03-June-2025

- States steel production surging but scrap collection struggling to keep pace

- Mills relying on imports and sponge iron to bridge raw material gap

- Seasonal disruptions, fragmented supply chains may deepen scrap vulnerability

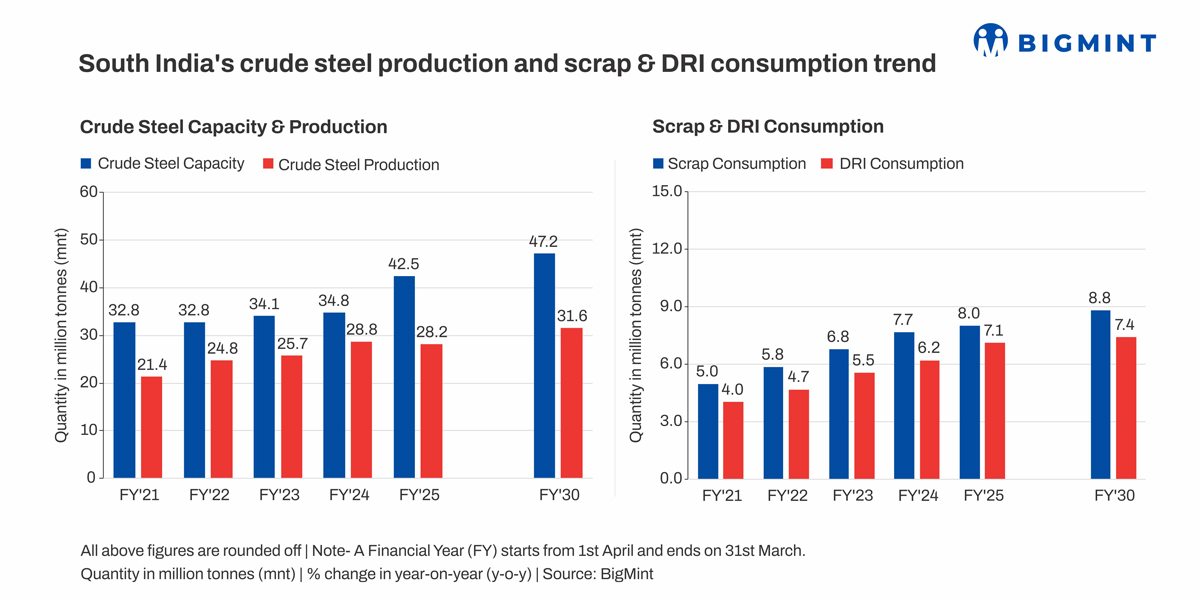

Morning Brief: Tamil Nadus steel sector has quietly transformed over the past five years, positioning itself as a cornerstone of south Indias evolving ferrous landscape. Between FY20 and FY24, the states crude steel output grew from 2.5 million tonnes (mnt) to 4 mnt-a 60% rise. This growth trajectory is expected to continue, with production projected to touch 4.6 mnt by FY30, reflecting rising infrastructure and construction activity across the region.

How fast is scrap demand growing in Tamil Nadu?

As steelmaking capacity expands, so does the appetite for raw materials, particularly ferrous scrap. Tamil Nadu's scrap consumption climbed from 1.9 mnt in FY20 to 2.8 mnt in FY24, registering a 47% increase. The demand is concentrated in electric arc furnace (EAF) and induction furnace (IF) units that rely heavily on consistent scrap availability to maintain melting operations. Projections indicate that scrap requirements could reach 3.3 mnt by FY'30.

Where is this scrap coming from-and is it enough?

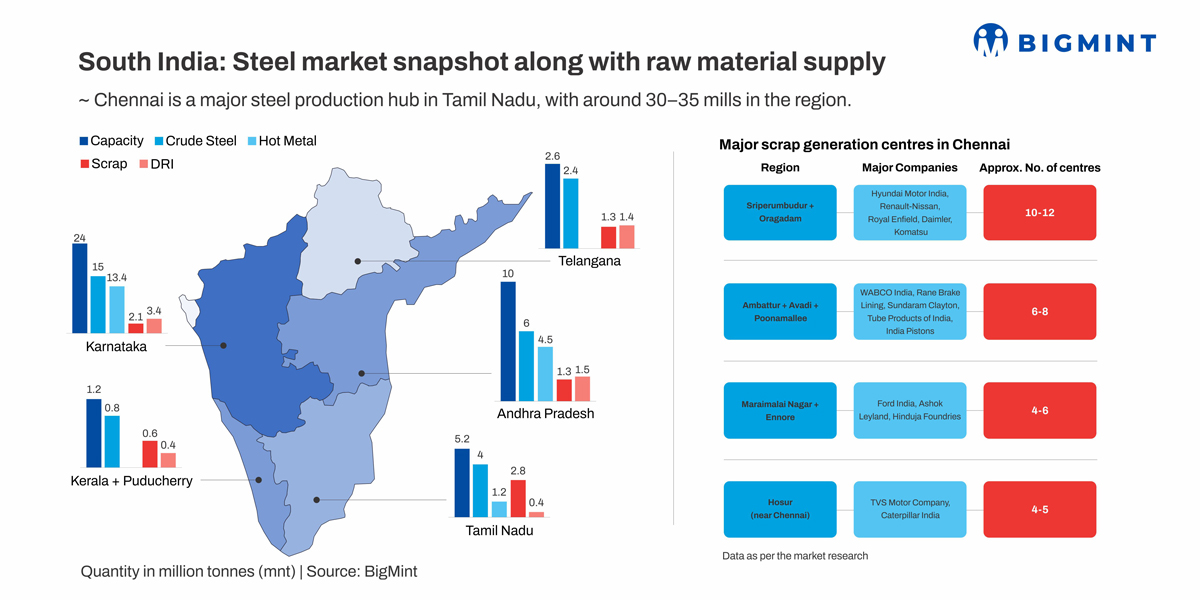

Despite having several industrial clusters that generate quality scrap, local availability remains uneven. The Oragadam and Sriperumbudur belts provide clean CR busheling and turning and boring (T&B) scrap, driven by the presence of auto and engineering units.

However, HMS 80:20 and 90:10 grades, which form the bulk of the melting input, are collected from dispersed locations such as Coimbatore, Madurai, Tiruchirappalli, and Chennais urban scrapyards. Small- and medium-sized traders manage the bulk of this collection, often with limited infrastructure and reach. Larger processors such as MTC, Shakti, SBA Metals, and TTRI aggregate this material, but even their combined efforts are beginning to fall short.

Is import dependency here to stay?

With domestic supply increasingly unable to keep pace with demand, steel mills are turning to the global market. Scrap imports from the United States, European Union, Australia, Japan, and Southeast Asia have picked up over the last few years. Chennai Port plays a pivotal role as the primary entry point, and shipping timelines now factor heavily into procurement strategies.

On average, shipments from the US and EU take 45-50 days to arrive, while East Asian cargoes can reach in as few as 10-15 days. This growing reliance on imports brings exposure to freight volatility, global pricing shifts, and currency risks.

What role does sponge iron play in balancing the mix?

To mitigate the risk of scrap shortfalls, mills are diversifying their charge mix by including sponge iron. This material now accounts for nearly 20% of total melting input. Tamil Nadu has a modest sponge iron capacity of ~0.8 mnt annually, which mostly supports local demand. However, mills also draw from sponge hubs in Karnatakas Bellary-Hospet region and Odishas Rourkela cluster, especially when scrap prices surge or imports face delays.

What are the emerging supply risks?

Geography plays a double-edged role. While proximity to Chennai Port aids imports, Tamil Nadus coastal location also exposes mills to seasonal disruptions. Monsoon rains, cyclones, and port congestion frequently delay cargo handling and internal logistics. Moreover, during festivals like Pongal and Ramadan, many traders, yards, and transporters reduce operations or shut down temporarily, disrupting collection cycles and delivery schedules.

What lies ahead for Tamil Nadus scrap ecosystem?

The outlook suggests a sustained rise in steel demand across the state, driven by infrastructure, housing, and manufacturing growth. Crude steel output is projected to touch 4.6 mnt by FY30, as per BigMint projections, with scrap demand reaching 3.3 mnt. Without substantial improvement in local scrap generation and logistics infrastructure, Tamil Nadu could face a structural supply imbalance. This would force greater reliance on imports or costly production reconfigurations.

Future.Steel - South

Is India prepared for a future where regional scrap shortages could impact steel production economics? Can Tamil Nadus scrap ecosystem evolve fast enough to support growing demand? How should mills balance the trade-off between local sourcing, imports, and sponge iron substitution?

These pressing issues-and more-will be addressed in the session Global Scrap Availability: Implications for Indias Steel IndustryatFuture.Steel - South, scheduled for18-19 June 2025atTaj Coromandel, Chennai. Join industry leaders, analysts, and policymakers as we map the road ahead for raw material security in Indias southern steel belt.