14-June-2025

- India's scrap consumption rises nearly 45% since CY'21

- Scrap usage in steelmaking to reach 54-55 mnt by FY'30

- Global trade protectionism threatens sustained quality scrap supplies

Morning Brief: Ferrous scrap plays a stellar role in sustaining burgeoning global steel production and has the potential to emerge as a key tool in the sustainable transition of the steel industry. World Steel Association (WSA) data show that global crude steel production in calendar year 2024 (CY'24) stood at 1,885 million tonnes (mnt) compared to 1,904 mnt in CY'23.

The BF-BOF route had a dominant share at over 70% of steel production globally. This is because in China, the world's top steel producer with a share of roughly 55% of global production, the BOF route comprises around 90% of crude steel output.

The EAF route accounted for 29% of global crude steel output. As per WSA, while 100% ferrous scrap-based EAF steel production has a CO2 emissions intensity of 0.67tCO/tcs, the BF BOF route globally averages around 2.32 tCO/ tcs.

India vs world: Key statistics

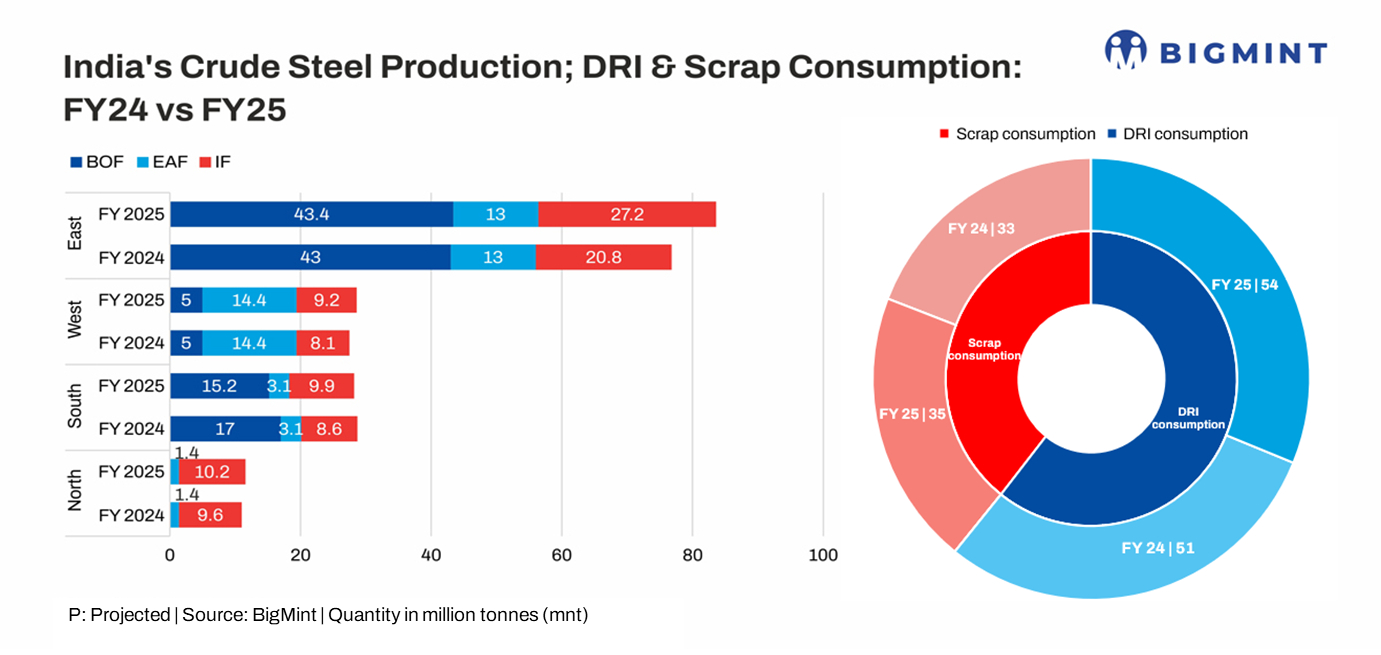

India was the second-largest steel producing country in CY'24, with production reaching nearly 150 mnt. Out of India's total crude steel production of 152 mnt in FY'25, the contribution of the BF-BOF route was 63.3 mnt -- around 42%. Production from the EAF and IF routes stood at roughly 32 mnt and over 56 mnt, respectively.

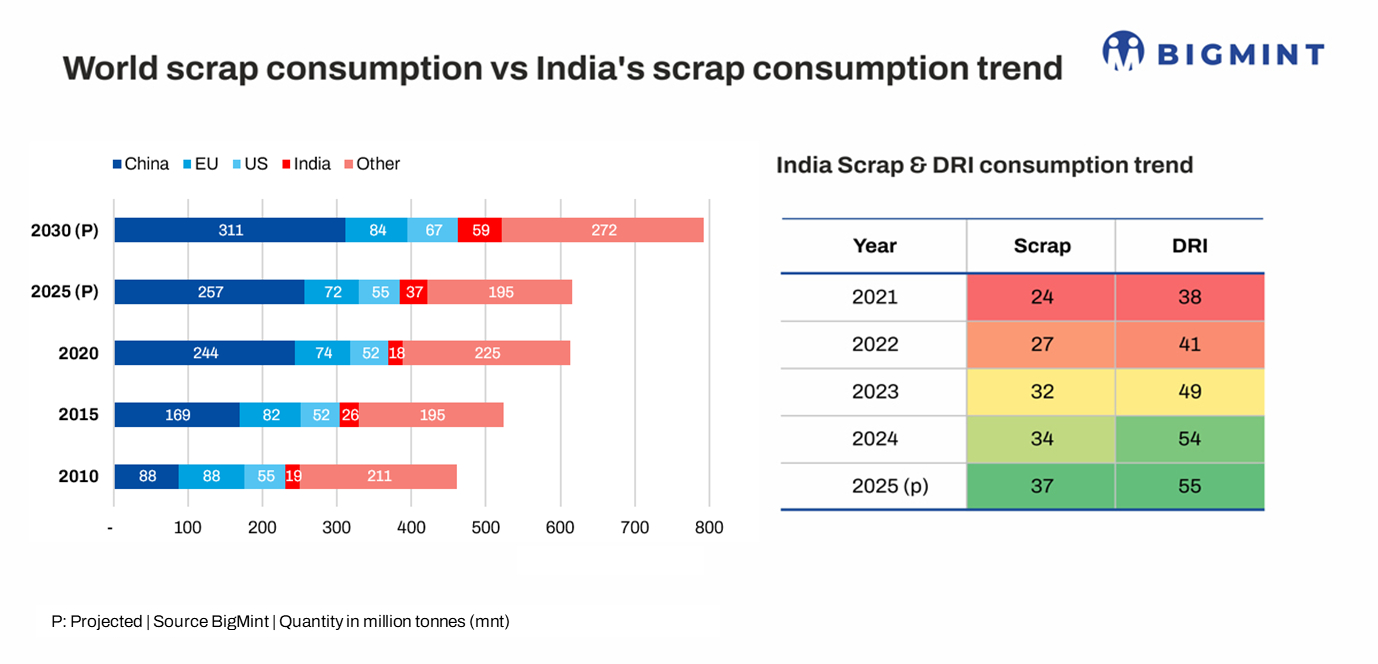

Scrap as a feedstock is used in all steel production routes. Consumption of scrap in steelmaking was over 34 mnt in CY'24, a steady growth from 24 mnt in 2021-- over 43% in 3 years. This is in sharp contrast to the decline in global scrap consumption in steel production, which inched down from a peak of 654 mnt in CY'21 to 603 mnt in CY'24.

The release of post-pandemic demand and momentum in the global steel industry tapered off in CY'23 and CY'24 amid inflation and monetary tightening, geopolitical upheavals, trade conflicts, energy hyperinflation, and, most importantly, overcapacity.

Steel market volatility spilled over into raw material markets and affected consumption. India, with consumption of over 34 mnt of scrap in CY'24, was the fourth largest consumer globally after China (more than 220 mnt), EU (73 mnt), and the US (55.6 mnt).

Global steel scrap generation, however, has been largely flat over the last five years, with total generation pegged at 606 mnt compared with 613 mnt in 2020. It is projected to edge up slightly to 616 mnt in CY'25.

Scrap vs sponge iron consumption.

As per BigMint data, India's production and consumption of sponge iron has recorded a sharp growth in recent years. Production has climbed to around 55 mnt, while consumption increased by 6% y-o-y in FY'25 to 54 mnt. The country's iron ore production reached nearly 290 mnt in the last fiscal, while pellet output surged to 105 mnt.

Easy availability of iron ore and coal at competitive prices, economical operations due to utilisation of waste heat in coal-DRI process, and limited domestic availability of ferrous scrap have resulted in the rapid growth in sponge iron usage at the expense of scrap.

Scrap imports

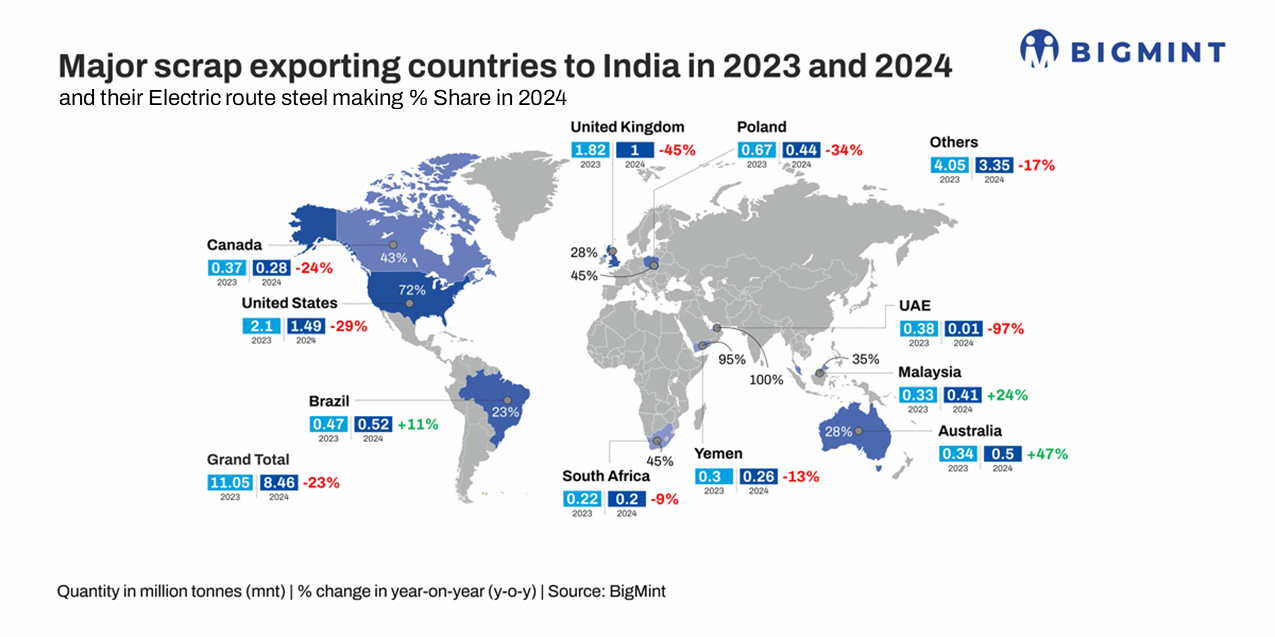

Interestingly, despite the growth in crude steel production, India's ferrous scrap imports edged down sharply by over 20% y-o-y to around 8.4 mnt in FY'25 versus over 11 mnt recorded in FY'24.

This was due to higher uptake of domestic scrap, partial replacement of scrap by domestic ore-based metallics due to cost consideration and easier availability, and decline in scrap exports by key supplier countries.

Geopolitical unrest and disruptions in maritime trade and freight surges also impacted imports.

The main exporting countries were the US and UK, Brazil, Poland, Australia, and Malaysia. Volumes from the UAE have crashed due to restrictions in that country.

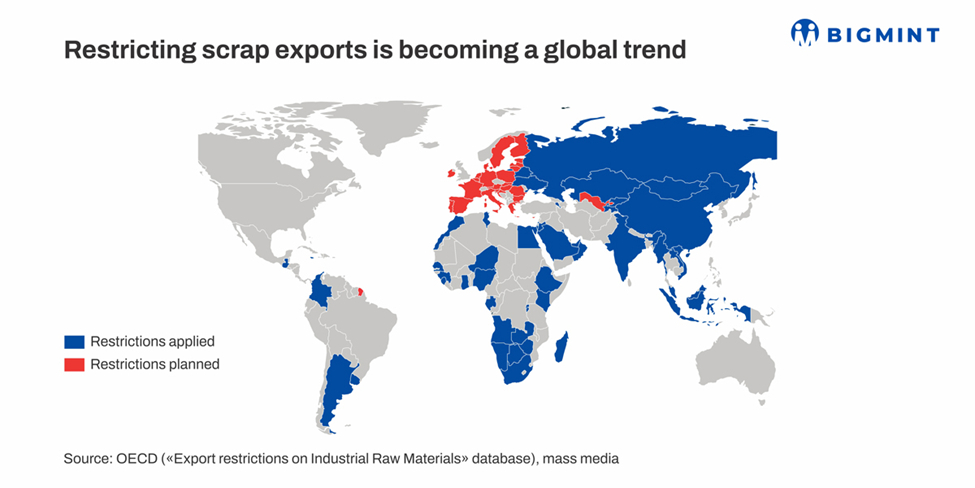

Export restrictions: Ferrous scrap export restrictions are becoming more widespread globally.

As of March 2025, around 48 countries have imposed 75 different restrictions on scrap exports, with 38% of these measures involving partial or complete export bans.

This is because countries are trying to prioritise domestic supply in response to the surge in scrap demand driven by the decarbonisation of the steel industry, while supply remains constrained. It is also seen as crucial for stabilising ferrous scrap prices and preserving industrial competitiveness.

The result: India as the one of the top scrap importers globally, will be directly affected.

Scrap generation

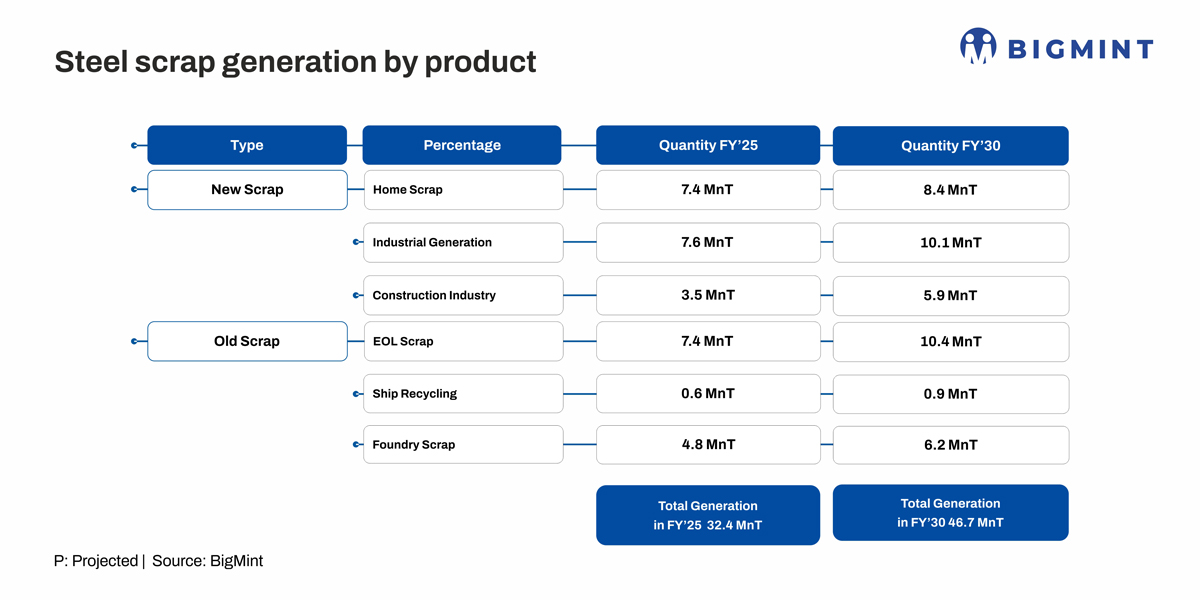

Data show that domestic ferrous scrap generation rose by 7% y-o-y in the last fiscal to over 32 mnt compared with 30 mnt in FY'24. Boosting scrap generation through upgradation of domestic recycling infrastructure and bolstering end-of-life scrap processing are key pillars of government policy.

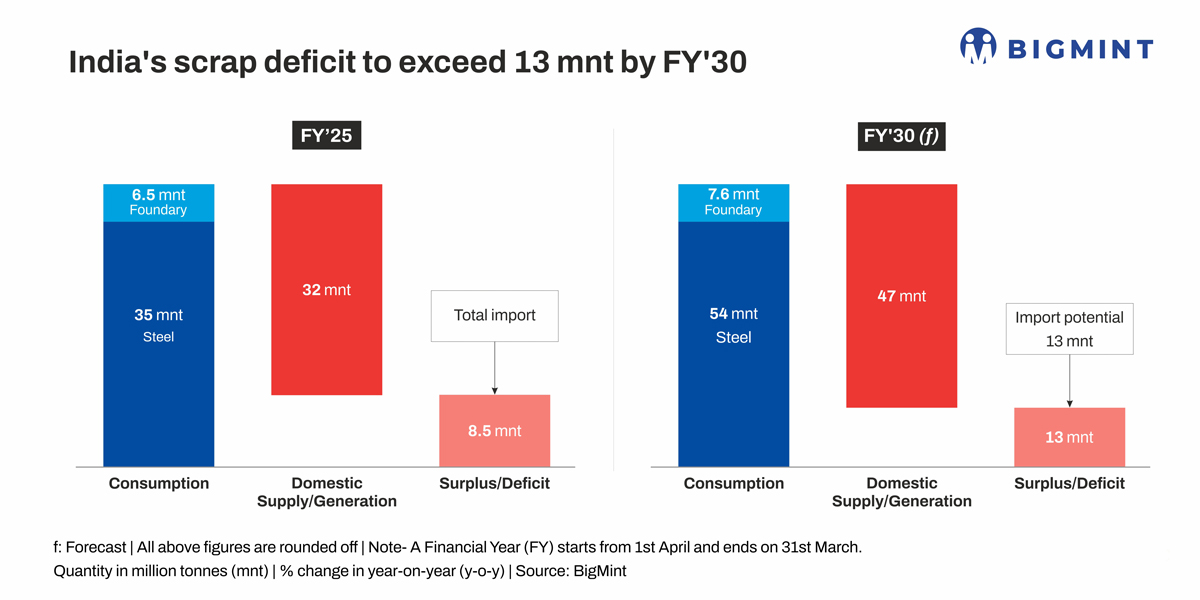

However, the gap between demand and generation of scrap is still quite wide, which will reinforce India's dependency on imports going forward.

As per BigMint data, domestic generation of ferrous scrap will touch 46.7 mnt by FY'30 from 32.4 mnt currently. As an important steel industry decarbonisation tool, scrap usage will be prioritised and policy focus is on the creation of an organised value chain in the country.

The Vehicle Scrappage Policy (2021) is expected to enhance EOL scrap availability in the mid-term. Due to the relatively smaller lifecycle of cars and other vehicles, this policy seeks to catch the low-hanging fruit for fast-tracking domestic generation on an immediate basis.

India's transition towards sustainable steelmaking is being guided by the Ministry of Steel's Vision 2047 roadmap. The plan aims to increase the share of scrap in steelmaking to 30% by FY'30, up from 20% currently.

Challenges

- There lies an untapped potential in India's ELV sector, while there are also pressing challenges that impede its growth.

- The lack of modern recycling infrastructure and standardisation has resulted in inefficient dismantling processes hampering the sector's efficiency.

- The absence of a centralised database for pricing standards creates a lack of transparency.

- Manual operations dominate the landscape, thereby driving up operational costs, while unregulated activities exacerbate environmental degradation.

As the third-largest automobile manufacturer globally, the Indian automobile sector contributes approximately 7-8% to the nation's GDP, producing around 30 million vehicles annually. With approximately 327 million registered vehicles, the potential for recycling ELVs is enormous. However, to fully leverage this potential and establish a robust scrappage ecosystem, several hurdles must be overcome.

To enhance domestic scrap availability, the government is considering to increase rebates on registration charges for new vehicles and to offer additional discounts for scrapping certificates.

India's scrap potential

India's ferrous scrap consumption is set to rise from 41.9 mnt in FY'25 to 61.8 mnt by FY'30, driven by higher use in both steelmaking and foundries. Scrap usage in BOF and EAF/IF routes will grow from 35.2 mnt to 54.2 mnt, while foundry consumption will rise from 6.7 mnt to 7.6 mnt.

Domestic scrap generation is projected to increase from 32.4 mnt in FY25 to 46.7 mnt by FY30. Despite this growth, supply will lag behind demand, creating a 6-7 mnt shortfall, sustaining import reliance. India aims to achieve 35-40% scrap usage in steelmaking by FY'30. To meet this target, improving scrap collection, processing infrastructure, and recovery systems will be critical.

Future.Steel-South

As the world moves towards sustainable steelmaking, scrap has become a critical raw material and a commodity in short supply. How will export restrictions impact the availability of quality steel scrap for Indian mills? Hear experts share their views on "Global Scrap Availability: Implications for India's Steel Industry" at BigMint's upcoming conference Future.Steel-South to be held on 18 June 2025 at the Taj Coromandel, Chennai, India.