23-May-2025

- Region's crude steel production in FY'25 was over 28 mnt

- Scrap consumption in steelmaking may rise 10% by FY'30

- BF-BOF to drive capacity expansion in some states in the region

Morning Brief: Crude steel production and capacity enhancement in India is progressing at a steady pace and the different regions of the country are witnessing rapid growth. South India, for instance, has been witness to fast-paced industrial growth over the decades and the steel industry in the region has thrived as a result.

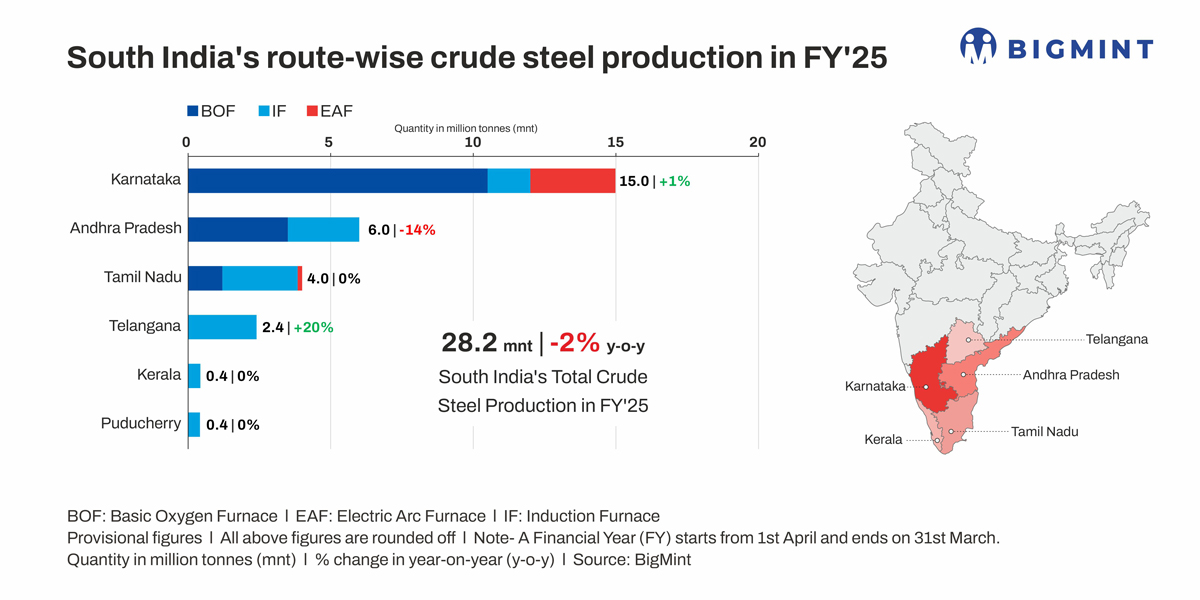

Karnataka was the top producer, recording total output at 15 mnt, followed by Andhra Pradesh at 6 mnt, and Tamil Nadu at 4 mnt.

Steel production & capacity in South India

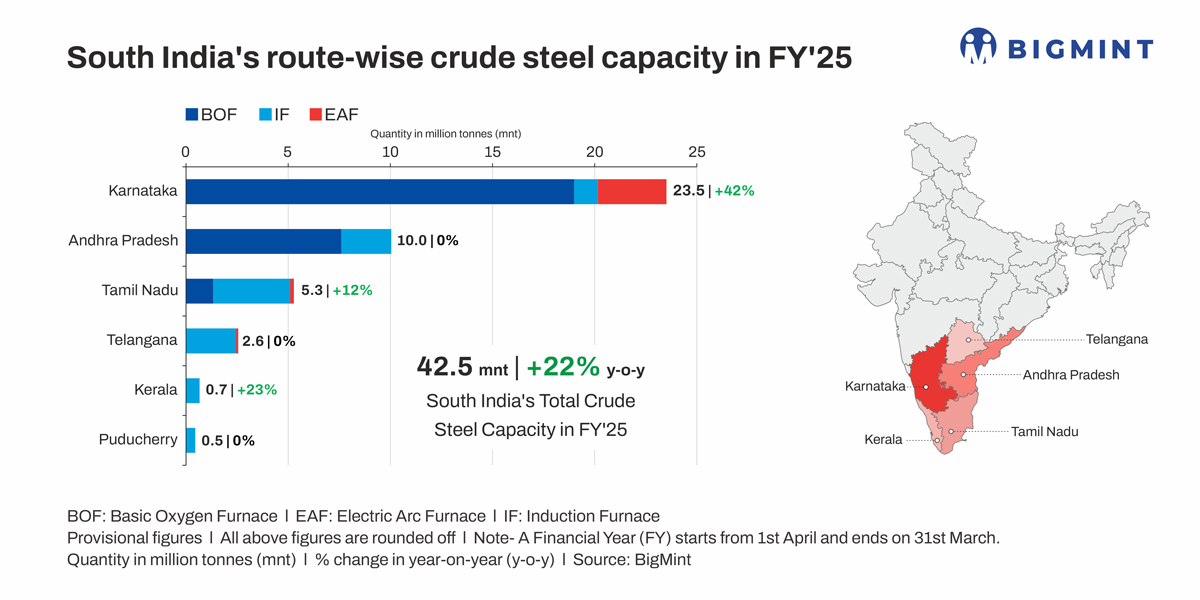

South India's share in India's crude steel production was estimated at over 18% in FY'25. The region has one of the highest per capita steel consumption in the country, thanks to its burgeoning infrastructure and manufacturing sectors. Total crude steel capacity in South India is estimated at 44.16 mnt in FY'25, an increase of 27% y-o-y.

Currently, this growth is mainly driven by the BF-BOF route. Notably, the share of BF-BOF in total capacity stands at around 66%, at nearly 28 mnt-- mainly concentrated in Karnataka and Andhra Pradesh. While EAF steelmaking capacity stands at 3.63 mnt, IF-based capacity is 12.6 mnt.

Of the total production of 28.2 mnt in FY'25, the BF-BOF route (across the six states mentioned) accounted for roughly 15 mnt, or about 54% of total output, while the IF-based route churned out nearly 10 mnt. The EAF route's contribution stood at 3.1 mnt.

Some of the leading producers were JSW Steel, RINL, SAIL, BMM Ispat, AP High-Grade Steel, Kalyani Steels, etc.

Raw material requirements

BigMint data show that scrap consumption in steelmaking stood at 8 mnt in FY'25 across the six states covered. This is an increase of around 11% y-o-y compared with 7.2 mnt in FY'24. Notably, scrap usage in IF steel production stood at 5.8 mnt, while use in BOFs and EAFs in the region stood at 1.4 mnt and 0.4 mnt, respectively.

On the other hand, sponge iron consumption was assessed at 7.1 mnt in FY'25. While total DRI usage in IFs in the different states of the region was 5 mnt, another around 2.2 mnt was consumed by EAFs.

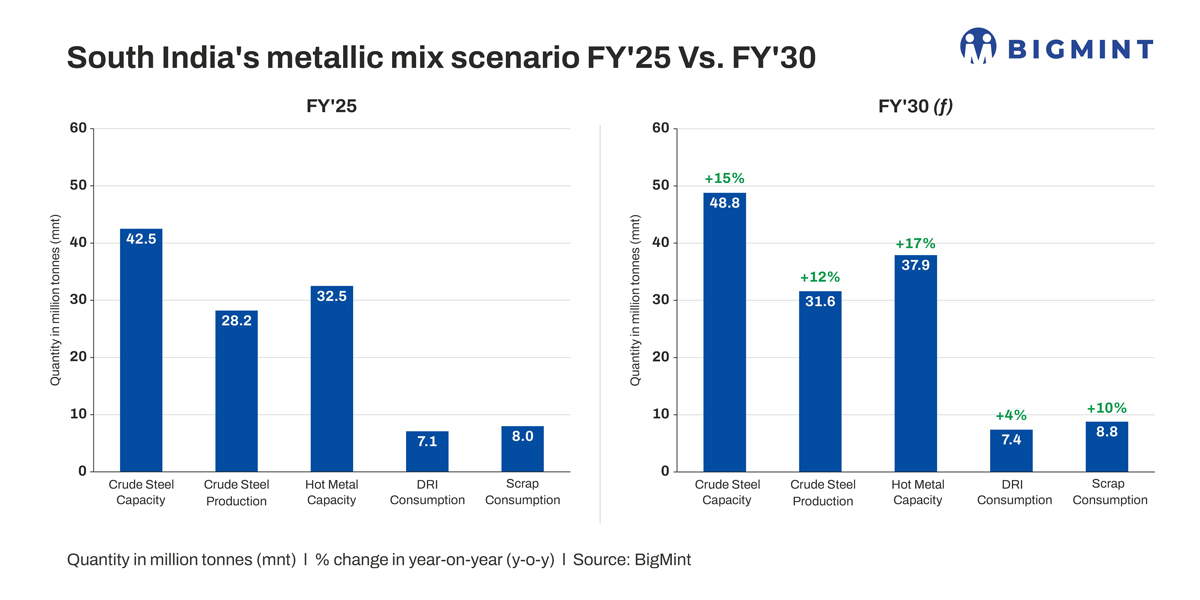

BigMint estimates that the crude steel capacity of the six states of South India is likely to reach around 49 mnt in FY'30, an increase of over 10% compared with FY'25. Capacity expansion will mainly be driven by the BOF route, while simultaneous expansion will happen in the IF and EAF routes. Likewise, crude steel production is expected to increase by over 12% to reach nearly 32 mnt in FY'30.

Estimates show that scrap consumption is likely to rise by 10% to around 8.8 mnt by FY'30 on higher consumption across routes. Given the strategic advantage of growing low-emissions steel production in the region, ferrous scrap usage is likely to gain a further boost in the years to come.