05-June-2025

- Shorter transit times, freight economics drive shift to bulk

- Quality, grade specifications better controlled in bulk mode

- Chennai, Vizag port infrastructure suited to bulk vessels

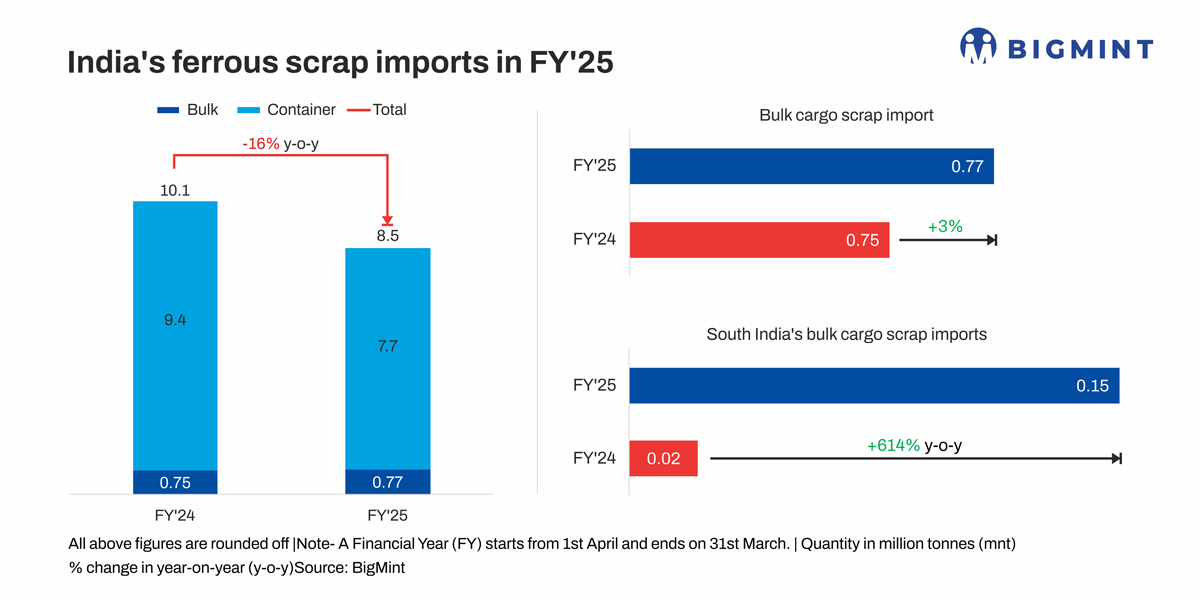

Morning Brief: South India, the country's third-largest ferrous scrap-consuming region, seems to be witnessing a shift in import preferences, with bulk shipments having grown sharply to 0.15 million tonnes (mnt) in FY25 from just 21,000 tonnes (t) in FY24, as per data compiled by BigMint. This is a more than sixfold jump in just one year.

This scenario was also evident in the national arena, though at a more moderate level. India's ferrous scrap imports stood at 8.45 mnt in FY'25, down 16% y-o-y, with containerised shipments falling by 18% y-o-y to 7.68 mnt. In contrast, bulk scrap imports firmed up by 3% to 0.77 mnt.

Factors driving bulk scrap imports to southern ports

Shorter lead times:Containerised scrap shipments from the Far East and Southeast Asia reach south Indian ports faster than those from Europe or the US, giving local mills a logistical edge.

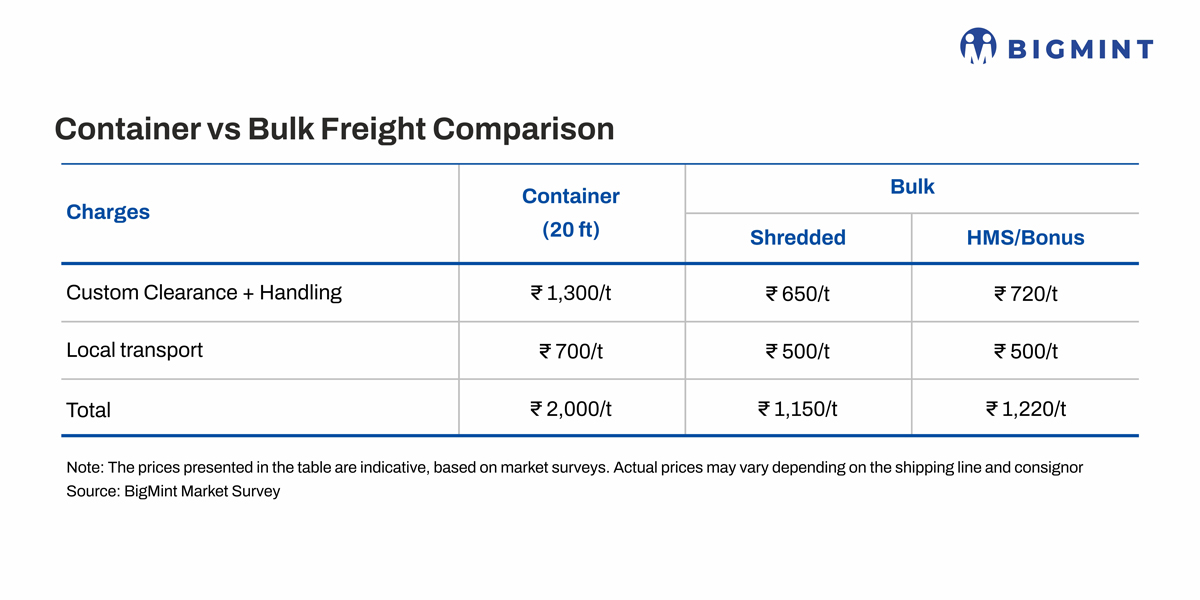

Lower freight costs:From a cost perspective, bulk cargo offers a clear financial advantage. Freights for bulk shipments are $10-12/t lower than those for containers. Furthermore, usually bulk consignments have a per-tonne cost advantage of $5-10 on scrap offers as well.

Vessel economics:The availability of handysize vessels, which require lower capital expenditure and are easier to charter, makes bulk shipments a flexible and cost-effective solution for buyers looking for scale and reliability.

Quality concerns:Importers also highlighted that both quality and quantity are better controlled in bulk mode. Traders and processors handling bulk scrap can ensure cleaner material and tighter specifications, which containerised imports often fail to match due to fragmented loading and handling practices.

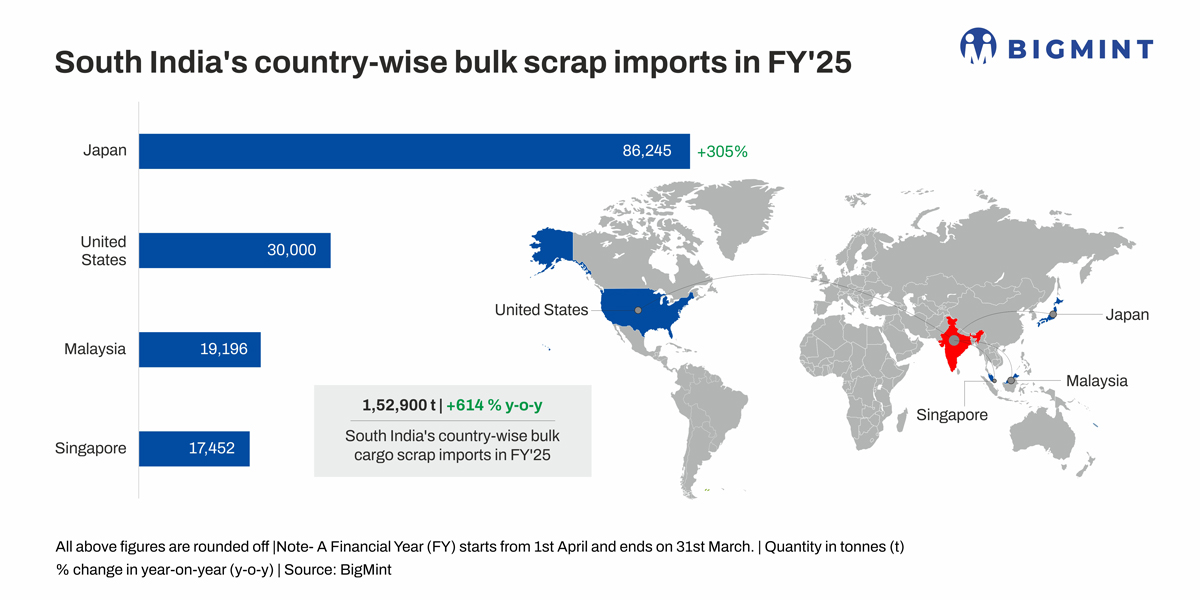

Chennai Port has been a key beneficiary of this trend, handling rising volumes of CR busheling (Shindachi), car bales, and new tin plate (NTP) grades, which are all high-quality feedstock typically shipped via bulk vessels.

A market participant noted, "The quality in bulk shipments is far more consistent, and the scale suits larger mills. If a buyer wants 10,000 t of busheling, sourcing that from the domestic market with uniform specs is near impossible. Bulk imports bridge that gap."

Geopolitical factors:Some bulk shipments have also been redirected to India from neighbouring regions such as Bangladesh due to geopolitical factors. A Chennai-based trader summed up the situation as follows: "For the past six months, Bangladesh has not been buying due to weak economic activity and lack of new infrastructure projects. That volume has started flowing into India."

South India's port infrastructure, especially at Chennai and Vizag, is playing a pivotal role in enabling this transition. These ports offer the berthing space and handling capacity required for bulk vessels, including handysize and handymax carriers. As regional scrap flows adapt and vessel availability improves, these ports are likely to see increased volumes of break bulk shipments over the coming fiscal.

With stable demand from large-scale secondary steel producers in south India and with Chennai Port offering cost-effective logistics, bulk scrap is poised to retain its momentum in FY'26. Handymax vessels carrying high-grade busheling and shredded from Japan, Southeast Asia, and the US are likely to continue anchoring at regional ports.

But the larger question remains - can bulk shipments sustainably replace containerised scrap imports at scale? Will smaller mills be able to adapt, or will the market be polarised between large importers and smaller buyers relying on domestic sources?