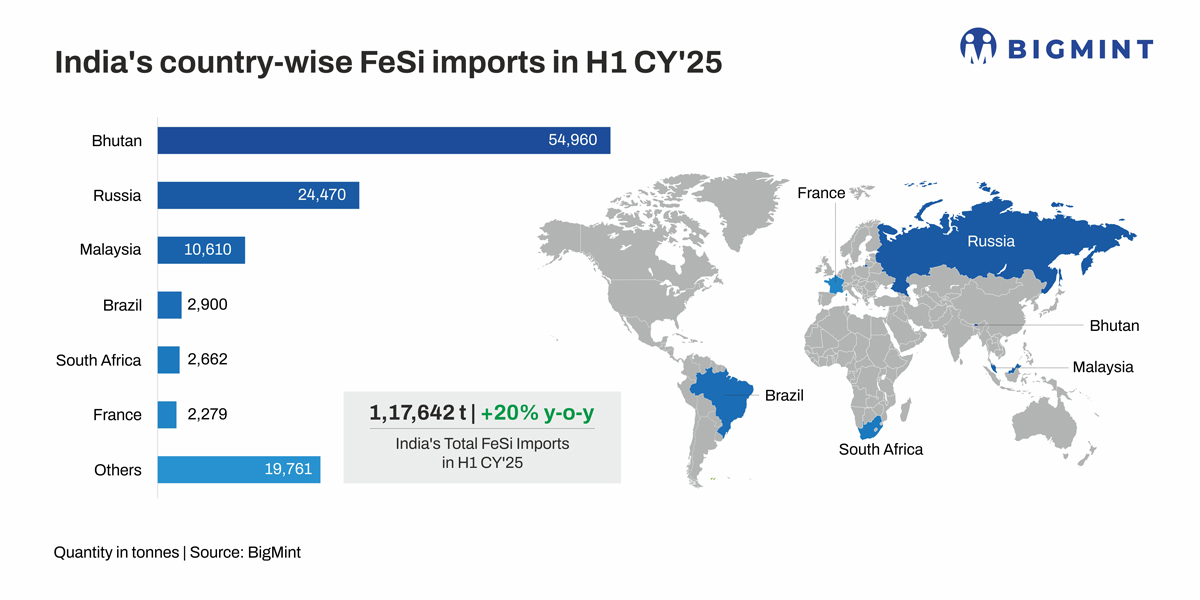

India's ferro silicon imports rose 20% y-o-y to 117,642 tonnes (t), compared to 98,025 t in H1CY24, as per data maintained with BigMint. The sharp uptick was not out of the ordinary, given that India has consistently been a net importer of ferro silicon, with domestic consumption surpassing production.

Higher volumes in H1CY'25 were driven by supply constraints in the domestic market amid rising demand. During this period, May 2025 witnessed the highest monthly volume of 24,942 t, with similar levels last recorded in July 2023, at 26,900 t in July 2023.

Major supply sources

Bhutan remained India's largest ferro silicon supplier, though its exports to India fell 20% y-o-y to 54,960 t in H1CY25, from 68,790 t in the corresponding period last year. In contrast, combined shipments from Russia and Malaysia surged by a massive 195% y-o-y to 35,080 t, from 11,885 t in H1CY24. Competitive pricing and consistent availability from these countries drew buyers towards imports over domestic sourcing.

Together, Bhutan, Russia, and Malaysia accounted for the majority of Indias ferro silicon imports during the period.

Jaigaon continued to be the leading import hub, receiving 39% of total imports (45,864 t), followed by Chennai and Darranga.

![]()

Key factors driving ferro silicon imports in H1CY'25

Domestic market sees supply constraints: The bulk of India's ferro silicon production is concentrated in the northeast, particularly Meghalaya, Guwahati, and Arunachal Pradesh. Recently, two major Meghalaya-based producers shut down operations due to high power costs, and another is relocating to Arunachal. These units had a combined capacity of about 40,000 tonnes (t) per annum, which caused a regional supply shortfall.

Production costs rise due to power tariff hikes: Ferro silicon production is highly energy-intensive. With Meghalayas electricity tariffs increasing to INR 7.10/unit in FY'25 from INR 6.47/unit in the previous fiscal, many domestic producers found operations unviable due to soaring production costs.

Competitive import offers emerge: In April 2025, import offers stood at around $1,200/t CIF, as per sources. Despite longer transit times, buyers are likely to have found overseas material more cost-effective.

End-users show robust demand: Indias stainless steel production rose by 26% y-o-y in H1CY25 to 2.06 mnt from 1.68 mnt in H1CY24. This was driven by a 24% rise in flats production (1.41 mnt) and a 28% increase in longs output (0.63 mnt). The growth stemmed from improved demand in infrastructure, railways, and automobiles and easing input cost pressures. The stainless steel segment is one of the key end-users of ferro silicon, so with rising production, ferro silicon demand also saw an increase.

Outlook

A recent notice from Meghalaya Power Distribution Corporation Ltd., dated 22 July 2025, announced power cuts across industrial units, including ferro silicon plants due to unpaid tariff dues pending for over six months. Until payments are cleared, the power supply will remain suspended, threatening further disruption in domestic output and strengthening the case for imports.

Additionally, as availability tightens and import reliance grows, domestic ferro silicon prices are expected to rise in the near term, especially if the Meghalaya power situation remains unresolved.

Unlock further insights

Stay ahead with strategic insights at the upcoming 5th International Ferro Alloys Conference 2025 "Navigating Trade Uncertainties: Sustainable Growth in Ferro Alloys", scheduled for 2-4 September 2025 at JW Marriott, New Delhi.

Don't miss the expert panel on Ferro Silicon at Crossroads: Is India Losing Ground to Imports?