25-June-2025

- Paucity of high-grade drives imports from Middle East

- Arrivals centered primarily in Kutch, Goa, Chennai

- Global iron ore price decline stirs interest in imports

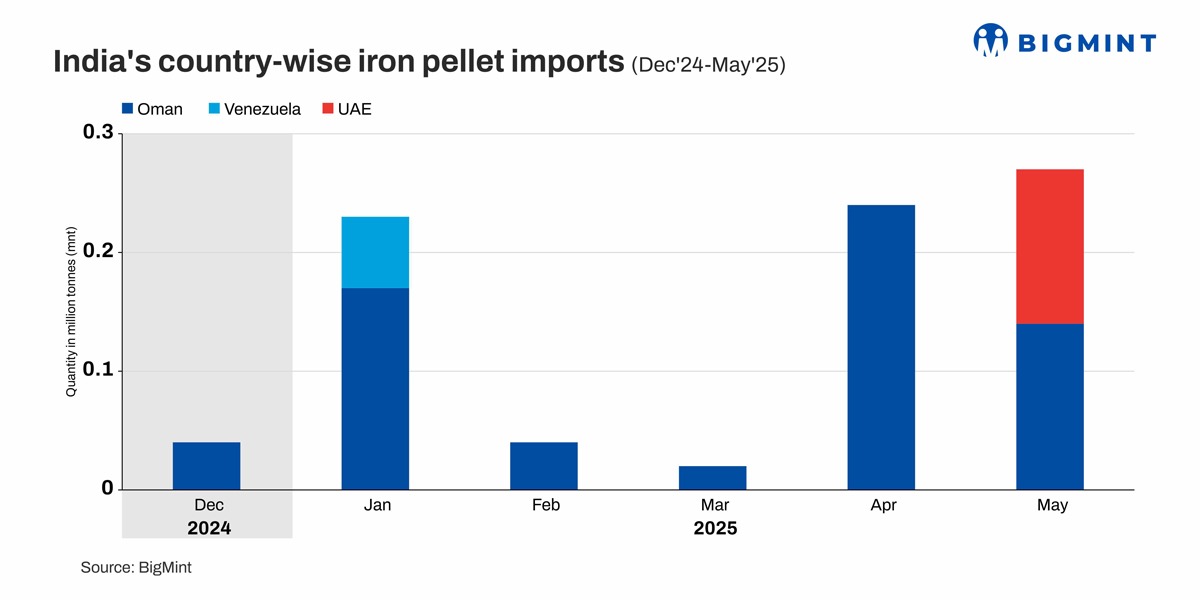

Morning Brief: India's pellet imports continued at a brisk pace in May 2025 after resuming in December after a four-year gap. Volumes increased by a whopping 93% to 0.27 million tonnes (mnt) in May compared to 0.14 mnt in the preceding month.

This is the highest monthly inflow recorded this year. Additionally, cumulative imports stood at 0.68 mnt in January-May, sourced primarily from the Middle East.

Company-wise break-up

Varrsana Ispat Limited was the leading importer, with 0.09 mnt. MS Metals and Steels and Goa Sponge followed, with 0.05 mnt each, while Suryadev procured 0.02 mnt. The rest was received by miscellaneous importers.

Port-wise imports

As per port-wise data, Kandla handled the largest volume (0.15 mnt), while Chennai took the second spot (0.08 mnt). Mormugao handled the remaining 0.05 mnt of imported pellet cargo.

Factors influencing pellet imports in May'25

Market faces shortfall of high-grade pellets: Largely, pellet grades of above Fe 65% were sourced from overseas, primarily Oman and the United Arab Emirates.

Pellets with Fe 65%+ and low alumina (max 1%) content are not easily available in the domestic market. Production of high-grade pellets is low, and major domestic suppliers usually offer Fe 62.5-63% material.

Additionally, the high freights from central to western India (where most imports seem to be landing) made overall sourcing costs unviable. These factors, coupled with favourable pricing of imported material, encouraged Indian entities to procure pellets from overseas.

Regional supply issues emerge: The decision to procure foreign pellets was also influenced by a variety of local supply issues specific to Kutch, Chennai, and Goa, the three major importing regions.

For example, south India faced difficulties due to a dearth of material in Bellary and Odisha. Notably, pellet-makers in Bellary faced an iron ore shortage, and increased captive consumption curtailed the amount available for the merchant market.

In Gujarat, the shutdown of Jindal SAW's plant for maintenance and favourable global pricing heightened interest in pellet imports. Steelmakers in Goa had to rely on imports due to operational disruptions in western India, where some local plants have been offline since early April.

Exporters offer attractive pricing: While supply shortages in the domestic market prompted players to turn to imports, favourable pricing ultimately helped seal the deal.

Globally, both iron ore and pellet prices have fallen. Benchmark Australian-origin Fe 62% iron ore fines in China were priced at an average of $99-100/tonne (t) CNF Rizhao in April-May, lower by $4-5/t from December, when pellet imports resumed.

Meanwhile, pellet prices (Fe 65%, Brazilian-origin) were at $117-118/t CNF Rizhao, lower by $10/t from December levels ($127/t).

As such, export offers to India remained favourable in April, with deals concluded at $115-120/t CFR for Chennai and Goa and $110-120/t CNF Kandla for Gujarat, with the latter price band being, in particular, for Fe 65+% pellets with low alumina (max 1%) content.

In comparison, domestic landed costs were much higher, with a wide gap between imported and domestic pellets. A Kandla-based buyer in April stated, "In March, we booked a low-phosphorous Fe 65% cargo at INR 12,700/t ($149/t) CFR Kandla from the central-eastern region. That is way higher than current MENA imports. So, we are sticking with imports for now."

Additionally, a Middle East-based source informed BigMint, "Iranian pellets (for Fe 65% grade) are being offered to India at $89-90/t FOB Bandar Abbas Port."

Outlook

Rising pellet imports have emerged as a grave concern, with even the Pellet Manufacturers' Association of India (PMAI) expressing apprehensions about the elevated inflows.

Going by current market dynamics, it seems that the sustainability of this trend will depend primarily on two factors: (1) the supply situation in India and (2) the price viability of imports.

India is less likely to significantly raise its production capacity of higher-grade pellets anytime soon. As such, any requirement for such specialised grades will need to be fulfilled through overseas procurement.

Secondly, it seems that these pellet imports were opportunistic purchases, which occurred due to the global price decline. A rise in iron ore prices or freights may again turn the focus to domestic material.

However, another factor in this equation is the Iran-Israel conflict - a recent development, which may end up exerting the most influence. Due to rising crude oil prices and route disruptions, freights from Middle East are likely to witness an increase. A source observed, "Supply may halt for the upcoming laycan due to the recent war."

Consequently, given that the Middle East has been pretty much the sole supplier to India, the spike in pellet imports might taper off in June due to the simple reason of lack of availability. While Brazil also produces the required Fe 65% pellets, it remains to be seen whether prices and freights will appeal to Indian importers.