29-July-2025

- Imports likely of Iranian origin, routed through Oman

- Domestic supply constraints drive buyers to imports

- Falling global prices lead to attractive import offers

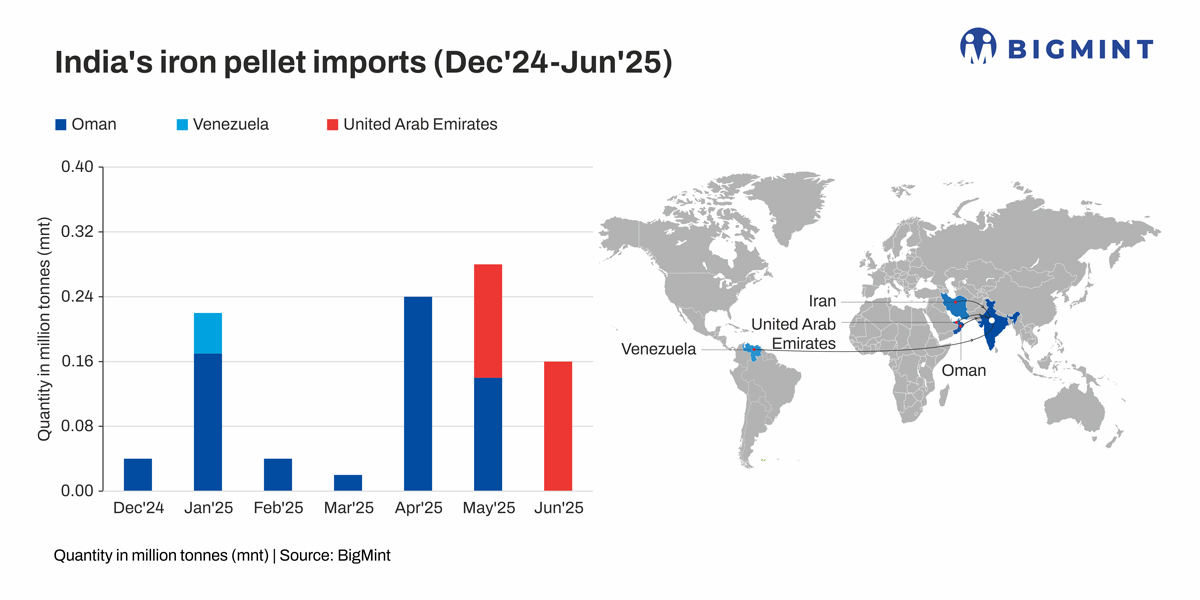

Morning Brief: India's iron ore pellet imports in January-June 2025 (H1CY'25) stood at 0.95 million tonnes (mnt) compared to nil in the corresponding period last year (CPLY), as per data available with BigMint.

The sharp rise follows a four-year hiatus in pellet imports, broken only in December of last year, with arrivals originating primarily from Oman in the Middle East. However, given that Oman has no production capacity, it seems that Iran is more likely to be the source of imported pellets into India, with Oman being a mere transshipment hub.

Notably, the increasing influx of overseas pellets has generated widespread concern among domestic producers, who are, as per reports, operating at less than 70% of their installed capacity. As a result, the Pellet Manufacturers' Association of India (PMAI) has appealed to the government to curbs imports, as they undermine the domestic industry's viability and threatening its self-reliance.

Contrasting with the significant uptrend in imports, India's pellet production increased by a marginal 0.9% y-o-y to 53.5 mnt in H1CY'25.

Why did pellet imports resume in CY'25?

Regional supply woes, high freights prompt shift to imports: Regional supply issues and high domestic transportation costs were, most probably, the most significant factors that pushed Indian traders to procure pellets.

For example, market participants grappled with material scarcity in Bellary and Odisha. There was limited availability of the required iron ore grades in Bellary, which affected production volumes of pellets. Additionally, increased captive consumption curtailed the amount available for the merchant market.

Gujarat-based steelmakers also faced supply shortages following the shutdown of Jindal SAW's plant for maintenance. Meanwhile, steelmakers in Goa turned to imports to compensate for the reduced supply following operational disruptions in western India-based pellet plants, some of which have been offline since early April.

Transporting pellets from central to western India would have also culminated in logistical challenges, largely due to the prohibitively high freights involved. This, coupled with the availability of overseas-origin material at favourable pricing, further tilted the scales in favour of imports.

Additionally, high-grade (Fe 65%), low alumina (max 1%) pellets were available for import, which are not easily obtained in the domestic market, as producers typically offer Fe 62.5-63% material.

Attractive offers lure steelmakers: Indian buyers received compelling import offers, with prices of both iron ore and pellet falling globally.

To illustrate, benchmark Australian-origin Fe 62% iron ore fines in China fell around $4/tonne (t) to $99/t in May from $104/t in December, when pellet imports resumed. Similarly, pellet prices (Fe 65%, Brazilian-origin) were at $117/t CNF Rizhao in May, easing by $11/t from December's values.

Ultimately, favourable global pricing translated into attractive offers, which Indian buyers were all too eager to accept. Chennai and Goa saw deals concluded at $115-120/t CFR in April, while Gujarat saw imports land at $110-$120/t CNF, especially for high-grade Fe 65+% pellets with low alumina (max 1%) content.

In contrast, local prices were much higher. One Kandla-based buyer noted in April that they had to book domestic cargoes of low-phosphorus Fe 65% at INR 12,700/t ($149/t) CFR Kandla in March - prices substantially higher than imported material.

Some import offers for Iranian Fe 65% pellets were even heard at $89-90/t FOB Bandar Abbas Port.

Outlook

The jump in pellet imports has caused alarm among domestic producers, given that significant capital has been invested and rapid capacity expansions made. However, market participants believe that the trend may subside in the coming months.

While Indian buyers are insisting that they are purchasing Iranian pellets at around $90-93/t FOB, with global prices rising, these tags may soon move closer to $100/t FOB. However, despite the recovery in global iron ore prices, bids from Indian players have not yet picked up, while those from Chinese importers have increased.

Consequently, due to higher realisations, more shipments may be directed to China, with it turning out to be a more attractive market for Iranian sellers.

"Given this, I don't think Iranian suppliers will be keen to sell to India at the lower price point, and will likely prefer exporting to China instead," an Iranian source informed BigMint.

Additionally, the Iran-Israel war may also have dampened bookings for July due to an increase in freights.

Gain expert insights as industry leaders discuss "Will India turn to a net iron ore importer amidst global oversupply?" at the BigMint India Ferrous Week 2025, to be held during 19-21 August 2025 at JW Mariott, Kolkata.