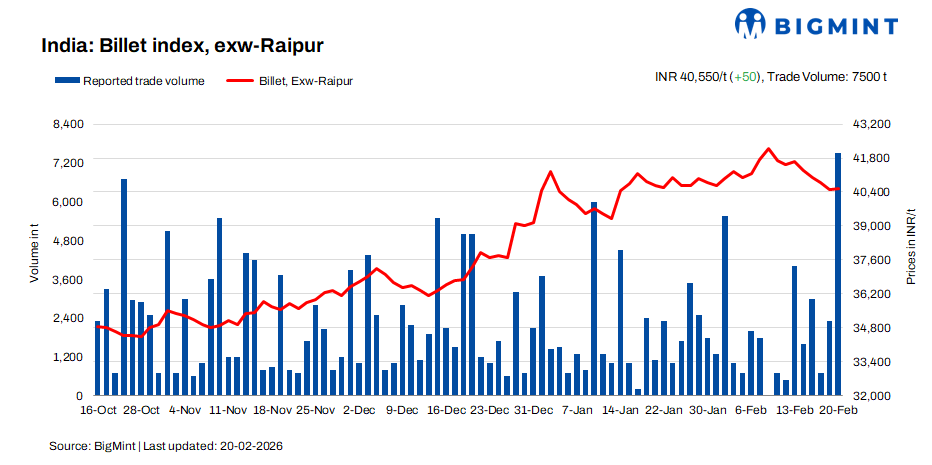

India: BigMint's billet index recovers INR 50/t d-o-d on improved semi-finished bookings

...

- About 7,500 t deals were recorded in billet exw-Raipur

- Finished steel recovery awaited for sustained momentum

BigMint's billet index rose by INR 50/t day-on-day to INR 40,550/t exw-Raipur on 20 February, recovering from intraday lows of INR 40,300-40,400/t, as improved bookings lent modest support to the semi-finished steel segment.

Around 7,500 tonnes of billet deals were recorded in the Raipur market, indicating a pickup in trade volumes compared with recent sessions. Buying momentum strengthened in the second half of the day, as intraday volatility and recent price corrections encouraged buyers to re-enter the market at revised levels leading to improved buying.

Market participants noted that while sentiment improved marginally, confidence remains fragile. A Raipur-based trader said, "The recovery is largely cautious after consecutive corrections. Sustained momentum will depend on improvement in finished steel demand."

Finished steel remains subdued

In Raipur, finished steel prices remained under pressure. Rebar prices declined by INR 200/t d-o-d, while wire rod prices remained largely stable, with limited buying activity observed. Downstream demand continues to be cautious, keeping procurement largely need-based.

Sponge iron shows mixed movement

Sponge iron prices corrected by INR 150/t d-o-d, though improved bookings helped stabilise spot offers toward the close. The modest correction in DRI prices provided some cushion to billet margins.

The conversion spread from pellet-based sponge iron (PDRI) to billets for standalone induction furnaces in Raipur was assessed at around INR 13,600/t, reflecting a slight improvement in producer margins compared with the previous session.

Rationale

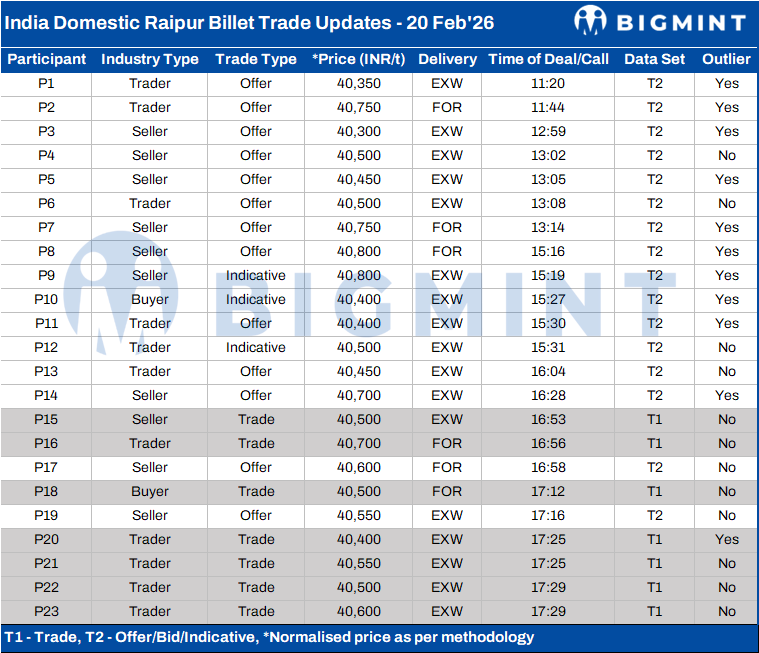

This index is derived based on transactions, offers, bids, and indicative price data sets. Transactions are considered T1 and given a weightage of 50%, whereas other data sets are considered as T2 and given a weightage of the balance 50%.

- Transactions (T1) - Seven trades at INR 40,400-40,700/t were recorded during the 10:30 am to 5:30 pm BigMint trading window and considered for final price calculation as T1 inputs. The average of these transactions was INR 40,538/t, which was given a 50% weightage in the final price calculation.

- Other price indicators - bids/offers/indicatives (T2) - Sixteen offers were reported in the trading window and considered as T2 inputs. The average price of these sixteen was INR 40,516/t and given a 50% weightage in the final price calculation.

The final price of billets was INR 40,527/t exw-Raipur, rounded off to INR 40,550/t exw.

Click here for detailed methodology