13-August-2025

- Total imports recorded at 11.76 mnt in Jul'25

- Imports from S. Africa, Indonesia witness sharp declines

- Coal imports likely to edge up ahead of festive season

Morning Brief: India's imports of non-coking coal, used for thermal power generation and in the industrial sector, declined to a 2-year low of 11.76 million tonnes (mnt) in July 2025, a drop of over 22% m-o-m and 21% y-o-y, as per latest data available with BigMint.

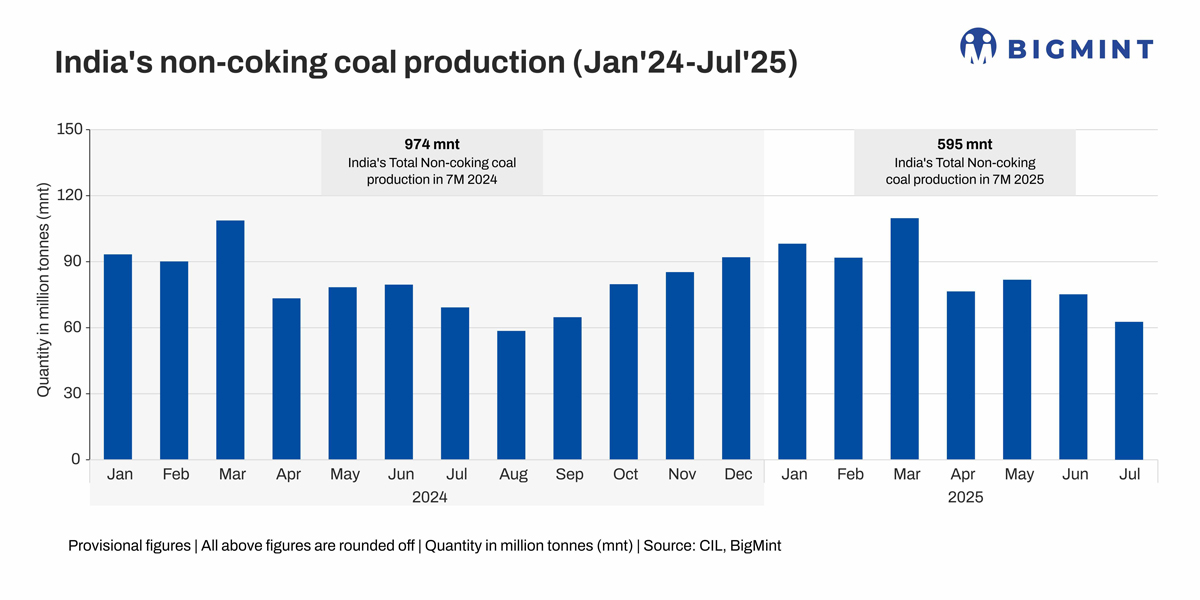

Interestingly, this steep decline in imports happened despite domestic production remaining under pressure due to heavy monsoon rains throughout the country. CIL, the countrys leading coal miner with a share of over 80% of domestic production, recorded an over 11% drop in dispatches in July.

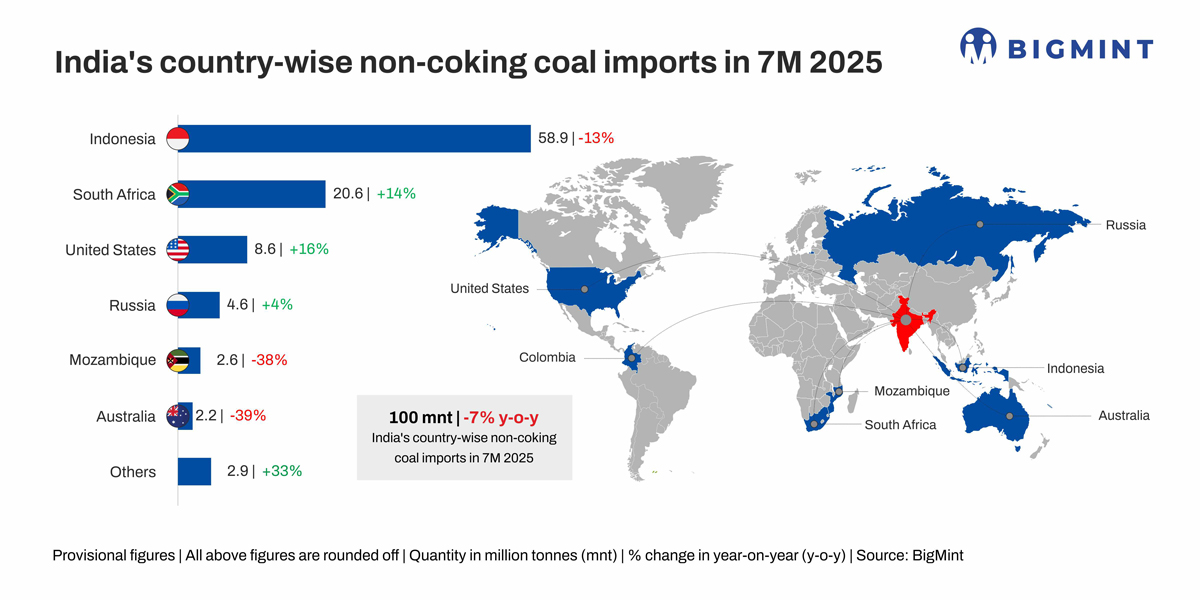

Country-wise imports

Indonesia remained the top exporter of non-coking coal to India in July, although volumes dropped over 21% m-o-m to 6.82 mnt from 8.68 mnt in June.

Imports from South Africa, too, declined around 40% m-o-m to 1.9 mnt, while Russian shipments to India fell even more sharply by around 50% m-o-m. Exports by the US and Mozambique also recorded declines m-o-m. Australia saw an increase in shipments but volumes remained low.

Mundra was the top unloading port in the country for non-coking coal, although volumes fell 20% m-o-m. Krishnapatnam, Vizag and the other leading ports all recorded sharp declines in cargoes unloaded.

Why did imports edge down in Jul'25?

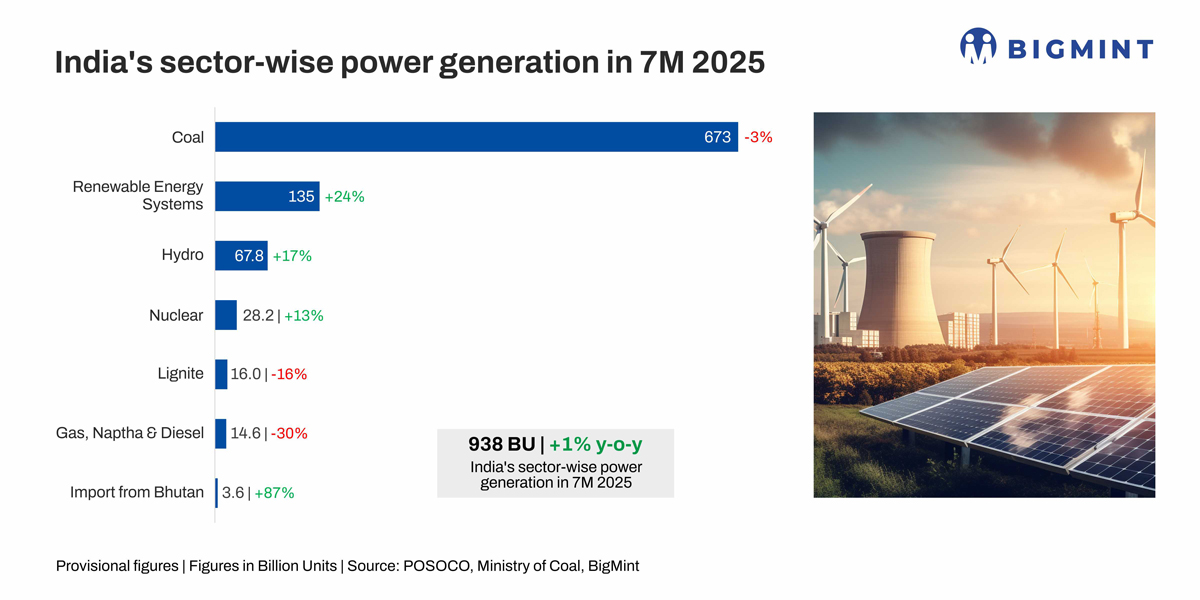

Coal-fired generation drops: India's coal-powered electricity generation in July dropped m-o-m to 104 billion units (BU) from 105 BU in June, a decrease of 1.1% m-o-m. Given that around 75% of Indias electricity is still based on thermal power, this decrease was by no means insignificant. Lignite-based generation, too, dropped 20% m-o-m.

Notably, coal-fired generation fell an even steeper 3.8% y-o-y in July. This was due to the early onset of monsoon this year and a lower peak demand requirement than expected. As a result, coal imports for the power sector edged down.

High thermal coal port stocks: Non-coking coal stocks at domestic ports rose to 14.27 mnt in week 31 against 13.29 mnt a month or two back. Subdued demand for imported cargoes resulted in stock build up at ports which discouraged fresh imports.

Downtrend in sponge iron market: Sponge iron prices hit a four-and-a-half-year low in May which resulted in increased blending of domestic coal in rotary kiln-based DRI production in order to minimise costs. Sources informed that some players were blending domestic to imported coal in a ratio of 90:10. Moreover, DRI production inched down m-o-m to 4.8 mnt in July.

The rapid decline in steel prices coupled with cost considerations weighed on imported coal demand, especially from South Africa.

Non-fossil power generation surges: Although India's overall power generation remained higher in July at 166 BU compared with 162 BU in June, coal-fired generation edged down. However, generation from renewable sources surged. Hydropower, especially, recorded m-o-m growth of 30%, while nuclear power generation, too, increased in July.

The share of solar and wind remained stable. The growth in renewable power generation was responsible for reducing dependence on imported thermal coal.

Outlook

According to sources, availability of August delivery cargoes with traders seems limited and September cargo offers have increased given the hike in vessel freight rates globally. With monsoon receding in most parts of the country and with the festive season approaching, coal imports in August and September are expected to edge up compared with July levels.

Moreover, the surge in industrial production post-monsoon and ahead of the festive season is also likely to boost imported coal demand. The Indian primary mills have announced a hike in long steel prices, which is expected to have a positive impact on domestic sponge iron prices and production. Increased DRI production and improvement in prices are likely to augment imported coal demand.

BIFW

How is India progressing in terms of reducing reliance on imported coal for power generation and industrial purposes? How are government policies and shifts in the domestic coal market facilitating the broader objective of attaining domestic self-sufficiency ? Tap into fresh insights to be shared by experts during the panel Indias Thermal Coal Supply Shift: Sustaining Domestic Growth and Reducing Import Dependence at BigMint's India Ferrous Week (BIFW) to be held from 19-21 August in Kolkata, India.