30-May-2025

- Far East, SE Asia provide higher quality scrap grades

- Shorter transit times, lower freights attract importers

- Demand for imported scrap to decline in CY'25

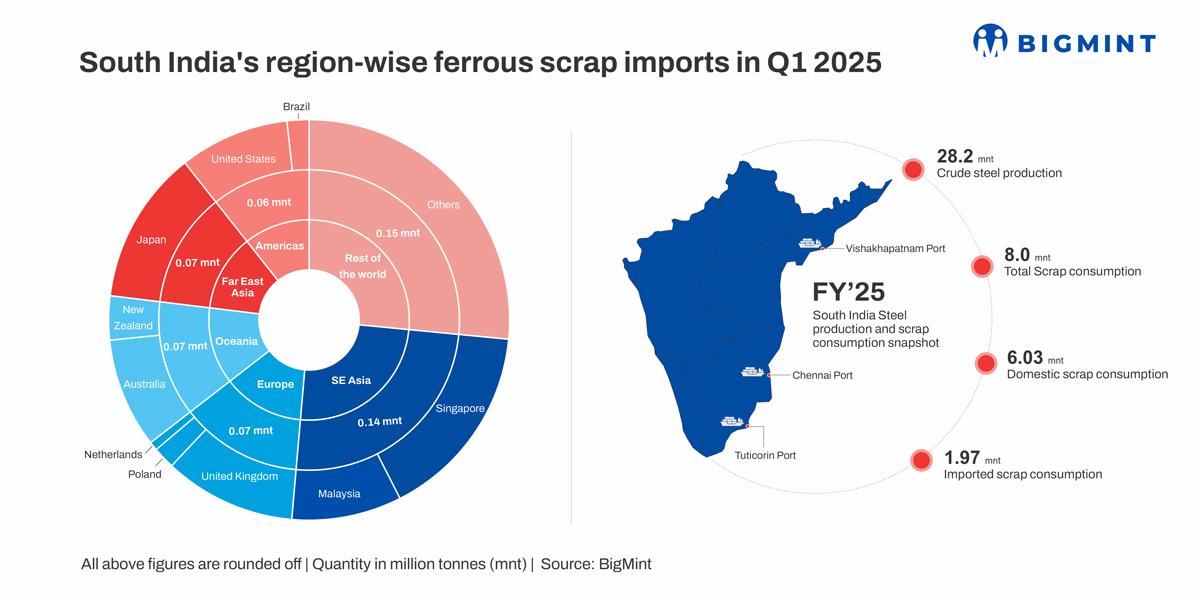

Morning Brief:South India, with consolidated steelmaking capacity of around 42 million tonnes (mnt) spread across six states, has witnessed a shift in ferrous scrap sourcing patterns in early 2025 compared to earlier years. While imports from the United States (US) and the United Kingdom (UK) dominated in 2022-24, East and Southeast Asia supplied the lion's share (37.5%, 0.21 mnt) in the first quarter of this year. Parallelly, the US and UK provided only 19.6% (0.11 mnt) of imports.

BigMint traces the key reasons behind this shift.

Trade flows see marked shift in Q1CY'25

The notable shift in 2025 has been the increasing presence of East Asian suppliers. The share of imports from the US and UK has not been in alignment with the major trends in south India's volumes.

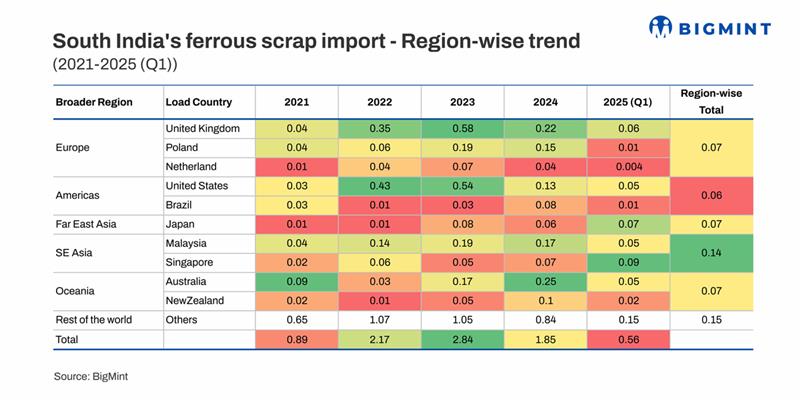

Specifically, south India's scrap imports showed an overall uptrend from 0.89 mnt registered in 2021 -- 2.17 mnt in 2022 and 2.84 mnt in 2023 -- while volumes fell 35% y-o-y to 1.85 mnt in 2024. Meanwhile, imports totalled 0.56 mnt in Q1CY'25.

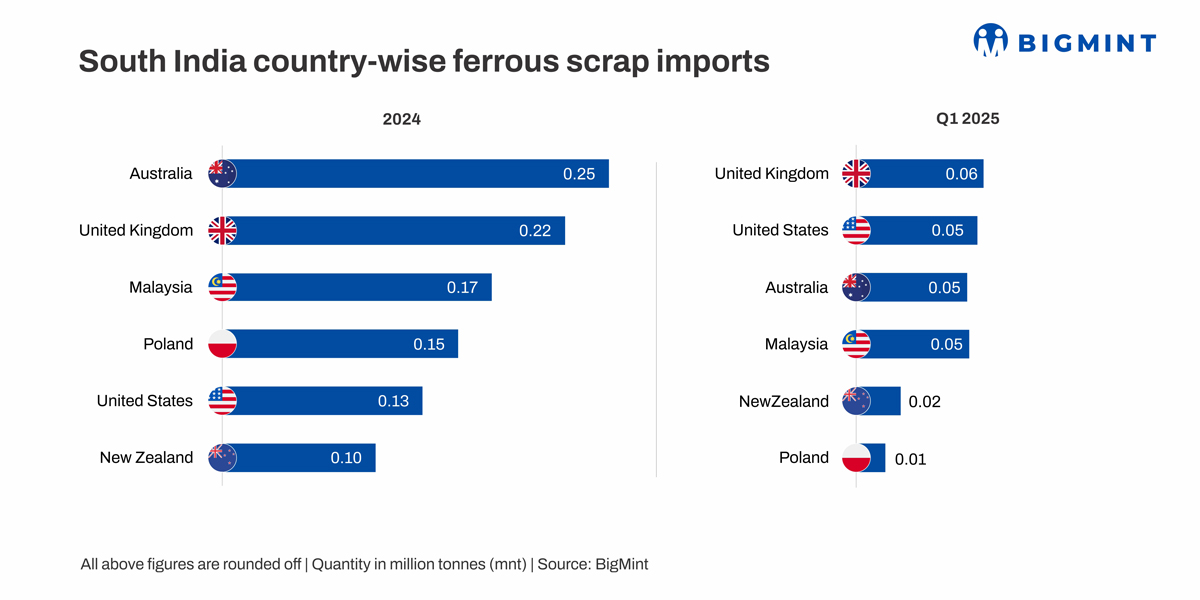

Imports from the UK comprised 16.1% (0.35 mnt) of south India's scrap imports in 2022 and peaked at 20.4% (0.58 mnt) in 2023. However, the share dropped to 11.9% (0.22 mnt) in 2024, 0.13 mnt in 2024 and 10.7% (0.06 mnt) in early 2025, indicating a steep pullback.

Meanwhile, the US supplied 19.8% (0.43 mnt) in 2022 and 19% (0.54 mnt) in 2023. However, similar to the US, the share of UK-origin scrap imports dropped to 7% (0.13 mnt) in 2024 and then inched up to 8.9% (0.05 mnt) in Q1CY'25.

From Australia, 1.4% (0.03 mnt) was sourced in 2022, 6% (0.17 mnt) in 2023, and 13.5% (0.25 mnt) in 2024. Subsequently, its share declined to 8.9% (0.05 mnt) in Q1CY'25.

Among Southeast Asian countries, Malaysia maintained stable contributions of around 6-9% during 2022-2024 (0.14-0.17 mnt) and early 2025 (0.05 mnt). Meanwhile, Singapore's share was minimal in 2022-24 at 1.8-3.8% (0.05-0.07 mnt) in 2022, which then shot up to 16.1% (0.09 mnt) in just the first three months of 2025. Singapore, effectively, was the highest contributor of scrap this year.

In Far East Asia, Japan followed a similar trajectory, with a share of 0.5-3.2% (0.01-0.08 mnt) in 2022-24. However, in Q1CY'25, Japan shipped 0.07 mnt - its highest quarterly volume in the five-year period.

Why is Asian scrap gaining ground in south India?

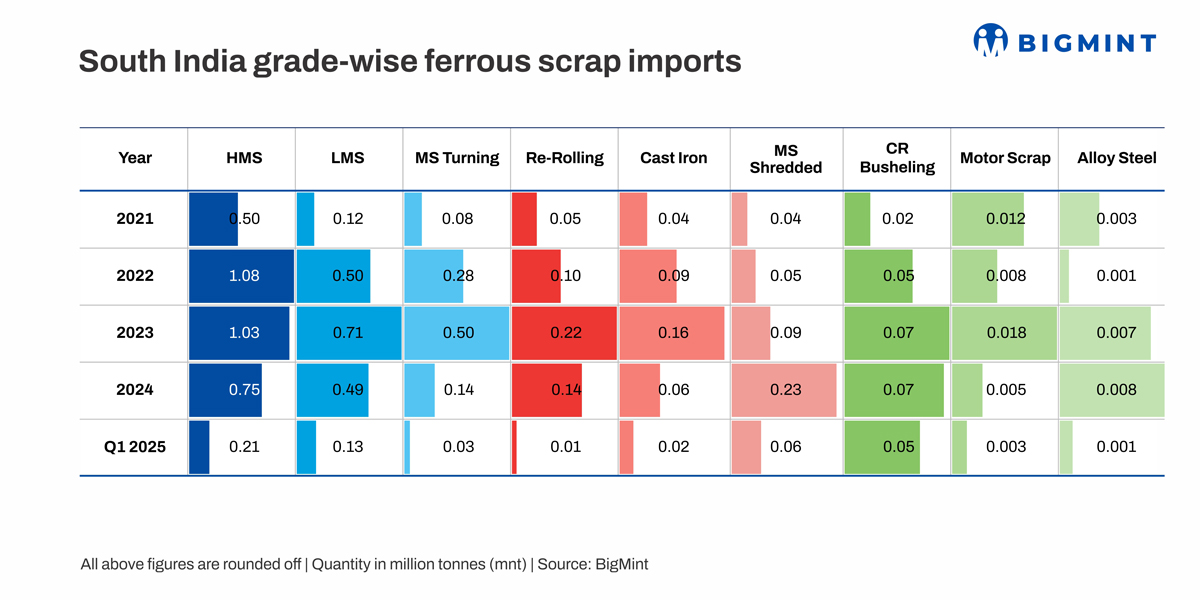

Grades more suited to south Indian mills:Containerised shipments from the Far East and Southeast Asia mostly comprise cleaner quality of scrap -- busheling, bundles, rebar cuttings, H2, and light melting scrap (LMS). These are better suited to the operational models of induction furnace (IF) units across Tamil Nadu and Karnataka. Asian suppliers also offer quick turnarounds and flexible parcel sizes. Additionally, break bulk scrap from Southeast and Far East Asia offers better value.

Shorter transit times, lower freights lure importers:Given that freights are a large part of the cost equation, proximity matters. Scrap from Japan, South Korea, and Australia have become more attractive simply because transit times are shorter at just 10-15 days and the material is cheaper to ship. Shorter voyage times also help mills manage supply chain risks more effectively.

"Affordability is key in this market. Mills are focusing on short-range cargoes. No one wants the exposure of long-haul voyages right now," a source informed BigMint.

Meanwhile, following the Red Sea Crisis, freight costs from Europe to India have more than doubled -- from $600-700/t in 2022-2023 to $1,300-1,400/t now, making shipments from the West less attractive.

US, UK focus more on Turkiye market:Traditionally, the US and the UK were major sources of imported ferrous scrap for India. However, much of this material was diverted to Turkiye in Q1, where demand and prices were high. In contrast, Indian steel mills have been navigating a subdued domestic market. Import prices, which had briefly risen to $375/t CFR in January, softened again to around $365/t in March, with demand expected to remain muted through the next quarter.

Far East, SE Asia struggle with subdued domestic demand:Steel demand in Japan and Malaysia has declined sharply, with domestic markets being flooded with cheap Chinese goods. Consequently, domestic mills' capacity utilisation has reduced, though scrap generation remains strong. However, given flagging sales of domestic steel, scrap demand has gone down, leading to a supply glut. As such, scrap traders have turned to exports to offload material.

Outlook

Overall, south India's scrap imports may decline, mirroring a downtrend in the country's demand. Leading steel producers have increased their sponge iron usage, while domestic scrap availability has improved.

Meanwhile, as the global scrap market tightens, south India is also likely to see more structured sourcing strategies such as direct tie-ups between mills and overseas processors or exporters. High-grade scrap from Japan, South Korea, and Singapore is expected to feature more prominently in import flows, especially as these grades offer better yield and furnace efficiency. That apart, improved scrap processing capabilities are expected to ensure a more stable supply of quality material. Around 7-8 shredders are already operational near Chennai Port, and mills are investing in baling and shredding units to keep costs in check. However, there is still room for growth -- ELV recycling infrastructure needs a push to tap into the growing auto scrap potential.

Amid global pricing uncertainties and long-haul shipping disruptions, how are south Indian steelmakers navigating regional scrap shortages? In what ways could these geopolitical and macroeconomic factors impact steel production economics? Can south India's scrap ecosystem evolve fast enough to maintain supply chain efficiency?

These questions - and more - will be addressed in the session "Global Scrap Availability: Implications for India's Steel Industry" at Future.Steel - South, scheduled for 18-19 June 2025 at Taj Coromandel, Chennai. Join industry leaders, analysts, and policymakers as we map the road ahead for raw material security in India's southern steel belt.