24-July-2025

- Output reaches over 53 mnt in H1CY'25, up 0.9% y-o-y

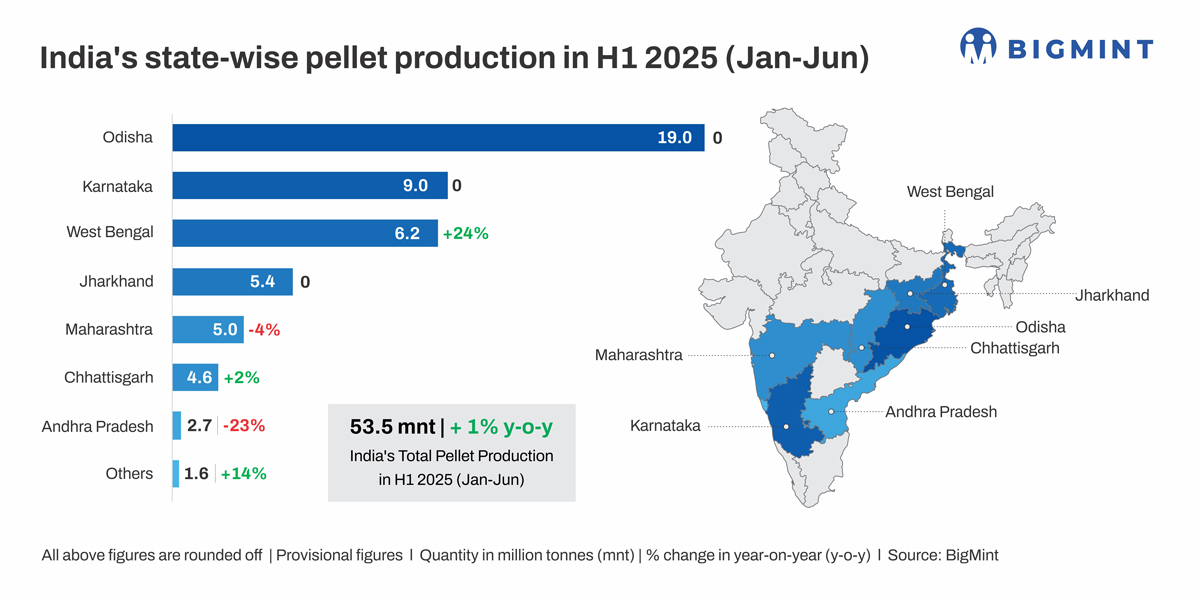

- Odisha remains top producer, Bengal records growth in output

- Higher iron ore production, fresh capacities driving pellet volumes

Morning Brief: India's iron ore pellet production increased marginally in January-June 2025 (H1CY'25) to around 53.5 million tonnes (mnt), an increase of just about 0.94% y-o-y compared with 53 mnt in the corresponding period of last year, as per latest provisional data available with BigMint.

The country has witnessed a phenomenal surge in pellet capacity over the years. In FY'25, India increased production of iron ore pellets to 105 mnt, up 5% y-o-y. Despite a slowdown in the second half of the year, the growth was driven by stable steel production, increased use of pellets in blast furnaces, and expansion of domestic capacity.

State-wise production

Odisha retained the top spot among pellet-producing states in the country, with total output reaching 19 mnt in H1CY'25 - stable y-o-y. Likewise, Karnataka's production at 9 mnt was also stable compared to the year-ago period.

West Bengal, however, saw a surge in production, with output climbing to over 6 mnt from 5 mnt in H1CY'24, thanks to fresh capacity coming onstream. Jharkhand, Maharashtra and the other leading pellet-producing states registered largely stable production figures during the review period.

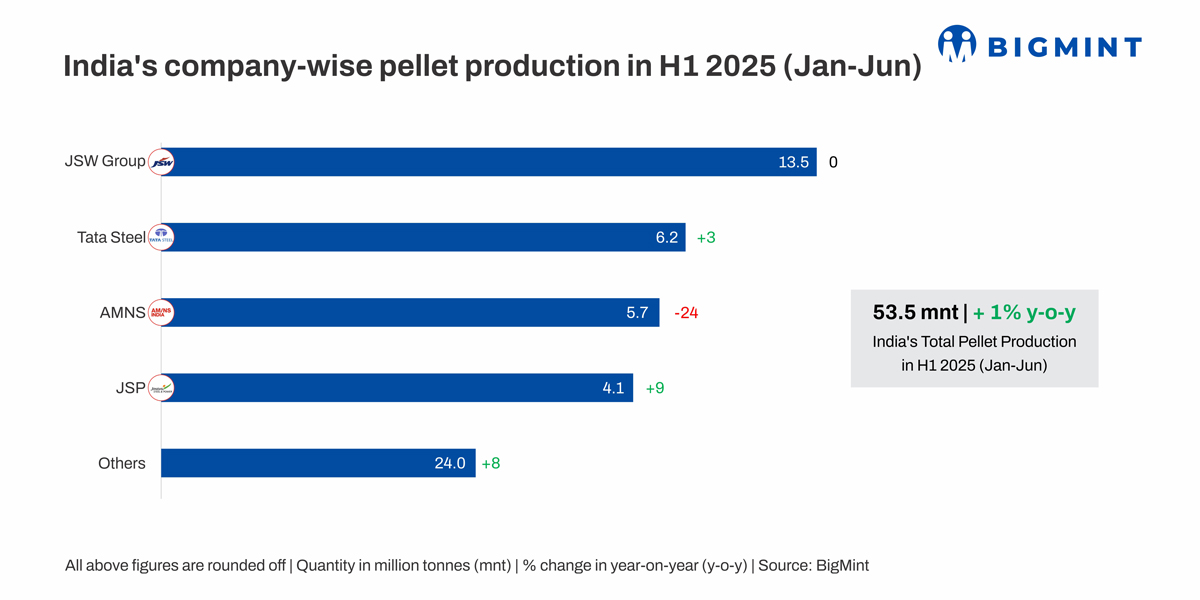

Top producers

JSW Steel was the top pellet producer in the country in H1CY'25, with total volumes recorded at around 13.5 mnt. With 27 mnt of pellet output, the steel major had emerged as the top producer in FY'25, too.

The other leading producers were all the major primary steel players in the country - AMNS India, Tata Steel and Jindal Steel. While Tata saw an uptick in output with its Kalinganagar facility in Odisha commencing operations, AMNS witnessed a decrease in production during the review period.

Factors supporting pellet production

Growth in crude steel output: Indias crude steel production increased by 9.2% y-o-y to nearly 81 mnt in H1CY'25, as per WSA data. Pellet usage in both integrated steelmaking as well as the secondary sector has expanded significantly over the years. This is due to the fact that pellets provide material efficiency in metallurgical processes and ensure energy efficiency and yield.

Increased DRI production: Domestic sponge iron production increased to nearly 30 mnt in H1CY'25. DRI production has surged to meet steelmaking requirements, while the share of pellet-based DRI has increased to around 63-65% on easier availability compared with iron ore lumps. India's sponge iron production reached close to 55 mnt in CY'24.

Higher iron ore production: India's iron ore production increased by a slight 3% to 158 mnt in H1CY'25 compared to 153 mnt in H1CY'24, according to provisional data maintained with BigMint. Higher iron ore production is leading to consolidation in pellet production and capacity.

Fresh pellet production capacity: New capacities are getting added, with the country's total capacity reaching close to 170 mnt/year. Tata Steel's 6 mnt per annum Kalinganagar plant deserves special mention. The comparatively smaller players such as Bengal Energy and others in central and eastern India are also ramping up capacity. India's total design capacity for pellets increased to 164 mnt per year in FY'25, up from 148 mnt in the previous fiscal year.

Outlook

With gradual growth in capacity enhancement, India's pellet production is poised for sustained growth. In CY'24 total production stood at around 102 mnt. Going by the look of things, pellet output in CY25 is expected to exceed last years level by at least 5-7 mnt. This conservative estimate is based on 9-10% growth in crude steel output.

However, capacity utilisation in the countrys pellet sector languishing below 70% remains a concern. Would it be appropriate to deduce that overcapacity is weighing on the market? Although exports are just about 7-8% of domestic production, the rapid de-growth in exports last year and thus far in CY'25 is seems to be exerting pressure on the domestic market.

Listen to industry experts and gain insights on "India's Pellet Industry: Capacity, Constraints & Opportunities" at the BigMint India Ferrous Week, to be held during 19-21 Aug 2025 at JW Mariott, Kolkata.