14-August-2025

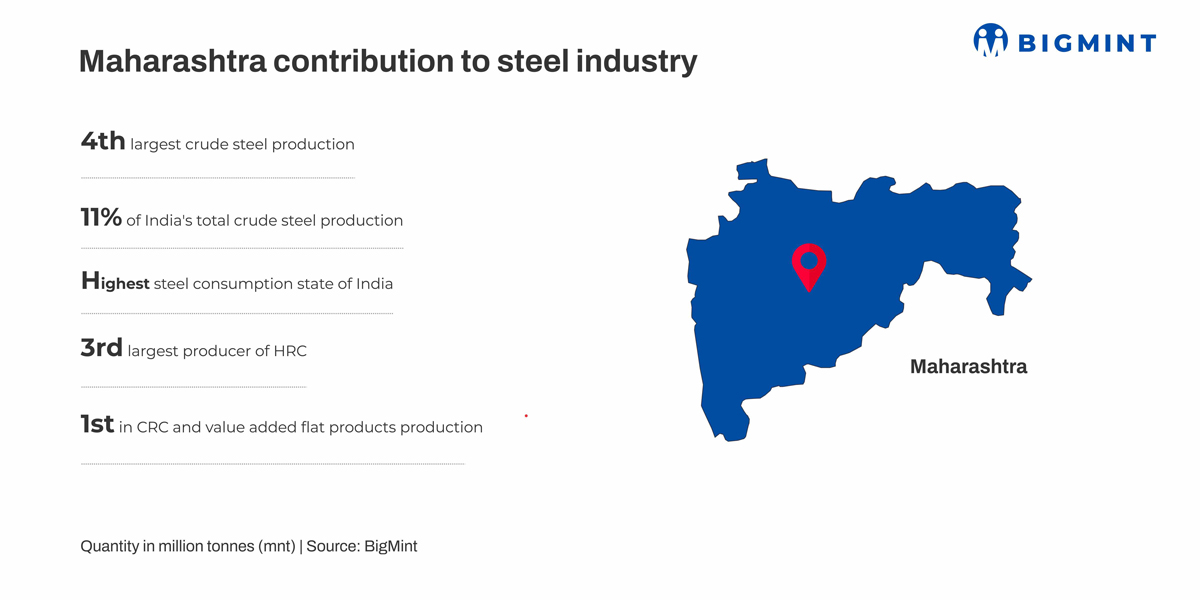

- Maharashtra ranks as India's 4th-largest crude steel producer

- Govt initiatives, auto industry driving steelmaking growth

India, the world's second-largest steel producer, continues to strengthen its position in the global steel landscape. In FY'25, India's crude steel production reached 152 million tonnes (mnt), up from 144 mnt in FY'24, reflecting consistent growth supported by infrastructure development, rising domestic demand, and industrial activity.

Among the states leading this progress, Maharashtra deserves special mention as a rising steelmaking powerhouse.Notably, Maharashtra ranks as the fourth-largest crude steel producer in the country. In FY'25, it generated 16.5 million tonnes (mnt) of crude steel from an installed capacity of 21 mnt. With expansion plans underway, this capacity is expected to grow33% to 28 mnt by FY'30.

Beyond steel, Maharashtra is also India's largest contributing state to the national GDP, accounting for around 13-14% of India's total economy, underscoring its position as both an industrial and economic leader.

BigMint goes behind the scenes.

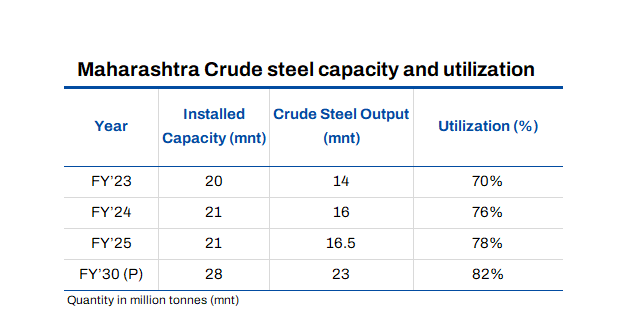

Maharashtra's crude steel utilisation

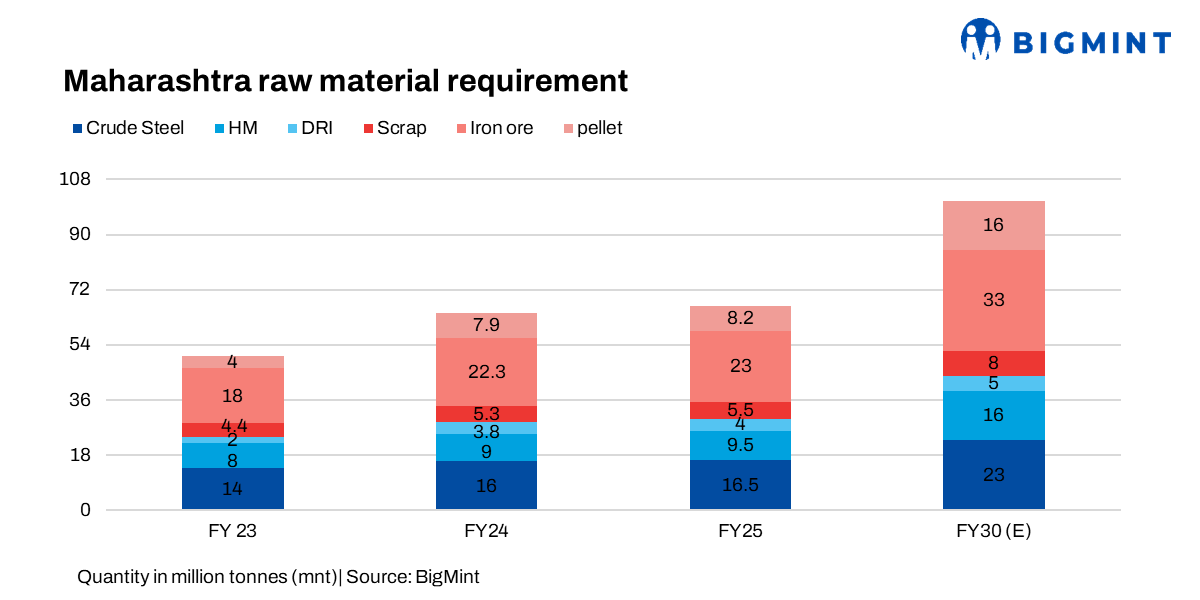

Maharashtra's crude steel capacity and utilisation trends reflect steady growth in both installed capacity and output over the years. Installed capacity increased from 20 mnt in FY'23 to 21 mnt by FY'24-25, with output rising from 14 mnt to 16.5 mnt in the same period. Capacity utilisation improved from 70% in FY'23 to 78% in FY'25, indicating more efficient operations.

Looking ahead, projections for FY'30 suggest installed capacity will reach 28 mnt, with output of 23 mnt and utilisation at 82%, highlighting the state's strengthening position in India's steel sector through ongoing capacity expansion and operational optimisation. For context, BigMint projects that India's crude steel output will reach 210-220 mnt by FY'30, marking a substantial increase of 38-45% over current levels, driven by both primary and secondary producers across the country.

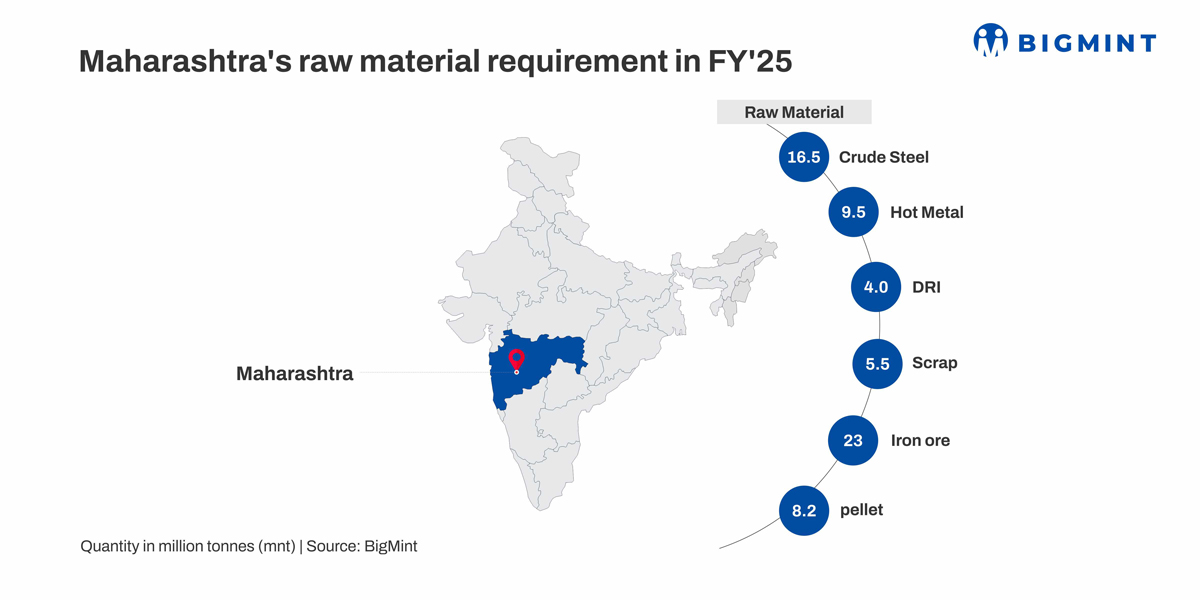

Maharashtra's resource utilisation for FY'25 steel production

In FY'25, Maharashtra consumed 23 mnt of iron ore, 6.5 mnt of coking coal, and 3.5 mnt of non-coking coal to meet its steel production needs. Additionally, it utilised 3.5 mnt of sponge iron, 5 mnt of scrap, and 0.12 mnt of pig iron, reflecting a well-diversified raw material mix supporting both primary and secondary steelmaking routes.

Raw material sourcing

Iron ore

In contrast to mineral-rich states such as Chhattisgarh and Odisha, Maharashtra possesses relatively limited captive iron ore reserves. During FY'25, the state's iron ore consumption stood at approximately 23 mnt, while domestic production was only around 11 mnt. The state's steelmakers procure iron ore from Chandrapur, central India, and via imports.

Coal

Coal is a key fuel for Maharashtra's steel sector, essential for DRI production and captive power generation. Around 40% of sponge iron coal needs are met through imports, with the state, overall, sourcing its coal from both domestic and overseas suppliers.

Domestic: Primarily sourced from subsidiaries of Western Coalfields Limited (WCL), including South Eastern Coalfields Limited (SECL) and Coal India Limited (CIL).

Imports: Sourced mainly from South Africa, Indonesia, Australia, and Canada to bridge the gap in sponge iron and power generation needs.

In FY'25, coking coal consumption in Maharashtra was approximately 6.5 mnt, while non-coking coal consumption totalled 3.5 mnt. This considered blend of imported and domestic coal ensures a stable, diversified, and reliable supply chain -- a vital factor for maintaining operational efficiency within the state's sponge iron manufacturing sector.

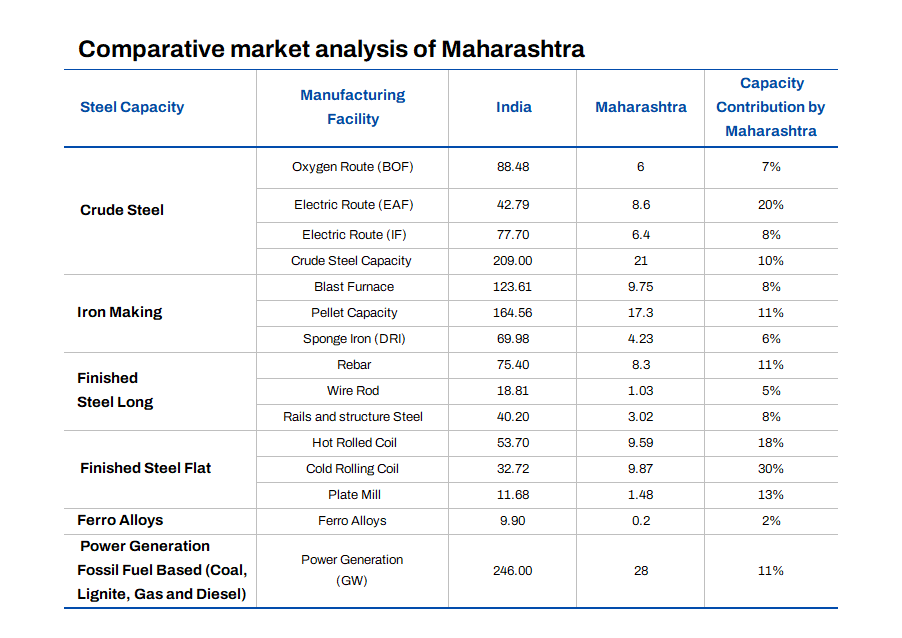

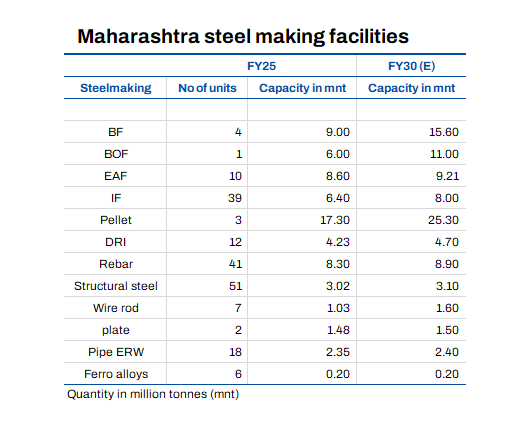

Production routes & utilisation

In FY'25, Maharashtra's crude steel production stood at 16.5 mnt against a total installed capacity of 21 mnt, reflecting a utilisation rate of nearly 79%. Of this, basic oxygen furnace (BOF) units accounted for 5.5 mnt of production, with an installed capacity of 6 mnt, while electric arc furnace (EAF) and induction furnace (IF) routes collectively contributed 11 mnt from a capacity of 15 mnt. These figures underscore the dominance of the EAF and IF routes, which contributed approximately two-thirds of the state's total crude steel output, highlighting Maharashtra's growing reliance on secondary steelmaking processes.

Overall steel capacity of Maharashtra

Metallic mix ratio

In Maharashtra's steel industry, the metallic mix ratios vary significantly across production routes, underscoring the state's diversified steelmaking capabilities. Within the blast furnace (BF) route, the input blend comprises approximately 45% sinter, 35% pellets, and 20% lumps. The BOF route is dominated by 86% hot metal (HM) and 14% scrap. In the EAF segment, the feedstock composition includes 55% HM, 12% scrap, and 33% DRI. The IF route reflects the highest dependence on secondary resources, with a mix of 10% HM (pig iron), 70% scrap, and 25% DRI, highlighting its heavy reliance on scrap and DRI-based melting operations.

Scrap consumption in state

India's total scrap consumption in FY'25 was estimated at 33 mnt, of which 8.5 mnt was imported. Maharashtra emerged as one of the leading scrap-consuming states, driven largely by the requirements of its IF industry. The state's annual scrap usage stood at 5.4 mnt, including 1.35 mnt sourced through imports. These imported volumes represented roughly 15-16% of India's total scrap imports during FY'25. Imported scrap, procured from multiple international suppliers, plays a critical role in meeting Maharashtra's steel production requirements, particularly for its secondary steelmaking units.

The state is rapidly scaling up metal recycling: scrap's share in the input mix has risen from 22% in FY'20 to 33% in FY'25, driven by government-backed urban scrap collection centers and GST incentives for compliant recyclers. Early adoption of DRI (using green hydrogen) is being piloted by leading private sector firms.

Maharashtra's key steel hubs

Maharashtra hosts key steel manufacturing clusters serving diverse markets. Jalna is a major secondary steel hub with over 200 induction furnaces and rolling mill units producing TMT bars, angles, and structurals. Wardha in Vidarbha houses integrated plants and re-rolling units, benefiting from proximity to raw materials. Pune's industrial belt focuses on value-added and specialty steels for the automotive and engineering sectors. Wada in Palghar is an emerging hub for long products, supported by port access. Kolhapur links foundry-grade steel with its engineering base. Strong infrastructure, transport connectivity, and skilled manpower make these clusters vital to India's secondary and value-added steel output.

Upcoming capacities

With the growing focus on sustainability, automation, and technological innovation, Maharashtra's steel industry is poised for a new phase of accelerated growth. Over the past 2-3 years, steel manufacturers, fabricators, and suppliers in the state have aggressively pursued capacity expansion plans. Environmental clearance (EC) approvals have already been secured for an additional 10 mnt of crude steel, 2 mnt of DRI, and 6 mnt of pellet capacity. These expansions not only aim to meet rising domestic and export demand but also align with the industry's shift towards greener and more efficient production practices. Supported by robust infrastructure, strategic port access, and a strong industrial ecosystem, Maharashtra is set to strengthen its position as a leading steelmaking hub in India.

Opportunities for growth, investment in Maharashtra's steel sector

1. Government initiatives supporting steel industry

The Indian government has initiated initiatives such as the following:

a) National Steel Policy 2030, with the target of producing 300 mnt of steel by 2030.

b) Production-Linked Incentive (PLI) Scheme, for favouring steel manufacturing with modernised facilities.

c) Development of infrastructure projects, enhancing the demand for steel fabrication in Maharashtra.

2. Development of smart cities, mega projects

Maharashtra is also experiencing growth in smart cities, metro rail projects, and industrial corridors, raising demand for high-quality steel plates and fabricated steel structures.

- Mumbai Metro Expansion - Demands huge steel fabrication components.

- Navi Mumbai International Airport - Improving demand for steel plate suppliers in Maharashtra.

- Delhi-Mumbai Industrial Corridor (DMIC)- Offering opportunities for Indian steelmakers.

3. Rise in EVs, automotive industry

As Maharashtra is a major hub for auto manufacturing, the growth of electric vehicles (EVs) is fuelling demand for high-strength, lightweight steel.

Indian steel manufacturers are working in collaboration with steel plate suppliers in Maharashtra to create new-generation alloys and next-generation steel grades to aid in this shift.

4. Increasing relevance of Maharashtra's steel export market

Maharashtra's ports, namely Mumbai and JNPT (Jawaharlal Nehru Port Trust), are major outlets for steel exports. As India emerges as a leading steel exporter, steel sellers in Maharashtra and Indian steel mills are stretching their global presence.

Challenges faced by state

In spite of the optimistic scenario, the steel sector in Maharashtra is confronted with a number of challenges:

1. Logistical hurdles

Maharashtra's steelmakers face elevated logistics costs, spending up to 15-20% more per tonne due to distance from iron ore sources. Policy discussions are ongoing regarding reopening legacy mines and expediting environmental clearances for local mineral development. The state government has also earmarked incentives for companies investing in value-chain integration or logistics solutions (e.g., slurry pipelines and rail corridor upgrades)

2. Raw material availability, pricing challenges

Maharashtra's growing demand for raw materials such as iron ore and coal is not met by local availability, forcing manufacturers to source from neighboring states or import. Volatile prices of these key inputs strain profit margins for steel producers, while supply chain disruptions further impact steel suppliers in the state, leading to delivery delays.

3. High power tariffs

Maharashtra's steelmakers grapple with some of the highest industrial power tariffs in India --historically 25-45% above nearby states -- raising production costs and eroding competitiveness. Recent tariff hikes, time-of-day charges, and reduced solar incentives have intensified pressures, prompting industry protests. Despite subsidy measures, the sector awaits effective, long-term tariff reforms to sustain growth and attract fresh investment.

4. Environmental regulations, compliance

In Maharashtra, strict environmental regulations require steel producers to limit emissions, manage waste, and adopt energy-efficient processes in line with state and central pollution control norms. Compliance often involves significant investment in cleaner technologies, such as advanced dust collection systems, wastewater treatment, and energy recovery units, ensuring sustainable operations while meeting regulatory standards.

Conclusion

Maharashtra-based steel manufacturers have a promising future ahead with their advancement in the manufacture of green steel, automation of operations, and the global export landscape. Even with difficulties that involve the prices of raw material and regulations, a steady flow of capex -- in terms of technology and infrastructure -- will see Maharashtra continue leading the pack among Indian steel industries.

Adding to this momentum, Gadchiroli district is poised to become a major steel production hub, with large integrated projects projected to contribute up to 30% of India's future steel output. The state's development blueprint also aims to extend this industrial ecosystem into neighboring districts such as Chandrapur, Gondia, and Bhandara, creating a comprehensive steel corridor in the region.

With its focus on sustainability, innovation, and smart manufacturing, Maharashtra's steel sector is ready to drive India's growth story in the international steel market. Be a manufacturer, supplier, or investor; this is the ideal moment to be a part of India's changing steel world.