01-March-2025

- L&T, APSEZ, IRB Infra, KPIL, GR Infraprojects in focus

- Cos see record order books across roads, ports, energy etc

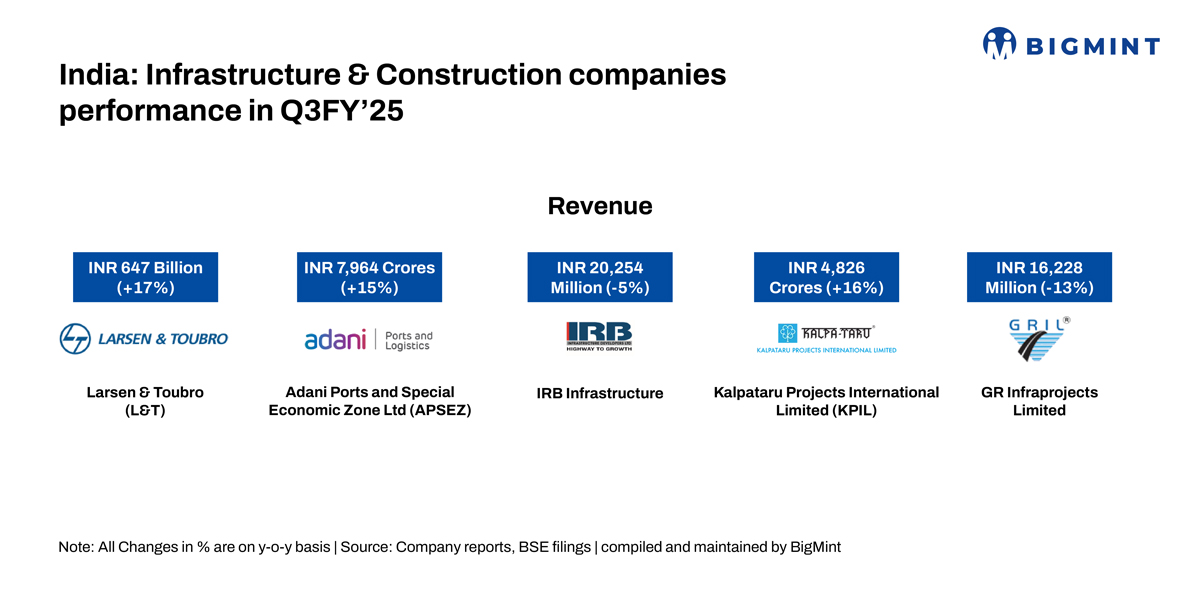

India's infrastructure sector saw strong performance in Q3FY'25, with major players like L&T, APSEZ, IRB Infrastructure, KPIL, and GR Infraprojects reporting significant growth. Key highlights include record order inflows, robust execution, expanding order books, and strategic investments across roads, ports, energy, and urban development, positioning these companies for long-term growth and sustainability.

Performance highlights of Q3FY'25

1. Larsen & Toubro (L&T): L&T's order inflow increased 53% on the year to INR 1,160 billion in Q3FY'25, which is the higher-ever in a quarter. The highest-ever quarterly order inflow was driven by significant orders across the infrastructure, energy, and hi-tech manufacturing segments.

The company's order book during 9MFY'25 was at INR 5,642 billion, up 20% y-o-y. International orders accounted for 42% of the December 2024 order book. Additionally, strong order prospects of INR 5.5 trillion are anticipated in the near term, with domestic opportunities making up 59% of the total.

2. Adani Ports & Special Economic Zone (APSEZ): The company handled record cargo volume of 332 million tonnes (mnt), up 7% y-o-y during 9MFY'25. The growth was primarily driven by container volumes.

Revenue increased 15% y-o-y to INR 7,964 crore during the quarter. Likewise, EBITDA was up 15% y-o-y to INR 4,802 crores in Q3FY'25.

- Launch of Trucking Management Solution (TMS): Enhancing supply chain efficiency through digital integration.

- Upgraded EBITDA guidance for FY'25 to INR 18,800-18,900 crore (from INR 17,000-18,000 crore).

The company has a strong order pipeline of projects worth INR 5.5 trillion in the near term. The port volumes are expected to reach 460-480 mnt in FY'25.

3. IRB Infrastructure: IRB Infrastructure continues to strengthen its position in India's road development sector, delivering strong financial and operational performance in Q3FY'25. The company reported a 21% y-o-y growth in toll revenue, driven by key projects such as Private InvIT, Mumbai-Pune Expressway, and the Ahmedabad-Vadodara Expressway. Total revenue reached INR 20,904 million, reflecting a steady increase, while EBITDA improved by 7% y-o-y to INR 10,492 million, maintaining a strong 52% margin.

On the operational front, Ganga Expressway Project received INR 8.7 billion in grants and remains on schedule. Newly-awarded TOT projects have outperformed revenue expectations, while the Vadodara-Mumbai Expressway (HAM) and Palsit-Dankuni BOT projects are nearing completion.

With India targeting 200,000 km of National Highway expansion by 2030, requiring INR 607 billion in investments, the company is well-positioned to capitalise on these opportunities. Backed by a strong project pipeline and increasing public-private partnerships, the company is poised for sustained growth, leveraging its expertise in BOT, TOT, and HAM models to drive future expansion.

4. Kalpataru Projects International Limited (KPIL): Kalpataru Projects International Limited (KPIL) reported a good Q3FY'25 performance, marked by robust revenue growth, profitability, and a record order backlog. The company continues to strengthen its position in high-growth EPC sectors, including transmission & distribution (T&D), buildings & factories (B&F), oil & gas, Railways, and urban infrastructure.

KPIL posted 17% y-o-y growth in revenue during the quarter, led by remarkable execution and healthy order backlog in T&D, B&F, and oil & gas.

The company reported a record-high order backlog of INR 61,429 crore, up 19% y-o-y, providing strong revenue visibility for the coming years. Order inflows reached INR 20,181 crore in FY'25, with an additional INR 2,500 crore in L1 position.

The tender pipeline remains robust, fuelled by government investments in T&D infrastructure, real estate, urban mobility, Jal Jeevan Mission (JJM), and airport expansion under the UDAN scheme.

5. GR Infraprojects Limited (GRIL): GR Infraprojects reported total revenue of INR 16,228 million in Q3FY'25, down 13% from INR 18,642 million in the same period year ago, due to lower execution. EBITDA stood at INR 1,923 million, while PAT increased to INR 1,686 million, improving profitability despite decline in revenue.

Order book & growth pipeline

The order book stood at INR 1,68,869 million, with 70% from road projects, 15% from transmission, and 6% from tunnels & railways. Additionally, the company has secured INR 30,843 million worth of new orders, increasing the order book to INR 1,99,712 million.

Operational highlights

- EPC projects remain the core focus, with a diversified presence in highways, metros, bridges, tunnels, and transmission.

- Received PCOD for Ena-Kim HAM project and transferred one operational HAM asset to Indus Infra Trust.

- Expansion into transmission and railway sectors, securing new contracts for metro and electrification projects.

Join the Indian Supply Chain Professionals Summit 2025: Infra & Construction - Price Trends and Future Outlook

The Indian Supply Chain Professionals Summit 2025 will bring together industry leaders, policymakers, and innovators to address these critical issues. Sessions will include insights into global and Indian supply dynamics, innovative construction solutions, and effective supply chain strategies.

17-18 April 2025 | Le Meridien, New Delhi

Don't miss this opportunity to shape the future of India's steel and infrastructure sectors. Register now to be part of the conversation driving India's industrial growth.