27-February-2025

- Tight supply props up BF rebar prices

- IF rebar tags fluctuate amid poor demand

- HRC prices drop on declining sales

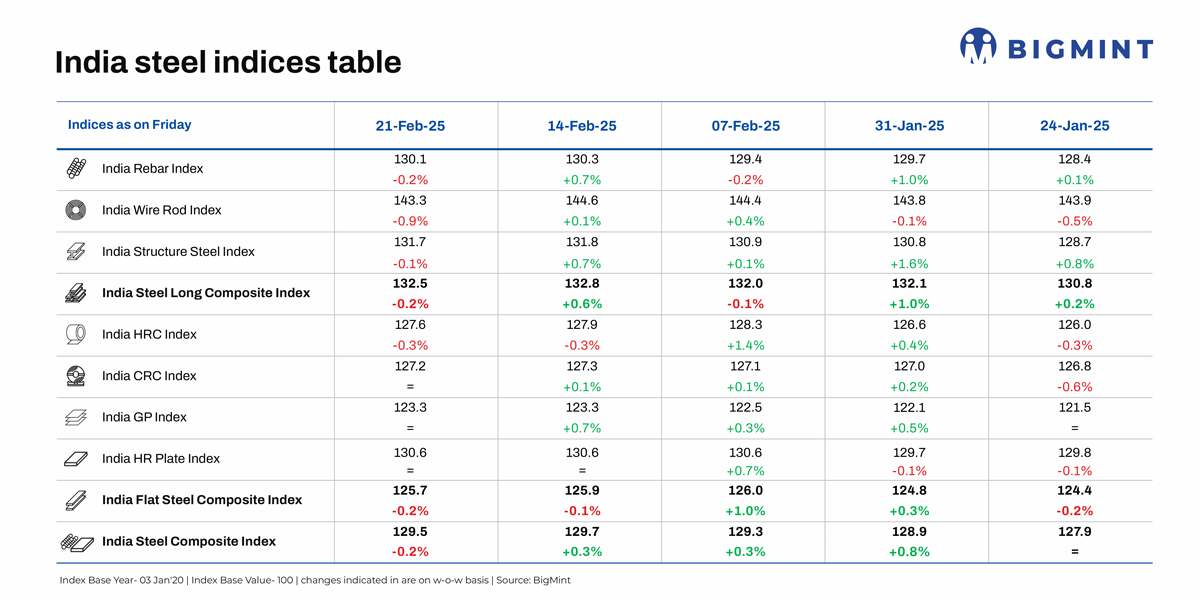

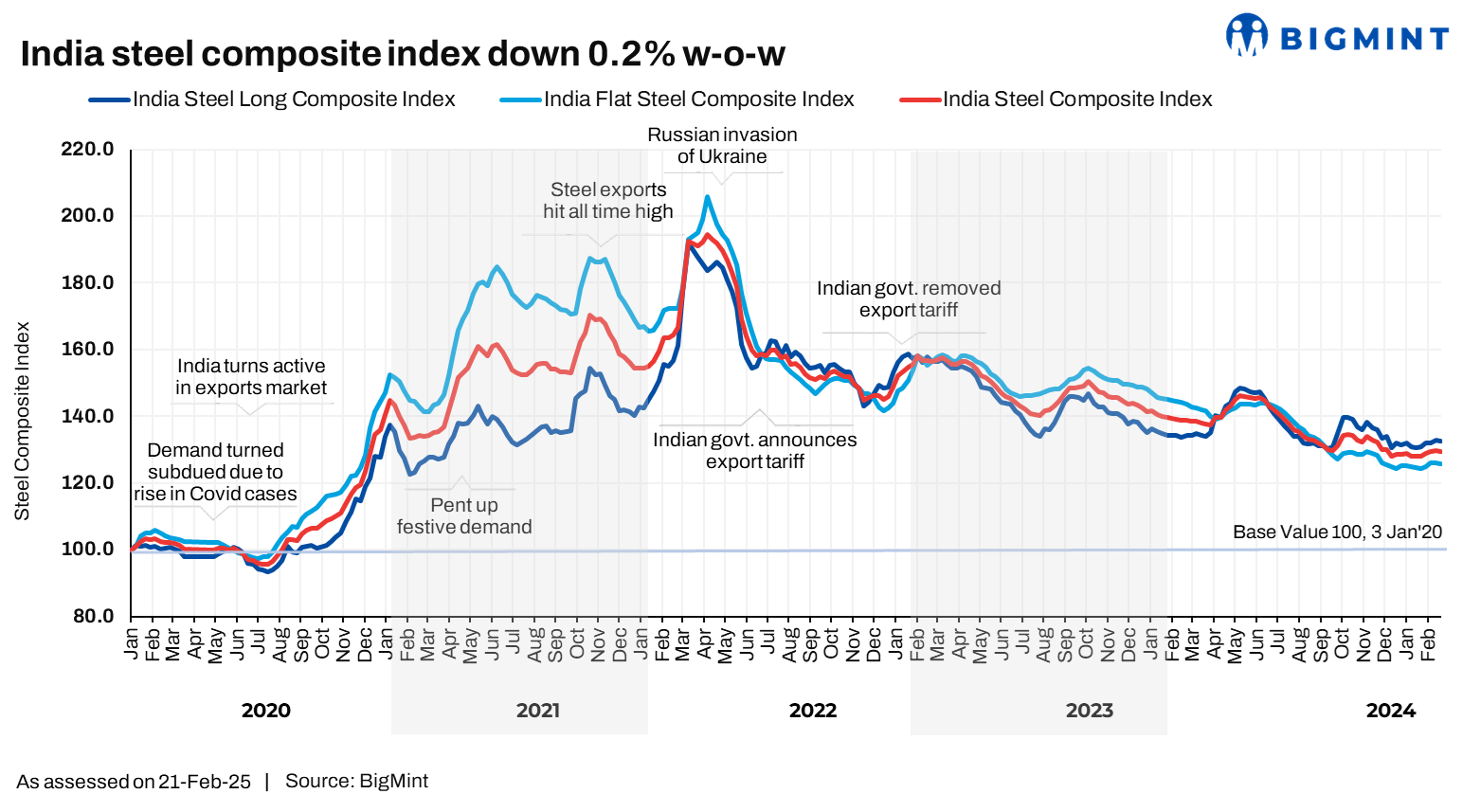

Morning Brief: BigMint's Steel Composite Index edged down by 0.2% w-o-w to 129.5 points on 21 February 2025, as dull market sentiments stalled the incremental uptrend seen over the past few weeks.

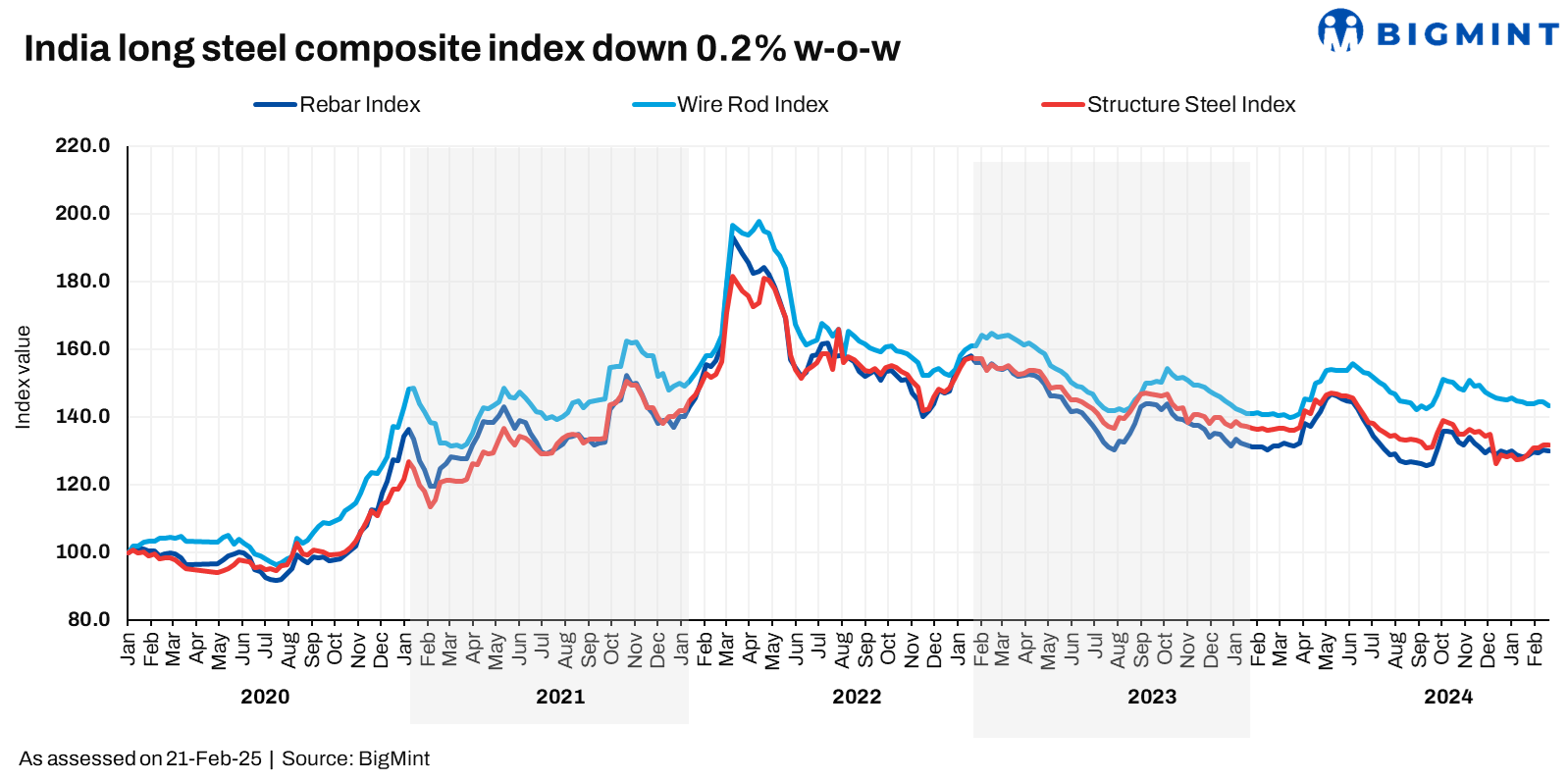

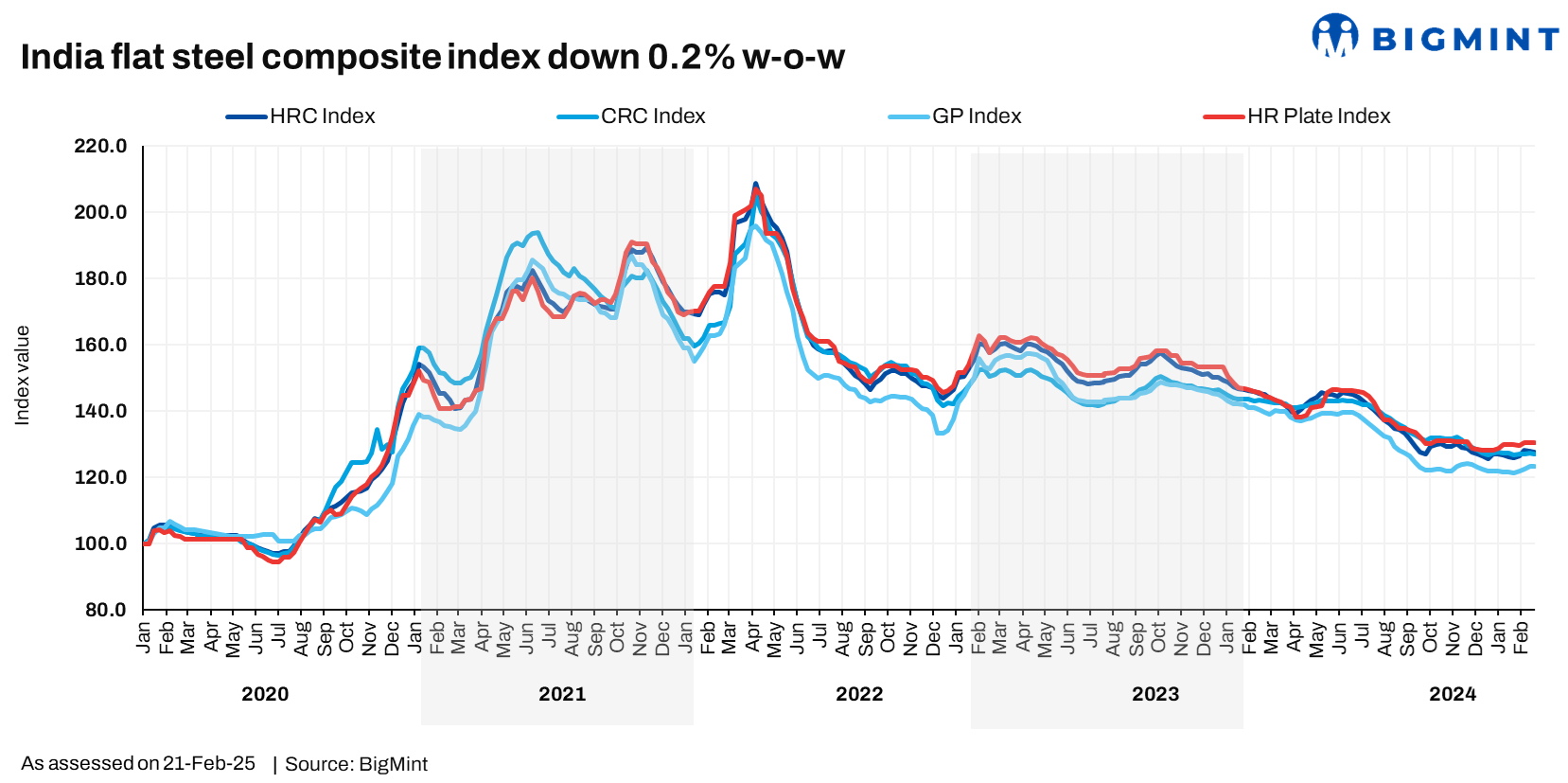

Both the long and flat steel sub-indices eroded by 0.2%. The index has been trapped within the 128-130 range for the last three months. Prices have remained largely stagnant, with suppliers forced to backpedal on hikes amid considerable resistance from buyers.

Factors impacting index last week

Tight supply supports BF rebar prices: Trade-level blast furnace (BF) rebar prices fluctuated with a narrow range last week, with Mumbai seeing a w-o-w dip of INR 100/tonne (t) ($1/t) to INR 52,600/t ($607/t) exy, exclusive of GST at 18%.

While prices were under pressure due to subdued demand, they found support in limited material availability. Market participants highlighted that only around 25% of the volume ordered was being delivered. Supply may continue to be relatively tight, given that a leading private steelmaker's BF will be offline for the coming quarter, leading to a production impact of around 30,000 t per month.

Prices of raw materials - iron ore fines and Australian premium hard coking coal (PHCC) - edged up, further supporting prices.

In the project segment, prices remained within INR 50,000-51,000/t ($577-589/t) FOR Mumbai amid cautious procurement.

Slow demand pressures IF rebar tags: Trade-level tags of induction furnace (IF) rebars exhibited mixed trends w-o-w, with prices gaining by INR 700/t ($8/t) w-o-w to reach INR 48,600/t ($561/t) exw in the benchmark Mumbai market.

Slow demand and need-based procurement weighed on prices. While mills attempted to raise prices, they ultimately ended up offering trade discounts, as traders dragged their feet on booking bulk volumes. However, inventory idling time dropped across markets, to approximately 10-12 days, which supported prices to some degree.

HRC prices drop amid declining sales: Trade-level hot-rolled coil (HRC) prices across India dipped by up to INR 300/t ($3/t) w-o-w to INR 47,300-49,700/t ($546-574/t), with Mumbai seeing a drop of INR 200/t ($2/t) w-o-w to INR 48,300/t ($558/t) ex, excluding 18% GST.

The market witnessed modest procurement this week, mostly for the purpose of fulfilling immediate needs. This pushed suppliers to cut prices, and the lack of price support announcements from mills compounded their difficulties. Participants fear that if current market conditions continue, many might resort to sourcing imported material.

Additionally, the market chatter is that Tata Steel has scheduled maintenance shutdowns at its Kalinganagar, Meramandali, and Jamshedpur plants, with the latter expected to be down for an extended period.

Imports of bulk HRCs and plates stood at 308,819 t till 17 February and an additional 64,535 t are expected by the month-end, as per vessel line-up data maintained with BigMint. The first week of March is set to see arrivals of around 75,900 t.

HRC export offers show mixed trends: India's HRC export offers exhibited mixed trends. BigMint's India HRC export index for the Middle East and Vietnam remained stable w-o-w, at around $525-530/t CFR UAE, though China reduced its offers by $5/t to $495/t CFR. Demand in the Middle East was stable ahead of Ramadan.

However, India's indicative offers to Europe declined by $10-15/t w-o-w to $570-580/t CFR Antwerp amid ongoing anti-dumping probes.

Outlook

Prices may remain range-bound in the coming days. Although demand continues to be tepid, tightening supply, stemming from production cuts by major steelmakers, may support trade prices.

India Steel Composite Index

The India Steel Composite Index is assessed on a weekly basis, every Friday at 18:30 IST, as per the weighted average prices based on manufacturing capacity and production.

BigMint considers the Composite Index with the base year being 3 January 2020 (financial year 2019-2020) and the base value as 100. The Composite Index does not give the absolute price but a trend of the market. The Indian steel industry is broadly classified into the BF-BOF and the electric/induction furnace routes. Keeping this broad classification in view, BigMint proposes to release the Composite Index by considering both production routes by manufacturing capacity and the production weighted method to compute the index for India.